Adaptive Swing-Trading-Strategie basierend auf Preisausbrüchen

Erstellungsdatum:

2023-12-04 14:34:13

zuletzt geändert:

2023-12-04 14:34:13

Kopie:

0

Klicks:

697

1

konzentrieren Sie sich auf

1629

Anhänger

Überblick

Die Strategie identifiziert Markttrends anhand von Preisbruchpunkten und beurteilt große Trends in Kombination mit Anpassungsindikatoren, um kurzfristige Preisumkehrmöglichkeiten zu erfassen. Die Strategie ist geeignet für den Handel mit digitalen Währungen mit hoher Volatilität.

Strategieprinzip

- Identifizieren Sie den Preis-Extrempunkt als die Grenze des Kanals. Wenn der Preis einen neuen Hoch oder einen neuen Tief erzeugt, nehmen Sie diesen Punkt als die Grenze des Kanals.

- Berechnen Sie die Adaptive Schwankungs-MA, um die Richtung der Gesamttrend zu bestimmen. Je größer der MA ist, desto größer ist die Schwankungsphase.

- Wenn der Preis nach oben durch den Kanal geht, erzeugt er ein Kaufsignal. Wenn der Preis nach unten durch den Kanal geht, erzeugt er ein Verkaufsignal.

- Ein Stop-Loss-Punkt ist 1% des Einstiegspreises.

Analyse der Stärken

- Die Preiskanäle sind anpassungsfähig und können Trendwendepunkte genau bestimmen.

- Die Schwankungen der Indikatoren helfen, Trends zu erkennen, um nicht die Richtung zu verfehlen, in der sich die Trends bewegen.

- Die Umkehrstrategie ist geeignet, um kurzfristige Preisrückschläge zu erfassen.

Risikoanalyse

- Bei einem starken und anhaltenden Rückgang können mehrere Stop-Loss-Punkte ausgelöst werden, was zu größeren Verlusten führt.

- In den letzten Monaten hat sich die Situation in den USA verschlechtert.

- Die Eintrittszeit muss manuell festgelegt werden, und automatische Transaktionen sind mit einem Überschneidungsrisiko verbunden.

Optimierungsrichtung

- Optimierung der Parameter des MA, um die Gesamtbewegung besser zu beurteilen.

- Erhöhung der Energiemesswerte, um Rückschlagsignale zu vermeiden, die zu einem Energieausfall führen könnten.

- Das System wurde in den letzten Jahren durch die Entwicklung neuer Technologien und die Entwicklung neuer Technologien erweitert.

Zusammenfassen

Die Strategie ist übersichtlich und hat einen gewissen praktischen Wert. Es ist jedoch notwendig, das Handelsrisiko zu kontrollieren, um unter bestimmten Umständen große Verluste zu verhindern. Der nächste Schritt kann in mehreren Dimensionen optimiert werden, z. B. aus dem Gesamtrahmen, den Indikatorparametern und der Risikokontrolle, um die Strategieparameter und die Handelssignale zuverlässiger zu machen.

Strategiequellcode

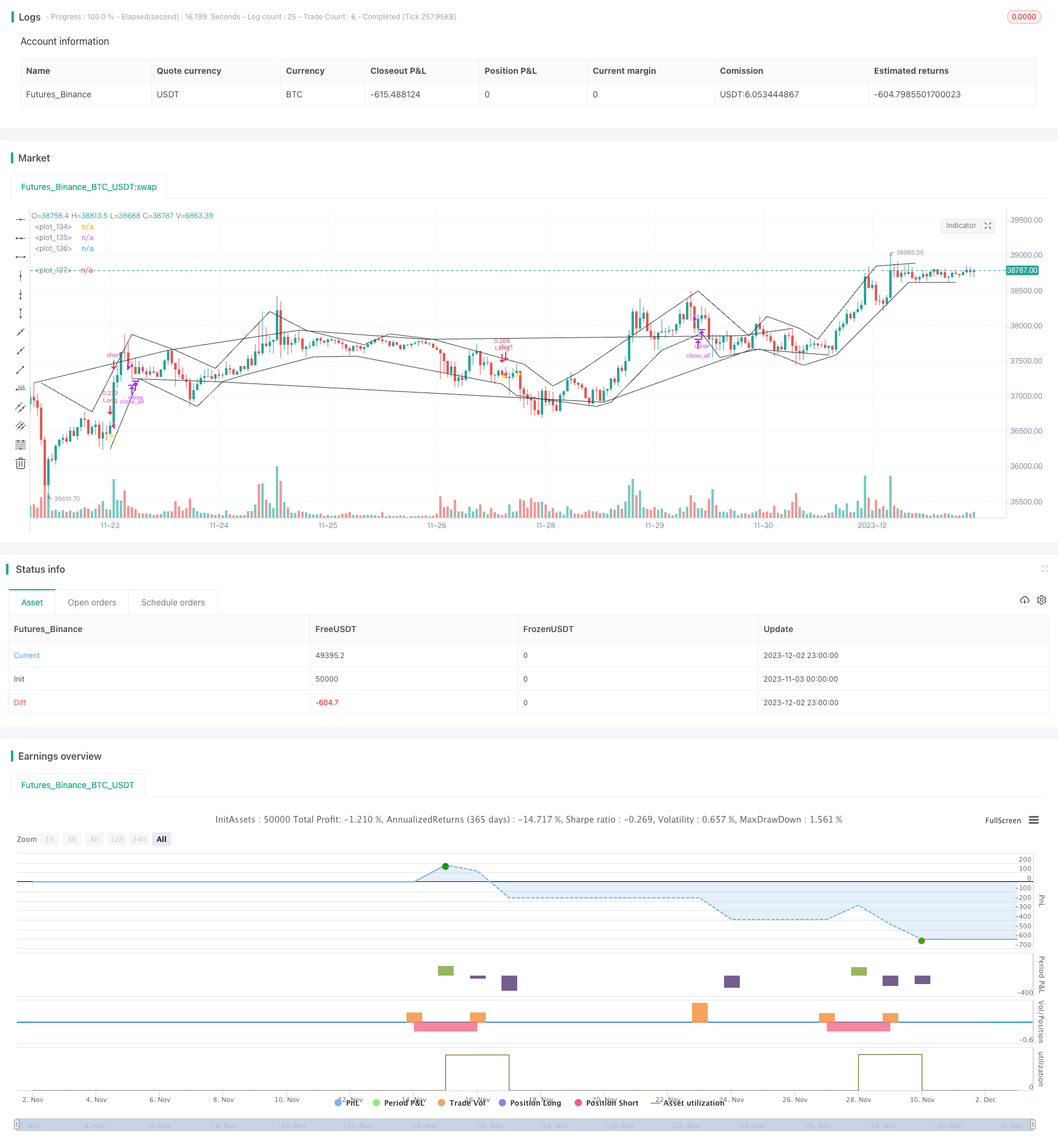

/*backtest

start: 2023-11-03 00:00:00

end: 2023-12-03 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// @version = 4

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © TradingGroundhog

// ||--- Cash & Date:

cash_amout = 10000

pyramid_val = 1

cash_given_per_lot = cash_amout/pyramid_val

startDate = input(title="Start Date",defval=13)

startMonth = input(title="Start Month",defval=9)

startYear = input(title="Start Year",defval=2021)

afterStartDate = (time >= timestamp(syminfo.timezone,startYear, startMonth, startDate, 0, 0))

// ||------------------------------------------------------------------------------------------------------

// ||--- Strategy:

strategy(title="TradingGroundhog - Strategy & Fractal V1 - Short term", overlay=true, max_bars_back = 4000, max_labels_count=500, commission_type=strategy.commission.percent, commission_value=0.00,default_qty_type=strategy.cash, default_qty_value= cash_given_per_lot, pyramiding=pyramid_val)

// ||------------------------------------------------------------------------------------------------------

// ||--- Fractal Recognition:

filterBW = input(true, title="filter Bill Williams Fractals:")

filterFractals = input(true, title="Filter fractals using extreme method:")

length = input(2, title="Extreme Window:")

regulartopfractal = high[4] < high[3] and high[3] < high[2] and high[2] > high[1] and high[1] > high[0]

regularbotfractal = low[4] > low[3] and low[3] > low[2] and low[2] < low[1] and low[1] < low[0]

billwtopfractal = filterBW ? false : (high[4] < high[2] and high[3] < high[2] and high[2] > high[1] and high[2] > high[0] ? true : false)

billwbotfractal = filterBW ? false : (low[4] > low[2] and low[3] > low[2] and low[2] < low[1] and low[2] < low[0] ? true : false)

ftop = filterBW ? regulartopfractal : regulartopfractal or billwtopfractal

fbot = filterBW ? regularbotfractal : regularbotfractal or billwbotfractal

topf = ftop ? high[2] >= highest(high, length) ? true : false : false

botf = fbot ? low[2] <= lowest(low, length) ? true : false : false

filteredtopf = filterFractals ? topf : ftop

filteredbotf = filterFractals ? botf : fbot

// ||------------------------------------------------------------------------------------------------------

// ||--- V1 : Added Swing High/Low Option

ShowSwingsHL = input(true)

highswings = filteredtopf == false ? na : valuewhen(filteredtopf == true, high[2], 2) < valuewhen(filteredtopf == true, high[2], 1) and valuewhen(filteredtopf == true, high[2], 1) > valuewhen(filteredtopf == true, high[2], 0)

lowswings = filteredbotf == false ? na : valuewhen(filteredbotf == true, low[2], 2) > valuewhen(filteredbotf == true, low[2], 1) and valuewhen(filteredbotf == true, low[2], 1) < valuewhen(filteredbotf == true, low[2], 0)

//---------------------------------------------------------------------------------------------------------

// ||--- V2 : Plot Lines based on the fractals.

showchannel = input(true)

//---------------------------------------------------------------------------------------------------------

// ||--- ZigZag:

showZigZag = input(true)

//----------------------------------------------------------------------------------------------------------

// ||--- Fractal computation:

istop = filteredtopf ? true : false

isbot = filteredbotf ? true : false

topcount = barssince(istop)

botcount = barssince(isbot)

vamp = input(title="VolumeMA", defval=2)

vam = sma(volume, vamp)

fractalup = 0.0

fractaldown = 0.0

up = high[3]>high[4] and high[4]>high[5] and high[2]<high[3] and high[1]<high[2] and volume[3]>vam[3]

down = low[3]<low[4] and low[4]<low[5] and low[2]>low[3] and low[1]>low[2] and volume[3]>vam[3]

fractalup := up ? high[3] : fractalup[1]

fractaldown := down ? low[3] : fractaldown[1]

//----------------------------------------------------------------------------------------------------------

// ||--- Fractal save:

fractaldown_save = array.new_float(0)

for i = 0 to 4000

if array.size(fractaldown_save) < 3

if array.size(fractaldown_save) == 0

array.push(fractaldown_save, fractaldown[i])

else

if fractaldown[i] != array.get(fractaldown_save, array.size(fractaldown_save)-1)

array.push(fractaldown_save, fractaldown[i])

if array.size(fractaldown_save) < 3

array.push(fractaldown_save, fractaldown)

array.push(fractaldown_save, fractaldown)

fractalup_save = array.new_float(0)

for i = 0 to 4000

if array.size(fractalup_save) < 3

if array.size(fractalup_save) == 0

array.push(fractalup_save, fractalup[i])

else

if fractalup[i] != array.get(fractalup_save, array.size(fractalup_save)-1)

array.push(fractalup_save, fractalup[i])

if array.size(fractalup_save) < 3

array.push(fractalup_save, fractalup)

array.push(fractalup_save, fractalup)

Bottom_1 = array.get(fractaldown_save, 0)

Bottom_2 = array.get(fractaldown_save, 1)

Bottom_3 = array.get(fractaldown_save, 2)

Top_1 = array.get(fractalup_save, 0)

Top_2 = array.get(fractalup_save, 1)

Top_3 = array.get(fractalup_save, 2)

//----------------------------------------------------------------------------------------------------------

// ||--- Fractal Buy Sell Signal:

bool Signal_Test = false

bool Signal_Test_OUT_TEMP = false

var Signal_Test_TEMP = false

longLossPerc = input(title="Long Stop Loss (%)", minval=0.0, step=0.1, defval=0.01) * 0.01

if filteredbotf and open < Bottom_1 and (Bottom_1 - open) / Bottom_1 >= longLossPerc

Signal_Test := true

if filteredtopf and open > Top_1

Signal_Test_TEMP := true

if filteredtopf and Signal_Test_TEMP

Signal_Test_TEMP := false

Signal_Test_OUT_TEMP := true

//----------------------------------------------------------------------------------------------------------

// ||--- Plotting:

//plotshape(filteredtopf, style=shape.triangledown, location=location.abovebar, color=color.red, text="•", offset=0)

//plotshape(filteredbotf, style=shape.triangleup, location=location.belowbar, color=color.lime, text="•", offset=0)

//plotshape(ShowSwingsHL ? highswings : na, style=shape.triangledown, location=location.abovebar, color=color.maroon, text="H", offset=0)

//plotshape(ShowSwingsHL ? lowswings : na, style=shape.triangleup, location=location.belowbar, color=color.green, text="L", offset=0)

plot(showchannel ? (filteredtopf ? high[2] : na) : na, color=color.black, offset=0)

plot(showchannel ? (filteredbotf ? low[2] : na) : na, color=color.black, offset=0)

plot(showchannel ? (highswings ? high[2] : na) : na, color=color.black, offset=-2)

plot(showchannel ? (lowswings ? low[2] : na) : na, color=color.black, offset=-2)

plotshape(Signal_Test, style=shape.flag, location=location.belowbar, color=color.yellow, offset=0)

plotshape(Signal_Test_OUT_TEMP, style=shape.flag, location=location.abovebar, color=color.white, offset=0)

//----------------------------------------------------------------------------------------------------------

// ||--- Buy And Sell:

strategy.entry(id="Long", long=true, when = Signal_Test and afterStartDate)

strategy.close_all(when = Signal_Test_OUT_TEMP and afterStartDate)

//----------------------------------------------------------------------------------------------------------