Implementierung der Fisher-Indikatoren und der FMZ in JavaScript-Sprache

Schriftsteller:FMZ~Lydia, Erstellt: 2022-11-07 11:37:48, Aktualisiert: 2024-12-02 21:42:27

Während der technischen Analyse des Handels analysieren und studieren Händler die Aktienpreisdaten als die Daten der Normalverteilung.Fisher Transformationist eine Methode, die Preisdaten in normale Verteilung umwandeln kann.Fisher TransformationDie Handelssignale können mit Hilfe der Indikatoren des laufenden Tages und des vorhergehenden Tages gesendet werden.

Es gibt viele Inhalte über dieFisher TransformAuf Baidu, Zhihu, hier werden wir nicht wiederholen.

Indikator-Algorithmus:

- Mittlerer Preis heute:

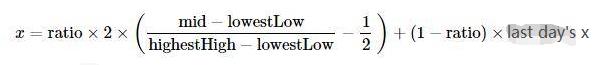

- Judge the calculation period, which can be 10 days. Calculate the highest and lowest price in the period:

```lowestLow = lowest price in the period```,```highestHigh = highest price in the period```.

- Define the price change parameter (the ```ratio``` is a constant between 0-1, for example, 0.5 or 0.33):

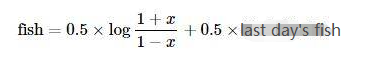

- Using the ```Fisher``` transformation on the price change parameter ```x```, the ```Fisher``` indicator is obtained:

### Implement the algorithm by using the JavaScript language

It is implemented step by step according to the indicator algorithm. It should be noted that the algorithm is an iterative algorithm. For ```preX``` and ```preFish```, they were set to 0 at the beginning. For ```Math Log``` is to find the logarithm based on the natural constant e. In addition, the above algorithm did not mention the correction of x, which I almost ignored when writing:

Correct the value of x, force it to be 0.999 if it is greater than 0.99. Same for that of less than -0.99.

if (x > 0.99) {

x = 0.999

} else if (x < -0.99) {

x = -0.999

}

The first time I saw the algorithm and indicators, I transplanted them according to the algorithm. I have not verified this implementation, and some who are interested in research can verify whether there are any errors. Thank you very much for pointing out the mistakes.

```Fisher Transform``` indicator algorithm source code:

```js

function getHighest(arr, period) {

if (arr.length == 0 || arr.length - period < 0) {

return null

}

var beginIndex = arr.length - period

var ret = arr[beginIndex].High

for (var i = 0 ; i < arr.length - 1 ; i++) {

if (arr[i + 1].High > ret) {

ret = arr[i + 1].High

}

}

return ret

}

function getLowest(arr, period) {

if (arr.length == 0 || arr.length - period < 0) {

return null

}

var beginIndex = arr.length - period

var ret = arr[beginIndex].Low

for (var i = 0 ; i < arr.length - 1 ; i++) {

if (arr[i + 1].Low < ret) {

ret = arr[i + 1].Low

}

}

return ret

}

function calcFisher(records, ratio, period) {

var preFish = 0

var preX = 0

var arrFish = []

// When the length of K-line is not enough to meet the period

if (records.length < period) {

for (var i = 0 ; i < records.length ; i++) {

arrFish.push(0)

}

return arrFish

}

// traverse the K-line

for (var i = 0 ; i < records.length ; i++) {

var fish = 0

var x = 0

var bar = records[i]

var mid = (bar.High + bar.Low) / 2

// When the current BAR is insufficient in period calculation

if (i < period - 1) {

fish = 0

preFish = 0

arrFish.push(fish)

continue

}

// Calculate the highest and lowest price in the period

var bars = []

for (var j = 0 ; j <= i ; j++) {

bars.push(records[j])

}

var lowestLow = getLowest(bars, period)

var highestHigh = getHighest(bars, period)

// price change parameters

x = ratio * 2 * ((mid - lowestLow) / (highestHigh - lowestLow) - 0.5) + (1 - ratio) * preX

if (x > 0.99) {

x = 0.999

} else if (x < -0.99) {

x = -0.999

}

preX = x

fish = 0.5 * Math.log((1 + x) / (1 - x)) + 0.5 * preFish

preFish = fish

arrFish.push(fish)

}

return arrFish

}

Zeichnungsdiagramm

Es ist leicht, auf FMZ, Strategie Square zu zeichnen:https://www.fmz.com/squareEs gibt eine Vielzahl von Beispielen für Referenz, Sie können sie durchsuchen.

var cfg = { // The object used to initialize chart settings (i.e. chart settings)

plotOptions: {

candlestick: {

color: '#d75442', // color value

upColor: '#6ba583' // color value

}

},

title: { text: 'Fisher Transform'}, //title

subtitle: {text: ''}, //sub-title

plotOptions: {

candlestick: {

tooltip: {

pointFormat:

'<span style="color:{point.color}">\u25CF</span> <b> {series.name}</b><br/>' +

'opening quotation: {point.open}<br/>' +

'the highest: {point.high}<br/>' +

'the lowest: {point.low}<br/>' +

'closing quotation: {point.close}<br/>'

}

}

},

yAxis: [{

title: {

text: 'K-line market'

},

height: '70%',

lineWidth: 1

}, {

title: {

text: 'Fisher Transform'

},

top: '75%',

height: '30%',

offset: 0,

lineWidth: 1

}],

series: [//series

{

type: 'candlestick',

yAxis: 0,

name: 'K-line',

id: 'KLine',

// Control the candle color with downward trend

color: 'green',

lineColor: 'green',

// Control the candle color with upward trend

upColor: 'red',

upLineColor: 'red',

data: []

},{

type: 'line', // Set the current data series type as line

yAxis: 1, // The y-axis used as the y-axis with the index of 0 (a highcharts chart can have multiple y-axes, and the y-axis with the index of 0 is specified here)

showInLegend: true, //

name: 'fish', // Set it according to the parameter label passed in by the function

lineWidth: 1,

data: [], // Data items of data series

tooltip: { // Tooltip

valueDecimals: 2 // The decimal point of the value is reserved for 5 digits

}

},{

type: 'line', // Set the current data series type as line

yAxis: 1, // The y-axis used as the y-axis with the index of 0 (a highcharts chart can have multiple y-axes, and the y-axis with the index of 0 is specified here)

showInLegend: true, //

name: 'preFish', // Set it according to the parameter label passed in by the function

lineWidth: 1,

data: [], // Data items of data series

tooltip: { // Tooltip

valueDecimals: 2 // The decimal point of the value is reserved for 5 digits

}

}

]

}

var chart = Chart(cfg)

function main() {

var ts = 0

chart.reset()

while (true) {

var r = exchange.GetRecords()

var fisher = calcFisher(r, 0.33, 10)

if (!r || !fisher) {

Sleep(500)

continue

}

for (var i = 0; i < r.length; i++){

if (ts == r[i].Time) {

chart.add([0,[r[i].Time, r[i].Open, r[i].High, r[i].Low, r[i].Close], -1])

chart.add([1,[r[i].Time, fisher[i]], -1])

if (i - 1 >= 0) {

chart.add([2,[r[i].Time, fisher[i - 1]], -1])

}

}else if (ts < r[i].Time) {

chart.add([0,[r[i].Time, r[i].Open, r[i].High, r[i].Low, r[i].Close]])

chart.add([1,[r[i].Time, fisher[i]]])

if (i - 1 >= 0) {

chart.add([2,[r[i].Time, fisher[i - 1]]])

}

ts = r[i].Time

}

}

}

}

Daher ist es sehr praktisch, Daten, Darstellungsdiagramme und Designstrategie auf FMZ zu studieren. Hier haben wir gerade ein Beispiel gezeigt, ihr könnt gerne eine Nachricht hinterlassen.

- Quantitative Praxis der DEX-Börsen (2) -- Benutzerhandbuch für Hyperflüssigkeiten

- DEX-Börsen Quantitative Praxis ((2) -- Hyperliquid Benutzerhandbuch

- Quantitative Praxis der DEX-Börsen (1) -- dYdX v4 Benutzerhandbuch

- Einführung in Lead-Lag-Arbitrage in Kryptowährungen (3)

- DEX-Börsen Quantitative Praxis ((1)-- dYdX v4 Benutzerhandbuch

- Einführung der Lead-Lag-Suite in der Kryptowährung (3)

- Einführung in Lead-Lag-Arbitrage in Kryptowährungen (2)

- Einführung der Lead-Lag-Suite in der digitalen Währung (2)

- Diskussion über den externen Signalempfang der FMZ-Plattform: Eine Komplettlösung für den Empfang von Signalen mit integriertem Http-Service in der Strategie

- FMZ-Plattform: Erforschung von Signalempfangsstrategien für externe Netzwerke

- Einführung in Lead-Lag-Arbitrage in Kryptowährungen (1)

- Strategie für den Wendepunkt der Doppel-EMA-Futures für digitale Währungen (Tutorial)

- Abonnieren Sie eine neue Aktienstrategie für digitale Währung (Tutorial)

- Eine Idee mit 60 Zeilen Code verwirklichen - Vertragsbottom Fishing Strategie

- Der Wert des Wertpapiers wird auf der Basis der in Artikel 4 Absatz 1 Buchstabe b genannten Methode berechnet.

- Konstruktion eines auf FMZ Quant basierenden Systems zur Verwaltung der Auftragssynchronisierung (2)

- Futures für digitale Währungen - Multi-Species-ATR-Strategie (Tutorial)

- Schreiben Sie ein halbautomatisches Handelswerkzeug mit der Sprache Pine

- Erforschen Sie das Hochfrequenz-Strategie-Design von der magischen Veränderung von LeeksReaper

- Strategieanalyse von LeeksReaper (2)

- Die "Magische Doppel-EMA-Strategie" von den YouTube-Veteranen

- Beispiel für die Gestaltung der dYdX-Strategie

- Konstruktion eines auf FMZ Quant basierenden Systems zur Verwaltung der Auftragssynchronisierung (1)

- Strategieanalyse von LeeksReaper (1)

- Derbit Options Delta Dynamische Absicherungsstrategie

- Aktueller Stand und empfohlene Anwendung der Finanzierungsrate-Strategie

- Überprüfung des Marktes für digitale Währungen im Jahr 2021 und die einfachste 10-fache Strategie verpasst

- Modell für digitale Währungsfaktoren

- Das ist die magische doppelte EMA-Gleichlinienstrategie von YouTube-Gott.

- Schreiben Sie ein halbautomatisches Handelstool in der Sprache Pine

- Faktormodell für digitale Währungen