Überblick

Diese Strategie ist ein intelligentes Handelssystem, das auf RSI und Preisdivergenz basiert. Es erfasst Marktumkehrsignale, indem es die Divergenzbeziehung zwischen dem RSI-Indikator und den Preistrends dynamisch überwacht. Die Strategie integriert Fraktale als zusätzliche Bestätigung und ist mit einem adaptiven Stop-Profit- und Stop-Loss-Mechanismus ausgestattet, um eine vollständig automatisierte Transaktionsausführung zu erreichen. Das System unterstützt vielfältige und mehrzyklische Anwendungen und zeichnet sich durch hohe Flexibilität und Zweckmäßigkeit aus.

Strategieprinzip

Die Kernlogik der Strategie basiert auf den folgenden Schlüsselelementen:

- RSI-Divergenzidentifizierung: Identifizieren Sie potenzielle Divergenzen, indem Sie die Hochs und Tiefs des RSI-Indikators und der Preisbewegung vergleichen. Wenn der Preis einen neuen Höchststand erreicht, der RSI jedoch keinen neuen Höchststand, wird ein Top-Divergenz-Verkaufssignal gebildet; wenn der Preis einen neuen Tiefststand erreicht, der RSI jedoch keinen neuen Tiefststand erreicht, wird ein Bottom-Divergenz-Kaufsignal gebildet.

- Fraktale Bestätigung: Verwenden Sie Fraktale, um die Preisstruktur zu analysieren, die Gültigkeit von Divergenzen durch Erkennen lokaler Hochs und Tiefs zu bestätigen und die Zuverlässigkeit von Signalen zu verbessern.

- Parameteranpassung: Das System führt den Sensitivitätsparameter ein, um das fraktale Beurteilungsintervall dynamisch anzupassen und so eine Anpassung an unterschiedliche Marktumgebungen zu erreichen.

- Risikokontrolle: Integriert prozentbasierte Stop-Loss- und Take-Profit-Mechanismen, um sicherzustellen, dass das Risiko jeder Transaktion kontrollierbar ist.

Strategische Vorteile

- Hohe Signalzuverlässigkeit: Der doppelte Bestätigungsmechanismus der RSI-Divergenz und der Fraktaltheorie verbessert die Genauigkeit der Handelssignale erheblich.

- Starke Anpassungsfähigkeit: Die Strategie kann Parameter flexibel an unterschiedliche Marktbedingungen anpassen und verfügt über eine gute Anpassungsfähigkeit an die Umgebung.

- Perfektes Risikomanagement: Es integriert dynamische Stop-Profit- und Stop-Loss-Mechanismen, um die Risikobelastung jeder Transaktion effektiv zu kontrollieren.

- Hoher Automatisierungsgrad: Der gesamte Prozess von der Signalerkennung bis zur Transaktionsausführung ist automatisiert, wodurch die emotionalen Auswirkungen menschlicher Eingriffe reduziert werden.

- Gute Skalierbarkeit: Der Strategierahmen unterstützt vielfältige und mehrzyklische Anwendungen und erleichtert so Portfolioinvestitionen.

Strategisches Risiko

- Abhängigkeit vom Marktumfeld: In einem Markt mit offensichtlichen Trends kann die Zuverlässigkeit von Divergenzsignalen abnehmen und es ist notwendig, einen Trendfiltermechanismus hinzuzufügen.

- Parametersensitivität: Die Schlüsselparameter der Strategie, wie RSI-Schwellenwert und fraktales Beurteilungsintervall, müssen sorgfältig debuggt werden. Unsachgemäße Parametereinstellungen können die Leistung der Strategie beeinträchtigen.

- Signalverzögerung: Da gewartet werden muss, bis das Divergenzmuster vollständig ausgebildet ist, bevor das Signal bestätigt werden kann, kann es zu einer gewissen zeitlichen Verzögerung beim Einstieg kommen.

- Störungen durch Marktrauschen: In einem volatilen Markt können falsche Divergenzsignale entstehen und es müssen zusätzliche Filterbedingungen hinzugefügt werden.

Richtung der Strategieoptimierung

- Erhöhen Sie die Trendfilterung: Führen Sie Trendbeurteilungsindikatoren ein, um umgekehrte Signale in starken Trendmärkten zu filtern und die Anpassungsfähigkeit von Strategien an unterschiedliche Marktumgebungen zu verbessern.

- Optimieren Sie die Parameteranpassung: Entwickeln Sie einen dynamischen Parameteranpassungsmechanismus auf Grundlage der Marktvolatilität, um die Reaktionsfähigkeit der Strategie auf Marktveränderungen zu verbessern.

- Verbessern Sie die Risikokontrolle: Führen Sie einen dynamischen Stop-Loss-Mechanismus ein, um die Stop-Loss-Position automatisch an Marktschwankungen anzupassen und die Auswirkungen des Fondsmanagements zu optimieren.

- Verbesserte Signalbestätigung: Kombinieren Sie Marktmikrostrukturindikatoren wie Handelsvolumen und Volatilität, um ein umfassenderes Signalbestätigungssystem zu erstellen.

Zusammenfassen

Diese Strategie konstruiert ein robustes Handelssystem durch die innovative Kombination von RSI-Divergenz und Fraktaltheorie. Die Vorteile der Strategie liegen in ihrer hohen Signalzuverlässigkeit, starken Anpassungsfähigkeit und einem vollständigen Risikokontrollmechanismus. Durch kontinuierliche Optimierung und Verbesserung soll die Strategie eine stabile Leistung in unterschiedlichen Marktumgebungen aufrechterhalten. Es wird empfohlen, bei einer Echtzeitanwendung die Parameter im Hinblick auf die Markteigenschaften umfassend zu testen und zu optimieren und strikte Risikokontrollmaßnahmen umzusetzen.

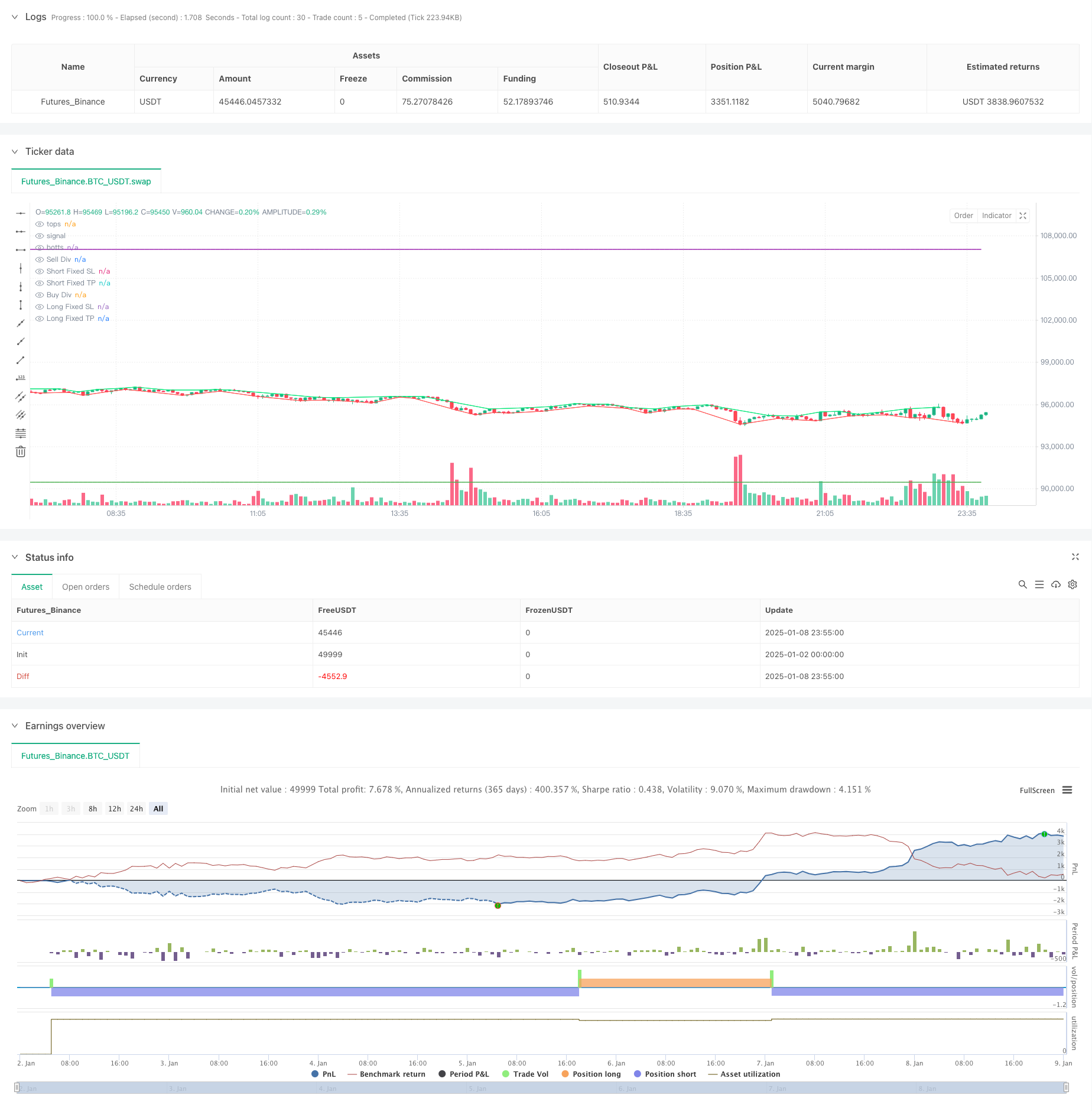

/*backtest

start: 2025-01-02 00:00:00

end: 2025-01-09 00:00:00

period: 5m

basePeriod: 5m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT","balance":49999}]

*/

//FRACTALS

//@version=5

//last : 30m 70 68 22 25 0 0 4.7 11.5

//init

capital=1000

percent=100

fees=0//in percent for each entry and exit

//Inputs

start = input(timestamp("1 Feb 2002"), "Start Time", group = "Date")

end = input(timestamp("1 Feb 2052"), "End Time", group = "Date")

//Strategy

strategy("Divergence Finder (RSI/Price) Strategy with Options", overlay = true, initial_capital=capital, default_qty_value=percent, default_qty_type=strategy.percent_of_equity, commission_type=strategy.commission.percent, calc_on_order_fills=false,process_orders_on_close=true , commission_value=fees, currency=currency.EUR, calc_on_every_tick=true, use_bar_magnifier=false)

//indicator("Divergence Finder (RSI/Price) with Options", overlay=true, max_boxes_count=200, max_bars_back=500,max_labels_count=500)

srcUp=input.source(close, "Source for Price Buy Div", group="sources")

srcDn=input.source(close, "Source for Price Sell Div", group="sources")

srcRsi=input.source(close, "Source for RSI Div", group="sources")

HighRSILimit=input.int(70, "Min RSI for Sell divergence (p1:pre last)", group="signals", inline="1", step=1)

HighRSILimit2=input.int(68, "Min RSI for Sell divergence (p2):last", group="signals", inline="1", step=1)

LowRSILimit=input.int(22, "Min RSI for Buy divergence (p1:pre last)", group="signals", inline="2", step=1)

LowRSILimit2=input.int(25, "Min RSI for Buy divergence (p2:last)", group="signals", inline="2", step=1)

minMarginP=input.float(0, "Min margin between price for displaying divergence (%)", group="signals", step=0.01)

minMarginR=input.float(0, "Min margin between RSI for displaying divergence (%)", group="signals", step=1)

nb=input.int(2, "Sensivity: Determine how many candle will be used to determine last top or bot (too high cause lag, too low cause repaint)", group="Sensivity", inline="3", step=1)

stopPer= input.float(4.7, title='Stop %', group = "Per", inline="3", step=0.01)

tpPer = input.float(11.5, title='TP %', group = "Per", inline="4", step=0.01)

//nb=2

leftBars = nb

rightBars=nb

labels=input.bool(true, "Display Divergence labels", group="Display")

draw=input.bool(true, "Display tops/bottoms")

dnFractal = (close[nb-2] < close[nb]) and (close[nb-1] < close[nb]) and (close[nb+1] < close[nb]) and (close[nb+2] < close[nb])

upFractal = (close[nb-2] > close[nb]) and (close[nb-1] > close[nb]) and (close[nb+1] > close[nb]) and (close[nb+2] > close[nb])

ph=dnFractal

pl=upFractal

plot(dnFractal and draw ? close[nb] : na, style=plot.style_line,offset=-2, color=color.lime, title="tops")

plot(upFractal and draw ? close[nb] : na, style=plot.style_line, offset=-2, color=color.red, title="botts")

plotchar(dnFractal ? high[nb] : na, char='⮝',location=location.absolute,offset=-2, color=color.rgb(236, 255, 63), title="Down Fractal")

plotchar(upFractal ? low[nb] : na, char='⮟', location=location.absolute, offset=-2, color=color.rgb(67, 227, 255), title="Up Fractal")

float myRSI=ta.rsi(srcRsi, 14)

bool divUp=false

bool divDn=false

//compare lasts bots

p2=ta.valuewhen( ph,srcDn[nb], 0 ) //last price

p1=ta.valuewhen( ph,srcDn[nb], 1 ) //pre last price

r2=ta.valuewhen( ph,myRSI[nb], 0 ) //last rsi

r1=ta.valuewhen( ph,myRSI[nb], 1 ) //pre last rsi

if ph

if p1 < p2// - (p2 * minMarginP)/100

if r1 > HighRSILimit and r2 > HighRSILimit2

if r1 > r2 + (r2 * minMarginR)/100

divDn:=true

plot(divDn ? close:na, style=plot.style_cross, linewidth=3, color= color.red, offset=-rightBars, title="Sell Div")

if labels and divDn and strategy.position_size >= 0

label.new(bar_index-nb,high, "Sell Divergence "+str.tostring(p1)+" "+str.tostring(math.round(r1, 2))+" "+str.tostring(p2)+" "+str.tostring(math.round(r2, 2)),xloc=xloc.bar_index,yloc=yloc.abovebar, color = color.red, style = label.style_label_down)

else if divDn and strategy.position_size >= 0

label.new(bar_index-nb,high, "Sell Divergence",xloc=xloc.bar_index,yloc=yloc.abovebar, color = color.red, style = label.style_label_down)

p2:=ta.valuewhen( pl,srcUp[nb], 0 )

p1:=ta.valuewhen( pl,srcUp[nb], 1 )

r2:=ta.valuewhen( pl,myRSI[nb], 0 )

r1:=ta.valuewhen( pl,myRSI[nb], 1 )

if pl

if p1 > p2 + (p2 * minMarginP)/100

if r1 < LowRSILimit and r2 < LowRSILimit2

if r1 < r2 - (r2 * minMarginR)/100

divUp:=true

plot(divUp ? close:na, style=plot.style_cross, linewidth=3, color= color.green, offset=-rightBars, title="Buy Div")

if labels and divUp and strategy.position_size <= 0

label.new(bar_index-nb,high, "Buy Divergence "+str.tostring(p1)+" "+str.tostring(math.round(r1, 2))+" "+str.tostring(p2)+" "+str.tostring(math.round(r2, 2)),xloc=xloc.bar_index,yloc=yloc.belowbar, color = color.green, style = label.style_label_up)

else if divUp and strategy.position_size <= 0

label.new(bar_index-nb,high, "Buy Divergence",xloc=xloc.bar_index,yloc=yloc.belowbar, color = color.green, style = label.style_label_up)

//strat LONG

longEntry = divUp// and strategy.position_size == 0

longExit = divDn// and strategy.position_size == 0

//strat SHORT

shortEntry = divDn

shortExit = divUp

LongActive=input(true, title='Activate Long', group = "Directions", inline="2")

ShortActive=input(true, title='Activate Short', group = "Directions", inline="2")

//StopActive=input(false, title='Activate Stop', group = "Directions", inline="2")

//tpActive = input(false, title='Activate Take Profit', group = "TP", inline="4")

//RR=input(0.5, title='Risk Reward Multiplier', group = "TP")

//QuantityTP = input(100.0, title='Trade Ammount %', group = "TP")

//calc stop

//longStop = strategy.position_avg_price * (1 - stopPer)

//shortStop = strategy.position_avg_price * (1 + stopPer)

longStop = strategy.position_avg_price - (strategy.position_avg_price * stopPer/100)

shortStop = strategy.position_avg_price + (strategy.position_avg_price * stopPer/100)

longTP = strategy.position_avg_price + (strategy.position_avg_price * tpPer/100)

shortTP = strategy.position_avg_price - (strategy.position_avg_price * tpPer/100)

//Calc TP

//longTP = ((strategy.position_avg_price-longStop)*RR+strategy.position_avg_price)

//shortTP = (strategy.position_avg_price-((shortStop-strategy.position_avg_price)*RR))

//display stops

plot(strategy.position_size > 0 ? longStop : na, style=plot.style_linebr, color=color.red, linewidth=1, title="Long Fixed SL")

plot(strategy.position_size < 0 ? shortStop : na, style=plot.style_linebr, color=color.purple, linewidth=1, title="Short Fixed SL")

//display TP

plot(strategy.position_size > 0 ? longTP : na, style=plot.style_linebr, color=color.green, linewidth=1, title="Long Fixed TP")

plot(strategy.position_size < 0 ? shortTP : na, style=plot.style_linebr, color=color.green, linewidth=1, title="Short Fixed TP")

//do

if true

//check money available

if strategy.equity > 0

//if tpActive //Need to put TP before Other exit

strategy.exit("Close Long", from_entry="Long", limit=longTP,stop=longStop, comment="Close Long with : "+ str.tostring(math.round(strategy.equity)) +" $ ", qty_percent=100)

strategy.exit("Close Short", from_entry="Short", limit=shortTP,stop=shortStop, comment="Close Short with : "+ str.tostring(math.round(strategy.equity)) +" $ ", qty_percent=100)

//Set Stops

//if StopActive

// strategy.exit("Stop Long", from_entry="Long", stop=longStop, comment="Stop Long with : "+ str.tostring(math.round(strategy.equity)) +" $ ")

// strategy.exit("Stop Short", from_entry="Short", stop=shortStop, comment="Stop Short with : "+ str.tostring(math.round(strategy.equity)) +" $ ")

if longEntry

if ShortActive

strategy.close("Short",comment="Close Short with : "+ str.tostring(math.round(strategy.equity)) +" $ ")

alert("Close Short")

if LongActive

strategy.entry("Long", strategy.long, comment="Open Long with : "+ str.tostring(math.round(strategy.equity)) +" $ ")

alert("Open Long")

if longExit

if LongActive

strategy.close("Long",comment="Close Long with : "+ str.tostring(math.round(strategy.equity)) +" $ ")

alert("Close Long")

if ShortActive

strategy.entry("Short", strategy.short, comment="Open Short with : "+ str.tostring(math.round(strategy.equity)) +" $ ")

alert("Open Short")

//alertcondition(longEntry and LongActive, title="Buy Divergence Open", message="Buy Divergence Long Opened!")

//alertcondition(longExit and ShortActive, title="Sell Divergence Open", message="Buy Divergence Short Opened!")

//alertcondition(longExit and LongActive, title="Buy Divergence Closed", message="Buy Divergence Long Closed!")

//alertcondition(longEntry and ShortActive, title="Sell Divergence Closed", message="Buy Divergence Short Closed!")