Quantified investment models: a trick to easily identify if a listed company's earnings are fake!

Author: Inventors quantify - small dreams, Created: 2017-12-05 09:54:04, Updated:Quantified investment models: a trick to easily identify if a listed company's earnings are fake!

Quantitative analysis is used to manage assets, i.e. to quantify investments. In quantity trading, a stock model is constructed using fundamental factors, quantity price factors, market sentiment, and so on to select the best basket of stocks.

It can be said that the fundamental factors of the quantity model of the stock market are due to the fact that they rely heavily on the accuracy and veracity of financial data. This article teaches you to use the specific formula of the stock market to effectively distinguish the reliability of the financial statements of listed companies and thus choose quality stocks.

- It is difficult to assess the authenticity of the financial data:

With the growing number of A-listed companies, the quality of financial statements is becoming more and more uneven.

The most direct way to judge a listed company's financial statements is to look at their financial condition; to examine whether it is reasonable from accounting subjects such as expenses and revenues, then to compare it with other peer companies, then to investigate further. For quantitative investment financial institutions, the question of the veracity of the financial statements is more difficult to distinguish and examine.

A quantitative investment fund is a type of investment fund that selects a stock from a basket of stocks, or from a pool of over 3,000 stocks, and then chooses dozens or hundreds of stocks to hold.

Stability, alpha capability is a factor of concern for fund managers, and individual stocks are not overly important. Overall, it is difficult to judge the accuracy of financial data for each company.

Benfort's law can be used to test the accuracy of earnings Ben-Hur's law is a method of judging the truthfulness of financial statements even when you don't know the company.

In real life, the first natural number is a regular number, so Ben-Hur's special law, also known as Ben-Hur's first law of numbers, is a regular number.

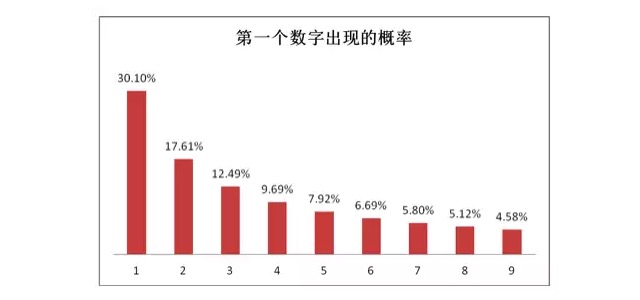

The probability of the first digit being a 1 is about 30%, the first digit being a 2 is about 17%, and the probability of occurrence decreases gradually as the number increases, with the first digit being a 9 having a probability of only 4.6% (non-zero digits, such as the first digit of 1432 is 1 and the first digit of 0564 is 5).

1

In our lives, the data that is relevant to our lives does not come out of thin air, they grow from a smaller piece of data. Water bills, population density, length of rivers, stock indexes, etc. all satisfy the first law of thermodynamics.

For example: the stock index starts at 1000 points, assuming an average growth of 10% per year, then in 7.3 years it will reach 2000 points, so the stock index in this 7.3 years, the first number has always been the

1 . If it grows another 4.2 years, it will reach 3000 points, so in this 4.2 years, the first number is the 2 . In summary, it is easy to see that the longer the thumb is in the first digit, the higher the probability of the first digit.

The study of Zinte securities confirms Benfort's specific law: Zinte Securities has conducted a study on the financial statements of listed companies, which used data from the last decade (from 2007 to 2016) to calculate the financial statements of the entire market, and the average deviation was within an acceptable range, in line with the theoretical value of Ben-Fadell's special law.

2

It can be said that the earnings data of a listed company are basically also satisfying Ben-Foy's special law, the first digit of all financial data should be the probability of rationality. If the earnings data are modified by humans, it is inevitable that the overall data will deviate from the theoretical probability value.

In summary, when examining the veracity or falsity of a company's financial data, the degree of deviation is used as a basis for judging whether the financial statements are true or false.

- C++ version how to get time stamps on millisecond scale

- I would like to add www.bitfinex.com This exchange supports exchange.IO (("websocket") market access mode GetDepth (()

- HTTP 403 error

- Can you please support Bitfinex's iota variety?

- Okex reported an error in GetDepth: Invalid depth during the call.

- Bithumb getaccount error message, please point to master

- Talib's account

- Please explain why the trading platform chooses Polonix/ETH_ETC to report GetTicker: Invalid ticker: error

- Do you want to go to the beach on the hour or the day?

- pnet authentication fails to submit photos

- ..............

- Please teach me chart problems, bi-directional coordinate chart

- How do you deal with the API disconnect in a downturn?

- __init_botvs__ running error to ask the author to see

- Bigone is compatible?

- How to make the Binance money?

- GetDepth: Invalid depth: Why is okx getting depth to report anomalies?

- The three main pitfalls of parametric optimization are forward bias, over-optimization, and curve fitting.

- How to make suggestions

- Please help tech support to see this error, does not support OKEX trading against LTC_USDT?