The most advanced way to trade: master the order wall!

Author: Little white cabbage, Created: 2022-06-29 17:42:29, Updated:In the currency circle, the main buying and selling trends have been captured.OutsideIt can be passed.Chain dataMonitoring;In the arenaYou can do it through the exchange.Discounted dataI am not sure if this is the case here.

The exchange's trading data is the most timely and direct way to see the main trend.

Invoice data can also be divided into commission and market price transaction data, depending on the order price setting.

The order is to set the quantity to be bought and sold, and the price to be set. After clicking on the order, your cap order is sent to the order box of the exchange waiting for the execution of the cap order. The cap order executive is also known as the market broker, whose pricing and quantitative method is called the cap strategy broker.

A market order is an order to buy or sell at the current market price. A market order requires only that you set a number of bids, without entering a price (the price will automatically match the best bid and ask).

Based on market observations and historical experience, the main focus is on entering and exiting the market in the form of commissioned orders, using the form of market price orders.

Next, share how to use outsourced order data to effectively capture the main drivers.

What do you mean?

Main volume tracking indicator, based on market order data, real-time monitoring of the status of large volume orders reaching a certain number of values to achieve the tracking of the main volume.

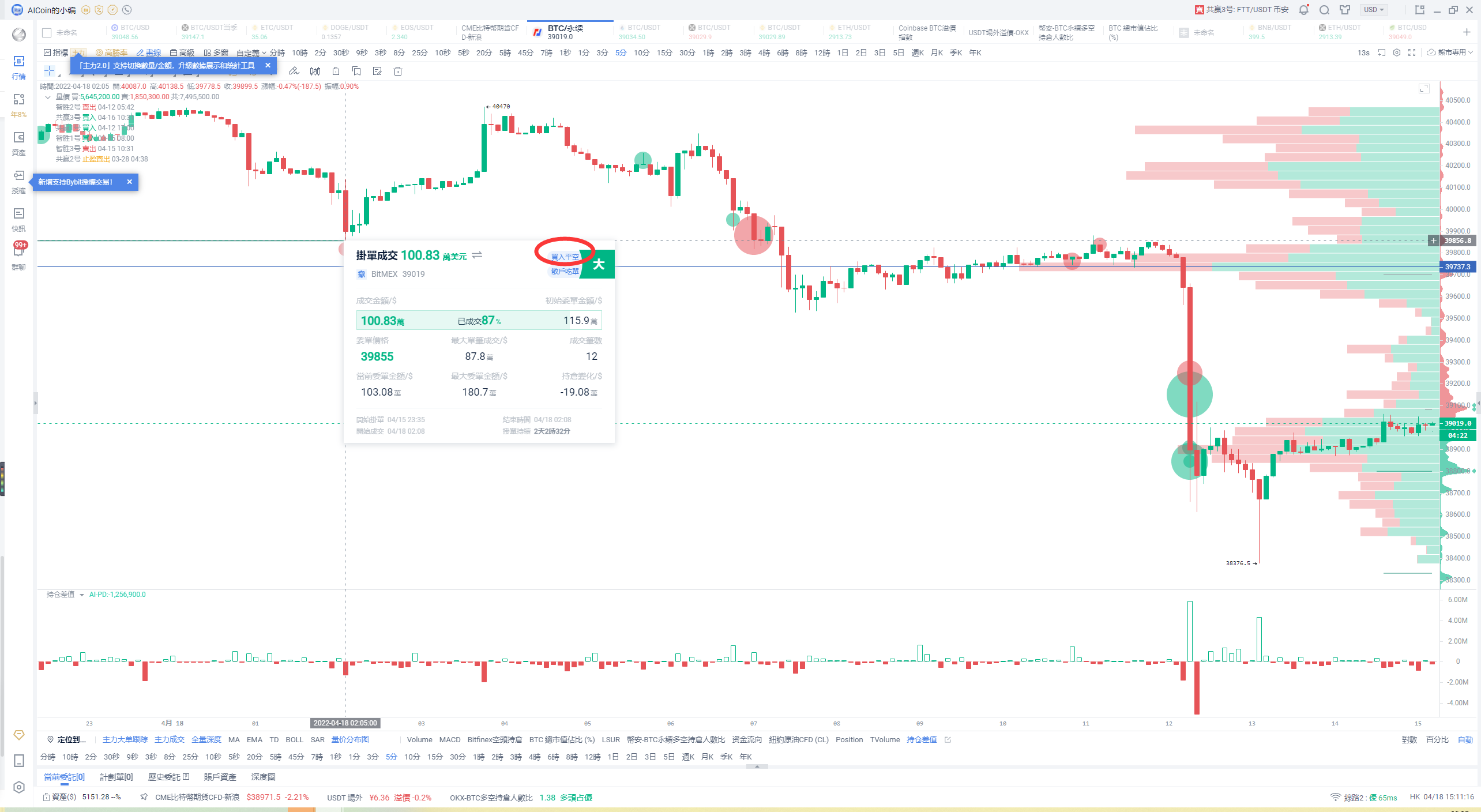

For example, this is a large Coinbase BTC/USD order at $42,000, red represents the direction of the sale; red is light red, represents the outstanding order; long representation time: from 23:22 on 13 February to date, it has lasted 4 days and 15 hours; high represents the size, the initial order amount is $8.55 million, and the price of the order is $8.5 million. In this way, it is possible to know clearly at what price position and at what time the main forces are ready or already in action.

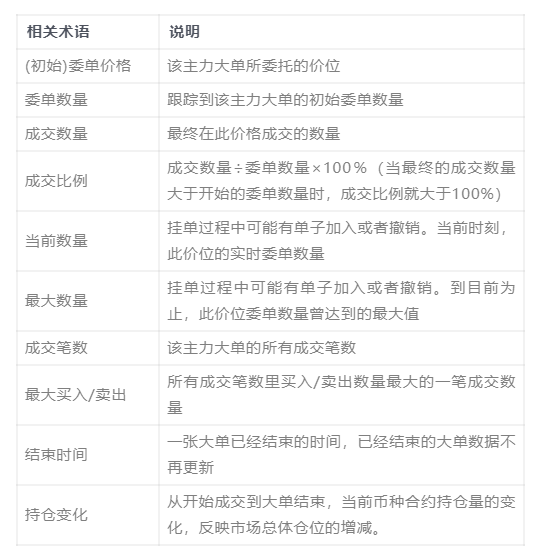

The term explains:

In this way, it is possible to know clearly at what price position and at what time the main forces are ready or already in action.

The term explains: After understanding the basics, let's explore how to use it effectively.

After understanding the basics, let's explore how to use it effectively.

The first is the impact of bulk orders on efficiency

One of the most basic judgments is definitely that a large commission purchase is the main bullish, a large commission sale is the main bearish.

But we all know that there are many types of coin circle trading, there are spot and futures, there are delivery and perpetual trading pairs, and there are open positions in futures.

Based on our AI reviews and historical experience, the impact of large orders on the market for different types of trading pairs:

Contract opening > Buy > Settle > Sell > Sell

Since contracts often have leverage and time constraints, the industry needs to react in a shorter time, otherwise the longer the time, the greater the risk the individual faces.

An example we were impressed with was the large number of orders for the sale of blank orders that appeared and collapsed within minutes of the transaction before the token announced its withdrawal from users in China in October last year.How to open a futures swap

Since the contract opening is so important, let's talk about how to judge the closing.

A good contract is one that has a holding volume. If the holding volume decreases significantly after a large order is placed, it can be assumed that this is a flat position; if the holding volume increases significantly, it can be assumed that it is an open position.

The HUD calculates the HUD of the current K-line versus the previous K-bar, plus a custom cycle to quickly determine the opening and closing positions.

** What pairs of transactions are worth mentioning **

In addition, a more subjective observation is that in recent times, these deals have been more of a reference value for the main bidders:

Cash trading pairs on platforms such as Bitfinex/Coinbase/Binance; OKX BTC/USD and ETH/USD for the quarter, OKX btc/usdt perpetual; USDT perpetual contract trading pairs on other cash on Binance

What are the main concerns?

The above is all about choosing a transactional pair, and we will talk about which large order situations need to be focused on next.

First, the larger the single order, the larger the amount of the single order, especially on a strong reference pair, the greater the impact on the market.

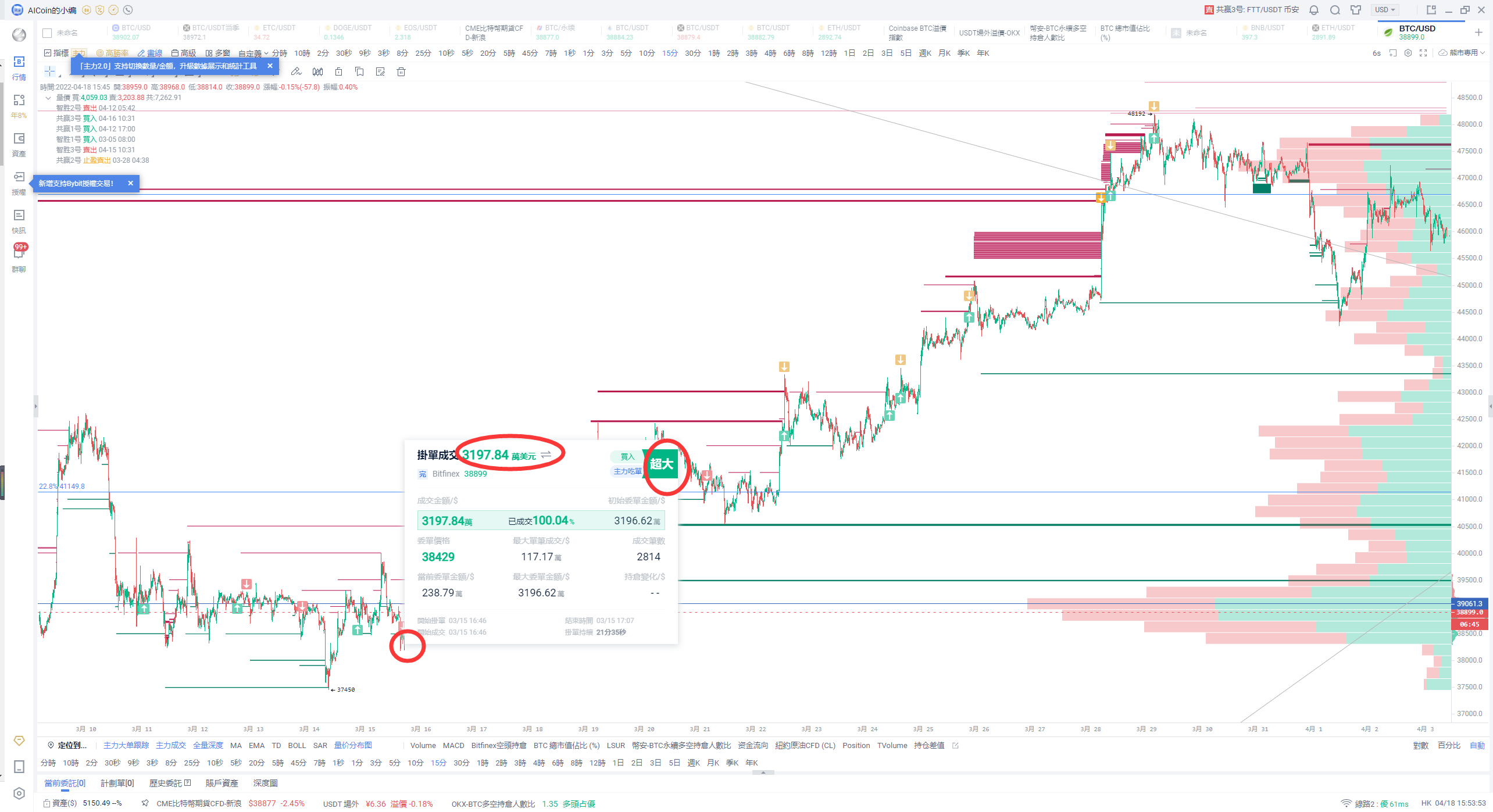

For example, after the super-large transaction on the Bitifnex BTC/USD platform on 3.15 16:46, the market went into a tailspin. A super order may not be as obvious as a direct super order. Following the super main force, we also need to pay special attention to the large order wall that appears densely.

Let's take a look back at the recent wall of intensive orders:

A super order may not be as obvious as a direct super order. Following the super main force, we also need to pay special attention to the large order wall that appears densely.

Let's take a look back at the recent wall of intensive orders: OKX ETH/USDT 4.11-4.13 is a t-shaped payment wall

OKX ETH/USDT 4.11-4.13 is a t-shaped payment wall Bitfinex BTC/USD art paywall and paywall

Bitfinex BTC/USD art paywall and paywall

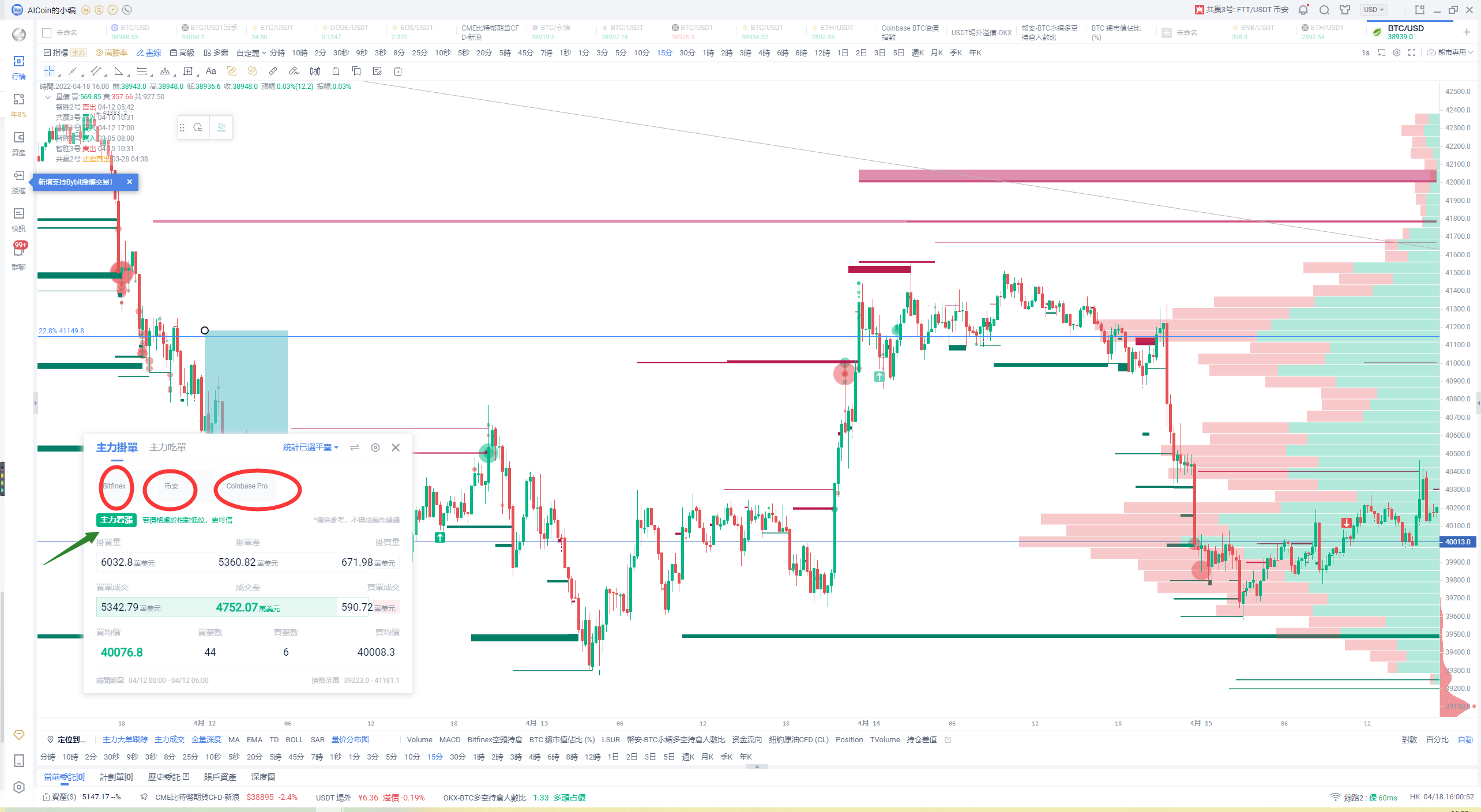

Of course, such a supermarket will not appear for a long time, when the party supermarket does not appear, but when there are many large orders and transactions, it is necessary to statistically determine the main data within a segment to help judge the market trend.

Examples: from 12:00 to 22:00, OKX BTC/USDT appeared and handled a lot of large orders, and the large single transaction statistics for this time frame in the Lira-Liri, resulted in a strong bearish conclusion.

In addition to single-platform data monitoring, we also need to focus on consistent multi-platform actions. For example, on April 12th, between 0:00 and 6:00 am, during the BTC investigation of 39K, a large number of orders were placed on BTC spot trading pairs, including Binance, Coinbase and Bitfinex, and then we saw a rebound of more than $2000.

The following is a summary of the above:

1, Select important trading pairs, principles: futures open futures open futures open futures buy buy buy and sell, key trading pair recommendations: spot trading pairs on platforms such as Bitfinex/Coinbase/Binance; OKX BTC/USDETH/USD for the quarter, OKX btc/usdt perpetual; USDT perpetual contract trading pairs on Binance other spot

2, the super-majority of the key trading pair must be focused on the amount: super-large order more attention; dense order wall more attention

3, Main order statistics: Shock zone statistics; statistics when large orders are placed in succession

4. Cross-platform statistics: Multiple key trades are considered when the main opinion is in agreement; when the opinion is not in agreement, the order of the trades, the order of the funds;

- High frequency trading problems

- New findings: Chain data + in-field transaction data = main entry and exit points

- Ask for help with procedural framework and multi-strategy combination

- Is pine script able to directly switch market data?

- The web page is full of questions.

- Do you think that the retracement graph can only show a few thousand data points?

- MACD, the king of the indicators, is the one who has the biggest household denomination indicator.

- How to order through FMZ

- The new version of the TV reset icon is not convenient.

- MyLanguage Doc

- What is the unit of volume?

- Which of the following is the most recent year-over-year increase in the overhead and reverse overhead rates?

- Problems with tradingview: Always delay 1 to 2 seconds between signal to FMZ

- How to operate multiple accounts on one disk

- WeChat can't receive a policy alert?

- Quantity price distribution chart: Watch the distribution of the chips to get an insight into average costs

- Problems with disk error reporting

- Why can't small currencies be recalculated?

- The grid strategy

- Return to the latest strategy of cash multi-currency hedging

bamsmenThe question is, is the iceberg commissioned?