Die auf dem Volatilitätsindex und dem Stochastischen Oszillator basierende mehrjährige Handelsstrategie

Schriftsteller:ChaoZhang, Datum: 2023-12-21 14:34:42Tags:

Übersicht Diese Strategie kombiniert den Volatilitätsindex VIX und den stochastischen Oszillator RSI durch eine Zusammensetzung von Indikatoren über verschiedene Zeiträume hinweg, um effiziente Breakout-Eingänge und Überkauf/Überverkaufsausgänge zu erzielen.

Grundsätze

-

Berechnen Sie den VIX-Volatilitätsindex: Nehmen Sie die höchsten und niedrigsten Preise der letzten 20 Tage, um die Volatilität zu berechnen.

-

Berechnen Sie den RSI-Oszillator: Nehmen Sie die Preisänderungen in den letzten 14 Tagen.

-

Verknüpfen Sie die beiden Indikatoren. Gehen Sie lang, wenn VIX das obere Band oder den höchsten Perzentil überschreitet. Schließen Sie lange, wenn der RSI über 70 geht.

Vorteile

- Integriert mehrere Indikatoren für eine umfassende Bewertung des Marktzeitpunkts.

- Indikatoren über Zeiträume hinweg überprüfen sich gegenseitig und verbessern die Entscheidungsgenauigkeit.

- Anpassbare Parameter können für verschiedene Handelsinstrumente optimiert werden.

Risiken

- Eine falsche Einstellung der Parameter kann mehrere falsche Signale verursachen.

- Ein einzelner Exit-Indikator kann Preisumkehrungen verpassen.

Optimierungsvorschläge

- Mehr bestätigende Indikatoren wie gleitende Durchschnitte und Bollinger-Bänder in die Zeiteinträge integrieren.

- Hinzufügen von mehr Exit-Indikatoren wie Umkehr-Candlestick-Muster.

Zusammenfassung Diese Strategie nutzt den VIX, um Marktzeit und Risikoniveaus zu messen, und filtert ungünstige Trades anhand von Überkauf-/Überverkaufswerte aus dem RSI aus, um zu geeigneten Momenten einzutreten und rechtzeitig mit Stops auszutreten.

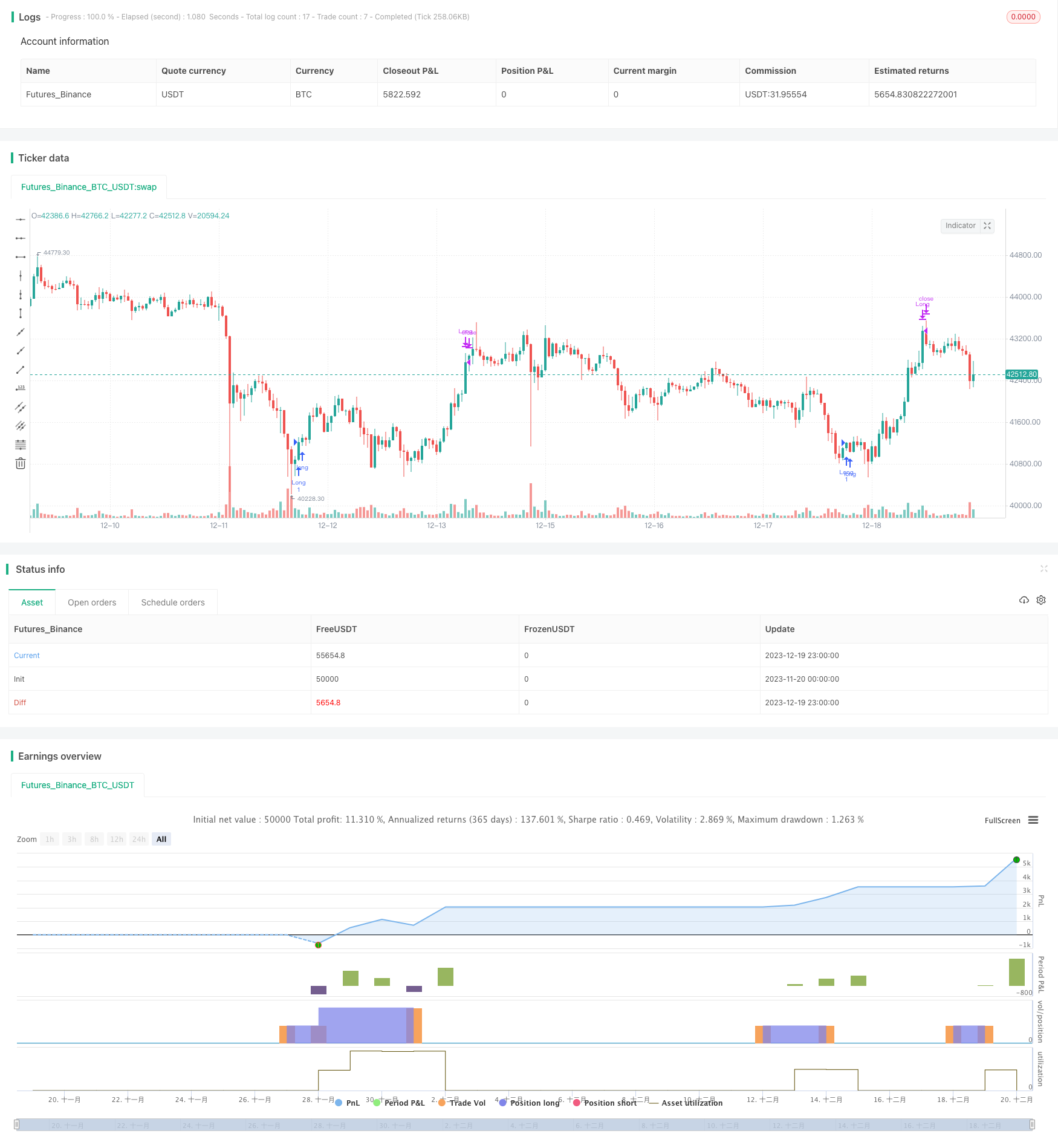

/*backtest

start: 2023-11-20 00:00:00

end: 2023-12-20 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © timj

strategy('Vix FIX / StochRSI Strategy', overlay=true, pyramiding=9, margin_long=100, margin_short=100)

Stochlength = input.int(14, minval=1, title="lookback length of Stochastic")

StochOverBought = input.int(80, title="Stochastic overbought condition")

StochOverSold = input.int(20, title="Stochastic oversold condition")

smoothK = input(3, title="smoothing of Stochastic %K ")

smoothD = input(3, title="moving average of Stochastic %K")

k = ta.sma(ta.stoch(close, high, low, Stochlength), smoothK)

d = ta.sma(k, smoothD)

///////////// RSI

RSIlength = input.int( 14, minval=1 , title="lookback length of RSI")

RSIOverBought = input.int( 70 , title="RSI overbought condition")

RSIOverSold = input.int( 30 , title="RSI oversold condition")

RSIprice = close

vrsi = ta.rsi(RSIprice, RSIlength)

///////////// Double strategy: RSI strategy + Stochastic strategy

pd = input(22, title="LookBack Period Standard Deviation High")

bbl = input(20, title="Bolinger Band Length")

mult = input.float(2.0 , minval=1, maxval=5, title="Bollinger Band Standard Devaition Up")

lb = input(50 , title="Look Back Period Percentile High")

ph = input(.85, title="Highest Percentile - 0.90=90%, 0.95=95%, 0.99=99%")

new = input(false, title="-------Text Plots Below Use Original Criteria-------" )

sbc = input(false, title="Show Text Plot if WVF WAS True and IS Now False")

sbcc = input(false, title="Show Text Plot if WVF IS True")

new2 = input(false, title="-------Text Plots Below Use FILTERED Criteria-------" )

sbcFilt = input(true, title="Show Text Plot For Filtered Entry")

sbcAggr = input(true, title="Show Text Plot For AGGRESSIVE Filtered Entry")

ltLB = input.float(40, minval=25, maxval=99, title="Long-Term Look Back Current Bar Has To Close Below This Value OR Medium Term--Default=40")

mtLB = input.float(14, minval=10, maxval=20, title="Medium-Term Look Back Current Bar Has To Close Below This Value OR Long Term--Default=14")

str = input.int(3, minval=1, maxval=9, title="Entry Price Action Strength--Close > X Bars Back---Default=3")

//Alerts Instructions and Options Below...Inputs Tab

new4 = input(false, title="-------------------------Turn On/Off ALERTS Below---------------------" )

new5 = input(false, title="----To Activate Alerts You HAVE To Check The Boxes Below For Any Alert Criteria You Want----")

sa1 = input(false, title="Show Alert WVF = True?")

sa2 = input(false, title="Show Alert WVF Was True Now False?")

sa3 = input(false, title="Show Alert WVF Filtered?")

sa4 = input(false, title="Show Alert WVF AGGRESSIVE Filter?")

//Williams Vix Fix Formula

wvf = ((ta.highest(close, pd)-low)/(ta.highest(close, pd)))*100

sDev = mult * ta.stdev(wvf, bbl)

midLine = ta.sma(wvf, bbl)

lowerBand = midLine - sDev

upperBand = midLine + sDev

rangeHigh = (ta.highest(wvf, lb)) * ph

//Filtered Bar Criteria

upRange = low > low[1] and close > high[1]

upRange_Aggr = close > close[1] and close > open[1]

//Filtered Criteria

filtered = ((wvf[1] >= upperBand[1] or wvf[1] >= rangeHigh[1]) and (wvf < upperBand and wvf < rangeHigh))

filtered_Aggr = (wvf[1] >= upperBand[1] or wvf[1] >= rangeHigh[1]) and not (wvf < upperBand and wvf < rangeHigh)

//Alerts Criteria

alert1 = wvf >= upperBand or wvf >= rangeHigh ? 1 : 0

alert2 = (wvf[1] >= upperBand[1] or wvf[1] >= rangeHigh[1]) and (wvf < upperBand and wvf < rangeHigh) ? 1 : 0

alert3 = upRange and close > close[str] and (close < close[ltLB] or close < close[mtLB]) and filtered ? 1 : 0

alert4 = upRange_Aggr and close > close[str] and (close < close[ltLB] or close < close[mtLB]) and filtered_Aggr ? 1 : 0

//Coloring Criteria of Williams Vix Fix

col = wvf >= upperBand or wvf >= rangeHigh ? color.lime : color.gray

isOverBought = (ta.crossover(k,d) and k > StochOverBought) ? 1 : 0

isOverBoughtv2 = k > StochOverBought ? 1 : 0

filteredAlert = alert3 ? 1 : 0

aggressiveAlert = alert4 ? 1 : 0

if (filteredAlert or aggressiveAlert)

strategy.entry("Long", strategy.long)

if (isOverBought)

strategy.close("Long")

- Kurzfristige Handelsstrategie auf Basis des Chaikin Volatilitätsindikators

- Strategie zur Verfolgung von Trendüberschreitungen mit doppelter MA

- Super-Trend-Dreifachstrategie

- Dynamische Strategie zur Verringerung von Verlusten

- Bewegliche Durchschnitts-Crossover-Strategie mit Stop-Loss und Take-Profit

- Umgekehrte Strategie zur Umkehrung der Mittelwerte basierend auf gleitenden Durchschnitten

- Bollinger-Band-basierte Hochfrequenzhandelsstrategie

- Eine quantitative Ichimoku-Cloud-Handelsstrategie

- Momentum-Strategie auf der Grundlage des Modells des doppelten Bottom Breakouts

- Stochastische Stromwirbelstrategie

- Erweiterte anpassungsfähige Handelsstrategie der CCI für die Grundfischerei in Rohstoffen

- Momentum-Strategie auf Basis von LazyBear's Squeeze

- Gewinnausfallstop-Strategie auf Basis eines gleitenden Durchschnitts

- Dynamische gewichtete gleitende Durchschnittshandelsstrategie

- Letzte Kerzenstrategie

- Quantitative Strategie zur Umkehrung des negativen Volumenindex

- Triple Supertrend Breakout-Strategie

- MACD der Strategie der relativen Stärke

- Drei Drachen-System

- Top-Handel nur auf Basis der wöchentlichen EMA8-Strategie