Talk about the order book balance of a centralized exchange

Author: Inventors quantify - small dreams, Created: 2023-11-12 18:58:42, Updated: 2024-11-08 09:12:02

Recently, I summarized key insights from a number of papers on price-limit order books. You will learn how to measure the imbalance of order book transactions and its predictive power over price movements. This article explores how to use order book data to model price movements.

Let's talk about the order book first.

The order book balance refers to the relative equilibrium between the buy and sell orders on the exchange. The order book is a real-time record of all buy and sell orders in the market. This includes orders that buyers and sellers are willing to trade at different prices.

Here are some key concepts related to order book balancing:

-

Buyer and seller orders: Buyer orders in the order book indicate investors willing to buy the asset at a specific price, while seller orders indicate investors willing to sell the asset at a specific price.

-

Order book depth: The order book depth refers to the number of orders on both the buyer and seller sides. Greater depth indicates that there are more buy and sell orders in the market, which may be more liquid.

-

Transaction price and volume: The transaction price is the price of the most recent transaction, and the volume is the number of assets traded at that price. The transaction price and volume are determined by the competition between the buyers and sellers of the order book.

-

Order book imbalance: Order book imbalance refers to the difference between the number of orders or total turnover of the buyer and the seller. This can be determined by examining the depth of the order book.

-

Market Depth Chart: A market depth chart is a graphical representation of the depth and balance of the order book. Typically, the number of orders placed by buyers and sellers is shown on a bar chart or other visualization at the price level.

-

Factors affecting prices: The balance of the order book directly affects the market price. If the buyer orders more, the price may rise; if the seller orders more, the price may fall.

-

High-frequency trading and algorithmic trading: Order book balancing is critical for high-frequency trading and algorithmic trading as they rely on real-time order book data to make decisions to quickly capture market opportunities.

Understanding the order book balance is important for investors, traders, and market analysts because it provides useful information about market liquidity, potential price direction, and market trends.

Unbalanced trade

The key idea in analyzing the limit order book is to determine whether the market as a whole is more likely to buy or sell. This concept is known as transactional imbalance.

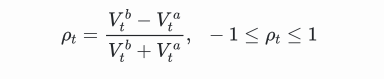

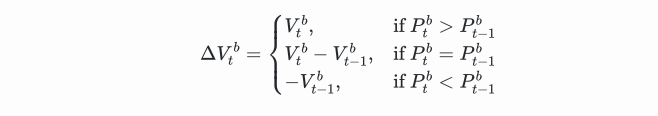

Transactional imbalance at time t is defined as:

Here, $V_{t}^{b}$ is the volume of trades on the best buy list at time t, and $V_{t}^{a}$ is the volume of trades on the best sell list at time t. We can interpret $ρ_{t}$ close to 1 as strong buyer pressure, and $ρ_{t}$ close to -1 as strong seller pressure. This only takes into account the volume of trades on the best buy and best sell list, the L1 order book.

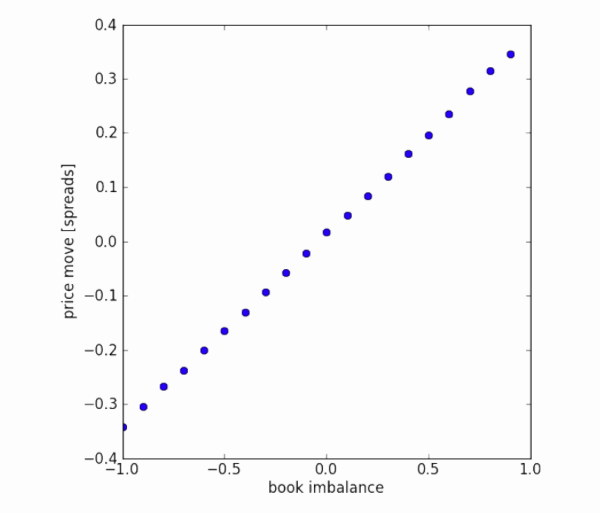

The graph shows the average of segmented transactional imbalances (x-axis) and future price movements, standardized by price differential (y-axis). The data set is the order flow for a quarter in a market. There seems to be a linear relationship between order imbalances at one level and future price movements. However, on average, future price movements are within the bid-ask spread.

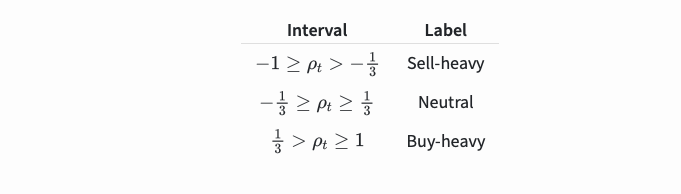

The trade imbalance $ρ_{t}$ is divided into three paragraphs:

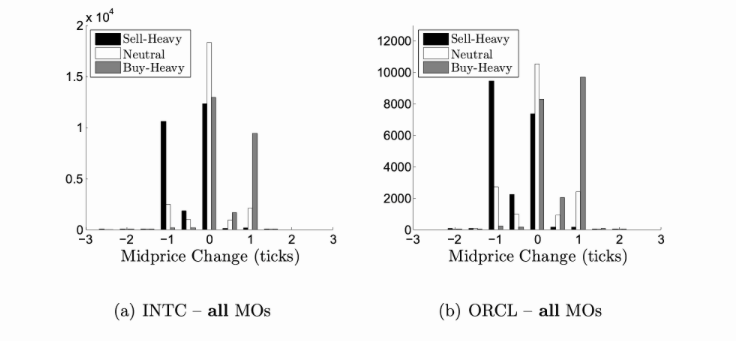

In the same way, we have found that these segments can predict future price movements:

The ability to predict turnover imbalances was analyzed on a variety's order book, with a time span of January 2014 to December 2014. For each incoming market order (MO), turnover imbalances were recorded and segmented according to the number of ticks in the next 10 milliseconds of median price movements. The graph shows the distribution of the segments and the median price movements. We can see that positive price movements are more likely to occur before the order book with higher buyer pressure. Similarly, negative movements are more likely to occur before the order book with higher discount selling pressure.

The order flow is unbalanced

Transaction imbalance focuses on total transactions in the limit order book. One disadvantage is that some of these transactions may come from old orders with insufficiently relevant information. We can instead focus on recent orders. This concept is called order flow imbalance.

Since Level 3 data is expensive and usually only available to institutional traders, we will be keeping an eye on changes in the limit order book.

We can calculate order flow imbalance by finding how much the turnover moved at the best buy and best sell prices. The turnover change at the best buy price is:

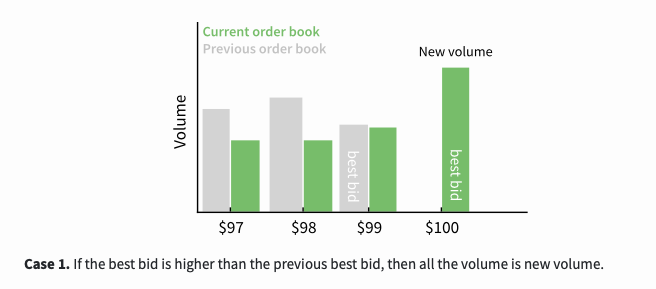

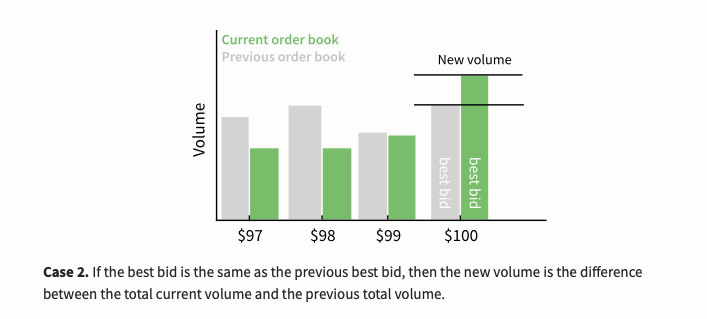

This is a function that involves three situations. The first is that if the best buy price is higher than the best buy price before, then all trades are new trades:

In the second case, if the best buy price is the same as the best buy price before, then the new transaction is the difference between the current total transaction and the previous total transaction.

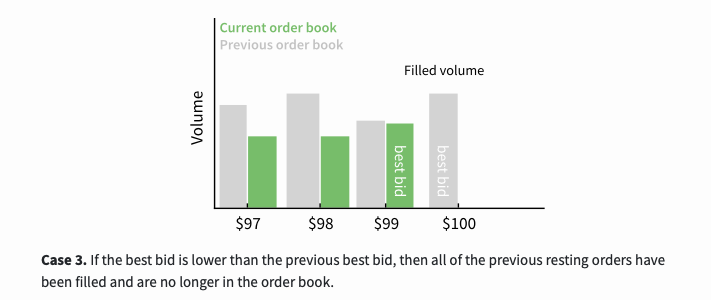

In the third case, if the best buy price is lower than the previous best buy price, then all previous orders have been settled and are no longer in the order book.

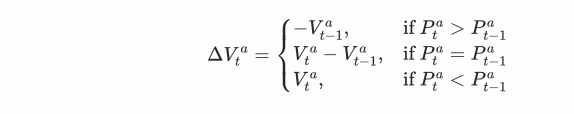

For the change in the volume of transactions at the best selling price, the calculation is similar:

The net order flow imbalance (OFI) at time t is given by:

$OFI_{t} = \Delta V_{t}^{b,1} - \Delta V_{t}^{a,1}$

This will be positive if there are more orders and negative if there are more orders sold. This measures both the number of transactions and the direction of the transactions. In the previous section, the trade imbalance only measures the direction and does not measure the number of transactions.

You can use these values to obtain the net order flow imbalance (OFI) over time:

$\sum_{i=t-n}^{t} OFI_i$

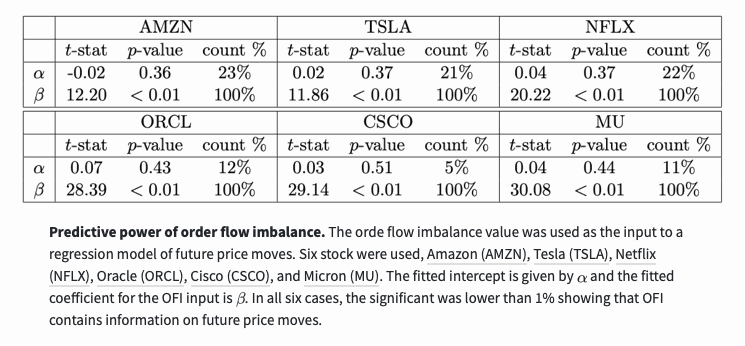

Using a regression model to test whether order flow imbalances contain information about future price movements:

The OFI values calculated above focus on the best buy and best sell prices. In Part 4, they also calculated the value of the top 5 best prices, providing five inputs rather than just one. They found that deep research into the order book could provide new information for future price movements.

Summary

Here, I summarize key insights from a number of research papers on the volume of orders in the price cap order book. These papers show that the order book contains information that is highly predictive of future price changes. However, these changes do not overcome the difference in buying and selling prices.

I have added a link to the paper in the reference section. Please see for more details.

References & Notes

- Álvaro Cartea, Ryan Francis Donnelly, and Sebastian Jaimungal: “Enhancing Trading Strategies with Order Book Signals” Applied Mathematical Finance 25(1) pp. 1–35 (2018)

- Alexander Lipton, Umberto Pesavento, and Michael G Sotiropoulos: “Trade arrival dynamics and quote imbalance in a limit order book” arXiv (2013)

- Álvaro Cartea, Sebastian Jaimungal, and J. Penalva: “Algorithmic and high-frequency trading.” Cambridge University Press

- Ke Xu, Martin D. Gould, and Sam D. Howison: “Multi-Level Order-Flow Imbalance in a Limit Order Book” arXiv (2019)

This is the first time I've seen this movie.

- Bayes - Decoding the Mystery of Probability, Exploring the Mathematical Wisdom Behind Decision Making

- Bayes - the mystery of decoding probability, exploring the mathematical wisdom behind decision making

- The Advantages of Using FMZ's Extended API for Efficient Group Control Management in Quantitative Trading

- Price Performance After the Currency is Listed on Perpetual Contracts

- Efficient cluster management using FMZ's extended API is an advantage in quantitative trading

- The price performance after the currency went live

- The Correlation Between the Rise and Fall of Currencies and Bitcoin

- Relation between currency declines and Bitcoin

- A Brief Discussion on the Balance of Order Books in Centralized Exchanges

- Measuring Risk and Return - An Introduction to Markowitz Theory

- Measuring risk and return by the use of the Goma-Kovitz Theory

- A Powerful Tool for Programmatic Traders: Incremental Update Algorithm for Calculating Mean and Variance

- Programmatic trader leverage: incremental update algorithm to calculate the mean and variance

- Construction and Application of Market Noise

- PSY Factor Upgrade and Transformation

- High-Frequency Trading Strategy Analysis - Penny Jump

- Alternative Trading Ideas--K-line Area Trading Strategy

- Construction and application of market noise

- PSY (psychological line) factor upgrading and transformation

- High frequency trading strategy analysis - Penny Jump