Inventors quantified the PINE language introductory tutorial

Author: Inventors quantify - small dreams, Created: 2022-05-30 16:23:43, Updated: 2022-09-28 17:10:21I'm going to put it down.

2 and 3.trail_offsetParameters: After performing the tracking stop loss stop loss action, the placement of the placement order is the distance from the highest price (when over) or the lowest price (when empty).

3 and 4.trail_pointsParameters: astrail_priceParameters are simply positions with the number of arguments.

It's not that easy to understand, it's okay! Let's understand learning through a strategy of retrospective scenarios, which is actually very simple.

/*backtest

start: 2022-09-23 00:00:00

end: 2022-09-23 08:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Binance","currency":"ETH_USDT"}]

args: [["RunMode",1,358374],["ZPrecision",0,358374]]

*/

strategy("test", overlay = true)

varip a = na

varip highPrice = na

varip isTrade = false

varip offset = 30

if not barstate.ishistory and not isTrade

strategy.entry("test 1", strategy.long, 1)

strategy.exit("exit 1", "test 1", 1, trail_price=close+offset, trail_offset=offset)

a := close + offset

runtime.log("每点价格为:", syminfo.mintick, ",当前close:", close)

isTrade := true

if close > a and not barstate.ishistory

highPrice := na(highPrice) ? close : highPrice

highPrice := close > highPrice ? close : highPrice

plot(a, "trail_price 触发线")

plot(strategy.position_size>0 ? highPrice : na, "当前最高价")

plot(strategy.position_size>0 ? highPrice-syminfo.mintick*offset : na, "移动止损触发线")

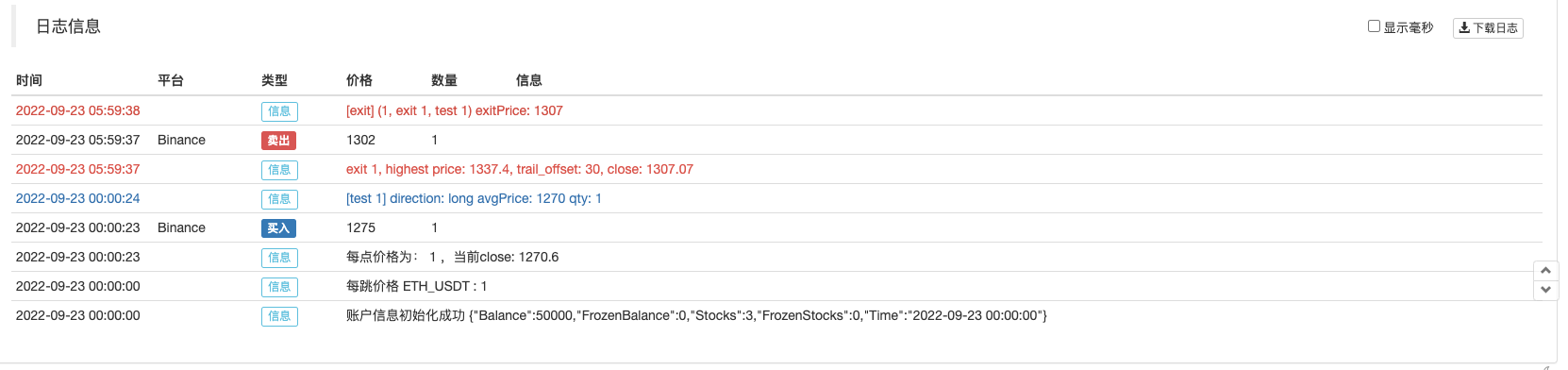

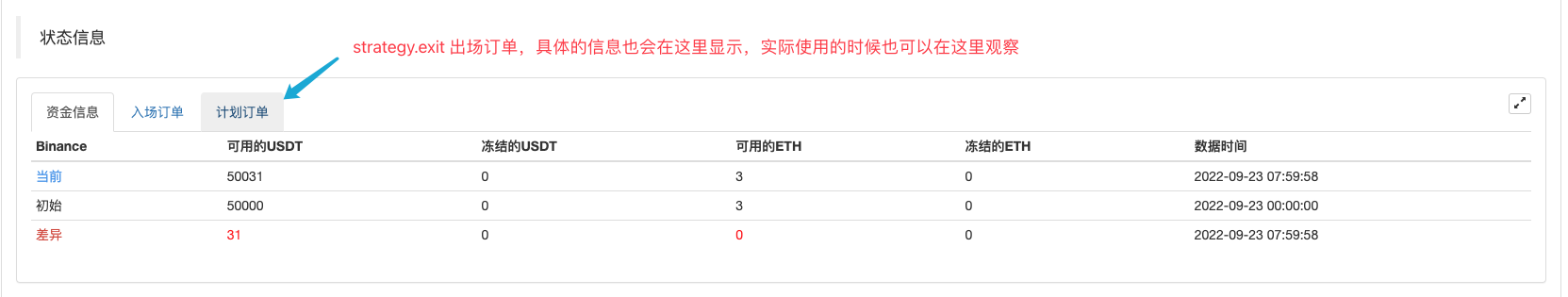

Multi-headed entry immediately when the policy starts executing, and then immediately the next.strategy.exitThe exit order (specified as the stop loss trigger parameter) starts to execute the stop loss trigger logic when the price of the market moves higher than the trail_price trigger line, the stop loss trigger line (blue) starts to follow the dynamic adjustment of the highest price, the blue line is the location of the stop loss trigger position, and finally the price of the market moves lower than the blue line.

So we're using this function to optimize a supertrending strategy, and we're just going to specify a single entry order for the strategy.strategy.exitThis tracking stop-loss and stop-loss function can be added to the checklist.

if not barstate.ishistory and findOrderIdx("open") >= 0 and state == 1

trail_price := strategy.position_size > 0 ? close + offset : close - offset

strategy.exit("exit", "open", 1, trail_price=trail_price, trail_offset=offset)

runtime.log("每点价格为:", syminfo.mintick, ",当前close:", close, ",trail_price:", trail_price)

state := 2

tradeBarIndex := bar_index

The full code of the strategy:

/*backtest

start: 2022-05-01 00:00:00

end: 2022-09-27 00:00:00

period: 1d

basePeriod: 5m

exchanges: [{"eid":"Binance","currency":"ETH_USDT"}]

args: [["RunMode",1,358374],["ZPrecision",0,358374]]

*/

varip trail_price = na

varip offset = input(50, "offset")

varip tradeBarIndex = 0

// 0 : idle , 1 current_open , 2 current_close

varip state = 0

findOrderIdx(idx) =>

ret = -1

if strategy.opentrades == 0

ret

else

for i = 0 to strategy.opentrades - 1

if strategy.opentrades.entry_id(i) == idx

ret := i

break

ret

if strategy.position_size == 0

trail_price := na

state := 0

[superTrendPrice, dir] = ta.supertrend(input(2, "atr系数"), input(20, "atr周期"))

if ((dir[1] < 0 and dir[2] > 0) or (superTrendPrice[1] > superTrendPrice[2])) and state == 0 and tradeBarIndex != bar_index

strategy.entry("open", strategy.long, 1)

state := 1

else if ((dir[1] > 0 and dir[2] < 0) or (superTrendPrice[1] < superTrendPrice[2])) and state == 0 and tradeBarIndex != bar_index

strategy.entry("open", strategy.short, 1)

state := 1

// 反向信号,全平

if strategy.position_size > 0 and dir[2] < 0 and dir[1] > 0

strategy.cancel_all()

strategy.close_all()

runtime.log("趋势反转,多头全平")

else if strategy.position_size < 0 and dir[2] > 0 and dir[1] < 0

strategy.cancel_all()

strategy.close_all()

runtime.log("趋势反转,空头全平")

if not barstate.ishistory and findOrderIdx("open") >= 0 and state == 1

trail_price := strategy.position_size > 0 ? close + offset : close - offset

strategy.exit("exit", "open", 1, trail_price=trail_price, trail_offset=offset)

runtime.log("每点价格为:", syminfo.mintick, ",当前close:", close, ",trail_price:", trail_price)

state := 2

tradeBarIndex := bar_index

plot(superTrendPrice, "superTrendPrice", color=dir>0 ? color.red : color.green, overlay=true)

- What interface can be used to get the market value of the currencies?

- Is there anyone who can help?

- Sharing a trend strategy

- Foresight for the common man

- I hope FMZ officially publishes the project.

- What is leverage?

- Bin An's campaign strategy application

- Precision issues

- Is there a way to remove a table line?

- I've been getting no signals on the retest. Can you fix it?

- Please ask how to draw the earnings chart for the multi-currency.

- Digital currency

- Currency value

- Can you see, the Mac language's strategy is that both the test and the hard drive are working properly, that is, the phone's hard drive is there and click on it to show an error, what's the situation?

- Retest visualization does not show the buy and sell icon

- Delayed

- Is the public retrieval server not working?

- The server is offline, no trace.

- GetOrder id is not able to access order information

- What's the difference between a closing price model and a real-time price model? For example, if I'm on a 15 minute K-string, will the closing price model cause a large deviation of the transaction price?