Understanding the STOCHRSI indicator

Author: Inventors quantify - small dreams, Created: 2016-08-24 19:25:22, Updated: 2017-10-11 11:07:31Understanding the STOCHRSI indicator

- Recently, I helped a friend solve a problem about an indicator called STOCHRSI. It's a simple book. But as long as you study a little, you will get a little, share your experience below, you need to use this as a friend can learn.

I found some calculation formulas for this indicator online.

/*

LC := REF(CLOSE,1); //REF(C,1) 上一周期的收盘价

RSI:=SMA(MAX(CLOSE-LC,0),N,1)/SMA(ABS(CLOSE-LC),N,1) *100;

%K: MA(RSI-LLV(RSI,M),P1)/MA(HHV(RSI,M)-LLV(RSI,M),P1)*100; LLV(l,60)表示:检索60天内的最低价,可适应于检索任何股票

%D:MA(%K,P2);

LC := REF(CLOSE,1);

RSI:=SMA(MAX(CLOSE-LC,0),N,1)/SMA(ABS(CLOSE-LC),N,1) *100;

STOCHRSI:MA(RSI-LLV(RSI,M),P1)/MA(HHV(RSI,M)-LLV(RSI,M),P1)*100;

*/

My God, I've had enough patience to watch it. This description is a general formula. But even with a little programming experience, I can only guess! - 1. The information found on the Internet says that there are about three different forms of this indicator. The above formula is two of them. - 2. Look and compare chart markets across platforms. Find different descriptions of this indicator. The parameter description of the indicator function STOCHRSI in the talib index library on the platform is also not fully understood. - 3. Using the talib indicator library, input parameters 14, 14, 3, 3 This set of parameters, the resulting data and other platforms contrast, found a large difference. - 4. a little bit of trying to move the indicator... (a little bit scared, can't get it right and get abused by the code)

After a painful struggle... Summary: - 1, the RSI indicator is the underlying data of the indicator regardless of the form it takes; compare the other platforms described and the above formula; determine the parameters of the STOCHRSI indicator must have a parameter that is RSI. - 2, also found different descriptions of this indicator, some descriptions are that the indicator output is %K, %D two lines. Some descriptions are that the output is STOCHRSI, MA ((3) (the parameters of this description are 14, 14, 3, 3) The formula for calculating the two lines (data) is the same, although it is in two different forms: %K === STOCHRSI, %D === MA(3). Determine that 3 of MA(3) is a parameter. The remaining two parameters, which are M and P1 in the above formula, are already tried. 14 and 3 are both tried. Finally, the leaked indicator data is found, finally the data on other platforms is correct.

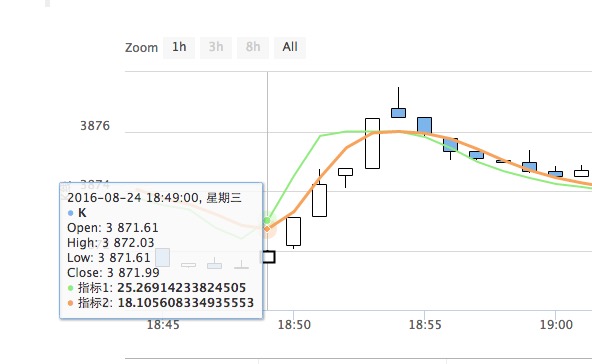

Green is fastline %K, orange is %D.

- The indicator is written by myself and can be compared to OKCoin below.

function LLV(array,period){

if(!array || array.length - period < 0){

throw "error:" + array;

}

var min = array[array.length - period];

for(var i = array.length - period; i < array.length; i++){

if( array[i] < min ){

min = array[i];

}

}

return min;

}

function HHV(array,period){

if(!array || array.length - period < 0){

throw "error:" + array;

}

var max = array[array.length - period];

for(var i = array.length - period; i < array.length; i++){

if( array[i] > max){

max = array[i];

}

}

return max;

}

function DeleteNullEle(initArr){

var dealArr = [];

var initArrLen = initArr.length;

for(var i = 0,j = 0 ; i < initArrLen ; i++,j++){

if(initArr[i] === null || isNaN(initArr[i]) ){

j--;

continue;

}

dealArr[j] = initArr[i];

}

return dealArr;

}

/*

LC := REF(CLOSE,1); //REF(C,1) 上一周期的收盘价

RSI:=SMA(MAX(CLOSE-LC,0),N,1)/SMA(ABS(CLOSE-LC),N,1) *100;

%K: MA(RSI-LLV(RSI,M),P1)/MA(HHV(RSI,M)-LLV(RSI,M),P1)*100; LLV(l,60)表示:检索60天内的最低价,可适应于检索任何股票

%D:MA(%K,P2);

LC := REF(CLOSE,1);

RSI:=SMA(MAX(CLOSE-LC,0),N,1)/SMA(ABS(CLOSE-LC),N,1) *100;

STOCHRSI:MA(RSI-LLV(RSI,M),P1)/MA(HHV(RSI,M)-LLV(RSI,M),P1)*100;

*/

function FstochRSI(records,n,m,p1,p2){

var len = records.length;

//var LC = records[len-2];//上一周期收盘价

//var rsi = TA.RSI(records,n);// RSI 数组 ,talib

var rsi = talib.RSI(records,n);

rsi = DeleteNullEle(rsi);//ceshi

var arr1 = [];

var arr2 = [];

var arr3 = [];

var arr4 = [];

var rsi_a = [];

var rsi_b = [];

var k = [];

var d = null;

/*不包含当前柱

for(var a = 0 ;a < rsi.length ; a++ ){//改造 不用 LLV

for(var aa = 0 ; aa <= a; aa++ ){

rsi_a.push(rsi[aa]);

}

arr1.push(rsi[a] - TA.Lowest(rsi_a,m));

}

for(var b = 0 ;b < rsi.length ; b++ ){//改造 不用 HHV

for(var bb = 0 ; bb <= b; bb++ ){

rsi_b.push(rsi[bb]);

}

arr2.push(TA.Highest(rsi_b,m) - TA.Lowest(rsi_b,m));

}

*/

for(var a = 0 ;a < rsi.length ; a++ ){//改造 不用 LLV

if(a < m){

continue;

}

for(var aa = 0 ; aa <= a; aa++ ){

rsi_a.push(rsi[aa]);

}

arr1.push(rsi[a] - LLV(rsi_a,m));

}

for(var b = 0 ;b < rsi.length ; b++ ){//改造 不用 HHV

if(b < m){

continue;

}

for(var bb = 0 ; bb <= b; bb++ ){

rsi_b.push(rsi[bb]);

}

arr2.push(HHV(rsi_b,m) - LLV(rsi_b,m));

}

arr1 = DeleteNullEle(arr1);

arr2 = DeleteNullEle(arr2);

//Log("arr1:",arr1.length,"-",arr1);//ceshi

//Log("arr2:",arr2.length,"-",arr2);//ceshi

arr3 = talib.MA(arr1,p1);

arr4 = talib.MA(arr2,p1);

arr3 = DeleteNullEle(arr3);

arr4 = DeleteNullEle(arr4);

//Log("ceshi");//ceshi

var c = 0;

var diff = 0;

if(arr3.length !== arr4.length){//实测 长度不相等

throw "error: !=" + arr3.length + "----" + arr4.length;

diff = arr4.length - arr3.length; //example diff = 10 - 6

}else{

//throw "error:" + arr3.length + "----" + arr4.length;

}

for( ;c < arr3.length ; c++ ){

k.push(arr3[c] / arr4[c + diff] * 100);

}

d = talib.MA(k,p2);

return [k,d,rsi];

}

- X Minutes to Python

- Thinking is more important than high-frequency algorithms.

- Quantified TA library by open source inventors, learn to use (includes Javascript/Python/C++ version)

- Psychological qualities, ability to innovate, financial management, strategy

- A simple strategy framework (which can be modified and extended on your own)

- The process and thinking of developing a quantitative strategy

- The causes of over-conformity in procedural transactions

- The 10 biggest pitfalls of quantitative trading

- Q: Can you explain to me what ETFs are?

- The Bronze Age: The Delusion of the Shinto

- How can we replicate the success of hedge funds?

- Deep Learning Tutorial

- Digital currencies - API-KEY applications, configurations, etc. for various exchanges

- X-minutes to Go

- X-minute to JavaScript

- The graph template is upgraded!

- How to get the current BOLL up-line, mid-line, down-line?

- Your disk number is greater than the maximum number in the package.

- Problems with data collection

- If you want to see if there's a problem with the simulation of var t = $.Cross ((2,14)), what's the problem with the fact that BTC gets stuck in this line?

lijingxfdjfunction main (()) {pos (192,210) } exchange.SetContractType (("swap") // is set to permanent contract var records = exchange.GetRecords ((PERIOD_M15)) is the name of the let [k, d, rsi] = FstochRSI ((records, 14, 14, 3, 3); Log (("K", k[k.length-2]) Log (("D", d[d.length-2]) I'm not sure. --- So, I called this function, and the data that was printed was not the same as the actual value of StochRsi on the binary.

JWhen retested, this function was found to be very slow and to be improved.

JI don't know what to do with the data from talib.STOCHRSI))) to correct the data from Bitcoinwisdom?

Inventors quantify - small dreamsThis may be a comparison problem, as the data used to determine the contrast are of the same species, period, parameter, BAR location. This has been tested before and should be the same.

Inventors quantify - small dreamstalib is an indicator library open source. It is used in BotVS, e.g. to search for even-line talib.MA ((records, 10); // records to search for even-line cycles of K-line data. It is calculated as the median of the records K line of 10 bars.

Inventors quantify - small dreamsFstochRSI ((records, n, m, p1, p2) corresponding to OKCoin parameters are the same, except that the first records is K-line data, which is the data source for the calculation of the indicator, and I compared the data calculated in the OK graph to the same data, which is that the algorithm is a bit slower.

Inventors quantify - small dreamsMaybe the algorithm or the code needs optimization.

JVery good, now it's normal. Thank you!

Inventors quantify - small dreamsThe code is already written in the post, you can compare it below.

JSo we're going to use the STOCH function first, and we're going to get the same effect.

Inventors quantify - small dreamsTalib's disagreement, internal calculations, are a bit different. I wrote STOCHRSI myself, and posted it later.