Choosing a timing strategy to judge the bull market

Author: Quantification of district classes, Created: 2019-10-15 09:23:15, Updated: 2019-10-15 10:09:04We found that the most important thing to quantify investment is to decide whether the current market is a bear market or a bull market or a bear market.

There are many ways to make a decision, including straightforward judgments, brown lines, highs and lows of transactions and cycles.

Average line judgement is the tendency of the average line to judge whether the current market is up or down. By judging whether the 5-day average line is standing, judge whether the bull is standing, judge whether the 120-day average line is falling, judge whether the bear market is entering. Several factors together determine the strength of the current market.

The Brin line is a good way to judge whether the market is rising or falling based on the slope of the middle line. It is a good practice in the bull market to pull up and down based on the high and low points of the Brin line. If the opening increases, the Brin line is a harbinger of market volatility.

Transaction volume is generally an auxiliary means, generally both at the bottom and at the top. The advantage of digital currencies is that the depth of the transaction is easily obtained. By analyzing the ordering situation and combining the transactions, it is also possible to determine the current market heat.

The above strategies have some difficulties to be implemented, and need to be adjusted slowly. Cycle high and low are the main strategies discussed in this article, with simple and direct benefits. The idea of cycle high and low is very simple, it is a combination of short cycle high and low and long cycle high and low, to determine whether the current market is bull, bull or bear, bear or bear market.

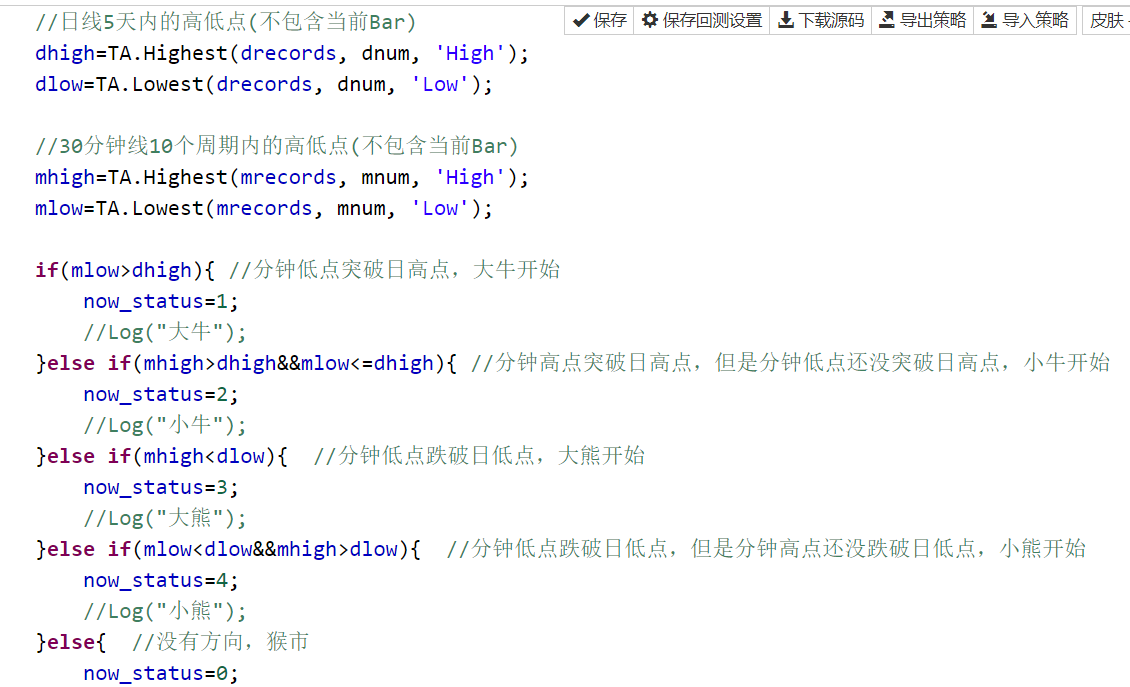

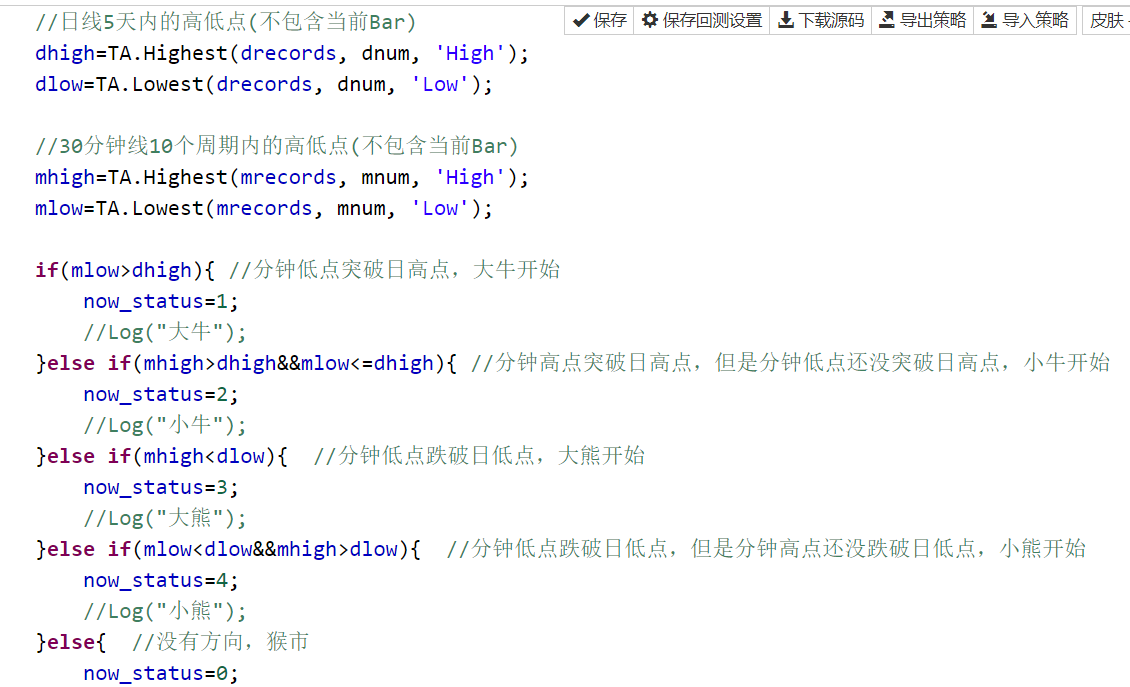

We first paste some of the code, the main idea is in the commentary, which is understandable. Long cycle selects the day line, 5 days for the cycle. Short cycle selects the 30-minute line, 10 for the cycle, i.e. 5 hours.](https://www.fmz.com)

](https://www.fmz.com)

We'll post the results again. Seeing the bulls turn into bears on September 24 and September 25 and the bulls on September 26 and October 7 and the bulls on October 9 are all good tips. Seeing the cycle highs and lows is not easy.](https://www.fmz.com)

](https://www.fmz.com)

If you combine a digital currency selection strategy with a hedging strategy, there is more to play with. If you list the top 20 digital currency bulls by market cap, you can basically achieve low-risk arbitrage by selecting two digital currency bears and bulls to hedge against each other.

You can click here.Copying policy◎ Friends who are interested can also join.I've been trying to find you.▽ Coinbase is a place where you can write articles and earn money with digital currency. )

)

- fmz bitz contract trading on the floor of the stock exchange error 200

- BitZ contract related summaries

- How to transfer between ok's permanent contract and quarterly contract accounts?

- Bitcoin websocket delayed issue

- Ask for instructions on how to write code based on real-time monitoring of bolbol trajectory

- Help: Pip install --upgrade pip in research environment reported error

- HELP: I've been getting errors when installing CCXT in the research environment using pip install ccxt (but the previous install was successful)

- How can the Malayalam language solve the shortage of playable content?

- fmz is running ok permanent contract on real disk, how to set contract type?

- Bitmex reported an error after running the robot for a while

- Why Bitmex can't get market information

- When will FMZ platforms be able to access the options review and research environment?

- No, Python's numpy is closed?

- Asking for help to raise the price of the currency

- What is the use of EXIT for MY language?

- python local retrieval, error message GetAccount (() missing 1 required positional argument:'self'

- Important notice about the Python version of the retrieval system changed by default to Python3!

- Okayx account access error What's going on?

- Research environment, python, getting bitmex xbtusd data report error: EOFError

- FMZ research platform Python introductory guide