Anpassungsfähiger gleitender Durchschnitt der Steigung

Schriftsteller:ChaoZhang, Datum: 31.5.2022Tags:Die AMA

Einleitung

Dieses Skript ist inspiriert von

Trenderkennung Grüne Farbe Starker Aufwärtstrend mit guter Kursdynamik. Rote Farbe: Ein starker Abwärtstrend. Gelb: Der Markt ist entweder unruhig, seitwärts oder konsolidiert sich.

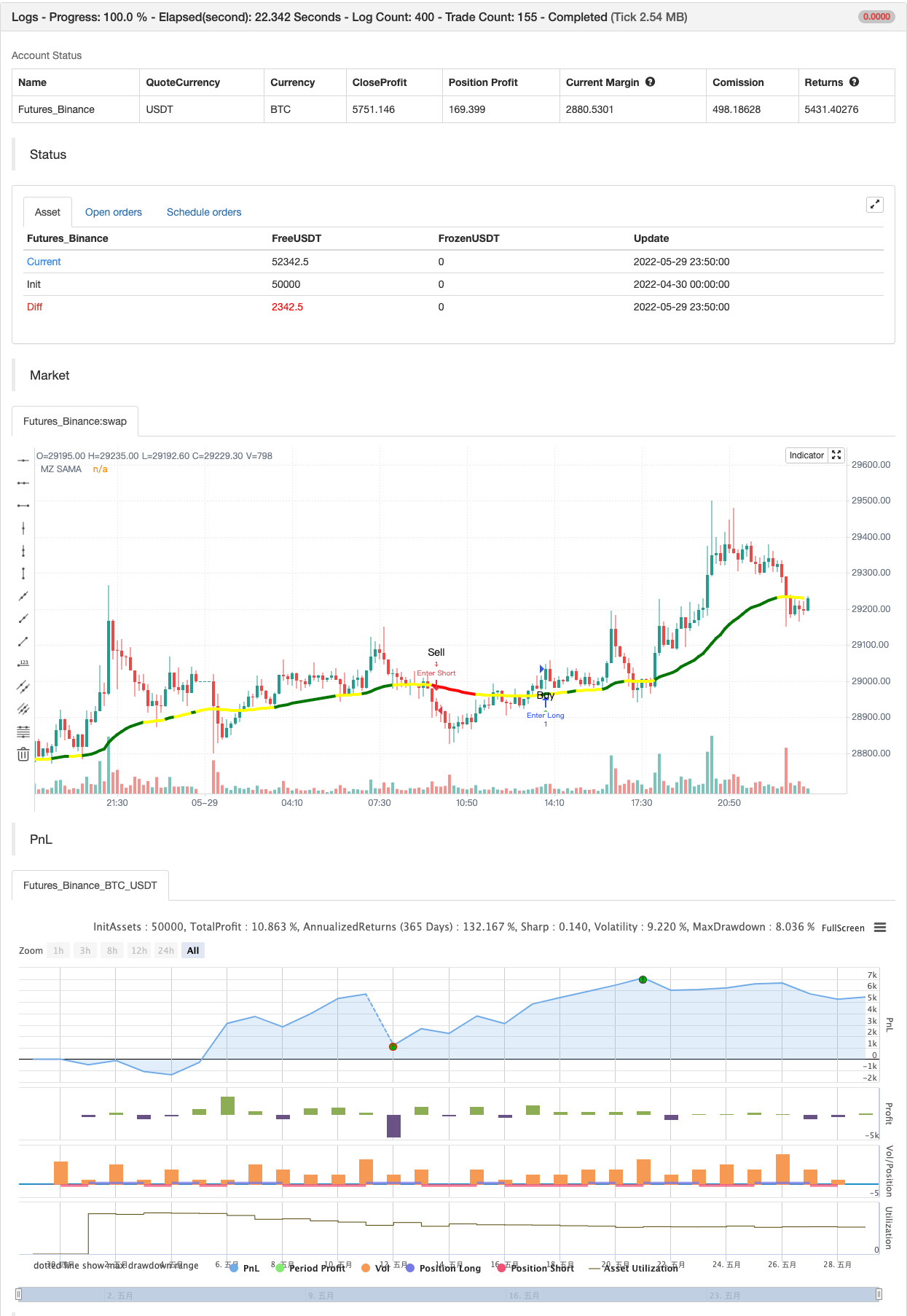

Voreinstellungen AMA-Länge ist 200 (Besser für Zeitrahmen größer als 1H) Kleine Länge ist 6 Die Hauptlänge beträgt 14 Die Steigungsperiode ist auf 34 mit 25 der Anfangsbreite festgelegt. Warnungen Best Entry ist bei absoluten Warnungen Timing, aber andere Trades können in der Mitte basierend auf Trend-Bedingung begonnen werden.

Zurückprüfung

/*backtest

start: 2022-04-30 00:00:00

end: 2022-05-29 23:59:00

period: 10m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © MightyZinger

//@version=5

indicator('Slope Adaptive Moving Average (MZ SAMA)', shorttitle='MZ SAMA', overlay=true)

/////////////////////////////////////////////////////////////////////

/////////////////////////////////////////////////////////////////////

///// MZ SAMA //////

/////////////////////////////////////////////////////////////////////

/////////////////////////////////////////////////////////////////////

chartResolution = input.timeframe('', title='Chart Resolution')

src = input.source(close, 'Source')

// Length Inputs

string grp_1 = 'SAMA Length Inputs'

length = input(200, title='Adaptive MA Length', group = grp_1) // To check for Highest and Lowest value within provided period

majLength = input(14, title='Major Length', group = grp_1) // For Major alpha calculations to detect recent price changes

minLength = input(6, title='Minor Length', group = grp_1) // For Minor alpha calculations to detect recent price changes

// Slope Inputs

string grp_2 = 'Slope and Dynamic Coloring Parameters'

slopePeriod = input.int(34, title='Slope Period', group = grp_2)

slopeInRange = input.int(25, title='Slope Initial Range', group = grp_2)

flat = input.int(17, title='Consolidation area is when slope below:', group = grp_2)

bull_col = input.color(color.green, 'Bull Color ', inline='dyn_col', group = grp_2)

bear_col = input.color(color.red, 'Bear Color ', inline='dyn_col', group = grp_2)

conc_col = input.color(color.yellow, 'Reversal/Consolidation/Choppiness Color ', inline='dyn_col', group = grp_2)

showSignals = input.bool(true, title='Show Signals on Chart', group='Plot Parameters')

//Slope calculation Function to check trend strength i.e. consolidating, choppy, or near reversal

calcslope(_ma, src, slope_period, range_1) =>

pi = math.atan(1) * 4

highestHigh = ta.highest(slope_period)

lowestLow = ta.lowest(slope_period)

slope_range = range_1 / (highestHigh - lowestLow) * lowestLow

dt = (_ma[2] - _ma) / src * slope_range

c = math.sqrt(1 + dt * dt)

xAngle = math.round(180 * math.acos(1 / c) / pi)

maAngle = dt > 0 ? -xAngle : xAngle

maAngle

//MA coloring function to mark market dynamics

dynColor(_flat, slp, col_1, col_2, col_r) =>

var col = color.new(na,0)

// Slope supporting bullish uprtrend color

col := slp > _flat ? col_1:

// Slope supporting bearish downtrend color

slp <= -_flat ? col_2:

// Reversal/Consolidation/Choppiness color

slp <= _flat and slp > -_flat ? col_r : col_r

col

//AMA Calculations

ama(src,length,minLength,majLength)=>

minAlpha = 2 / (minLength + 1)

majAlpha = 2 / (majLength + 1)

hh = ta.highest(length + 1)

ll = ta.lowest(length + 1)

mult = hh - ll != 0 ? math.abs(2 * src - ll - hh) / (hh - ll) : 0

final = mult * (minAlpha - majAlpha) + majAlpha

final_alpha = math.pow(final, 2) // Final Alpha calculated from Minor and Major length along with considering Multiplication factor calculated using Highest / Lowest value within provided AMA overall length

var _ama = float(na)

_ama := (src - nz(_ama[1])) * final_alpha + nz(_ama[1])

_ama

// SAMA Definition

sama = request.security(syminfo.tickerid, chartResolution, ama(src,length,minLength,majLength))

// Slope Calculation for Dynamic Coloring

slope = calcslope(sama, src, slopePeriod, slopeInRange)

// SAMA Dynamic Coloring from slope

sama_col = request.security(syminfo.tickerid, chartResolution, dynColor(flat, slope, bull_col, bear_col, conc_col))

// SAMA Plot

plot(sama, 'MZ SAMA', sama_col, 4)

// BUY & SELL CONDITIONS AND ALERTS

_up = sama_col == bull_col

_downn = sama_col == bear_col

_chop = sama_col == conc_col

buy = _up and not _up[1]

sell = _downn and not _downn[1]

chop_zone = _chop and not _chop[1]

_signal() =>

var sig = 0

if buy and sig <= 0

sig := 1

if sell and sig >= 0

sig := -1

sig

sig = _signal()

longsignal = sig == 1 and (sig != 1)[1]

shortsignal = sig == -1 and (sig != -1)[1]

// Plotting Signals on Chart

atrOver = 1 * ta.atr(5) // Atr to place alert shape on chart

plotshape(showSignals and longsignal ? (sama - atrOver) : na , style=shape.triangleup, color=color.new(color.green, 30), location=location.absolute, text='Buy', size=size.small)

plotshape(showSignals and shortsignal ? (sama + atrOver): na , style=shape.triangledown, color=color.new(color.red, 30), location=location.absolute, text='Sell', size=size.small)

// Signals Alerts

alertcondition(longsignal, "Buy", "Go Long" )

alertcondition(shortsignal, "Sell", "Go Short")

alertcondition(chop_zone, "Chop Zone", "Possible Reversal/Consolidation/Choppiness")

if longsignal

alert("Buy at" + str.tostring(close), alert.freq_once_per_bar_close)

if shortsignal

alert("Sell at" + str.tostring(close), alert.freq_once_per_bar_close)

if longsignal

strategy.entry("Enter Long", strategy.long)

else if shortsignal

strategy.entry("Enter Short", strategy.short)

- Darvas Box Kauf verkaufen

- Demark-Einstellungsindikator

- Bollinger-Bänder Stochastischer RSI Extreme

- Aktiengeschäft

- Parabolische SAR

- RSI-Divergenzindikator

- OBV-MACD-Indikator

- Pivot-Trend

- Preisdivergenzstrategie v1.0

- Unterstützungs-Widerstands-Ausbruch

- Der Ausgleichsbetrag für den Ausgleichsbetrag für den Ausgleichsbetrag für den Ausgleichsbetrag für den Ausgleichsbetrag

- Low Scanner Strategie Krypto

- [Blackcat] L2 Umkehrung Etiketten Strategie

- SuperB

- HIGH LOW SAR

- SuperTREX

- Spitzenmelder

- Niedriger Finder

- SMA-Trend

- Bollinger-Tiefpunkte