Gate.io杠杆借贷市场抢贷脚本(出租)

Author: maxge, Created: 2021-01-25 16:24:43, Updated:Gate.io杠杆借贷市场抢贷脚本

Leveraged loans: Leverage lending market is a market that offers a cash-free or multi-leverage method in the absence of a futures contract. Leverage lending is usually better than the contract rate. The market is made up of multiple transactions that all offer leverage lending. The market is roughly divided into two types: leverage lending and C2C lending: leverage lending, where users borrow from exchanges, users need over-mortgage virtual assets, and fixed interest rates, such as: Binance, AEX, MatrixPort.

This is the first time that the project has been used in the form of loans. 1, Mortgage virtual currency to borrow USDT;; suitable for long-term holdings of currencies, but short-term cash flow shortages, such as miners;; 2, Mortgage USDT to borrow virtual currency. After borrowing, sell the currency, which is equivalent to cashlessness. 3. Mortgage USDT to borrow USDT. After borrowing, have leveraged assets, can buy more coins, equals more leverage. In addition, the bank has also been providing loans for the purchase of virtual currency.

Background of the script development: Gate.io's lending market is a C2C borrowing model, i.e. all borrowing orders in the market are provided by users, and the interest rate and number of orders vary depending on the market conditions, not fixed. So for those who need long-term loans, the interest rate of the order opening or renewal is not necessarily optimal, and the low-interest rate of the order is usually quickly snatched, and the manual guarding of the order is not economically efficient, so the development of the script of the automatic low-interest rate order can save some interest, or when the market conditions are high, the first time to grab the borrowing order.

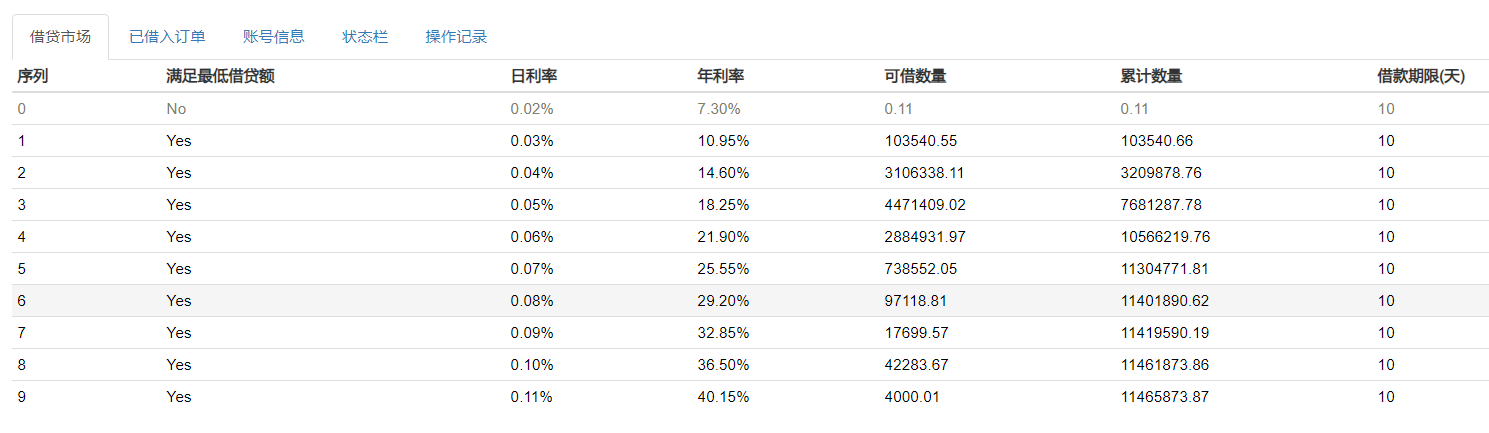

The script features: 1, the current version only supports the lending marketplace of Gate.io, with no coin trading functionality; 2, after setting the currency, interest rate, and quantity of borrowing required, the script automatically detects borrowing market orders and automatically accesses them when eligible listings appear; 3, the script stops automatically when enough is borrowed, saving resources; 4. After switching to the swap-loan-deposit mode, the script will borrow from the market for low-interest orders and then proactively return the high-interest orders in the order pool that the broker has borrowed from; 5, Status information displays: list of borrowing markets, list of borrowed orders, account holding information, execution status bar, operation record, and can be set to display the number of items.

Parameters and information screenshot:

This policy is for rent, $19 per month, contact vx:maxvok

- How to get both the spot price of btc and the permanent price of btc-usdt

- How to use the database in the policy (save data)

- What is the K-line cycle option for the robot?

- How to choose when to revise binance

- Help post - Deployment of the host failed

- Bitcoin BTC contracts, how to get more and empty holdings in the current market?

- Makebit brings you a free experience of professional strategy tools, 20 Martingale experience credits, first come, first served.

- For beginners, the EMA indicator can only calculate the EMA of the K line, but not the EMA of other values?

- FMZ supports the BTC-USDT perpetual contract review of the Bitcoin exchange?

- Re-use of files

- The RSI value calculated using the RSI API and the discrepancy in the token K line chart, please explain why?

- Official documentation is not clear enough about the API description

- Newcomers use the tutorial to report mistakes

- Searching for a digital currency quantification strategy

- Search for code

- I'm not sure if you want to be a part of this, or a part of this, or a part of this, or a part of this, or a part of this, or a part of this, or a part of this.

- Please ask about the usage of the Binance API.

- Digital currency futures trading library (test version) What is the use of the specific call?

- 求助,exchange.Buy报错,

- Who has a formula that fits the coin circle?

The grassPraise, useful tools