Reverse trading strategies based on the magnitude of the return

Author: Inventors quantify - small dreams, Created: 2018-01-24 11:38:01, Updated: 2019-07-31 18:03:53Reverse trading strategies based on the magnitude of the return

- #### ## ### ### ### ### ### ### ### ### ### ### ### ### ### ### ### ### ### ### ###

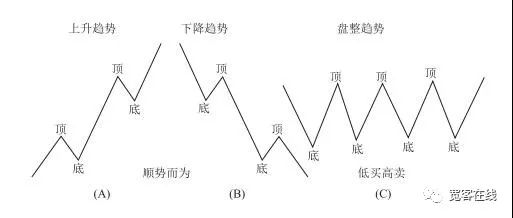

The river water does not need to plan its own course, but without exception reaches the ocean. The same goes for the price, it always moves along the line of least resistance, how easy it is always to come. If the rising resistance is smaller than the falling resistance, the price will rise, and vice versa.

Whether it is an uptrend or a downtrend, there will be a certain amount of retracement after every major trend movement. The retracement is often expressed as a percentage of the original price range, which is called the percentage retracement.

- #### No2: Strategic theory is the most important thing.

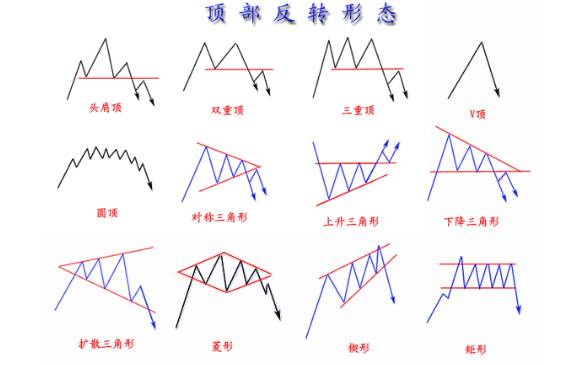

The price reversal is the result of an energy conversion, a difficult process that requires sufficient time and space to exchange energy. But as the law of conservation of energy states, time can be exchanged for space, and space can be offset against time. The reversal includes both a sharp one-day V-turn and a time-consuming round bottom and dome.

In contrast, reversals based on fixed point positions may be subject to variation in variation in the price volatility of varieties, but reversals based on fixed percentage amplitude are less likely to be similarly disturbed, unless the volatility level of the varieties has already changed. This strategy is based on this.

- #### No3: Strategy theory is the most important thing.

Similarly, in this strategy, there is no definition of how to distinguish between trends and shocks, but rather a straightforward theme, based on the relationship between the current price and the previous high and low. Because both trends and shocks are only a concept of subjective definition by humans, no one knows whether it is a trend or a shock until the market comes out, so these subjective definitions are typical concepts used in retrospective analysis.

Moreover, in different time and trend structure strength frameworks, it is basically difficult to define the precise definition of shocks and trends, the shocks of the big cycle is the trend of the small cycle. That is, it is also meaningless to analyze the definition of shocks and trends before the market has come out.

-

NO4: Strategic needs first

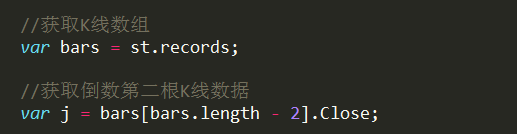

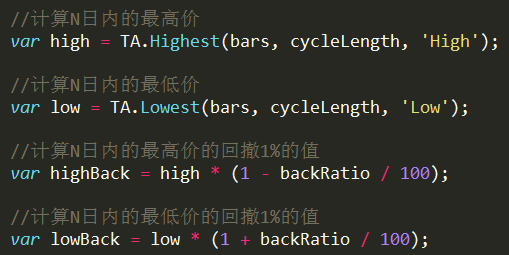

- 1 defines the parameters

- 2, get price data

- 3 Get the data you need

-

NO5: Entry requirements

Multiple positions: if there is no holding at the moment and the price is higher than the lowest price in the previous N root K line + the percentage spread.

Opening a position empty: If there is no holding at the moment and the price is less than the highest price in the previous N root K line - percentage spread.

Multiple-headed position: if there are multiple orders currently held and the price is less than half the sum of the lowest price on the previous N root K line and the highest price on the previous N root K line.

Blank position: If there is currently an empty order and the price is greater than half the sum of the lowest price on the previous N root K line and the highest price on the previous N root K line.

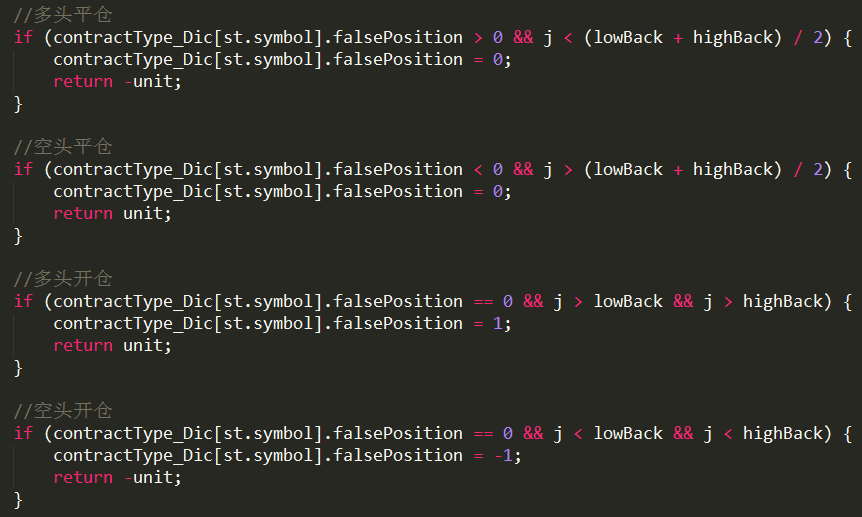

The source code is as follows:

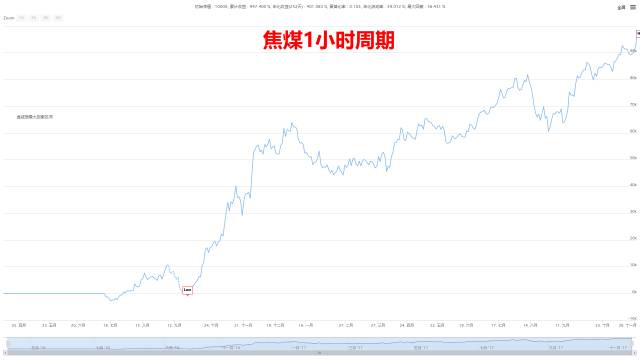

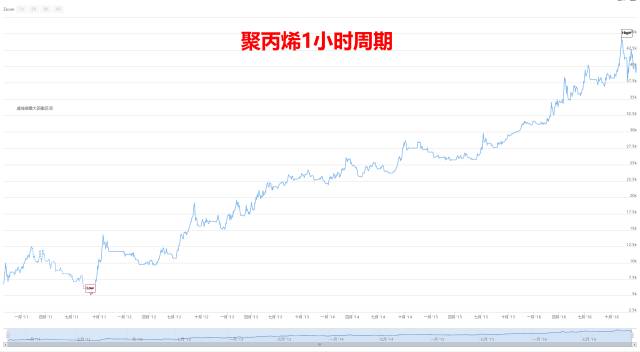

- #### No. 6: Retest the performance

- #### No7: Improving the strategy

Overall, this is a very powerful strategy for general use. Of course, this is just a simple strategic idea that could perhaps be improved elsewhere:

1, Increase the volatility factor. We all know that each variety has its own characteristics, and the fundamental and technical aspects influence each other. Increase the volatility factor, which can more objectively reflect the price trend of the current variety.

2, change the fixed cycle to the adaptive cycle. The core parameter of this strategy is actually one and the parameter is fixed. If we add and subtract the fixed parameter of the dynamic by the relationship between the rate of price change and the acceleration, it can better reflect the market at that time.

3, converting the percentage retracement to a fixed value. For example, if the current price is 1000, its 1% is 10; if the current price is 5000, its 1% is 50. 10 and 50 differ by several quantitative levels. The same contract variety, because the current price at different periods results in a large difference in the conditions of the open position.

- ### ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ## ##

In short, any price pattern that wants to give rise to a broad new trend needs a certain amount of time to form.

The market has its own concept of time, it doesn't matter if it is spring, summer, autumn, winter, rain or shine.

- #### No9: About us

We (inventors of Quantitative Trading Platforms) aim to change the current quantum cycle to a purer quantum cycle, one without dry goods, exchange-closures, and scammers. No one has ever created knowledge and theories in this world, they just exist and are waiting to be discovered.

Sharing is an attitude, but it's also wisdom!

Written by Hukybo

- Invalid order price/amount is always displayed in retest and live time

- GetOrders: 400: {"code":-1121,"msg":"Invalid symbol."}

- Gate.IO Python problem ((1/3)): HttpUtil.py code to be interpreted please

- Gate.io交易所的问题

- Trend trading expert: trading trends in real-time to win cards or go hunting for new opportunities

- What if we used the for statement to traverse an array?

- Big data in real life. The need for off-sample data testing in quantitative strategies.

- 为何exchang.GetTrades只能返回最后一笔交易?

- Ririn updates for learning beauty

- Rules for accurately determining whether a strategy is ineffective in a procedural transaction

- How to run multiple programs on Ali Cloud CentOS 7.4?

- I hope to increase the number of sex exchanges!

- New to asking questions about MA functions

- I bought a triangular hedge option (carrying a hard shovel) and asked for guidance.

- Is it possible to independently add a token PRO leverage account to an exchange

- Who has the most historical K-line data on OkEx?

- Who has the most historical K-line data on OkEx?

- problem with the mail function unencrypted connection

- Can the exchange add more options at the time of the review?

- ZB Exchange has a wrong tip!

ttxcThe conditions for opening a multi-head position are that the hedge is not currently held, and the price is higher than the lowest price in the previous N root K line + the percentage spread hedge, but the program code is: j > lowBack && j > highBack, why is it higher than highBack?