MyLanguage Doc

Schriftsteller:Die Erfinder quantifizieren - Kleine Träume, Erstellt: 2022-06-30 18:24:06, aktualisiert: 2024-02-06 17:36:19[TOC]

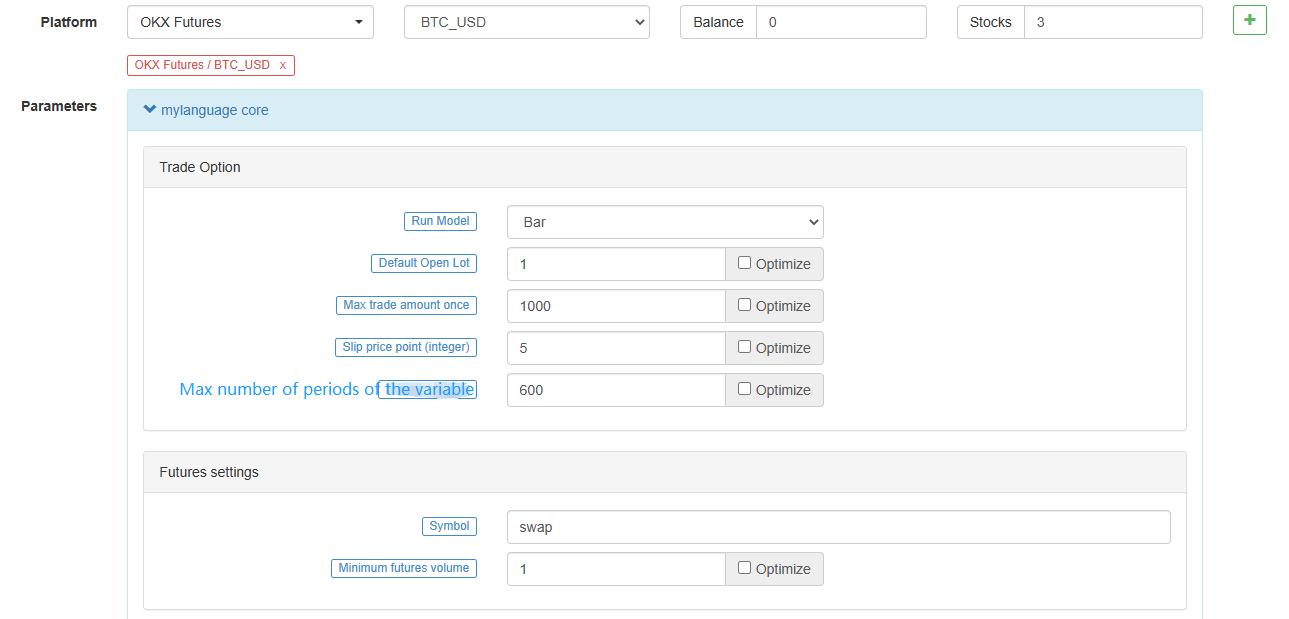

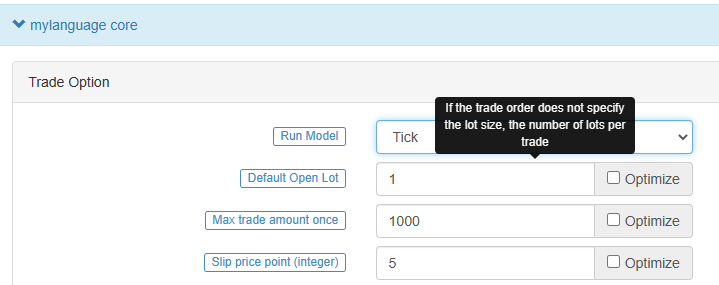

MyLanguage ist eine programmatische Handelssprache, die mit MyLanguage kompatibel und erweitert ist. Die MyLanguage von FMZ Quant wird einer strengen Syntaxprüfung unterzogen.%%Der Betreiber wird einen Fehler verursachen.

-

Grundlegende Anweisungen

- ## Vertrag

Kryptowährungsvertrag

Kryptowährungsvertrag

this_week cryptocurrency futures contract this week next_week cryptocurrency futures contract next week month cryptocurrency futures contract month quarter cryptocurrency futures contract quarter next_quarter cryptocurrency futures contract next quarter third_quarter cryptocurrency futures contract third quarter last_quarter contract last quarter XBTUSD BITMEX perpetual contract swap cryptocurrency futures perpetual contracts other than BITMEX exchange For details, please refer to the exchange.SetContractType() function section of the JavaScript/Python/C++ documentation

- Variablen

Eine Variable ist ein Platz im Computerspeicher, der für die Speicherung von Daten genutzt wird.

Öffnen Sie die erste Variable

// assign 1 to variable a a:=1;In

MyLanguage, ist leicht zu unterscheidendata volume:- Einwertdaten: Es gibt nur einen Wert, z. B.

0,1,'abc'. - Sequenzdaten: eine Datensequenz, die aus einer Reihe von Daten mit einem einzigen Wert besteht, z. B.

Close(Schlusskurs), wobeiCloseenthält den Schlusskurs vonnperiods.[ 10.1 , 10.2 , 10.3 , 10.4 , 10.5 ...]

Unterscheidung von

Variable type - String-Typ: muss mit ` umhüllt sein

'', ist der String-Typ nicht direkt zu verwenden und muss mit der Funktion in die Ansicht ausgeführt werden.

INFO(CLSOE>OPEN,'OK!');- Wertearten: einschließlich Ganzzahlen, Fließkommazahlen (Dezimalzahlen).

// integer int:=2; // decimal float:=3.1;- Boole-Typ, mit 1 (für wahr) oder 0 (für falsch): 1, 0, wahr oder falsch.

A:=1>0;Nach Ausführung dieses Codes wird der Wert vonAist 1.

// The closing price of the current period is greater than -999, you will find that the return value of each period is 1, which means true, because the closing price is almost impossible to be negative. is_true:=Close>-999;- Gesamtvariablen

VARIABLE:VALUE1:10; // Declare a global variable, assign the value 10, and execute it only once.Beachten Sie, dass beim Backtesting:

VARIABLE:NX:0; // The initial global variable NX is 0 NX..NX+1; // Accumulate 1 each time INFO(1,NX); // Print NX every timeAnfangs war die

INFOAusdrucke von Erklärungen101Vielleicht nicht.0Anfangs? Der Grund dafür ist, dass es 100 anfängliche K-Linien im Backtest gibt, und 100 K-Linien wurden bereits durchlaufen, was 100 Mal angehäuft wurde. Der tatsächliche Preis hängt davon ab, wie viele K-Linien zunächst erhalten werden.- ### Regeln für die Benennung

In den meisten Systemen erlaubt die Variablenbenennung nicht die Verwendung von System

reservierten Wörtern (eingebettete Variablennamen, Funktionsnamen). Close,CDarüber hinaus sind reine Zahlen oder führende Zahlen nicht erlaubt. Schließlich darf es nicht sehr lang sein, und verschiedene Systeme haben unterschiedliche Längenbeschränkungen. Ich glaube, dassMyLanguage für Chinesen sehr freundlich ist. Für erfahrene Programmierer wird empfohlen, die folgenden zwei Namensregeln zu verwenden: 1. Chinese name// elegant output 5-day moving average:=MA(C,5);2. English + underline// Output move_avg_5:=MA(C,5);Wenn Sie Englisch bevorzugen, versuchen Sie, die Bedeutung Ihrer Variablen so verständlich wie möglich zu machen.

A1,AAA,BBBGlauben Sie mir, wenn Sie in ein paar Tagen Ihren Indikatorcode wieder überprüfen, werden Sie wegen Gedächtnisverlustes sehr unglücklich sein.Ich hoffe, dass

MyLanguage ein mächtiges Werkzeug für Ihre Analyse und Entscheidungsfindung werden kann. - ## Datentyp

Wenn wir einer Variablen schriftlich klare Daten zuweisen, wird die Variable auch zum Typ der Daten selbst.

- 1. Art des Werts:

1.2.3.1.1234.2.23456 ...- 2. Stringtyp (str):

'1' .'2' .'3' ,String types must be wrapped with ''- 3. Sequenzdaten:

A collection of data consisting of a series of single-valued data- 4. Boolean-Typ (Boolean):

Verwendung

1stellttrueund0fürfalse.Beispiel

// declare a variable of value type var_int := 1; // Declare a variable for sequence data var_arr := Close; // The string type cannot be declared alone, it needs to be combined with the function INFO(C>O, 'positive line');- ## Betreiber

Die für die Ausführung des Indikatorcodes verwendeten Operationen und Berechnungen sind lediglich die Symbole, die in die Operation einbezogen werden.

- ### Zuweisungsoperator

Um einer Variablen einen Wert zuzuweisen

- 1. `:` ```:```, represents assignment and output to the graph (subgraph). ``` Close1:Close; // Assign Close to the variable Close1 and output to the figure ``` - 2. `:=` ```:=```, represents assignment, but is not output to the graph (main graph, sub graph...), nor is it displayed in the status bar table. ``` Close2:=Close; // Assign Close to the variable Close2 ``` - 3. `^^` ```^^```, Two ```^``` symbols represent assignment, assign values to variables and output to the graph (main graph). ``` lastPrice^^C; ``` - 4. `..` ```..```, two ```.``` symbols represent assignment, assign values to variables and display variable names and values in the chart, but do not draw pictures to the chart (main picture, sub-picture...). ``` openPrice..O ```- ### Relationale Operatoren

Relationale Operatoren sind binäre Operatoren, die in bedingten Ausdrücken verwendet werden, um die Beziehung zwischen zwei Daten zu bestimmen.

Rückgabewert: Boolean-Typ, entweder

true(1) oderfalse(0).- 1. more than```>``` ``` // Assign the operation result of 2>1 to the rv1 variable, at this time rv1=1 rv1:=2>1; ``` - 2. less than```<``` ``` // Returns false, which is 0, because 2 is greater than 1 rv3:=2<1; ``` - 3. more than or equal to```>=``` ``` x:=Close; // Assign the result of the operation that the closing price is more than or equal to 10 to the variable rv2 // Remark that since close is a sequence of data, when close>=10 is performed, the operation is performed in each period, so each period will have a return value of 1 and 0 rv2:=Close>=10; ``` - 4. less than or equal to```<=``` ``` omitted here ``` - 5. equal to```=``` ``` A:=O=C; // Determine whether the opening price is equal to the closing price. ``` - 6. Not equal to```<>``` ``` 1<>2 // To determine whether 1 is not equal to 2, the return value is 1 (true) ```- ### Logische Operatoren

Rückgabewert: Boolean-Typ, entweder

true(1) oderfalse(0).1. The logical and ```&&```, can be replaced by ```and```, and the left and right sides of the and connection must be established at the same time.// Determine whether cond_a, cond_b, cond_c are established at the same time cond_a:=2>1; cond_b:=4>3; cond_c:=6>5; cond_a && cond_b and cond_c; // The return value is 1, established2. Logical or ```||```, you can use ```or``` to replace the left and right sides of the or link, one side is true (true), the whole is true (return value true).cond_a:=1>2; cond_b:=4>3; cond_c:=5>6; cond_a || cond_b or cond_c; // The return value is 1, established3. ```()``` operator, the expression in parentheses will be evaluated first.1>2 AND (2>3 OR 3<5) // The result of the operation is false 1>2 AND 2>3 OR 3<5 // The result of the operation is true- ### Arithmetische Operatoren

Return value: numeric typeArithmetische Operatoren sind Arithmetische Operatoren. Es ist ein Symbol für das Abschließen von grundlegenden arithmetischen Operationen (Arithmetische Operatoren), das ein Symbol ist, das zur Verarbeitung von vier arithmetischen Operationen verwendet wird.

- **plus +** ``` A:=1+1; // return 2 ``` - **minus -** ``` A:=2-1; // return 1 ``` - **multiply \** ``` A:=2*2; // return 4 ``` - **divide /** ``` A:=4/2; // return 2 ```-

Funktionen

- Funktionen

In der Programmierwelt ist eine

function ein Stück Code, das eine bestimmte Funktion implementiert. function(param1,param2,...)- Composition: Function name (parameter1, parameter2, ...), may have no parameters or have multiple parameters. For example, ```MA(x,n);``` means to return to the simple moving average of ```x``` within ```n``` periods. Among them, ```MA()``` is a function, ```x``` and ```n``` are the parameters of the function. When using a function, we need to understand the basic definition of the function, that is, what data can be obtained by calling the function. Generally speaking, functions have parameters. When we pass in parameters, we need to ensure that the incoming data type is consistent. At this stage, the code hinting function of most IDEs is very imperfect. There is a data type of the parameter given, which brings some trouble to our use, and ```MA(x,n);``` is interpreted as: ``` Return to simple moving average Usage: AVG:=MA(X,N): N-day simple moving average of X, algorithm (X1+X2+X3+...+Xn)/N, N supports variables ``` This is very unfriendly to beginners, but next, we will dissect the function thoroughly, trying to find a quick way to learn and use the function.- ### Geben Sie den Wert zurück

Um Funktionen schnell zu lernen, müssen wir zuerst ein Konzept verstehen, es wird

return value Zurückgenannt, , wie der Name schon sagt, bedeutet zurückkehren ; Der Wert steht für spezifischen Wert , dann ist die Bedeutung des Rückgabewerts: die Daten, die erhalten werden können. // Because it will be used in the following code, the variable return_value is used to receive and save the return value of function() // retrun_value := function(param1,param2); // For example: AVG:=MA(C,10); // AVG is retrun_value, function is MA function, param1 parameter: C is the closing price sequence data, param2 parameter: 10.- ### Parameter

Zweitens ist das zweite wichtige Konzept der Funktion der Parameter, und verschiedene Rückgabewerte können durch Übergabe verschiedener Parameter erhalten werden.

// The variable ma5 receives the 5-day moving average of closing prices ma5:=MA(C,5); // The variable ma10 receives the 10-day moving average of closing prices ma10:=MA(C,10);Der erste Parameter

Xder oben genannten Variablenma5,ma10istC(Schlusskurs)Cist auch eine Funktion (sendet die Reihenfolge der Schlusskursse von der Eröffnung bis zur Gegenwart zurück), hat aber keine Parameter.MA()Die Funktion wird flexibler durch die Parameter zu verwenden.-

Wie man lernt

- 1. Zuerst müssen wir verstehen, was eine Funktion tut, das heißt, welche Daten diese Funktion uns zurückgeben kann.

- 2. Das Letzte ist, den Typ des zurückgegebenen Werts zu verstehen.

- 3. Darüber hinaus müssen wir den Datentyp des Parameters wissen

MA(x,n), wenn Sie den Datentyp des Parameters nicht kennenx,n, wird es nicht in der Lage sein, den Return-Wert korrekt zu erhalten.

Bei der folgenden Funktionseinführung und -verwendung folgen Sie den oben genannten drei Grundsätzen.

-

Sprachverstärkung

MyLanguageundJavaScriptMischsprachige Programmierung

%% // This can call any API quantified of FMZ scope.TEST = function(obj) { return obj.val * 100; } %% Closing price: C; Closing price magnified 100 times: TEST(C); The last closing price is magnified by 100 times: TEST(REF(C, 1)); // When the mouse moves to the K-line of the backtest, the variable value will be prompted- ```scope```object The ```scope``` object can add attributes and assign anonymous functions to attributes, and the anonymous function referenced by this attribute can be called in the code part of MyLanguage. - ```scope.getRefs(obj)```function In ```JavaScript``` code block, call the ```scope.getRefs(obj)``` function to return the data of the passed in ```obj``` object. The ```JavaScript``` code wrapped with the following ```%% %%``` will get the ```C``` passed in when the ```TEST(C)``` function in MyLanguage code is called Close price. The ```scope.getRefs``` function will return all the closing prices of this K-line data. Because of the use of ```throw "stop"``` to interrupt the program, the variable ```arr``` contains the closing price of the first bar only. You can try to delete ```throw "stop"```, it will execute the ```return``` at the end of the ```JavaScript``` code, and return all closing price data. ``` %% scope.TEST = function(obj){ var arr = scope.getRefs(obj) Log("arr:", arr) throw "stop" return } %% TEST(C); ``` - scope.bars Access all K-line bars in the ``JavaScript`` code block. The ```TEST``` function returns a value. 1 is a negative line and 0 is a positive line. ``` %% scope.TEST = function(){ var bars = scope.bars return bars[bars.length - 1].Open > bars[bars.length - 1].Close ? 1 : 0 // Only numeric values can be returned } %% arr:TEST; ``` ``` # Attention: # An anonymous function received by TEST, the return value must be a numeric value. # If the anonymous function has no parameters, it will result in an error when calling TEST, writing VAR:=TEST; and writing VAR:=TEST(); directly. # TEST in scope.TEST must be uppercase. ``` - scope.bar In the ```JavaScript``` code block, access the current bar. Calculate the average of the high opening and low closing prices. ``` %% scope.TEST = function(){ var bar = scope.bar var ret = (bar.Open + bar.Close + bar.High + bar.Low) / 4 return ret } %% avg^^TEST; ``` - scope.depth Access to market depth data (order book). ``` %% scope.TEST = function(){ Log(scope.depth) throw "stop" // After printing the depth data once, throw an exception and pause } %% TEST; ``` - scope.symbol Get the name string of current trading pair. ``` %% scope.TEST = function(){ Log(scope.symbol) throw "stop" } %% TEST; ``` - scope.barPos Get the Bar position of the K-line. ``` %% scope.TEST = function(){ Log(scope.barPos) throw "stop" } %% TEST; ``` - scope.get\_locals('name') This function is used to get the variables in the code section of MyLanguage. ``` V:10; %% scope.TEST = function(obj){ return scope.get_locals('V') } %% GET_V:TEST(C); ``` ``` # Attention: # If a variable cannot calculate the data due to insufficient periods, call the scope.get_locals function in the JavaScript code at this time # When getting this variable, an error will be reported: line:XX - undefined locals A variable name is undefined ``` - scope.canTrade The ```canTrade``` attribute marks whether the current bar can be traded (whether the current Bar is the last one) For example, judging that the market data is printed when the strategy is in a state where the order can be traded ``` %% scope.LOGTICKER = function() { if(exchange.IO("status") && scope.canTrade){ var ticker = exchange.GetTicker(); if(ticker){ Log("ticker:", ticker); return ticker.Last; } } } %% LASTPRICE..LOGTICKER; ```Anwendungsbeispiel

%% scope.TEST = function(a){ if (a.val) { throw "stop" } } %% O>C,BK; C>O,SP; TEST(ISLASTSP);Stoppen Sie die Strategie nach Eröffnung und Schließung einer Position einmal.

-

Mehrjahresbezug

Das System wählt automatisch eine geeignete zugrunde liegende K-Linien-Periode aus und verwendet diese zugrunde liegenden K-Linien-Periodendaten, um alle referenzierten K-Liniendaten zu synthetisieren, um die Genauigkeit der Daten zu gewährleisten.

- Anwendung:

#EXPORT formula_name ... #ENDWenn die Formel nicht nur berechnet wird, um Daten aus verschiedenen Perioden zu erhalten, können Sie auch eine leere Formel schreiben.

- Anwendung:

Eine leere Formel ist:

#EXPORT TEST NOP; #END // end- Anwendung:

#IMPORT [MIN,period,formula name] AS variable valueErhalten Sie verschiedene Daten des festgelegten Zeitraums (Schlusskurs, Eröffnungspreis usw., durch Variablenwert ermittelt).

Die

MINin derIMPORTBefehl bedeutetMinutenebene.MyLanguage der FMZ Quant-Plattform, und nur dieMINDas Niveau wird imIMPORTNicht-Standard-Perioden werden jetzt unterstützt.#IMPORT [MIN, 240, TEST] AS VAR240Daten wie die 240-minütige Periode (4-Stunden) K-Linie zu importieren.Codebeispiel:

// This code demonstrates how to reference formulas of different periods in the same code // #EXPORT extended grammar, ending with #END marked as a formula, you can declare multiple #EXPORT TEST Mean value 1: EMA(C, 20); Mean value 2: EMA(C, 10); #END // end #IMPORT [MIN,15,TEST] AS VAR15 // Quoting the formula, the K-line period takes 15 minutes #IMPORT [MIN,30,TEST] AS VAR30 // Quoting the formula, the K-line period takes 30 minutes CROSSUP(VAR15.Mean value is 1, VAR30.Mean value is 1),BPK; CROSSDOWN(VAR15.Mean value is 2, VAR30.Mean value is 2),SPK; The highest price in fifteen minutes:VAR15.HIGH; The highest price in thirty minutes:VAR30.HIGH; AUTOFILTER;- Es ist notwendig, bei der Anwendung auf

REF,LLV,HHVund sonstige Anweisungen zur Verweisung von Daten bei der Verweisung von Daten in mehreren Zeiträumen.

(*backtest start: 2021-08-05 00:00:00 end: 2021-08-05 00:15:00 period: 1m basePeriod: 1m exchanges: [{"eid":"Futures_OKCoin","currency":"ETH_USD"}] args: [["TradeAmount",100,126961],["ContractType","swap",126961]] *) %% scope.PRINTTIME = function() { var bars = scope.bars; return _D(bars[bars.length - 1].Time); } %% BARTIME:PRINTTIME; #EXPORT TEST REF1C:REF(C,1); REF1L:REF(L,1); #END // end #IMPORT [MIN,5,TEST] AS MIN5 INFO(1, 'C:', C, 'MIN5.REF1C:', MIN5.REF1C, 'REF(MIN5.C, 1):', REF(MIN5.C, 1), 'Trigger BAR time:', BARTIME, '#FF0000'); INFO(1, 'L:', L, 'MIN5.REF1L:', MIN5.REF1L, 'REF(MIN5.L, 1):', REF(MIN5.L, 1), 'Trigger BAR time:', BARTIME, '#32CD32'); AUTOFILTER;Vergleich der Unterschiede zwischen

MIN5.REF1CundREF(MIN5.C, 1)Wir finden:```REF(MIN5.C, 1)``` is the K -line period of the current model (the above code backtest period is set to 1 minute, i.e. ```period: 1m``), the closing price of the 5-minute period where the penultimate BAR is located at the current moment. These two definitions are differentiated, and they can be used as needed. - ## Mode Description - ### Signal filtering model of one opening and one leveling In the model, the ```AUTOFILTER``` function is written to control and realize the signal filtering of one opening and one closing. When there are multiple opening signals that meet the conditions, the first signal is taken as the valid signal, and the same signal on the K-line will be filtered out. Instructions supported by filtering model: BK, BP, BPK, SK, SP, SPK, CLOSEOUT, etc. Instructions with lot numbers such as BK(5) are not supported. For exampleDie Kommission kann die Mitgliedstaaten auffordern, die in Artikel 4 Absatz 1 genannten Maßnahmen zu ergreifen. Die Kommission hat die Kommission aufgefordert, die folgenden Informationen zu übermitteln: CROSSUP(C,MA1),BK; CROSSUP(MA1,MA2),BK; C>BKPRICE+10

Verständnis: Wie im obigen Beispiel, wenn AUTOFILTER nicht eingestellt ist, werden die dritte Zeile BK, die vierte Zeile BK und die fünfte Zeile SP sequenziell ausgelöst, und jede K-Linie löst ein einziges Mal ein Signal aus.

Wenn AUTOFILTER eingestellt ist, wird nach Auslösen von BK nur SP ausgelöst, andere BK-Signale werden ignoriert und jede K-Linie löst ein Signal aus.- ### Increase and decrease position model The ```AUTOFILTER``` function is not written in the model, allowing continuous opening signals or continuous closing signals, which can increase and decrease positions. Supported instructions: BK(N), BP(N), SK(N), SP(N), CLOSEOUT, BPK(N), SPK(N), open and close orders without lot size are not supported. (1)Instruction grouping is supported. (2)When multiple instruction conditions are satisfied at the same time, the signals are executed in the order in which the conditional statements are written. For example:Die Kommission kann die Mitgliedstaaten auffordern, die in Artikel 4 Absatz 1 genannten Maßnahmen zu ergreifen. Die Kommission hat die Kommission aufgefordert, die folgenden Informationen zu übermitteln: CROSSUP(C,MA1),BK(1); CROSSUP(MA1,MA2),BK(1); C>BKPRICE+10

Use ```TRADE\_AGAIN``` It is possible to make the same command line, multiple signals in succession.Verständnis: Das obige Beispiel wird einzeln ausgeführt, und das Signal nach der Ausführung wird nicht mehr ausgelöst.

- ### Model with one K-line and one signal Regardless of whether the K-line is finished, the signal is calculated in real-time orders, that is, the K-line is placed before the order is completed; the K-line is reviewed at the end. If the position direction does not match the signal direction at the end of the K-line, the position will be automatically synchronized. For example:Die Kommission kann die Mitgliedstaaten auffordern, die in Artikel 4 Absatz 1 genannten Maßnahmen zu ergreifen. Die Kommission hat die Kommission aufgefordert, die folgenden Informationen zu übermitteln: CROSSUP(MA1,MA2),BPK; //Der 5-Perioden gleitende Durchschnitt kreuzt nach oben und der 10-Perioden gleitende Durchschnitt geht lang. CROSSDOWN(MA1,MA2),SPK; //Der gleitende 5-Perioden-Durchschnitt kreuzt nach unten und der 10-Perioden-gleitende Durchschnitt geht kurz. Autofilter;

- ### A model of multiple signals on one K-line The model uses ```multsig``` to control and implement multiple signals from one K-line. Regardless of whether the K-line is finished, the signal is calculated in real-time. The signal is not reviewed, there is no signal disappearance, and the direction of the signal is always consistent with the direction of the position. If multiple signal conditions are met in one K-line, it can be executed repeatedly.Zum Beispiel: Die Kommission kann die Mitgliedstaaten auffordern, die in Artikel 4 Absatz 1 genannten Maßnahmen zu ergreifen. Die Kommission hat die Kommission aufgefordert, die folgenden Informationen zu übermitteln: CROSSUP(MA1,MA2),BK; C>BKPRICE+10

```MULTSIG``` can execute multiple command lines within one K-line. A command line is only signaled once.O,BK; // Diese Bedingungen können alle in einem K-Linienbalken ausgeführt werden, aber nur ein Signal pro Zeile 10+O,BK; // Strategie plus TRADE_AGAIN(10); kann mehrere Signale pro Zeile erzeugen 20+O,BK; 40+O,BK; MULTSIG ((1,1,10);

Supplement: 1.The model of adding and reducing positions, two ways of one signal and one K-line: placing an order at the closing price and placing an order at the order price, are both supported. 2.The model of adding and reducing positions also supports ordering of multiple signals from one K-line. The model of adding and reducing positions, write the ```multsig``` function to realize multiple additions or multiple reductions on one K-line. - ## Execution mode  - ### Bar model The Bar model refers to the model that is executed after the current BAR is completed, and the trading is executed when the next BAR starts. - ### Tick model The Tick model means that the model is executed once for each price movement and trades immediately when there is a signal. The Tick model ignores the previous day's signal (the previous day's signal is executed immediately on the same day), and the Tick model focuses only on the current market data to determine whether the signal is triggered. - ## Chart display - ### Additional indicators for main chart > Use operator ```^^```, set indicators are displayed on the main chart while assigning values to variables.MA60^^MA(C, 60); // Berechnen Sie den Durchschnittsindikator mit dem Parameter 60

- ### Additional Indicators for sub-chart Use operator ```:```, set indicators are displayed on the sub-chart while assigning values to variables.ATR:MA(MAX(MAX((HIGH-LOW),ABS(REF(CLOSE,1)-HIGH)),ABS(REF(CLOSE,1)-LOW)),26); // Die ATR-Variable wird mit dem Symbol

: versehen, dem die Formel zur Berechnung der ATR folgt  If you don't want it to be displayed on the main or subchart, use the "..." operator.MA60..MA(C, 60); // Berechnen Sie den Durchschnittsindikator mit dem Parameter 60

You can use ```DOT``` and ```COLORRED``` to set the line type and color of the line, etc., in line with the habits of users familiar with the MyLanguage. - ## Common problems > Introduce the **problems** commonly encountered in the process of writing indicators, usually the points that need to be paid attention to when writing (continuously added). - Remark the semicolon ```;``` at the end. - Remark that system keywords cannot be declared as variables. - Remark that the string uses **single quotes**, for example: the string ```'Open position'```. - ### Remark Annotation - ```// The Remark content ``` (input method can be typed in both Chinese and English) means that the code is not compiled during the execution process, that is, the content after ```//``` is not executed. Usually we use it to mark the meaning of the code, when it is convenient for code review, it can be quickly understood and recalled. - ```{ Remark content }```Block Remark. ``` A:=MA(C,10); {The previous line of code is to calculate the moving average.} ``` - ```(* Remark content *)```Block Remark. ``` A:=MA(C,10); (*The previous line of code is to calculate the moving average.*) ``` - ### Input When writing code, because the input method is often switched between Chinese and English, resulting in symbol errors. The common errors are as follows: colon ```:```, terminator ```;```, comma ```, ```, brackets ```()```, etc. These characters in different states of Chinese and English need attention. > If you use Sogou, Baidu, or Bing input methods, you can quickly switch between Chinese and English by pressing the ```shift``` key once. - ### Error-prone logic 1. At least, not less than, not less than: the corresponding relational operator ```>=```. 2. Up to, at most, no more than: the corresponding relational operator ```<=```. - ### Strategy launch synchronization In the futures strategy, if there is a manually opened position before the strategy robot starts, when the robot starts, it will detect the position information and synchronize it to the actual position status. In the strategy, you can use the ```SP```, ```BP```, ```CLOSEOUT``` commands to close the position.% % wenn (!scope.init) { Var ticker = exchange.GetTicker(); Wechsel.Kauf.Verkauf + 10, 1; scope.init = wahr; - Ich weiß. % % C>0, abgeschlossen;

` - Zwei-Wege-Positionen werden nicht unterstützt

MyLanguage unterstützt nicht den gleichen Vertrag mit Long- und Short-Positionen.

-

K-Liniendaten-Zitierung

- ## OFFEN

Erhalten Sie den Eröffnungspreis des K-Liniendiagramms.

Eröffnungspreis

Funktion: OPEN, Abkürzung für O

Parameter: keine

Erläuterung: Gibt den Eröffnungspreis von

dieser Periode zurück Sequenzdaten

OPEN gets the opening price of the K-line chart. Remark: 1.It can be abbreviated as O. Example 1: OO:=O; //Define OO as the opening price; Remark that the difference between O and 0. Example 2: NN:=BARSLAST(DATE<>REF(DATE,1)); OO:=REF(O,NN); //Take the opening price of the day Example 3: MA5:=MA(O,5); //Define the 5-period moving average of the opening price (O is short for OPEN).- ## HIGH

Holen Sie sich den höchsten Preis auf der K-Line-Tabelle.

Der höchste Preis

Funktion: HIGH, abgekürzt H

Parameter: keine

Erläuterung: Rückgabe des höchsten Preises für

diesen Zeitraum Sequenzdaten

HIGH achieved the highest price on the K-line chart. Remark: 1.It can be abbreviated as H. Example 1: HH:=H; // Define HH as the highest price Example 2: HH:=HHV(H,5); // Take the maximum value of the highest price in 5 periods Example 3: REF(H,1); // Take the highest price of the previous K-line- ## Niedrig

Holen Sie sich den niedrigsten Preis auf der K-Liniendiagramm.

Der niedrigste Preis

Funktion: LOW, abgekürzt L

Parameter: keine

Erläuterung: Rückgabe des niedrigsten Preises

dieser Periode Sequenzdaten

LOW gets the lowest price on the K-line chart. Remark: 1.It can be abbreviated as L. Example 1: LL:=L; // Define LL as the lowest price Example 2: LL:=LLV(L,5); // Get the minimum value of the lowest price in 5 periods Example 3: REF(L,1); // Get the lowest price of the previous K-line- ## Nahe

Holen Sie sich den Schlusskurs des K-Liniendiagramms.

Schlusskurs

Funktion: CLOSE, kurz C

Parameter: keine

Erläuterung: Gibt den Schlusskurs von

dieser Periode zurück Sequenzdaten

CLOSE Get the closing price of the K-line chart Remarks: 1.Obtain the latest price when the intraday K-line has not finished. 2.It can be abbreviated as C. Example 1: A:=CLOSE; //Define the variable A as the closing price (A is the latest price when the intraday K-line has not finished) Example 2: MA5:=MA(C,5); //Define the 5-period moving average of the closing price (C is short for CLOSE) Example 3: A:=REF(C,1); //Get the closing price of the previous K-line- ## VOL

Erhalten Sie das Handelsvolumen des K-Liniendiagramms.

Handelsvolumen

Funktion: VOL, kurz V

Parameter: keine

Erläuterung: Gibt das Handelsvolumen für

diesen Zeitraum zurück Sequenzdaten

VOL obtains the trading volume of the K-line chart. Remarks: It can be abbreviated as V. The return value of this function on the current TICK is the cumulative value of all TICK trading volume on that day. Example 1: VV:=V; // Define VV as the trading volume Example 2: REF(V,1); // Indicates the trading volume of the previous period Example 3: V>=REF(V,1); // The trading volume is greater than the trading volume of the previous period, indicating that the trading volume has increased (V is the abbreviation of VOL)- ## OPI

Die aktuelle Gesamtposition auf dem Futures- (Kontrakt-) Markt.

OpenInterest:OPI;- ## REF

Vorläufige Zitierung.

Reference the value of X before N periods. Remarks: 1.When N is a valid value, but the current number of K-lines is less than N, returns null; 2.Return the current X value when N is 0; 3.Return a null value when N is null. 4.N can be a variable. Example 1: REF(CLOSE,5);Indicate the closing price of the 5th period before the current period is referenced Example 2: AA:=IFELSE(BARSBK>=1,REF(C,BARSBK),C);//Take the closing price of the K-line of the latest position opening signal // 1)When the BK signal is sent, the bar BARSBK returns null, then the current K-line REF(C, BARSBK) that sends out the BK signal returns null; // 2)When the BK signal is sent out, the K-line BARSBK returns null, and if BARSBK>=1 is not satisfied, it is the closing price of the K-line. // 3)The K-line BARSBK after the BK signal is sent, returns the number of periods from the current K-line between the K-line for purchasing and opening a position, REF(C,BARSBK) Return the closing price of the opening K-line. // 4)Example: three K-lines: 1, 2, and 3, 1 K-line is the current K-line of the position opening signal, then returns the closing price of the current K-line, 2, 3 The K-line returns the closing price of the 1 K-line.- ## UNIT

Holen Sie sich die Handelseinheit des Datenvertrags.

Get the trading unit of the data contract. Usage: UNIT takes the trading unit of the loaded data contract.Kryptowährungs-Spot

UNIT-Wert ist 1.

Futures für Kryptowährungen

Der Wert in UNIT bezieht sich auf die Vertragswährung.

OKEX futures currency standard contracts: 1 contract for BTC represents $100, 1 contract for other currencies represents $10- ## MINPRICE

Der Mindestvariationspreis des Datenvertrags.

Take the minimum variation price of the data contract. Usage: MINPRICE; Take the minimum variation price of the loaded data contract.- ## MINPRICE1

Der Mindestvariationspreis eines Handelsvertrags.

Take the minimum variation price of a trading contract. Usage: MINPRICE1; Take the minimum variation price of a trading contract. -

Zeitfunktion

- ## BARPOS

Nehmen Sie die Position der K-Linie ein.

BARPOS, Returns the number of periods from the first K-line to the current one. Remarks: 1.BARPOS returns the number of locally available K-line, counting from the data that exists on the local machine. 2.The return value of the first K-line existing in this machine is 1. Example 1:LLV(L,BARPOS); // Find the minimum value of locally available data. Example 2:IFELSE(BARPOS=1,H,0); // The current K-line is the first K-line that already exists in this machine, and it takes the highest value, otherwise it takes 0.- ## DAYBARPOS

DAYBARPOS die aktuelle K-Line BAR ist die K-Line BAR des Tages.

- ## Periode

Der Periodenwert ist die Anzahl der Minuten.

1, 3, 5, 15, 30, 60, 1440- ## Datum

DatumFunktion DATE, Erhalten Sie das Jahr, den Monat und den Tag des Zeitraums seit 1900.

Example 1: AA..DATE; // The value of AA at the time of testing is 220218, which means February 18, 2022- ## Zeit

Es ist Zeit, die K-Linie zu nehmen.

TIME, the time of taking the K-line. Remarks: 1.The function returns in real time in the intraday, and returns the starting time of the K-line after the K-line is completed. 2.This function returns the exchange data reception time, which is the exchange time. 3.The TIME function returns a six-digit form when used on a second period, namely: HHMMSS, and displays a four-digit form on other periods, namely: HHMM. 4.The TIME function can only be loaded in periods less than the daily period, and the return value of the function is always 1500 in the daily period and periods above the daily period. 5. It requires attention when use the TIME function to close a position at the end of the day (1).It is recommended to set the time for closing positions at the end of the market to the time that can actually be obtained from the return value of the K-line (for example: the return time of the last K-line in the 5-minute period of the thread index is 1455, and the closing time at the end of the market is set to TIME>=1458, CLOSEOUT; the signal of closing the position at the end of the market cannot appear in the effect test) (2).If the TIME function is used as the condition for closing the position at the end of the day, it is recommended that the opening conditions should also have a corresponding time limit (for example, if the condition for closing the position at the end of the day is set to TIME>=1458, CLOSEOUT; then the condition TIME needs to be added to the corresponding opening conditions. <1458; avoid re-opening after closing) Example 1: C>O&&TIME<1450,BK; C<O&&TIME<1450,SK; TIME>=1450,SP; TIME>=1450,BP; AUTOFILTER; // Close the position after 14:50. Example 2: ISLASTSK=0&&C>O&&TIME>=0915,SK;- ## Jahr

Year.

YEAR, year of acquisition. Remark: The value range of YEAR is 1970-2033. Example 1: N:=BARSLAST(YEAR<>REF(YEAR,1))+1; HH:=REF(HHV(H,N),N); LL:=REF(LLV(L,N),N); OO:=REF(VALUEWHEN(N=1,O),N); CC:=REF(C,N); // Take the highest price, lowest price, opening price, and closing price of the previous year Example 2: NN:=IFELSE(YEAR>=2000 AND MONTH>=1,0,1);- ## MONAT

Nehmen Sie sich den Monat.

MONTH, returns the month of a period. Remark: The value range of MONTH is 1-12. Example 1: VALUEWHEN(MONTH=3&&DAY=1,C); // Take its closing price when the K-line date is March 1 Example 2: C>=VALUEWHEN(MONTH<REF(MONTH,1),O),SP;- ## Tag

Finden Sie die Anzahl der Tage in einer Periode

DAY, returns the number of days in a period. Remark: The value range of DAY is 1-31. Example 1: DAY=3&&TIME=0915,BK; // 3 days from the same day, at 9:15, buy it Example 2: N:=BARSLAST(DATE<>REF(DATE,1))+1; CC:=IFELSE(DAY=1,VALUEWHEN(N=1,O),0); // When the date is 1, the opening price is taken, otherwise the value is 0- ## Stunde

Hour.

HOUR, returns the number of hours in a period. Remark: The value range of HOUR is 0-23 Example 1: HOUR=10; // The return value is 1 on the K-line at 10:00, and the return value on the remaining K-lines is 0- ## Minute

Minute.

MINUTE, returns the number of minutes in a period. Remarks: 1: The value range of MINUTE is 0-59 2: This function can only be loaded in the minute period, and returns the number of minutes when the K-line starts. Example 1: MINUTE=0; // The return value of the minute K-line at the hour is 1, and the return value of the other K-lines is 0 Example 2: TIME>1400&&MINUTE=50,SP; // Sell and close the position at 14:50- ## Wochentag

Holen Sie sich die Nummer der Woche.

WEEKDAY, get the number of the week. Remark: 1: The value range of WEEKDAY is 0-6. (Sunday ~ Saturday) Example 1: N:=BARSLAST(MONTH<>REF(MONTH,1))+1; COUNT(WEEKDAY=5,N)=3&&TIME>=1450,BP; COUNT(WEEKDAY=5,N)=3&&TIME>=1450,SP; AUTOFILTER; // Automatically close positions at the end of the monthly delivery day Example 2: C>VALUEWHEN(WEEKDAY<REF(WEEKDAY,1),O)+10,BK; AUTOFILTER; -

Funktion des logischen Urteils

- ## BARSTATUS

Geben Sie den Positionsstatus für den laufenden Zeitraum zurück.

BARSTATUS returns the position status for the current period. Remark: The function returns 1 to indicate that the current period is the first period, returns 2 to indicate that it is the last period, and returns 0 to indicate that the current period is in the middle. Example: A:=IFELSE(BARSTATUS=1,H,0); // If the current K-line is the first period, variable A returns the highest value of the K-line, otherwise it takes 0- ## Zwischen

Between.

BETWEEN(X,Y,Z) indicates whether X is between Y and Z, returns 1 (Yes) if established, otherwise returns 0 (No). Remark: 1.The function returns 1(Yse) if X=Y, X=Z, or X=Y and Y=Z. Example 1: BETWEEN(CLOSE,MA5,MA10); // It indicates that the closing price is between the 5-day moving average and the 10-day moving average- ## BARSLASTCOUNT

BARSLASTCOUNT(COND) zählt die Anzahl der aufeinander folgenden Perioden, die die Bedingung erfüllen, und zählt ab dem laufenden Zeitraum.

Remark: 1. The return value is the number of consecutive non zero periods calculated from the current period 2. the first time the condition is established when the return value of the current K-line BARSLASTCOUNT(COND) is 1 Example: BARSLASTCOUNT(CLOSE>OPEN); //Calculate the number of consecutive positive periods within the current K-line- ## Kreuze

Kreuzfunktion.

CROSS(A,B) means that A crosses B from bottom to top, and returns 1 (Yes) if established, otherwise returns 0 (No) Remark: 1.To meet the conditions for crossing, the previous k-line must satisfy A<=B, and when the current K-line satisfies A>B, it is considered to be crossing. Example 1: CROSS(CLOSE,MA(CLOSE,5)); // Indicates that the closing line crosses the 5-period moving average from below- ## Kreuzzug

Durchschlag

CROSSDOWN(A,B): indicates that when A passes through B from top to bottom, it returns 1 (Yes) if it is established, otherwise it returns 0 (No) Remark: 1.CROSSDOWN(A,B) is equivalent to CROSS(B,A), and CROSSDOWN(A,B) is easier to understand Example 1: MA5:=MA(C,5); MA10:=MA(C,10); CROSSDOWN(MA5,MA10),SK; // MA5 crosses down MA10 to sell and open a position // CROSSDOWN(MA5,MA10),SK; Same meaning as CROSSDOWN(MA5,MA10)=1,SK;- ## CROSSUP

Crossup.

CROSSUP(A,B) means that when A crosses B from the bottom up, it returns 1 (Yes) if it is established, otherwise it returns 0 (No) Remark: 1.CROSSUP(A,B) is equivalent to CROSS(A,B), and CROSSUP(A,B) is easier to understand. Example 1: MA5:=MA(C,5); MA10:=MA(C,10); CROSSUP(MA5,MA10),BK; // MA5 crosses MA10, buy open positions // CROSSUP(MA5,MA10),BK;与CROSSUP(MA5,MA10)=1,BK; express the same meaning- Jeder

Bestimmen, ob sie kontinuierlich erfüllt ist.

EVERY(COND,N), Determine whether the COND condition is always satisfied within N periods. The return value of the function is 1 if it is satisfied, and 0 if it is not satisfied. Remarks: 1.N contains the current K-line. 2.If N is a valid value, but there are not so many K-lines in front, or N is a null value, it means that the condition is not satisfied, and the function returns a value of 0. 3.N can be a variable. Example 1: EVERY(CLOSE>OPEN,5); // Indicates that it has been a positive line for 5 periods Example 2: MA5:=MA(C,5); // Define a 5-period moving average MA10:=MA(C,10); // Define a 10-period moving average EVERY(MA5>MA10,4),BK; // If MA5 is greater than MA10 within 4 periods, then buy the open position // EVERY(MA5>MA10,4),BK; has the same meaning as EVERY(MA5>MA10,4)=1,BK;- ## existieren

Stellen Sie fest, ob Sie zufrieden sind.

EXIST(COND, N) judges whether there is a condition that satisfies COND within N periods. Remarks: 1.N contains the current K-line. 2.N can be a variable. 3.If N is a valid value, but there are not so many K-lines in front, it is calculated according to the actual number of periods. Example 1: EXIST(CLOSE>REF(HIGH,1),10); // Indicates whether there is a closing price greater than the highest price of the previous period in 10 periods, returns 1 if it exists, and returns 0 if it does not exist Example 2: N:=BARSLAST(DATE<>REF(DATE,1))+1; EXIST(C>MA(C,5),N); // Indicates whether there is a K-line that satisfies the closing price greater than the 5-period moving average on the day, returns 1 if it exists, returns 0 if it does not exist- ## Wenn

Zustandsfunktion.

IF(COND,A,B)Returns A if the COND condition is true, otherwise returns B. Remarks: 1.COND is a judgment condition; A and B can be conditions or values. 2.This function supports the variable circular reference to the previous period's own variable, that is, supports the following writing Y: IF(CON,X,REF(Y,1)). Example 1: IF(ISUP,H,L); // The K-line is the positive line, the highest price is taken, otherwise the lowest price is taken Example 2: A:=IF(MA5>MA10,CROSS(DIFF,DEA),IF(CROSS(D,K),2,0)); // When MA5>MA10, check whether it satisfies the DIFF and pass through DEA, otherwise (MA5 is not greater than MA10), when K and D are dead fork, let A be assigned a value of 2, if none of the above conditions are met, A is assigned a value of 0 A=1,BPK; // When MA5>MA10, the condition for opening a long position is to cross DEA above the DIFF A=2,SPK; // When MA5 is not greater than MA10, use K and D dead forks as the conditions for opening short positions- ## IFELSE

Zustandsfunktion.

` IFELSE(COND,A,B) Gibt A zurück, wenn die COND-Bedingung wahr ist, andernfalls B. Anmerkungen: 1.COND ist eine Urteilsbedingung; A und B können Bedingungen oder Werte sein. 2.Diese Funktion unterstützt eine kreisförmige Verweisung der Variablen auf die eigene Variable der vorherigen Periode, d. h. unterstützt die folgende Schrift Y: IFELSE ((CON,X,REF ((Y,1)); Beispiel 1: IFELSE ((ISUP,H,L); // Die K-Linie ist die positive Linie, der höchste Preis wird genommen, ansonsten wird der niedrigste Preis genommen Beispiel 2: A:=IFELSE(MA5>MA10,CROSS(DIFF,DEA),IFELSE(CROSS(D,K,2,0)); // Wenn MA5>MA10, überprüfen, ob es die DIFF erfüllt und durch DEA, andernfalls (MA5 ist nicht größer als MA10), wenn K und D sind Toten Gabel, lassen Sie A einen Wert von 2 zugewiesen werden, wenn keine der oben genannten Bedingungen erfüllt ist, wird A einen Wert von 0 zugewiesen A=1,BPK; // Wenn MA5>MA10, ist die Bedingung für die Eröffnung einer Longposition, die DEA über dem DIFF zu überschreiten A=2,SPK; // Wenn MA5 nicht größer als MA10 ist, verwenden Sie als Bedingung K und D-Toten Gabeln

- Berechnung der Ema-Schicht

- Problem mit dem Hochfrequenz-Handel

- Neue Erkenntnisse: Kettendaten + In-Feld-Transaktionsdaten = Hauptein- und Ausgangspunkte

- Hilfe bei Problemen mit dem Prozedurenrahmen und der Kombination von mehreren Strategien

- Kann die pine-Skript die Marktdaten direkt wechseln?

- Webseite: Probleme mit dem Aufladen

- Die Rechner-Grafik zeigt nur ein paar tausend Daten?

- Der König der Indikatoren MACD, der die Indikatoren für den Haushalt in den Händen hat

- TV Strategie Alarm: Wie kann man sich über FMZ anmelden?

- Die neue Version des Fernseh-Rückruf-Symbols ist nicht einfach.

- Die fortschrittlichste Art zu handeln: Machen Sie sich eine Orderwand!

- Was ist die Einheit für Volumen?

- Was ist die höhere jährliche Veränderung in den jüngsten Jahren zwischen dem direkten und dem umgekehrten Gebührensatz?

- Problem mit der Tradingview-Signalverzögerung zwischen FMZ und FMZ von 1 bis 2 Sekunden

- Wie man mehrere Konten auf einer Festplatte bedient

- Wir haben eine Reihe von Anfragen gestellt, aber wir haben keine Antwort bekommen.

- Die Preisverteilung der Quantität ist ein Ansatz, um die durchschnittlichen Kosten zu ermitteln.

- Fehlermeldung auf der Festplatte

- Warum können Kleingelds nicht zurückgetastet werden?

- Die Netzstrategie