RSI, MACD, Bollinger Bands und volumenbasierte Hybridhandelsstrategie

Schriftsteller:ChaoZhang, Datum: 2024-06-17 15:54:04Tags:RSIMACDSMA- Nein.

Übersicht

Diese Strategie kombiniert mehrere technische Indikatoren, darunter den Relative Strength Index (RSI), die Moving Average Convergence Divergence (MACD), Bollinger Bands und das Volumen, um optimale Handelschancen zu bestimmen.

Strategieprinzipien

- Berechnen Sie RSI, MACD, Bollinger Bands und Volumenindikatoren.

- Verwenden Sie kurzfristige und langfristige gleitende Durchschnitte, um die Trendrichtung zu ermitteln.

- Bestimmung der Höchst- und Tiefpunkte der Liquiditätszonen.

- Erstellen Sie Kaufsignale:

- Kaufen, wenn der RSI unter 30 liegt, der Schlusskurs unterhalb des unteren Bollinger Bands und über dem Tiefpunkt der Liquiditätszone liegt.

- Kaufen, wenn das MACD-Histogramm über 0 liegt, ein Aufwärtstrend hergestellt wird, der Schlusskurs höher ist als der höchste Punkt der vorherigen 10 Kerzen und über dem Tiefpunkt der Liquiditätszone liegt.

- Kaufen, wenn das Volumen steigt, der Schlusskurs über dem oberen Bollinger Band liegt und er über dem Tiefpunkt der Liquiditätszone liegt.

- Erstellen Sie Verkaufssignale:

- Verkaufen, wenn der RSI über 70 liegt, liegt der Schlusskurs über dem oberen Bollinger-Band und unter dem Höhepunkt der Liquiditätszone.

- Verkaufen, wenn das MACD-Histogramm unter 0 liegt, ein Abwärtstrend eingestellt wird, der Schlusskurs unter dem Tiefpunkt der vorherigen 10 Kerzen liegt und unter dem Höchstpunkt der Liquiditätszone liegt.

- Verkaufen, wenn das Volumen steigt, der Schlusskurs unterhalb des unteren Bollinger Bands liegt und unterhalb des Höhepunkts der Liquiditätszone liegt.

- Handel auf der Grundlage von Kauf- und Verkaufssignalen ausführen und doppelte Geschäfte vermeiden.

Strategische Vorteile

- Kombination von mehreren Indikatoren: Die Strategie berücksichtigt mehrere Aspekte, einschließlich Preis, Volumen, Trends und Volatilität, um zuverlässigere Handelssignale zu liefern.

- Trendbestätigung: Durch den Vergleich von kurzfristigen und langfristigen gleitenden Durchschnitten ermittelt die Strategie effektiv die aktuelle Trendrichtung.

- Volatilitätsbetrachtung: Durch die Einführung von Bollinger-Bändern und Volumenindikatoren kann die Strategie Veränderungen der Preisvolatilität und der Marktstimmung erfassen.

- Liquiditätszonen: Durch die Bestimmung von Liquiditätszonen kann die Strategie Trades in der Nähe der wichtigsten Unterstützungs- und Widerstandsniveaus ausführen und so die Erfolgsquote erhöhen.

- Verhinderung von Überhandelungen: Die Strategie verfügt über einen eingebauten Mechanismus, um Doppelhandel zu vermeiden und unnötige Handelskosten zu vermeiden.

Strategische Risiken

- Parameteroptimierungsrisiko: Die Leistung der Strategie hängt von der Auswahl mehrerer Parameter ab, und eine unsachgemäße Einstellung der Parameter kann zu einem Strategieversagen führen.

- Marktrisiko: Die Strategie ist auf der Grundlage historischer Daten optimiert und kann angesichts zukünftiger Marktveränderungen möglicherweise nicht gut funktionieren.

- Schwarze Schwäne: Die Strategie kann bei extremen Marktbedingungen nicht mit abnormalen Schwankungen umgehen.

- Schlupf- und Handelskosten: Schlupf- und Handelskosten beim tatsächlichen Handel können sich auf die Gesamtleistung der Strategie auswirken.

Strategieoptimierungsrichtlinien

- Dynamische Parameteroptimierung: Dynamische Anpassung der Strategieparameter an die Marktbedingungen, um sich an die verschiedenen Marktstadien anzupassen.

- Risikomanagement: Einführung von Stop-Loss- und Take-Profit-Mechanismen zur Kontrolle des Risikopositions einzelner Trades.

- Multi-Markt-Tests: Die Strategie auf verschiedenen Finanzmärkten anwenden, um ihre Universalität und Robustheit zu bewerten.

- Optimierung des maschinellen Lernens: Verwenden von Algorithmen des maschinellen Lernens zur Optimierung der Strategie und Anpassung an Marktveränderungen.

Zusammenfassung

Diese Strategie kombiniert mehrere technische Indikatoren, darunter RSI, MACD, Bollinger Bands und Volumen, um ein umfassendes Handelssystem zu bilden. Die Strategie berücksichtigt verschiedene Aspekte wie Preis, Trends, Volatilität und Marktstimmung und führt das Konzept der Liquiditätszonen ein, um Handelssignale zu optimieren. Obwohl die Strategie bestimmte Vorteile hat, steht sie immer noch vor Herausforderungen wie Parameteroptimierung und Marktrisiken. In Zukunft kann die Strategie durch dynamische Parameteroptimierung, Risikomanagement und maschinelles Lernen weiter verbessert werden.

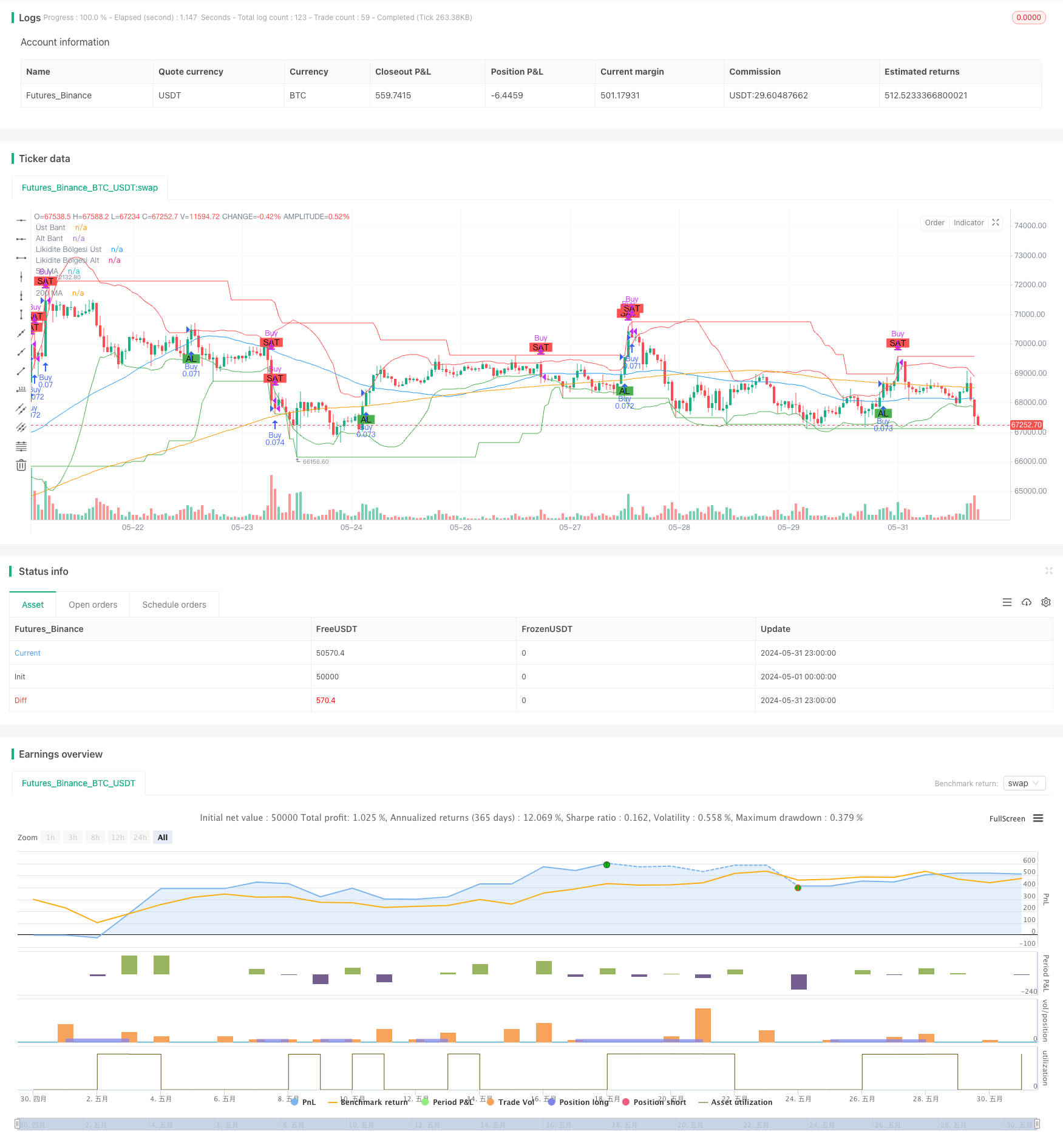

/*backtest

start: 2024-05-01 00:00:00

end: 2024-05-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Optimize Edilmiş Kapsamlı Ticaret Stratejisi - Likidite Bölgeleri ile 30 Dakika", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=10)

// Optimize edilebilir parametreler

rsiPeriod = input.int(14, minval=5, maxval=30, title="RSI Periyodu")

macdShortPeriod = input.int(12, minval=5, maxval=30, title="MACD Kısa Periyodu")

macdLongPeriod = input.int(26, minval=20, maxval=50, title="MACD Uzun Periyodu")

macdSignalPeriod = input.int(9, minval=5, maxval=20, title="MACD Sinyal Periyodu")

smaPeriod = input.int(20, minval=10, maxval=50, title="SMA Periyodu")

bollingerMultiplier = input.float(2.0, minval=1.0, maxval=3.0, title="Bollinger Bantları Çarpanı")

volumeSpikeMultiplier = input.float(1.5, minval=1.0, maxval=3.0, title="Hacim Artış Çarpanı")

shortTermMAPeriod = input.int(50, minval=20, maxval=100, title="Kısa Dönem MA Periyodu")

longTermMAPeriod = input.int(200, minval=100, maxval=300, title="Uzun Dönem MA Periyodu")

liquidityZonePeriod = input.int(50, minval=10, maxval=100, title="Likidite Bölgesi Periyodu")

// İndikatörleri Tanımla

rsi = ta.rsi(close, rsiPeriod)

[macdLine, signalLine, _] = ta.macd(close, macdShortPeriod, macdLongPeriod, macdSignalPeriod)

macdHist = macdLine - signalLine

basis = ta.sma(close, smaPeriod)

dev = bollingerMultiplier * ta.stdev(close, smaPeriod)

upperBand = basis + dev

lowerBand = basis - dev

volumeSpike = volume > ta.sma(volume, 20) * volumeSpikeMultiplier

// Hareketli Ortalamaları Kullanarak Trend Takibi

shortTermMA = ta.sma(close, shortTermMAPeriod)

longTermMA = ta.sma(close, longTermMAPeriod)

trendUp = shortTermMA > longTermMA

trendDown = shortTermMA < longTermMA

// Likidite Bölgelerini Belirleme

liquidityZoneHigh = ta.highest(high, liquidityZonePeriod)

liquidityZoneLow = ta.lowest(low, liquidityZonePeriod)

// Likidite Bölgelerini Çiz

plot(liquidityZoneHigh, color=color.red, title="Likidite Bölgesi Üst")

plot(liquidityZoneLow, color=color.green, title="Likidite Bölgesi Alt")

// Sinyal Durumlarını Saklamak İçin Değişkenler

var bool inPosition = false

var bool isBuy = false

// Al ve Sat Sinyali Bayrakları

var bool buyFlag = false

var bool sellFlag = false

// Bayrakları Sıfırla

buyFlag := false

sellFlag := false

// Al ve Sat Sinyallerini Tanımla

var bool buySignal = false

var bool sellSignal = false

if (barstate.isconfirmed)

buySignal := ((rsi < 30 and close < lowerBand and close > liquidityZoneLow) or

(macdHist > 0 and trendUp and close > ta.highest(high, 10)[1] and close > liquidityZoneLow) or

(volumeSpike and close > upperBand and close > liquidityZoneLow))

sellSignal := ((rsi > 70 and close > upperBand and close < liquidityZoneHigh) or

(macdHist < 0 and trendDown and close < ta.lowest(low, 10)[1] and close < liquidityZoneHigh) or

(volumeSpike and close < lowerBand and close < liquidityZoneHigh))

// Aynı Sinyali Tekrarlamamak İçin Kontroller

if (buySignal and (not inPosition or not isBuy))

inPosition := true

isBuy := true

buyFlag := true

sellFlag := false

strategy.entry("Buy", strategy.long)

if (sellSignal and inPosition and isBuy)

inPosition := false

isBuy := false

sellFlag := true

buyFlag := false

strategy.close("Buy")

// Sinyalleri Grafiğe Çiz

plotshape(series=buyFlag, location=location.belowbar, color=color.green, style=shape.labelup, text="AL")

plotshape(series=sellFlag, location=location.abovebar, color=color.red, style=shape.labeldown, text="SAT")

// Hareketli Ortalamaları ve Bollinger Bantlarını Çiz

plot(shortTermMA, color=color.blue, title="50 MA")

plot(longTermMA, color=color.orange, title="200 MA")

plot(upperBand, color=color.red, title="Üst Bant")

plot(lowerBand, color=color.green, title="Alt Bant")

- Bollinger-Bänder + RSI + Multi-MA-Trendstrategie

- Quantitative lang-kurze Umschaltstrategie auf Basis von G-Kanal und EMA

- Dynamische Doppel gleitende Durchschnitts-Quantitative Handelsstrategie

- Mehrzeitrahmen-EMA-Trend mit hoher Gewinnrate nach Strategie (Advanced)

- Multi-Strategie-Technische Analyse Handelssystem

- Dynamisches Handelssystem mit stochastischem RSI und Candlestick-Bestätigung

- Keine Strategie für einen Ausbruch der oberen Wick-Bühenkerze

- Elliott-Wellen-Theorie 4-9 Impulswellen automatische Detektion Handelsstrategie

- Bei der Berechnung der Vermögenswerte für die Berechnung der Vermögenswerte für die Berechnung der Vermögenswerte für die Berechnung der Vermögenswerte für die Berechnung der Vermögenswerte für die Berechnung der Vermögenswerte für die Berechnung der Vermögenswerte für die Berechnung der Vermögenswerte

- Mehrzeitägige gleitende Durchschnitts- und RSI-Momentums-Kreuzstrategie

- SMA-Crossover-Strategie mit RSI-Filter und Warnungen

- Kombination von dynamischem Donchian-Kanal und einfachen gleitenden Durchschnitten

- Dynamische Fibonacci-Retracement-Handelsstrategie

- Bollinger-Bänder und die Crossover-Handelsstrategie für exponentielle gleitende Durchschnitte

- Quantitative Handelsstrategie der Kombination von EMA und Supertrend

- EMA, RSI, TA, Handelsstrategie für mehrere Indikatoren

- SUPERTREND Trendfolgende Long Position mit Stop-Loss- und Take-Profit-Strategie

- Entwicklung der anpassungsfähigen Strategie zur Bewertung des erwarteten Wertes auf der Grundlage von gleitenden Durchschnitten

- EMA-Bühen-Kreuzungsstrategie

- EMA-Dynamische Stop-Loss-Handelsstrategie

- ZLSMA-erweiterte Chandelier-Ausfahrtsstrategie mit Volumen-Spike-Erkennung

- Kurzfristige quantitative Handelsstrategie auf der Grundlage von doppelten gleitenden Durchschnitts-Crossover-, RSI- und Stochastikindikatoren

- Strategie zur Umkehrung des RSI-Tiefpunkts

- Fisher Transform Dynamischer Schwellenwert nach Strategie

- Strategie zur Mittelumkehrung

- EMA100 und NUPL Relative nicht realisierte Gewinne quantitative Handelsstrategie

- Handelsstrategie für Volatilitätsbereiche auf Basis eines stochastischen Oszillators

- Einfache kombinierte Strategie: Pivot Point SuperTrend und DEMA

- EMA-Trendfilterstrategie

- Strategie für die Verlagerung des gleitenden Durchschnitts