еПСжШОиАЕйЗПеМЦPINEиѓ≠и®АеЕ•йЧ®жХЩз®Л

Author: еПСжШОиАЕйЗПеМЦ-е∞Пе∞П楶, Created: 2022-05-30 16:23:43, Updated: 2022-09-28 17:10:21НзљЃпЉЙгАВ

2гАБtrail_offsetеПВжХ∞пЉЪжЙІи°МиЈЯиЄ™ж≠ҐжНЯж≠ҐзЫИи°МдЄЇдєЛеРОпЉМжФЊзљЃзЪДеє≥дїУеНХиЈЭз¶їжЬАйЂШдїЈпЉИеБЪе§ЪжЧґпЉЙжИЦиАЕжЬАдљОдїЈпЉИеБЪз©ЇжЧґпЉЙзЪДиЈЭз¶їгАВ

3гАБtrail_pointsеПВжХ∞пЉЪе¶ВеРМtrail_priceеПВжХ∞пЉМеП™дЄНињЗжШѓдї•зЫИеИ©зВєжХ∞дЄЇжМЗеЃЪдљНзљЃгАВ

жШѓдЄНжШѓдЄНеЃєжШУзРЖиІ£пЉМж≤°еЕ≥з≥їпЉБжИСдїђжЭ•йАЪињЗдЄАдЄ™з≠ЦзХ•еЫЮжµЛеЬЇжЩѓжЭ•зРЖиІ£е≠¶дє†пЉМеЕґеЃЮеЊИзЃАеНХзЪДгАВ

/*backtest

start: 2022-09-23 00:00:00

end: 2022-09-23 08:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Binance","currency":"ETH_USDT"}]

args: [["RunMode",1,358374],["ZPrecision",0,358374]]

*/

strategy("test", overlay = true)

varip a = na

varip highPrice = na

varip isTrade = false

varip offset = 30

if not barstate.ishistory and not isTrade

strategy.entry("test 1", strategy.long, 1)

strategy.exit("exit 1", "test 1", 1, trail_price=close+offset, trail_offset=offset)

a := close + offset

runtime.log("жѓПзВєдїЈж†ЉдЄЇпЉЪ", syminfo.mintick, "пЉМељУеЙНclose:", close)

isTrade := true

if close > a and not barstate.ishistory

highPrice := na(highPrice) ? close : highPrice

highPrice := close > highPrice ? close : highPrice

plot(a, "trail_price иІ¶еПСзЇњ")

plot(strategy.position_size>0 ? highPrice : na, "ељУеЙНжЬАйЂШдїЈ")

plot(strategy.position_size>0 ? highPrice-syminfo.mintick*offset : na, "зІїеК®ж≠ҐжНЯиІ¶еПСзЇњ")

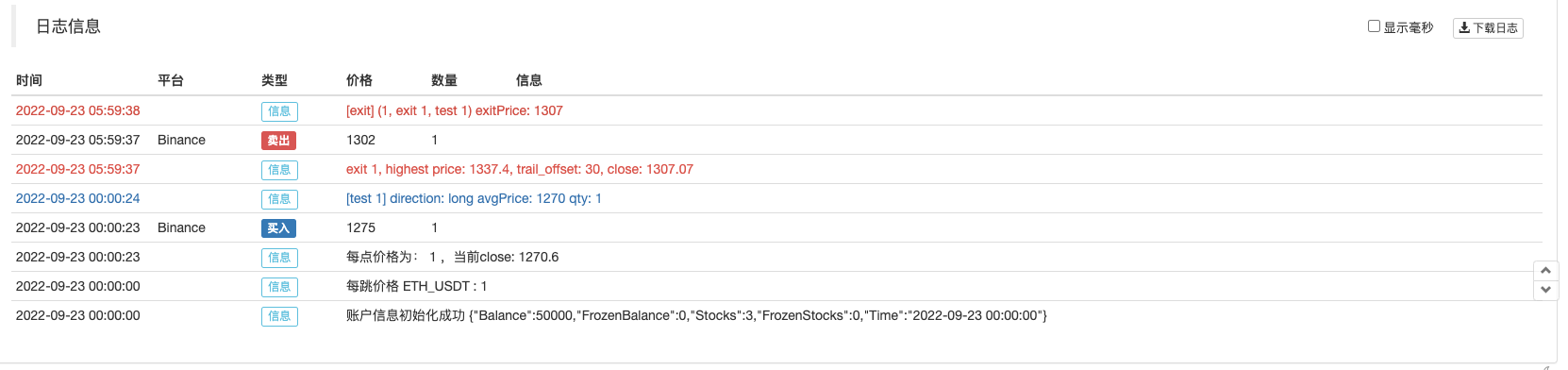

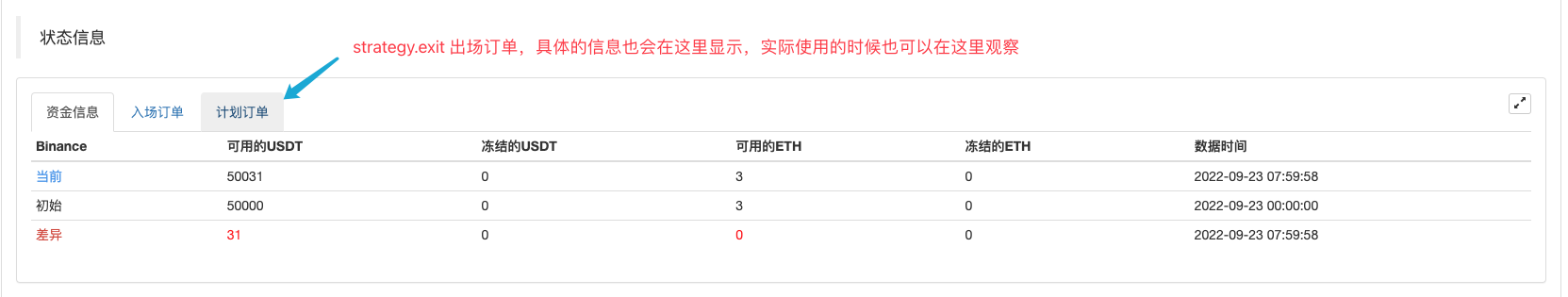

з≠ЦзХ•еЉАеІЛжЙІи°МжЧґзЂЛеН≥е§Ъе§іеЕ•еЬЇпЉМзДґеРОзЂЛеН≥дЄЛдЄАдЄ™strategy.exitеЗЇеЬЇиЃҐеНХпЉИжМЗеЃЪдЇЖиЈЯиЄ™ж≠ҐжНЯж≠ҐзЫИеПВжХ∞пЉЙпЉМељУи°МжГЕеПШеК®дїЈж†ЉдЄКжґ®иґЕињЗtrail_priceиІ¶еПСзЇњжЧґпЉМеЉАеІЛжЙІи°МиЈЯиЄ™ж≠ҐжНЯж≠ҐзЫИйАїиЊСпЉМж≠ҐжНЯж≠ҐзЫИзЇњпЉИиУЭиЙ≤пЉЙеЉАеІЛиЈЯйЪПжЬАйЂШдїЈеК®жАБи∞ГжХіпЉМиУЭиЙ≤зЇњдљНзљЃе∞±жШѓж≠ҐжНЯж≠ҐзЫИиІ¶еПСеє≥дїУзЪДдїЈдљНпЉМжЬАеРОељУи°МжГЕеПШеК®дїЈж†ЉиЈМз†іиУЭиЙ≤зЇњеН≥иІ¶еПСеє≥дїУгАВињЩж†ЈзїУеРИеЫЊи°®дЄКзФїеЗЇзЪДзЇњжШѓдЄНжШѓе∞±еЊИеЃєжШУзРЖиІ£дЇЖгАВ

йВ£дєИжИСдїђдљњзФ®ињЩдЄ™еКЯиГљжЭ•дЉШеМЦдЄАзІНиґЕзЇІиґЛеКњз≠ЦзХ•пЉМжИСдїђеП™зФ®зїЩз≠ЦзХ•еЕ•еЬЇиЃҐеНХжМЗеЃЪдЄАдЄ™strategy.exitеЗЇеЬЇиЃ°еИТеНХпЉМе∞±еПѓдї•еҐЮеК†ињЩзІНиЈЯиЄ™ж≠ҐжНЯж≠ҐзЫИеКЯиГљгАВ

if not barstate.ishistory and findOrderIdx("open") >= 0 and state == 1

trail_price := strategy.position_size > 0 ? close + offset : close - offset

strategy.exit("exit", "open", 1, trail_price=trail_price, trail_offset=offset)

runtime.log("жѓПзВєдїЈж†ЉдЄЇпЉЪ", syminfo.mintick, "пЉМељУеЙНclose:", close, "пЉМtrail_priceпЉЪ", trail_price)

state := 2

tradeBarIndex := bar_index

еЃМжХізЪДз≠ЦзХ•дї£з†БпЉЪ

/*backtest

start: 2022-05-01 00:00:00

end: 2022-09-27 00:00:00

period: 1d

basePeriod: 5m

exchanges: [{"eid":"Binance","currency":"ETH_USDT"}]

args: [["RunMode",1,358374],["ZPrecision",0,358374]]

*/

varip trail_price = na

varip offset = input(50, "offset")

varip tradeBarIndex = 0

// 0 : idle , 1 current_open , 2 current_close

varip state = 0

findOrderIdx(idx) =>

ret = -1

if strategy.opentrades == 0

ret

else

for i = 0 to strategy.opentrades - 1

if strategy.opentrades.entry_id(i) == idx

ret := i

break

ret

if strategy.position_size == 0

trail_price := na

state := 0

[superTrendPrice, dir] = ta.supertrend(input(2, "atrз≥їжХ∞"), input(20, "atrеС®жЬЯ"))

if ((dir[1] < 0 and dir[2] > 0) or (superTrendPrice[1] > superTrendPrice[2])) and state == 0 and tradeBarIndex != bar_index

strategy.entry("open", strategy.long, 1)

state := 1

else if ((dir[1] > 0 and dir[2] < 0) or (superTrendPrice[1] < superTrendPrice[2])) and state == 0 and tradeBarIndex != bar_index

strategy.entry("open", strategy.short, 1)

state := 1

// еПНеРСдњ°еПЈпЉМеЕ®еє≥

if strategy.position_size > 0 and dir[2] < 0 and dir[1] > 0

strategy.cancel_all()

strategy.close_all()

runtime.log("иґЛеКњеПНиљђпЉМе§Ъе§іеЕ®еє≥")

else if strategy.position_size < 0 and dir[2] > 0 and dir[1] < 0

strategy.cancel_all()

strategy.close_all()

runtime.log("иґЛеКњеПНиљђпЉМз©Їе§іеЕ®еє≥")

if not barstate.ishistory and findOrderIdx("open") >= 0 and state == 1

trail_price := strategy.position_size > 0 ? close + offset : close - offset

strategy.exit("exit", "open", 1, trail_price=trail_price, trail_offset=offset)

runtime.log("жѓПзВєдїЈж†ЉдЄЇпЉЪ", syminfo.mintick, "пЉМељУеЙНclose:", close, "пЉМtrail_priceпЉЪ", trail_price)

state := 2

tradeBarIndex := bar_index

plot(superTrendPrice, "superTrendPrice", color=dir>0 ? color.red : color.green, overlay=true)

- зФ®дїАдєИжО•еП£иГљиОЈеПЦеРДеЄБзІНзЪДеЄВеАЉпЉЯ

- жЬЙе•љењГдЇЇеЄЃеЄЃењЩеШЫпЉЯ

- еИЖдЇЂдЄАдЄ™иґЛеКњз≠ЦзХ•

- йАВеРИжЩЃйАЪдЇЇзЪДжЬЯзО∞е•ЧеИ©

- еЄМжЬЫFMZеЃШжЦєеЗЇдї£еЖЩй°єзЫЃжіїеК®

- дїАдєИжШѓе•ЧеИ©пЉЯ

- еЄБеЃЙеНГеЫҐе§ІжИШз≠ЦзХ•зФ≥иѓЈ

- дЄЛеНХз≤ЊеЇ¶йЧЃйҐШ

- table и°®ж†ЉзІїйЩ§и°МпЉМжЬЙдїАдєИеКЮж≥ХеРЧ

- еЫЮжµЛдЄАзЫійГљж≤°жЬЙдњ°еПЈ иГљиІ£еЖ≥еРЧпЉЯи∞Ґи∞Ґ

- иѓЈйЧЃе§ЪеЄБзІНиѓ•е¶ВдљХзФїжФґзЫКеЫЊи°®

- жХ∞е≠ЧиіІеЄБ

- еЄБжЬђдљН

- е∞Пе∞П楶иГљзЬЛзЬЛеРЧпЉМйЇ¶иѓ≠и®АзЪДз≠ЦзХ• еЫЮжµЛеТМеЃЮзЫШйГљжШѓеПѓдї•ж≠£еЄЄињРи°МзЪД пЉМе∞±жШѓжЙЛжЬЇеЃЮзЫШйВ£йЗМ зВєињЫеОїжШЊз§ЇйФЩиѓѓпЉМињЩдїАдєИжГЕеЖµ

- еЫЮжµЛеПѓиІЖеМЦдЄНжШЊз§Їдє∞еНЦзВєеЫЊж†З

- еїґињЯ

- еЕђзФ®еЫЮжµЛжЬНеК°еЩ®дЄНиГљзФ®дЇЖеРЧпЉЯ

- жЬНеК°еЩ®дЄНеЬ®зЇњ еЫЮжµЛдЄНдЇЖдЇЖ

- GetOrder idиОЈеПЦдЄНеИ∞иЃҐеНХдњ°жБѓ

- жФґзЫШдїЈж®°еЮЛеТМеЃЮжЧґдїЈж®°еЮЛжЬЙдїАдєИеМЇеИЂеСҐпЉЯжѓФе¶ВжИСжШѓ15еИЖйТЯKзЇњеЃЮзЫШпЉМжФґзЫШдїЈж®°еЮЛдЉЪдЄНдЉЪеѓЉиЗіжИРдЇ§дїЈж†ЉеБПеЈЃеЊИе§ІпЉЯдЄКдЄЛељ±зЇњйГ®еИЖдЉЪ嚥жИРжИРдЇ§еРЧпЉЯ