Selection of timing strategy ((1) Construction of low delay trend line when Z conversion angle is selected

Author: The baby dinosaur, Created: 2021-10-20 19:45:42, Updated: 2021-10-20 20:03:30 A few moments ago, someone in the background said that I develop a dog strategy every day, yes, dog strategy is over. Today I share with you a dog's most recent timing strategy (doge).A. The premise ● Let's get serious, the classic timing strategies are actually divided into several categories: short-term event-driven (in the coin circle, it is shown as monitoring announcements and tweets on major exchanges, involving text analysis), statistical regression and prediction (statistical arbitrage, matching trades, various ML and DL models, hierarchical Markov, etc.), GSISI type when choosing investor sentiment, and when choosing traditional classic technical indicators.

N日移动平均线=N日收盘价之和/N

● This is commonly referred to by investors as a straight line (MA), a straight line that breaks the buy, breaks the sell, and countless *beans contribute their own transaction fees to the exchange. However, there are some problems with the use of the equator for ordinary investors: first, the equator is severely delayed, and the trend is often halfway through when the signal is displayed, and the trend returns to the face; second, ordinary investors in the coin circle tend to operate on the index in fractional scale, 15, 5 minutes, or even 1 minute, in such a small period, the characteristic of the coin circle is more than 80% of the oscillations (the kind Martin likes), the trend rarely occurs, and investors lose a lot of procedural fees and slippage points to open the position according to the equator. • This paper aims to construct an algorithm for filtering equilinear indicators to reduce their latency for reference and use.

2. Z-conversion, passing function

● Prior to this article, I learned about the filter algorithms for indicators on various major websites, such as the most common silicon filter (which appears in several CTAs in Squirrel Broadcast) and the Carlman filter method studied by the author on joinquant, which successfully avoided the 2015 stock crash in retesting. The ER filter module on TB is extremely convenient to use. However, when I discovered that the Carlman filter module provided on joinquant does not load into the server, and it has thousands of lines of open source code, Apple abandoned the attempt to port it to the coin circle.

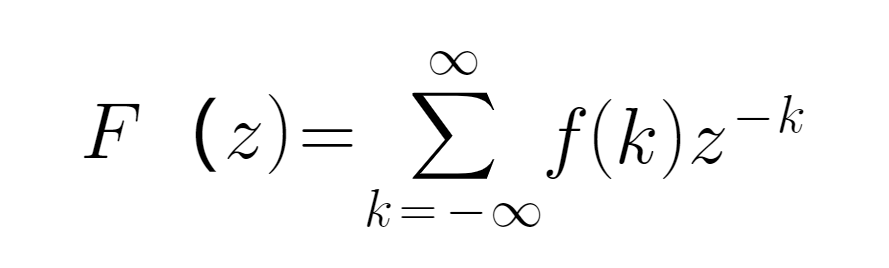

● The Z-conversion from Laplace is commonly used in the field of mathematical signal processing. For a discrete time sequence f ((k) and z defined in the multi-frequency domain, its formula is defined as follows:

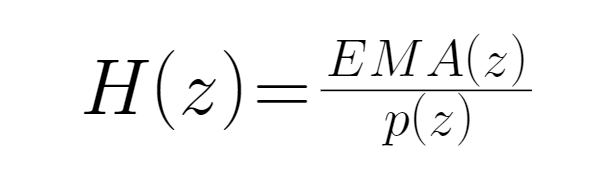

● The EMA has a lower latency than the MA (which is essentially the result obtained after processing the MA sequence using the EWMA algorithm), so we use the EMA sequence instead of the MA to improve the filter effect. We define the input as the price of the coin (which is written as p) and the output as the EMA indicator corresponding to the price (which is written as EMA).

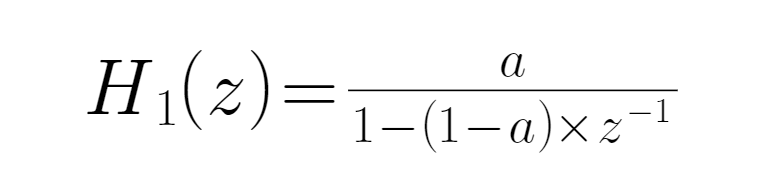

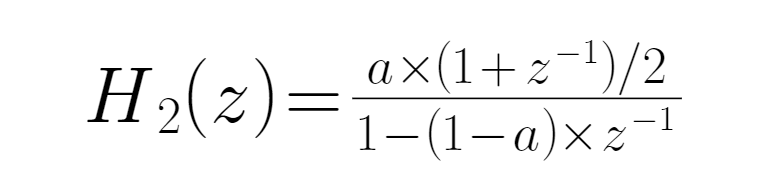

● Insert this formula into the EWMA algorithm to obtain the initial pass function of the EMA:

● wherein a is a variable parameter, the following equation.

C. Analysis of the passing function

● In the transmission function, the input signal is not correlated to the function value. By analyzing this function, it is known that when z**-1=-1, H(z) takes the maximum value, which is when the highest frequency is reached, the transmission function is H(z) = a/(2-a), and the noise of recent high-frequency data is maximized; when z**-1=1, H(z) is a constant, at which time the system frequency is 0, the input and the output results are exactly the same, if the time sequence is a constant sequence, then EMA will be here.

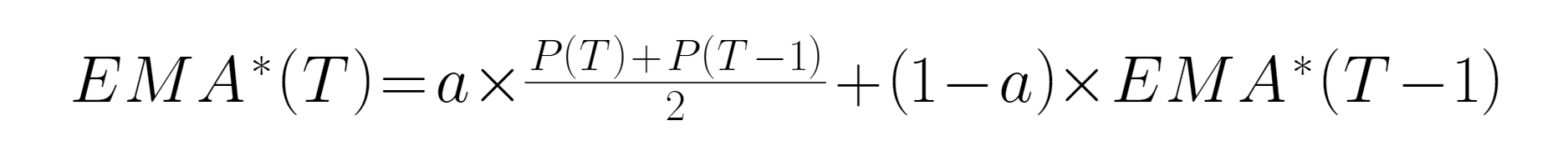

● When H (((z) is a low-pass filter, and H (((z) = 1, the output signal contains all the components of the input signal, that is, of the entire output signal, if all the low-frequency signals are subtracted, 1 - H ((z) can be constructed into a new filter, written as H  ● This expression for low-pass filter and high-pass filter only needs to be subtracted by 1:

● This expression for low-pass filter and high-pass filter only needs to be subtracted by 1: ● Now the expression of the filter has been constructed! With the Z transformation, we can construct a low-latency trendline with only one parameter a, the larger the a, the lower the latency, the better the smoothness. For different varieties, there are different optimal parameters.

● Now the expression of the filter has been constructed! With the Z transformation, we can construct a low-latency trendline with only one parameter a, the larger the a, the lower the latency, the better the smoothness. For different varieties, there are different optimal parameters.

4. Summary and notes

● The filter constructed in the above steps is only one stage, and its filter effect is not very ideal because the transition band is too long, and after increasing the stage, the complexity of the expression of the H

● Promise Quant Minos focuses on the development of all kinds of fantastic groundhogs strategies with Martin at its core, for example if you have a rental need or a large capital management need, you can contact vx:15001733415

- Ask me how to link WeChat without the option of WeChat in the message boost?

- Suspension of related operations

- The upside of the vertical pyramid, and the downside of the pyramid, has always been a fixed stop loss.

- The exchange.GetRecords

- dYdX exchange configuration, instructions for use

- JS wheels for the William indicator

- Trading digital currencies, using for loop to access different pairs of transactions on the same exchange, how long should the interval between different pairs be before the exchange is restricted by IP?Sleep ((100)) can you?

- ftx returns the data format problem.

- Short-line strategy: how to get minute-level k-string data for dozens of currencies?

- How do you get all the orders that have been made in history?

- Hard disk cannot access ip interface with ok-bound hard disk - self-solved

- The futures company requested the APPID

- I've solved the problem, where can I buy the recharge code?

- Cannot be recharged

- If you're new to this, how can you add an analogue hard drive?

- [Solved] Advice on Binance Perpetual Contract using USDT as the quantity to order

- The getposition function can only retrieve the holding information for the first contract transaction pair, ask if it is possible to use the for loop to get the holding information for multiple transaction pairs at the same time.

- I would like to know the address of the international station for currency transactions.

- Running the exchange.GetPosition ((() function in python, failing to get hold information, showing error

- The real-time tick log