MyLanguage Doc

Author: Inventors quantify - small dreams, Created: 2022-06-30 18:24:06, Updated: 2024-02-06 17:36:19[TOC]

MyLanguage is a programmatic trading language that is compatible and enhanced with MyLanguage. The MyLanguage of FMZ Quant will undergo strict syntax checking. For example, when using language enhancement to embed JavaScript language code, an extra space character after the %% operator will cause an error to be reported.

-

Basic instructions

- ## Contract

Cryptocurrency Contract

Cryptocurrency Contract

this_week cryptocurrency futures contract this week next_week cryptocurrency futures contract next week month cryptocurrency futures contract month quarter cryptocurrency futures contract quarter next_quarter cryptocurrency futures contract next quarter third_quarter cryptocurrency futures contract third quarter last_quarter contract last quarter XBTUSD BITMEX perpetual contract swap cryptocurrency futures perpetual contracts other than BITMEX exchange For details, please refer to the exchange.SetContractType() function section of the JavaScript/Python/C++ documentation

- ## Variables

A variable is a space opened up in the computer memory to store data. Simply put, it is used to store data.

open the first variable

// assign 1 to variable a a:=1;In

MyLanguage, it is simple to distinguish from thedata volume:- Single-valued data: There is only one value, such as

0,1,'abc'. - Sequence data: a data sequence composed of a bunch of single-valued data, such as

Close(closing price), whereClosecontains the closing price ofnperiods.[ 10.1 , 10.2 , 10.3 , 10.4 , 10.5 ...]

Distinguish from “variable type”

- String type: it must be wrapped with `

'', string type is not allowed to be used directly, and it need to be output to the view with the function.

INFO(CLSOE>OPEN,'OK!');- Value types: including integers, floating-point numbers (decimals).

// integer int:=2; // decimal float:=3.1;- Boolean type, using 1 (for true) or 0 (for false): 1, 0, true or false. For example:

A:=1>0;After this code is executed, the value ofAis 1.

// The closing price of the current period is greater than -999, you will find that the return value of each period is 1, which means true, because the closing price is almost impossible to be negative. is_true:=Close>-999;- Global variables

VARIABLE:VALUE1:10; // Declare a global variable, assign the value 10, and execute it only once.Remark that when backtesting:

VARIABLE:NX:0; // The initial global variable NX is 0 NX..NX+1; // Accumulate 1 each time INFO(1,NX); // Print NX every timeInitially, the

INFOstatement prints101, maybe it’s not0initially? The reason is that there are 100 initial K-lines in the backtest, and 100 K-lines have already been run through, which has been accumulated 100 times. The actual price depends on how many K-lines are initially obtained.- ### Naming rules

In most systems, variable naming does not allow the use of system “reserved words” (built-in variable names, function names). For example, the well-known

Close,C. In addition, pure numbers or leading numbers are not allowed. Finally, it is not allowed to be very long, and different systems have different length restrictions. In fact, you don’t have to worry about the efficiency of the mainstream system’s parsing of Chinese. I believe that “MyLanguage” is very friendly to Chinese. For experienced programmer, it is recommended that you use the following two naming rules:1. Chinese name// elegant output 5-day moving average:=MA(C,5);2. English + underline// Output move_avg_5:=MA(C,5);If you prefer English, try to make the meaning of your variables as understandable as possible. Do not use names such as:

A1,AAA,BBB…. Trust me when you review your indicator code again in a few days, you will be very miserable due to memory loss. Similarly, when you export the code to others, the reader must be devastated.So from now on, embrace the “MyLanguage” to the fullest! I hope it can become a powerful tool for your analysis and decision-making.

- ## Type of Data

Type of data is a basic concept. When we assign a clear data to a variable in writing, the variable also becomes the type of the data itself.

- 1. Type of Value:

1.2.3.1.1234.2.23456 ...- 2. String type(str):

'1' .'2' .'3' ,String types must be wrapped with ''- 3. Sequence data:

A collection of data consisting of a series of single-valued data- 4. Boolean type(boolean):

Use

1representstrueand0forfalse.Example

// declare a variable of value type var_int := 1; // Declare a variable for sequence data var_arr := Close; // The string type cannot be declared alone, it needs to be combined with the function INFO(C>O, 'positive line');- ## Operator

The operation and calculation used to execute the indicator code are simply the symbols involved in the operation.

- ### Assignment operator

to assign a value to a variable

- 1. `:` ```:```, represents assignment and output to the graph (subgraph). ``` Close1:Close; // Assign Close to the variable Close1 and output to the figure ``` - 2. `:=` ```:=```, represents assignment, but is not output to the graph (main graph, sub graph...), nor is it displayed in the status bar table. ``` Close2:=Close; // Assign Close to the variable Close2 ``` - 3. `^^` ```^^```, Two ```^``` symbols represent assignment, assign values to variables and output to the graph (main graph). ``` lastPrice^^C; ``` - 4. `..` ```..```, two ```.``` symbols represent assignment, assign values to variables and display variable names and values in the chart, but do not draw pictures to the chart (main picture, sub-picture...). ``` openPrice..O ```- ### Relational operators

Relational operators are binary operators that are used in conditional expressions to determine the relationship between two data.

Return value: Boolean type, either

true(1) orfalse(0).- 1. more than```>``` ``` // Assign the operation result of 2>1 to the rv1 variable, at this time rv1=1 rv1:=2>1; ``` - 2. less than```<``` ``` // Returns false, which is 0, because 2 is greater than 1 rv3:=2<1; ``` - 3. more than or equal to```>=``` ``` x:=Close; // Assign the result of the operation that the closing price is more than or equal to 10 to the variable rv2 // Remark that since close is a sequence of data, when close>=10 is performed, the operation is performed in each period, so each period will have a return value of 1 and 0 rv2:=Close>=10; ``` - 4. less than or equal to```<=``` ``` omitted here ``` - 5. equal to```=``` ``` A:=O=C; // Determine whether the opening price is equal to the closing price. ``` - 6. Not equal to```<>``` ``` 1<>2 // To determine whether 1 is not equal to 2, the return value is 1 (true) ```- ### Logical Operators

Return value: Boolean type, either

true(1) orfalse(0).1. The logical and ```&&```, can be replaced by ```and```, and the left and right sides of the and connection must be established at the same time.// Determine whether cond_a, cond_b, cond_c are established at the same time cond_a:=2>1; cond_b:=4>3; cond_c:=6>5; cond_a && cond_b and cond_c; // The return value is 1, established2. Logical or ```||```, you can use ```or``` to replace the left and right sides of the or link, one side is true (true), the whole is true (return value true).cond_a:=1>2; cond_b:=4>3; cond_c:=5>6; cond_a || cond_b or cond_c; // The return value is 1, established3. ```()``` operator, the expression in parentheses will be evaluated first.1>2 AND (2>3 OR 3<5) // The result of the operation is false 1>2 AND 2>3 OR 3<5 // The result of the operation is true- ### Arithmetic operators

Return value: numeric typeArithmetic operators are arithmetic operators. It is a symbol for completing basic arithmetic operations (arithmetic operators), which is a symbol used to process four arithmetic operations.

- **plus +** ``` A:=1+1; // return 2 ``` - **minus -** ``` A:=2-1; // return 1 ``` - **multiply \** ``` A:=2*2; // return 4 ``` - **divide /** ``` A:=4/2; // return 2 ```-

Functions

- ### Functions

In the programming world, a “function” is a piece of code that implements a certain function. And it can be called by other code, the general form is as follows:

function(param1,param2,...)- Composition: Function name (parameter1, parameter2, ...), may have no parameters or have multiple parameters. For example, ```MA(x,n);``` means to return to the simple moving average of ```x``` within ```n``` periods. Among them, ```MA()``` is a function, ```x``` and ```n``` are the parameters of the function. When using a function, we need to understand the basic definition of the function, that is, what data can be obtained by calling the function. Generally speaking, functions have parameters. When we pass in parameters, we need to ensure that the incoming data type is consistent. At this stage, the code hinting function of most IDEs is very imperfect. There is a data type of the parameter given, which brings some trouble to our use, and ```MA(x,n);``` is interpreted as: ``` Return to simple moving average Usage: AVG:=MA(X,N): N-day simple moving average of X, algorithm (X1+X2+X3+...+Xn)/N, N supports variables ``` This is very unfriendly to beginners, but next, we will dissect the function thoroughly, trying to find a quick way to learn and use the function.- ### Return value

To learn functions quickly, we need to understand a concept first, it’s called “return value”, “Return”, as the name suggests, means “return back”; The value represents “specific value”, then the meaning of the return value is: the data that can be obtained.

// Because it will be used in the following code, the variable return_value is used to receive and save the return value of function() // retrun_value := function(param1,param2); // For example: AVG:=MA(C,10); // AVG is retrun_value, function is MA function, param1 parameter: C is the closing price sequence data, param2 parameter: 10.- ### Parameters

Secondly, the second important concept of the function is the parameter, and different return values can be obtained by passing in different parameters.

// The variable ma5 receives the 5-day moving average of closing prices ma5:=MA(C,5); // The variable ma10 receives the 10-day moving average of closing prices ma10:=MA(C,10);The first parameter

Xof the above variablesma5,ma10isC(closing price), in fact,Cis also a function (returns the sequence of closing prices from the opening to the present), but it has no parameters. The 5 and 10 of the second parameter are used to tell theMA()function that we want to get the moving average of the closing price for a few days. The function becomes more flexible to use through the parameters.-

How to learn

- 1. First, we need to understand what a function does, that is, what data this function can return to us.

- 2. The last thing is to understand the type of the return value. After all, we use functions to get the return value.

- 3. Moreover, we need to know the data type of the parameter

MA(x,n), if you don’t know the data type of the parameterx,n, it will not be able to get the return correctly value.

In the following function introduction and use, follow the above three principles.

-

Language enhancement

MyLanguageandJavaScriptlanguage mixed programming

%% // This can call any API quantified of FMZ scope.TEST = function(obj) { return obj.val * 100; } %% Closing price: C; Closing price magnified 100 times: TEST(C); The last closing price is magnified by 100 times: TEST(REF(C, 1)); // When the mouse moves to the K-line of the backtest, the variable value will be prompted- ```scope```object The ```scope``` object can add attributes and assign anonymous functions to attributes, and the anonymous function referenced by this attribute can be called in the code part of MyLanguage. - ```scope.getRefs(obj)```function In ```JavaScript``` code block, call the ```scope.getRefs(obj)``` function to return the data of the passed in ```obj``` object. The ```JavaScript``` code wrapped with the following ```%% %%``` will get the ```C``` passed in when the ```TEST(C)``` function in MyLanguage code is called Close price. The ```scope.getRefs``` function will return all the closing prices of this K-line data. Because of the use of ```throw "stop"``` to interrupt the program, the variable ```arr``` contains the closing price of the first bar only. You can try to delete ```throw "stop"```, it will execute the ```return``` at the end of the ```JavaScript``` code, and return all closing price data. ``` %% scope.TEST = function(obj){ var arr = scope.getRefs(obj) Log("arr:", arr) throw "stop" return } %% TEST(C); ``` - scope.bars Access all K-line bars in the ``JavaScript`` code block. The ```TEST``` function returns a value. 1 is a negative line and 0 is a positive line. ``` %% scope.TEST = function(){ var bars = scope.bars return bars[bars.length - 1].Open > bars[bars.length - 1].Close ? 1 : 0 // Only numeric values can be returned } %% arr:TEST; ``` ``` # Attention: # An anonymous function received by TEST, the return value must be a numeric value. # If the anonymous function has no parameters, it will result in an error when calling TEST, writing VAR:=TEST; and writing VAR:=TEST(); directly. # TEST in scope.TEST must be uppercase. ``` - scope.bar In the ```JavaScript``` code block, access the current bar. Calculate the average of the high opening and low closing prices. ``` %% scope.TEST = function(){ var bar = scope.bar var ret = (bar.Open + bar.Close + bar.High + bar.Low) / 4 return ret } %% avg^^TEST; ``` - scope.depth Access to market depth data (order book). ``` %% scope.TEST = function(){ Log(scope.depth) throw "stop" // After printing the depth data once, throw an exception and pause } %% TEST; ``` - scope.symbol Get the name string of current trading pair. ``` %% scope.TEST = function(){ Log(scope.symbol) throw "stop" } %% TEST; ``` - scope.barPos Get the Bar position of the K-line. ``` %% scope.TEST = function(){ Log(scope.barPos) throw "stop" } %% TEST; ``` - scope.get\_locals('name') This function is used to get the variables in the code section of MyLanguage. ``` V:10; %% scope.TEST = function(obj){ return scope.get_locals('V') } %% GET_V:TEST(C); ``` ``` # Attention: # If a variable cannot calculate the data due to insufficient periods, call the scope.get_locals function in the JavaScript code at this time # When getting this variable, an error will be reported: line:XX - undefined locals A variable name is undefined ``` - scope.canTrade The ```canTrade``` attribute marks whether the current bar can be traded (whether the current Bar is the last one) For example, judging that the market data is printed when the strategy is in a state where the order can be traded ``` %% scope.LOGTICKER = function() { if(exchange.IO("status") && scope.canTrade){ var ticker = exchange.GetTicker(); if(ticker){ Log("ticker:", ticker); return ticker.Last; } } } %% LASTPRICE..LOGTICKER; ```Application example:

%% scope.TEST = function(a){ if (a.val) { throw "stop" } } %% O>C,BK; C>O,SP; TEST(ISLASTSP);Stop the strategy after opening and closing a position once.

-

Multiperiod reference

The system will select a suitable underlying K-line period automatically, and use this underlying K-line period data to synthesize all referenced K-line data to ensure the accuracy of the data.

- Use:

#EXPORT formula_name ... #ENDto create a formula. If the formula is not calculated just to obtain data of different periods, you can also write an empty formula.

- Use:

An empty formula is:

#EXPORT TEST NOP; #END // end- Use:

#IMPORT [MIN,period,formula name] AS variable valueto refer to a formula. Get various data of the set period (closing price, opening price, etc., obtained by variable value).

The

MINin theIMPORTcommand means minute level.MyLanguage of FMZ Quant platform, and only theMINlevel is supported in theIMPORTcommand. Non-standard periods are now supported. For example, you can use#IMPORT [MIN, 240, TEST] AS VAR240to import data such as 240-minute period (4 hours) K-line.Code example:

// This code demonstrates how to reference formulas of different periods in the same code // #EXPORT extended grammar, ending with #END marked as a formula, you can declare multiple #EXPORT TEST Mean value 1: EMA(C, 20); Mean value 2: EMA(C, 10); #END // end #IMPORT [MIN,15,TEST] AS VAR15 // Quoting the formula, the K-line period takes 15 minutes #IMPORT [MIN,30,TEST] AS VAR30 // Quoting the formula, the K-line period takes 30 minutes CROSSUP(VAR15.Mean value is 1, VAR30.Mean value is 1),BPK; CROSSDOWN(VAR15.Mean value is 2, VAR30.Mean value is 2),SPK; The highest price in fifteen minutes:VAR15.HIGH; The highest price in thirty minutes:VAR30.HIGH; AUTOFILTER;- It is necessary to pay attention to when using

REF,LLV,HHVand other instructions to reference data when referencing data in multiple periods.

(*backtest start: 2021-08-05 00:00:00 end: 2021-08-05 00:15:00 period: 1m basePeriod: 1m exchanges: [{"eid":"Futures_OKCoin","currency":"ETH_USD"}] args: [["TradeAmount",100,126961],["ContractType","swap",126961]] *) %% scope.PRINTTIME = function() { var bars = scope.bars; return _D(bars[bars.length - 1].Time); } %% BARTIME:PRINTTIME; #EXPORT TEST REF1C:REF(C,1); REF1L:REF(L,1); #END // end #IMPORT [MIN,5,TEST] AS MIN5 INFO(1, 'C:', C, 'MIN5.REF1C:', MIN5.REF1C, 'REF(MIN5.C, 1):', REF(MIN5.C, 1), 'Trigger BAR time:', BARTIME, '#FF0000'); INFO(1, 'L:', L, 'MIN5.REF1L:', MIN5.REF1L, 'REF(MIN5.L, 1):', REF(MIN5.L, 1), 'Trigger BAR time:', BARTIME, '#32CD32'); AUTOFILTER;Comparing the difference between

MIN5.REF1CandREF(MIN5.C, 1),we can find:```REF(MIN5.C, 1)``` is the K -line period of the current model (the above code backtest period is set to 1 minute, i.e. ```period: 1m``), the closing price of the 5-minute period where the penultimate BAR is located at the current moment. These two definitions are differentiated, and they can be used as needed. - ## Mode Description - ### Signal filtering model of one opening and one leveling In the model, the ```AUTOFILTER``` function is written to control and realize the signal filtering of one opening and one closing. When there are multiple opening signals that meet the conditions, the first signal is taken as the valid signal, and the same signal on the K-line will be filtered out. Instructions supported by filtering model: BK, BP, BPK, SK, SP, SPK, CLOSEOUT, etc. Instructions with lot numbers such as BK(5) are not supported. For exampleMA1:MA(CLOSE,5); MA2:MA(CLOSE,10); CROSSUP(C,MA1),BK; CROSSUP(MA1,MA2),BK; C>BKPRICE+10||C

Comprehension: As in the above example, when AUTOFILTER is not set, the third row BK, the fourth row BK and the fifth row SP are triggered in sequence, and each K-line triggers a signal once. After opening the position, and closing the position, the model state is reset.

If AUTOFILTER is set, after triggering BK, only SP is triggered, other BK signals are ignored, and each K-line triggers a signal once.- ### Increase and decrease position model The ```AUTOFILTER``` function is not written in the model, allowing continuous opening signals or continuous closing signals, which can increase and decrease positions. Supported instructions: BK(N), BP(N), SK(N), SP(N), CLOSEOUT, BPK(N), SPK(N), open and close orders without lot size are not supported. (1)Instruction grouping is supported. (2)When multiple instruction conditions are satisfied at the same time, the signals are executed in the order in which the conditional statements are written. For example:MA1:MA(CLOSE,5); MA2:MA(CLOSE,10); CROSSUP(C,MA1),BK(1); CROSSUP(MA1,MA2),BK(1); C>BKPRICE+10||C

Use ```TRADE\_AGAIN``` It is possible to make the same command line, multiple signals in succession.Comprehension: The above example is executed one by one, and the signal after execution is no longer triggered. Reset the model status after closing the position. A K -line triggers a signal once.

- ### Model with one K-line and one signal Regardless of whether the K-line is finished, the signal is calculated in real-time orders, that is, the K-line is placed before the order is completed; the K-line is reviewed at the end. If the position direction does not match the signal direction at the end of the K-line, the position will be automatically synchronized. For example:MA1:MA(CLOSE,5); MA2:MA(CLOSE,10); CROSSUP(MA1,MA2),BPK; //The 5-period moving average crosses up, and the 10-period moving average goes long. CROSSDOWN(MA1,MA2),SPK; //The 5-period moving average crosses down, and the 10-period moving average goes short. AUTOFILTER;

- ### A model of multiple signals on one K-line The model uses ```multsig``` to control and implement multiple signals from one K-line. Regardless of whether the K-line is finished, the signal is calculated in real-time. The signal is not reviewed, there is no signal disappearance, and the direction of the signal is always consistent with the direction of the position. If multiple signal conditions are met in one K-line, it can be executed repeatedly.For example: MA1:MA(CLOSE,5); MA2:MA(CLOSE,10); CROSSUP(MA1,MA2),BK; C>BKPRICE+10||C

```MULTSIG``` can execute multiple command lines within one K-line. A command line is only signaled once.O,BK; // These conditions may all be executed in a K-line Bar, but only one signal per line 10+O,BK; // Strategy plus TRADE_AGAIN(10);it can make multiple signals per line 20+O,BK; 40+O,BK; MULTSIG(1,1,10);

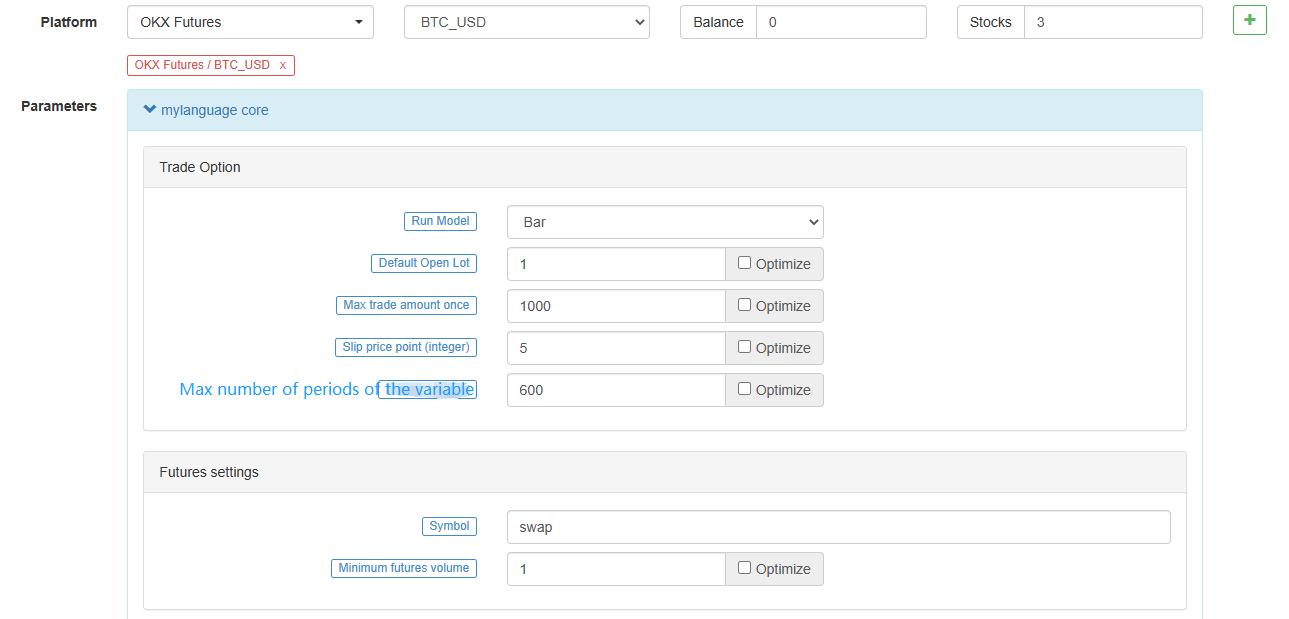

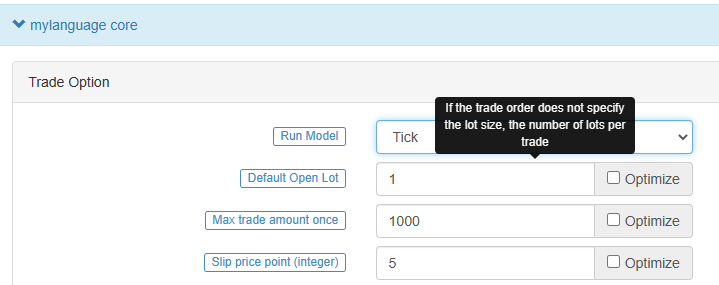

Supplement: 1.The model of adding and reducing positions, two ways of one signal and one K-line: placing an order at the closing price and placing an order at the order price, are both supported. 2.The model of adding and reducing positions also supports ordering of multiple signals from one K-line. The model of adding and reducing positions, write the ```multsig``` function to realize multiple additions or multiple reductions on one K-line. - ## Execution mode  - ### Bar model The Bar model refers to the model that is executed after the current BAR is completed, and the trading is executed when the next BAR starts. - ### Tick model The Tick model means that the model is executed once for each price movement and trades immediately when there is a signal. The Tick model ignores the previous day's signal (the previous day's signal is executed immediately on the same day), and the Tick model focuses only on the current market data to determine whether the signal is triggered. - ## Chart display - ### Additional indicators for main chart > Use operator ```^^```, set indicators are displayed on the main chart while assigning values to variables.MA60^^MA(C, 60); // Calculate the average indicator with the parameter of 60

- ### Additional Indicators for sub-chart Use operator ```:```, set indicators are displayed on the sub-chart while assigning values to variables.ATR:MA(MAX(MAX((HIGH-LOW),ABS(REF(CLOSE,1)-HIGH)),ABS(REF(CLOSE,1)-LOW)),26); // Assign a value to the ATR variable, the “:” symbol is followed by the formula for calculating the ATR

If you don't want it to be displayed on the main or subchart, use the "..." operator.MA60..MA(C, 60); // Calculate the average indicator with the parameter of 60

You can use ```DOT``` and ```COLORRED``` to set the line type and color of the line, etc., in line with the habits of users familiar with the MyLanguage. - ## Common problems > Introduce the **problems** commonly encountered in the process of writing indicators, usually the points that need to be paid attention to when writing (continuously added). - Remark the semicolon ```;``` at the end. - Remark that system keywords cannot be declared as variables. - Remark that the string uses **single quotes**, for example: the string ```'Open position'```. - ### Remark Annotation - ```// The Remark content ``` (input method can be typed in both Chinese and English) means that the code is not compiled during the execution process, that is, the content after ```//``` is not executed. Usually we use it to mark the meaning of the code, when it is convenient for code review, it can be quickly understood and recalled. - ```{ Remark content }```Block Remark. ``` A:=MA(C,10); {The previous line of code is to calculate the moving average.} ``` - ```(* Remark content *)```Block Remark. ``` A:=MA(C,10); (*The previous line of code is to calculate the moving average.*) ``` - ### Input When writing code, because the input method is often switched between Chinese and English, resulting in symbol errors. The common errors are as follows: colon ```:```, terminator ```;```, comma ```, ```, brackets ```()```, etc. These characters in different states of Chinese and English need attention. > If you use Sogou, Baidu, or Bing input methods, you can quickly switch between Chinese and English by pressing the ```shift``` key once. - ### Error-prone logic 1. At least, not less than, not less than: the corresponding relational operator ```>=```. 2. Up to, at most, no more than: the corresponding relational operator ```<=```. - ### Strategy launch synchronization In the futures strategy, if there is a manually opened position before the strategy robot starts, when the robot starts, it will detect the position information and synchronize it to the actual position status. In the strategy, you can use the ```SP```, ```BP```, ```CLOSEOUT``` commands to close the position.%% if (!scope.init) { var ticker = exchange.GetTicker(); exchange.Buy(ticker.Sell+10, 1); scope.init = true; } %% C>0, CLOSEOUT; “`

- ### Two-way positions are not supported

MyLanguage does not support the same contract with both long and short positions.

-

K-line data citation

- ## OPEN

Obtain the opening price of the K-line chart.

Opening price

Function: OPEN, short for O

parameters: none

Explanation: Returns the opening price of “this period”

Sequence data

OPEN gets the opening price of the K-line chart. Remark: 1.It can be abbreviated as O. Example 1: OO:=O; //Define OO as the opening price; Remark that the difference between O and 0. Example 2: NN:=BARSLAST(DATE<>REF(DATE,1)); OO:=REF(O,NN); //Take the opening price of the day Example 3: MA5:=MA(O,5); //Define the 5-period moving average of the opening price (O is short for OPEN).- ## HIGH

Get the highest price on the K-line chart.

The highest price

Function: HIGH, abbreviated H

parameters: none

Explanation: Return the highest price of “this period”

Sequence data

HIGH achieved the highest price on the K-line chart. Remark: 1.It can be abbreviated as H. Example 1: HH:=H; // Define HH as the highest price Example 2: HH:=HHV(H,5); // Take the maximum value of the highest price in 5 periods Example 3: REF(H,1); // Take the highest price of the previous K-line- ## LOW

Get the lowest price on the K-line chart.

The lowest price

Function: LOW, abbreviated L

parameters: none

Explanation: Return the lowest price of “this period”

Sequence data

LOW gets the lowest price on the K-line chart. Remark: 1.It can be abbreviated as L. Example 1: LL:=L; // Define LL as the lowest price Example 2: LL:=LLV(L,5); // Get the minimum value of the lowest price in 5 periods Example 3: REF(L,1); // Get the lowest price of the previous K-line- ## CLOSE

Get the closing price of the K-line chart.

Closing price

Function: CLOSE, abbreviated as C

parameters: none

Explanation: Returns the closing price of “this period”

Sequence data

CLOSE Get the closing price of the K-line chart Remarks: 1.Obtain the latest price when the intraday K-line has not finished. 2.It can be abbreviated as C. Example 1: A:=CLOSE; //Define the variable A as the closing price (A is the latest price when the intraday K-line has not finished) Example 2: MA5:=MA(C,5); //Define the 5-period moving average of the closing price (C is short for CLOSE) Example 3: A:=REF(C,1); //Get the closing price of the previous K-line- ## VOL

Obtain the trading volume of K-line chart.

Trading volume

Function: VOL, abbreviated as V

parameters: none

Explanation: Returns the trading volume of “this period”

Sequence data

VOL obtains the trading volume of the K-line chart. Remarks: It can be abbreviated as V. The return value of this function on the current TICK is the cumulative value of all TICK trading volume on that day. Example 1: VV:=V; // Define VV as the trading volume Example 2: REF(V,1); // Indicates the trading volume of the previous period Example 3: V>=REF(V,1); // The trading volume is greater than the trading volume of the previous period, indicating that the trading volume has increased (V is the abbreviation of VOL)- ## OPI

Take the current total position in the futures (contract) market.

OpenInterest:OPI;- ## REF

Forward citation.

Reference the value of X before N periods. Remarks: 1.When N is a valid value, but the current number of K-lines is less than N, returns null; 2.Return the current X value when N is 0; 3.Return a null value when N is null. 4.N can be a variable. Example 1: REF(CLOSE,5);Indicate the closing price of the 5th period before the current period is referenced Example 2: AA:=IFELSE(BARSBK>=1,REF(C,BARSBK),C);//Take the closing price of the K-line of the latest position opening signal // 1)When the BK signal is sent, the bar BARSBK returns null, then the current K-line REF(C, BARSBK) that sends out the BK signal returns null; // 2)When the BK signal is sent out, the K-line BARSBK returns null, and if BARSBK>=1 is not satisfied, it is the closing price of the K-line. // 3)The K-line BARSBK after the BK signal is sent, returns the number of periods from the current K-line between the K-line for purchasing and opening a position, REF(C,BARSBK) Return the closing price of the opening K-line. // 4)Example: three K-lines: 1, 2, and 3, 1 K-line is the current K-line of the position opening signal, then returns the closing price of the current K-line, 2, 3 The K-line returns the closing price of the 1 K-line.- ## UNIT

Get the trading unit of the data contract.

Get the trading unit of the data contract. Usage: UNIT takes the trading unit of the loaded data contract.Cryptocurrency spot

UNIT value is 1.

Cryptocurrency futures

The UNIT value is related to the contract currency.

OKEX futures currency standard contracts: 1 contract for BTC represents $100, 1 contract for other currencies represents $10- ## MINPRICE

The minimum variation price of the data contract.

Take the minimum variation price of the data contract. Usage: MINPRICE; Take the minimum variation price of the loaded data contract.- ## MINPRICE1

The minimum variation price of a trading contract.

Take the minimum variation price of a trading contract. Usage: MINPRICE1; Take the minimum variation price of a trading contract. -

Time function

- ## BARPOS

Take the position of the K-line.

BARPOS, Returns the number of periods from the first K-line to the current one. Remarks: 1.BARPOS returns the number of locally available K-line, counting from the data that exists on the local machine. 2.The return value of the first K-line existing in this machine is 1. Example 1:LLV(L,BARPOS); // Find the minimum value of locally available data. Example 2:IFELSE(BARPOS=1,H,0); // The current K-line is the first K-line that already exists in this machine, and it takes the highest value, otherwise it takes 0.- ## DAYBARPOS

DAYBARPOS the current K-line BAR is the K-line BAR of the day.

- ## PERIOD

The period value is the number of minutes.

1, 3, 5, 15, 30, 60, 1440- ## DATE

DateFunction DATE, Get the year, month, and day of the period since 1900.

Example 1: AA..DATE; // The value of AA at the time of testing is 220218, which means February 18, 2022- ## TIME

The time of taking the K-line.

TIME, the time of taking the K-line. Remarks: 1.The function returns in real time in the intraday, and returns the starting time of the K-line after the K-line is completed. 2.This function returns the exchange data reception time, which is the exchange time. 3.The TIME function returns a six-digit form when used on a second period, namely: HHMMSS, and displays a four-digit form on other periods, namely: HHMM. 4.The TIME function can only be loaded in periods less than the daily period, and the return value of the function is always 1500 in the daily period and periods above the daily period. 5. It requires attention when use the TIME function to close a position at the end of the day (1).It is recommended to set the time for closing positions at the end of the market to the time that can actually be obtained from the return value of the K-line (for example: the return time of the last K-line in the 5-minute period of the thread index is 1455, and the closing time at the end of the market is set to TIME>=1458, CLOSEOUT; the signal of closing the position at the end of the market cannot appear in the effect test) (2).If the TIME function is used as the condition for closing the position at the end of the day, it is recommended that the opening conditions should also have a corresponding time limit (for example, if the condition for closing the position at the end of the day is set to TIME>=1458, CLOSEOUT; then the condition TIME needs to be added to the corresponding opening conditions. <1458; avoid re-opening after closing) Example 1: C>O&&TIME<1450,BK; C<O&&TIME<1450,SK; TIME>=1450,SP; TIME>=1450,BP; AUTOFILTER; // Close the position after 14:50. Example 2: ISLASTSK=0&&C>O&&TIME>=0915,SK;- ## YEAR

Year.

YEAR, year of acquisition. Remark: The value range of YEAR is 1970-2033. Example 1: N:=BARSLAST(YEAR<>REF(YEAR,1))+1; HH:=REF(HHV(H,N),N); LL:=REF(LLV(L,N),N); OO:=REF(VALUEWHEN(N=1,O),N); CC:=REF(C,N); // Take the highest price, lowest price, opening price, and closing price of the previous year Example 2: NN:=IFELSE(YEAR>=2000 AND MONTH>=1,0,1);- ## MONTH

Take the month.

MONTH, returns the month of a period. Remark: The value range of MONTH is 1-12. Example 1: VALUEWHEN(MONTH=3&&DAY=1,C); // Take its closing price when the K-line date is March 1 Example 2: C>=VALUEWHEN(MONTH<REF(MONTH,1),O),SP;- ## DAY

Get the number of days in a period

DAY, returns the number of days in a period. Remark: The value range of DAY is 1-31. Example 1: DAY=3&&TIME=0915,BK; // 3 days from the same day, at 9:15, buy it Example 2: N:=BARSLAST(DATE<>REF(DATE,1))+1; CC:=IFELSE(DAY=1,VALUEWHEN(N=1,O),0); // When the date is 1, the opening price is taken, otherwise the value is 0- ## HOUR

Hour.

HOUR, returns the number of hours in a period. Remark: The value range of HOUR is 0-23 Example 1: HOUR=10; // The return value is 1 on the K-line at 10:00, and the return value on the remaining K-lines is 0- ## MINUTE

Minute.

MINUTE, returns the number of minutes in a period. Remarks: 1: The value range of MINUTE is 0-59 2: This function can only be loaded in the minute period, and returns the number of minutes when the K-line starts. Example 1: MINUTE=0; // The return value of the minute K-line at the hour is 1, and the return value of the other K-lines is 0 Example 2: TIME>1400&&MINUTE=50,SP; // Sell and close the position at 14:50- ## WEEKDAY

Get the number of the week.

WEEKDAY, get the number of the week. Remark: 1: The value range of WEEKDAY is 0-6. (Sunday ~ Saturday) Example 1: N:=BARSLAST(MONTH<>REF(MONTH,1))+1; COUNT(WEEKDAY=5,N)=3&&TIME>=1450,BP; COUNT(WEEKDAY=5,N)=3&&TIME>=1450,SP; AUTOFILTER; // Automatically close positions at the end of the monthly delivery day Example 2: C>VALUEWHEN(WEEKDAY<REF(WEEKDAY,1),O)+10,BK; AUTOFILTER; -

Logical judgment function

- ## BARSTATUS

Return the position status for the current period.

BARSTATUS returns the position status for the current period. Remark: The function returns 1 to indicate that the current period is the first period, returns 2 to indicate that it is the last period, and returns 0 to indicate that the current period is in the middle. Example: A:=IFELSE(BARSTATUS=1,H,0); // If the current K-line is the first period, variable A returns the highest value of the K-line, otherwise it takes 0- ## BETWEEN

Between.

BETWEEN(X,Y,Z) indicates whether X is between Y and Z, returns 1 (Yes) if established, otherwise returns 0 (No). Remark: 1.The function returns 1(Yse) if X=Y, X=Z, or X=Y and Y=Z. Example 1: BETWEEN(CLOSE,MA5,MA10); // It indicates that the closing price is between the 5-day moving average and the 10-day moving average- ## BARSLASTCOUNT

BARSLASTCOUNT(COND) counts the number of consecutive periods that satisfy the condition, counting forward from the current period.

Remark: 1. The return value is the number of consecutive non zero periods calculated from the current period 2. the first time the condition is established when the return value of the current K-line BARSLASTCOUNT(COND) is 1 Example: BARSLASTCOUNT(CLOSE>OPEN); //Calculate the number of consecutive positive periods within the current K-line- ## CROSS

Cross function.

CROSS(A,B) means that A crosses B from bottom to top, and returns 1 (Yes) if established, otherwise returns 0 (No) Remark: 1.To meet the conditions for crossing, the previous k-line must satisfy A<=B, and when the current K-line satisfies A>B, it is considered to be crossing. Example 1: CROSS(CLOSE,MA(CLOSE,5)); // Indicates that the closing line crosses the 5-period moving average from below- ## CROSSDOWN

Crossdown

CROSSDOWN(A,B): indicates that when A passes through B from top to bottom, it returns 1 (Yes) if it is established, otherwise it returns 0 (No) Remark: 1.CROSSDOWN(A,B) is equivalent to CROSS(B,A), and CROSSDOWN(A,B) is easier to understand Example 1: MA5:=MA(C,5); MA10:=MA(C,10); CROSSDOWN(MA5,MA10),SK; // MA5 crosses down MA10 to sell and open a position // CROSSDOWN(MA5,MA10),SK; Same meaning as CROSSDOWN(MA5,MA10)=1,SK;- ## CROSSUP

Crossup.

CROSSUP(A,B) means that when A crosses B from the bottom up, it returns 1 (Yes) if it is established, otherwise it returns 0 (No) Remark: 1.CROSSUP(A,B) is equivalent to CROSS(A,B), and CROSSUP(A,B) is easier to understand. Example 1: MA5:=MA(C,5); MA10:=MA(C,10); CROSSUP(MA5,MA10),BK; // MA5 crosses MA10, buy open positions // CROSSUP(MA5,MA10),BK;与CROSSUP(MA5,MA10)=1,BK; express the same meaning- ## EVERY

Determine if it is continuously satisfied.

EVERY(COND,N), Determine whether the COND condition is always satisfied within N periods. The return value of the function is 1 if it is satisfied, and 0 if it is not satisfied. Remarks: 1.N contains the current K-line. 2.If N is a valid value, but there are not so many K-lines in front, or N is a null value, it means that the condition is not satisfied, and the function returns a value of 0. 3.N can be a variable. Example 1: EVERY(CLOSE>OPEN,5); // Indicates that it has been a positive line for 5 periods Example 2: MA5:=MA(C,5); // Define a 5-period moving average MA10:=MA(C,10); // Define a 10-period moving average EVERY(MA5>MA10,4),BK; // If MA5 is greater than MA10 within 4 periods, then buy the open position // EVERY(MA5>MA10,4),BK; has the same meaning as EVERY(MA5>MA10,4)=1,BK;- ## EXIST

Determine if there is satisfaction.

EXIST(COND, N) judges whether there is a condition that satisfies COND within N periods. Remarks: 1.N contains the current K-line. 2.N can be a variable. 3.If N is a valid value, but there are not so many K-lines in front, it is calculated according to the actual number of periods. Example 1: EXIST(CLOSE>REF(HIGH,1),10); // Indicates whether there is a closing price greater than the highest price of the previous period in 10 periods, returns 1 if it exists, and returns 0 if it does not exist Example 2: N:=BARSLAST(DATE<>REF(DATE,1))+1; EXIST(C>MA(C,5),N); // Indicates whether there is a K-line that satisfies the closing price greater than the 5-period moving average on the day, returns 1 if it exists, returns 0 if it does not exist- ## IF

Condition function.

IF(COND,A,B)Returns A if the COND condition is true, otherwise returns B. Remarks: 1.COND is a judgment condition; A and B can be conditions or values. 2.This function supports the variable circular reference to the previous period's own variable, that is, supports the following writing Y: IF(CON,X,REF(Y,1)). Example 1: IF(ISUP,H,L); // The K-line is the positive line, the highest price is taken, otherwise the lowest price is taken Example 2: A:=IF(MA5>MA10,CROSS(DIFF,DEA),IF(CROSS(D,K),2,0)); // When MA5>MA10, check whether it satisfies the DIFF and pass through DEA, otherwise (MA5 is not greater than MA10), when K and D are dead fork, let A be assigned a value of 2, if none of the above conditions are met, A is assigned a value of 0 A=1,BPK; // When MA5>MA10, the condition for opening a long position is to cross DEA above the DIFF A=2,SPK; // When MA5 is not greater than MA10, use K and D dead forks as the conditions for opening short positions- ## IFELSE

Condition function.

”` IFELSE(COND,A,B) Returns A if the COND condition is true, otherwise returns B.

Remarks: 1.COND is a judgment condition; A and B can be conditions or values. 2.This function supports variable circular reference to the previous period’s own variable, that is, supports the following writing Y: IFELSE(CON,X,REF(Y,1)); Example 1: IFELSE(ISUP,H,L); // The K-line is the positive line, the highest price is taken, otherwise the lowest price is taken Example 2: A:=IFELSE(MA5>MA10,CROSS(DIFF,DEA),IFELSE(CROSS(D,K),2,0)); // When MA5>MA10, check whether it satisfies the DIFF and pass through DEA, otherwise (MA5 is not greater than MA10), when K and D are dead fork, let A be assigned a value of 2, if none of the above conditions are met, A is assigned a value of 0 A=1,BPK; // When MA5>MA10, the condition for opening a long position is to cross DEA above the DIFF A=2,SPK; // When MA5 is not greater than MA10, use K and D dead forks as the conditio

- calculation of ema slope

- High frequency trading problems

- New findings: Chain data + in-field transaction data = main entry and exit points

- Ask for help with procedural framework and multi-strategy combination

- Is pine script able to directly switch market data?

- The web page is full of questions.

- Do you think that the retracement graph can only show a few thousand data points?

- MACD, the king of the indicators, is the one who has the biggest household denomination indicator.

- How to order through FMZ

- The new version of the TV reset icon is not convenient.

- The most advanced way to trade: master the order wall!

- What is the unit of volume?

- Which of the following is the most recent year-over-year increase in the overhead and reverse overhead rates?

- Problems with tradingview: Always delay 1 to 2 seconds between signal to FMZ

- How to operate multiple accounts on one disk

- WeChat can't receive a policy alert?

- Quantity price distribution chart: Watch the distribution of the chips to get an insight into average costs

- Problems with disk error reporting

- Why can't small currencies be recalculated?

- The grid strategy