Can we quantify a transaction without typing a code?

Author: Inventors quantify - small dreams, Created: 2018-10-18 13:51:24, Updated: 2023-10-31 21:00:28

NO.1

Quantitative trading is already the dominant force in Wall Street; many of the world's top investment banks have banned manual directional speculative trading. Quantitative trading is also developing very rapidly at home, with institutions using it, futures brokers using it, and more and more people participating in quantitative trading.

But there are also many manual traders who are interested in quantitative trading. The inventor of the FMZ has developed a visualized quantitative trading platform to popularize it, reduce the threshold for programming quantitative trading and significantly improve the efficiency of writing.

NO.2

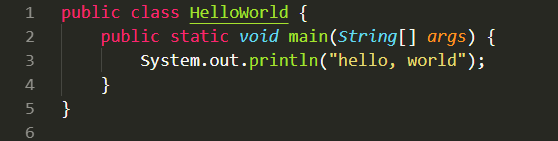

In traditional programming, you have to be familiar with the basic syntax of the programming language, data operations, data structures, logical controls... 10,000 words are omitted here.

Simply output a string program and you write 5 lines of code. I believe most beginners only know the parentheses hello, world, etc. So, if you are not sure how to start, you can start with visual programming.

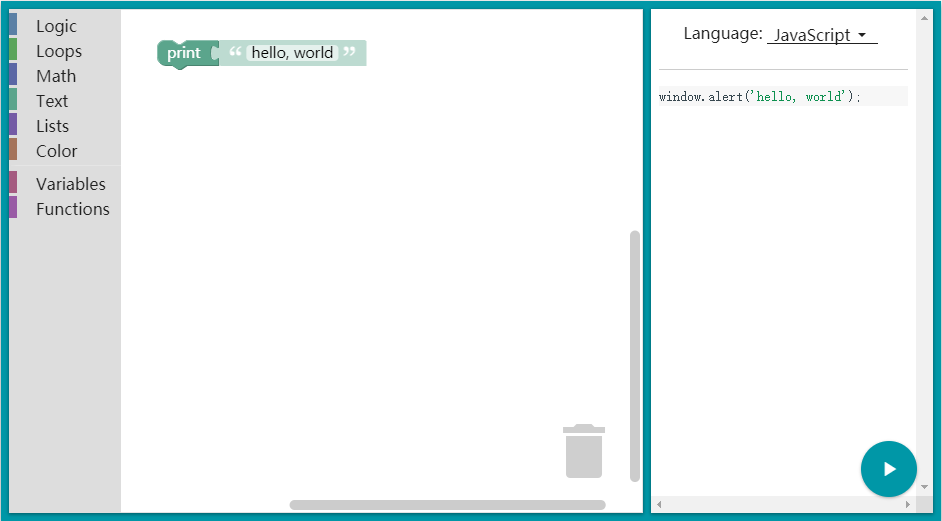

Visual programming has been around for a long time and is not a new thing. The idea of visualization is that it is built with a variety of control modules that can be used to build code logic, complete transaction strategy design, and process the process like a building block.

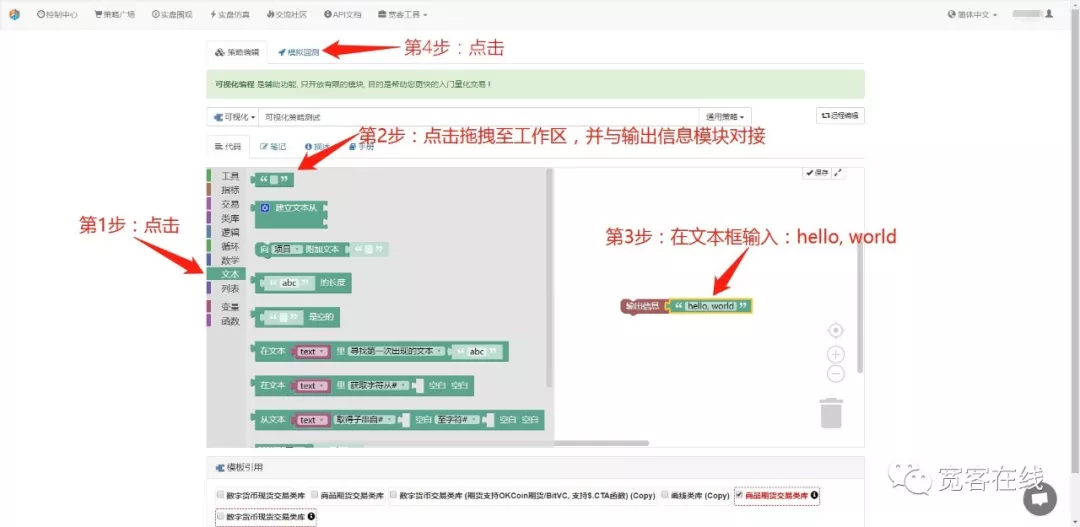

As shown above, the same procedure, in blockly visualization programming, requires only one line of code to be done. This greatly reduces the programming threshold, especially for traders who do not know how to program at all, which is a great operating experience. The inventor's quantized visualization programming is also made possible with blockly visualization tools released by Google.

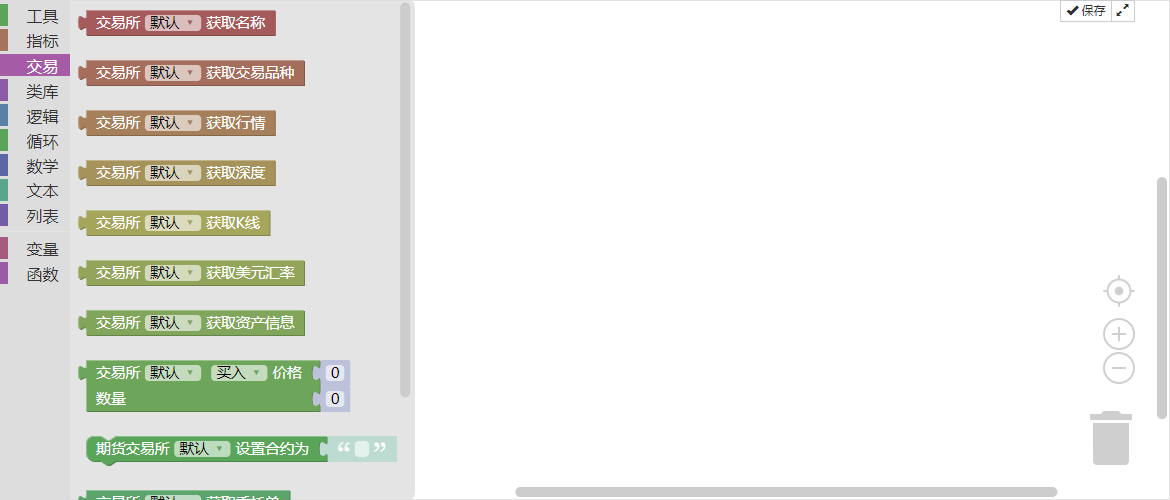

The inventor's quantized visualization programming, with hundreds of commonly used trading modules built in, will be followed by the addition of more trading modules to support new ideas and new applications for traders, which will be developed and maintained by the developers. Although the syntax is simple, it does not lose performance. Almost satisfies most quantized trading strategies.

NO.3

How to use

The first step: register and log inventors quantifyFMZThe official website is www.fmz.com.

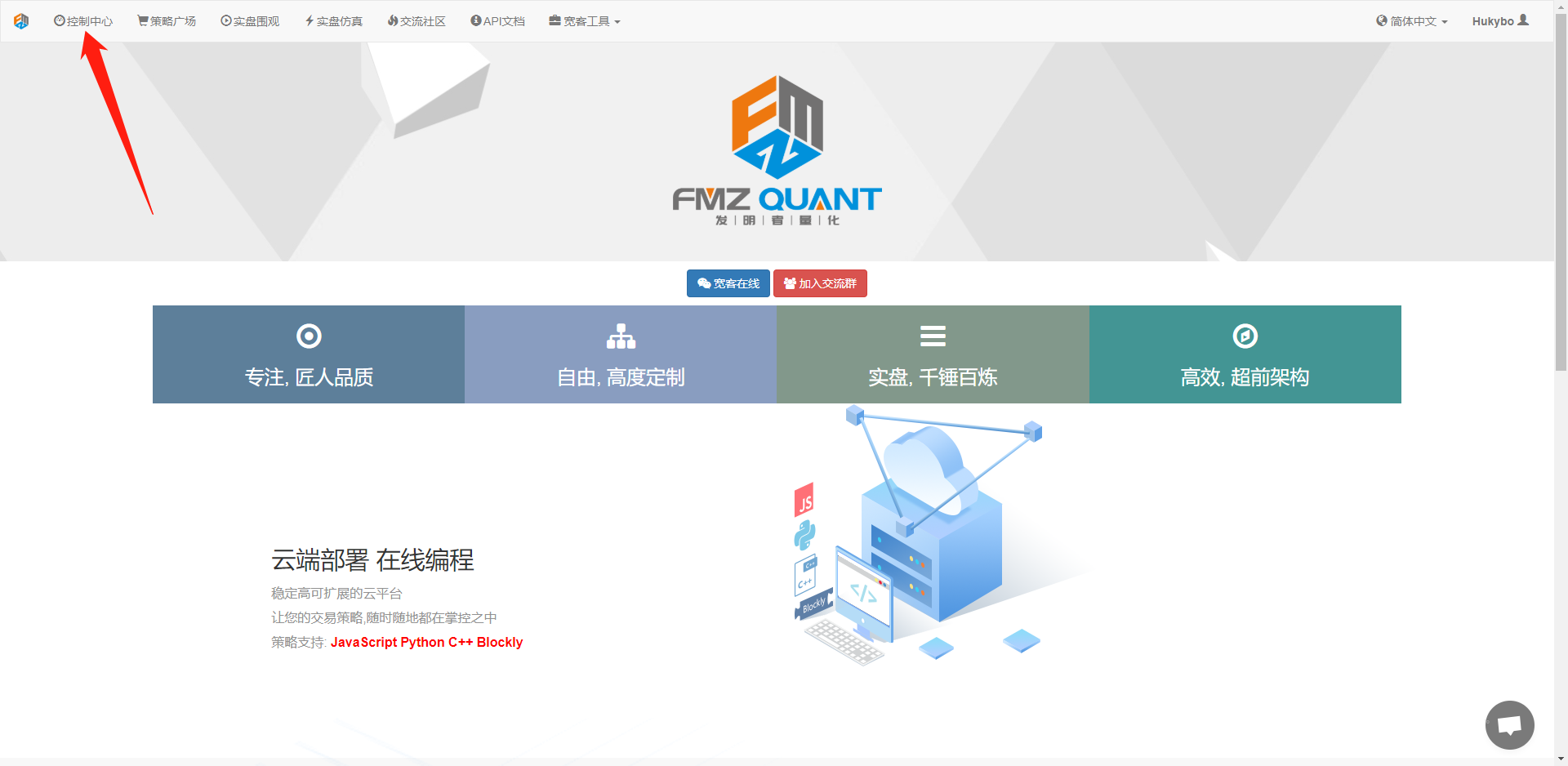

The second stepAccess to the control center:

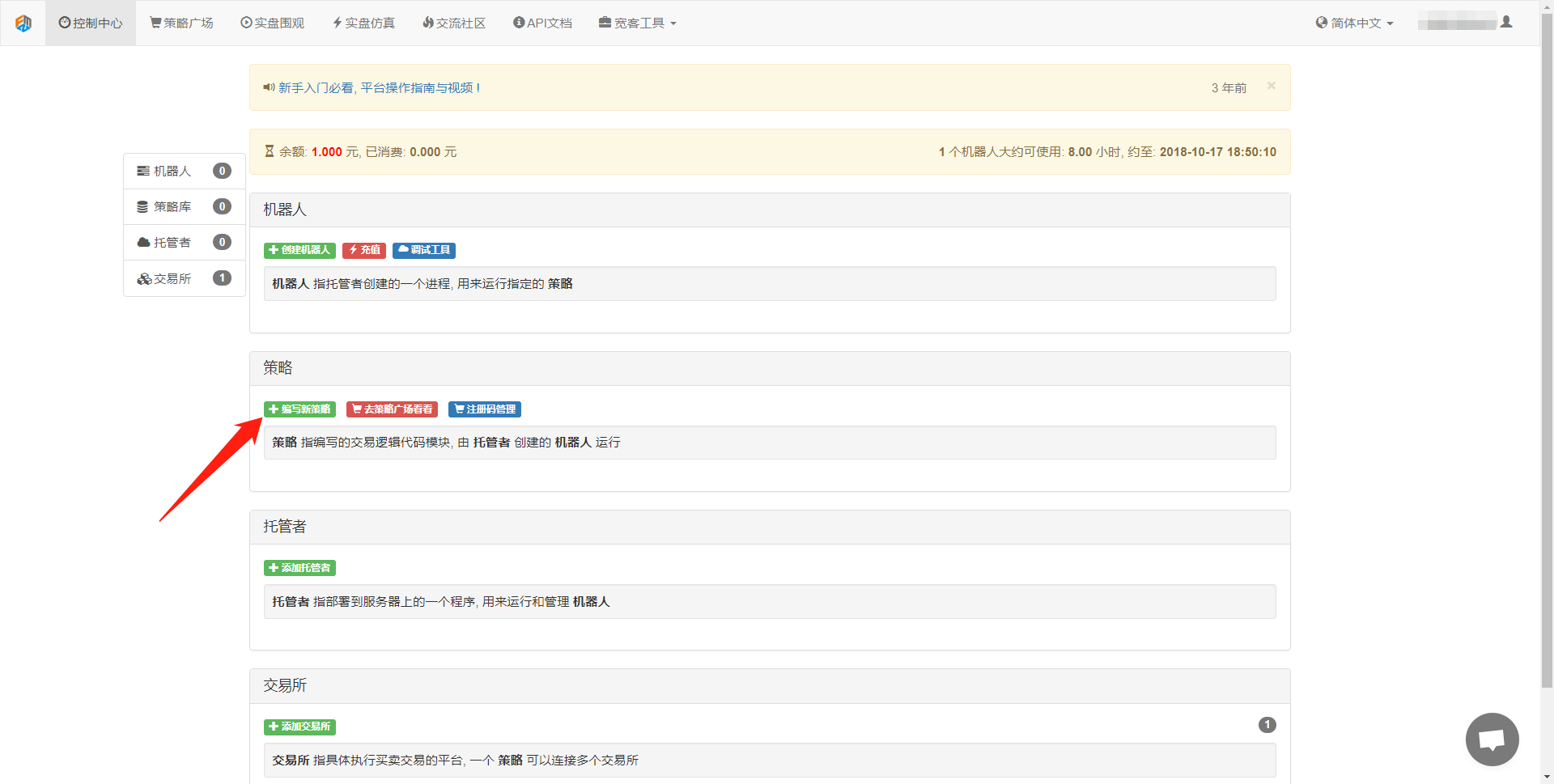

The third stepClick here to write a new strategy

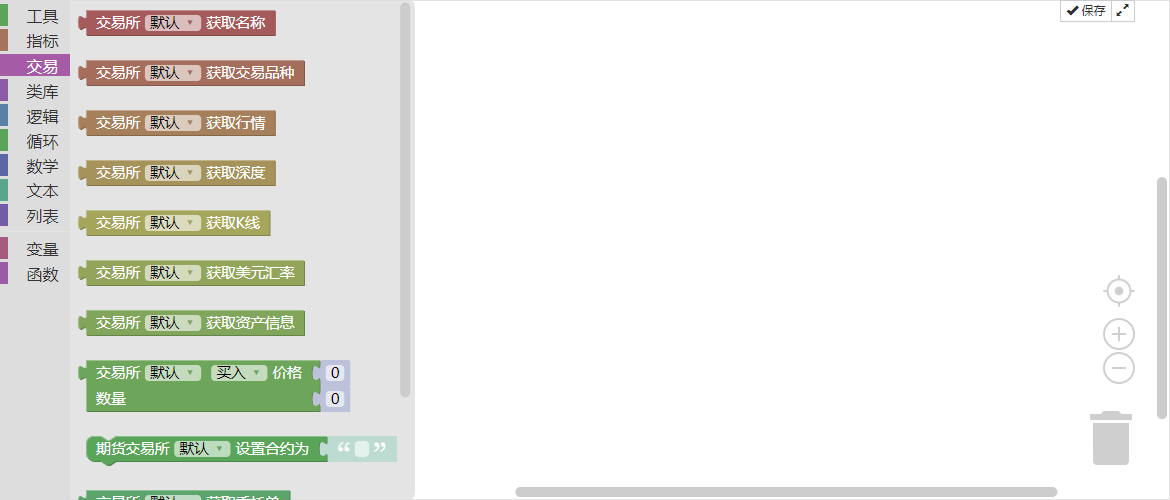

Step fourSelect a programming language for visualization, select a transaction library

FinallyIn the video below, you can see a picture of the user interface:

NO.4

Using the inventor's quantized visualization editor, try to write a program that outputs "hello, world", "hello, world"

Step 1: Select the output module

Step 2: Select the text module

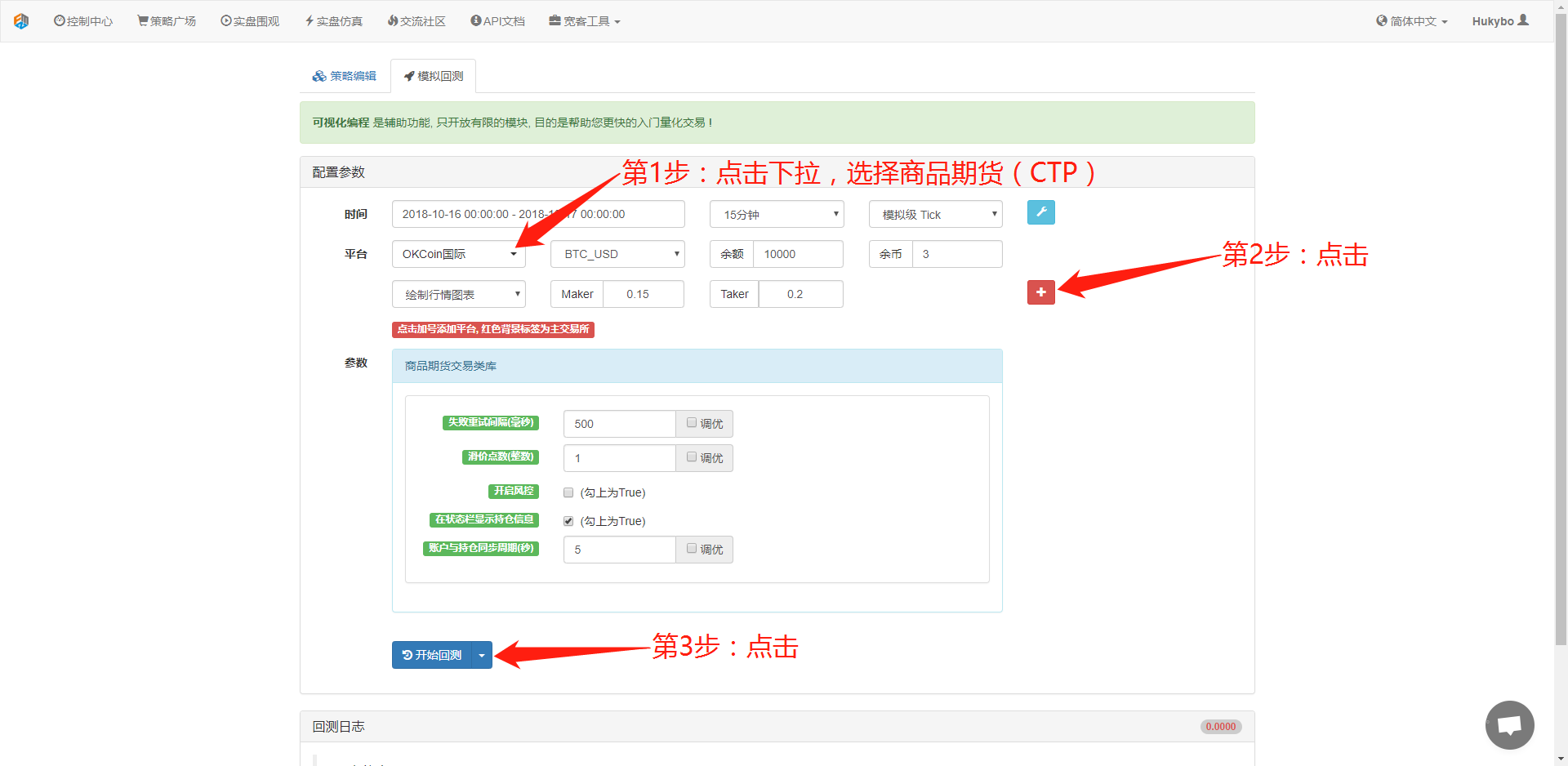

Step 3: Set up the retest

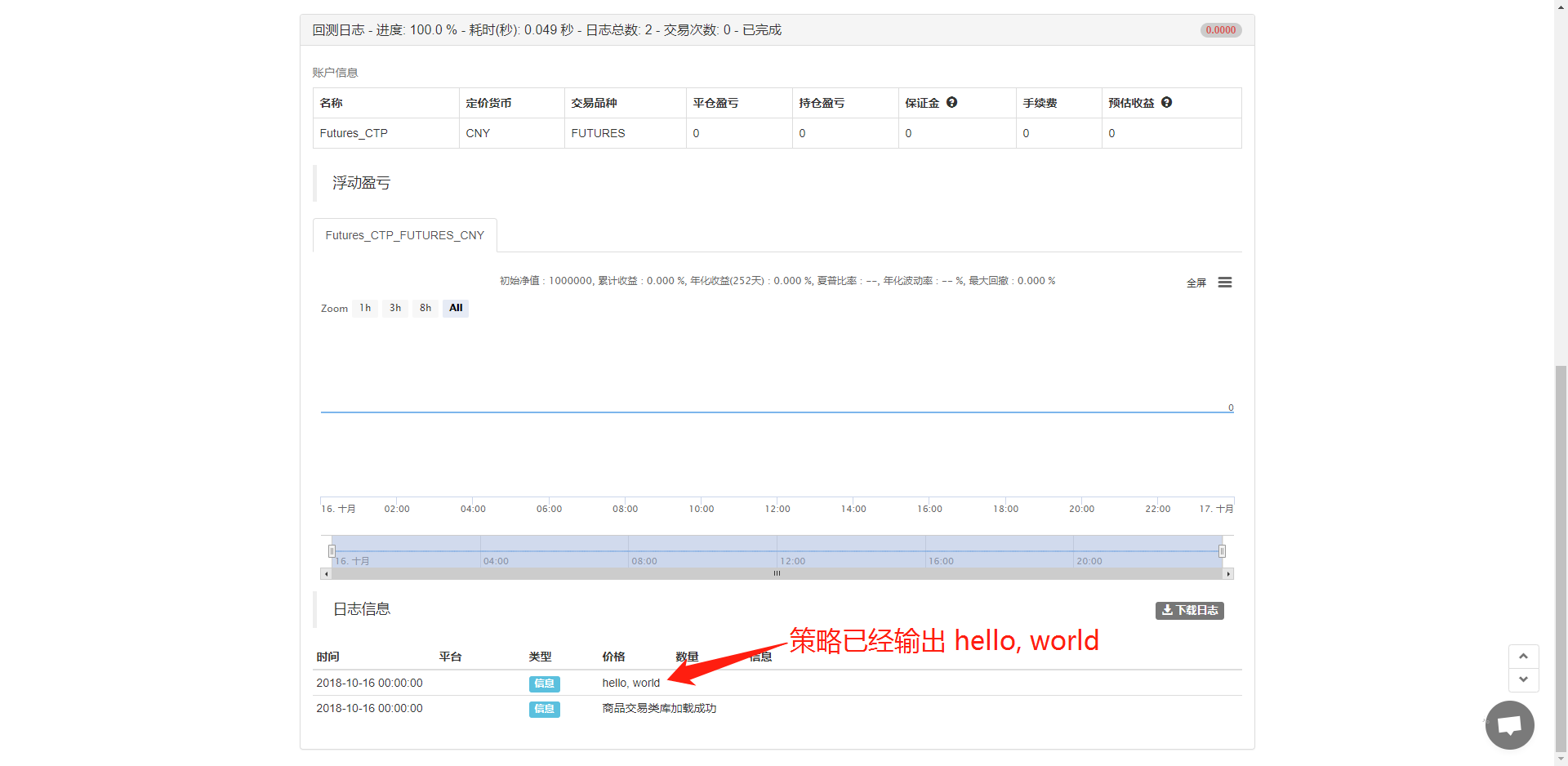

Step four: Retest the results

NO.5

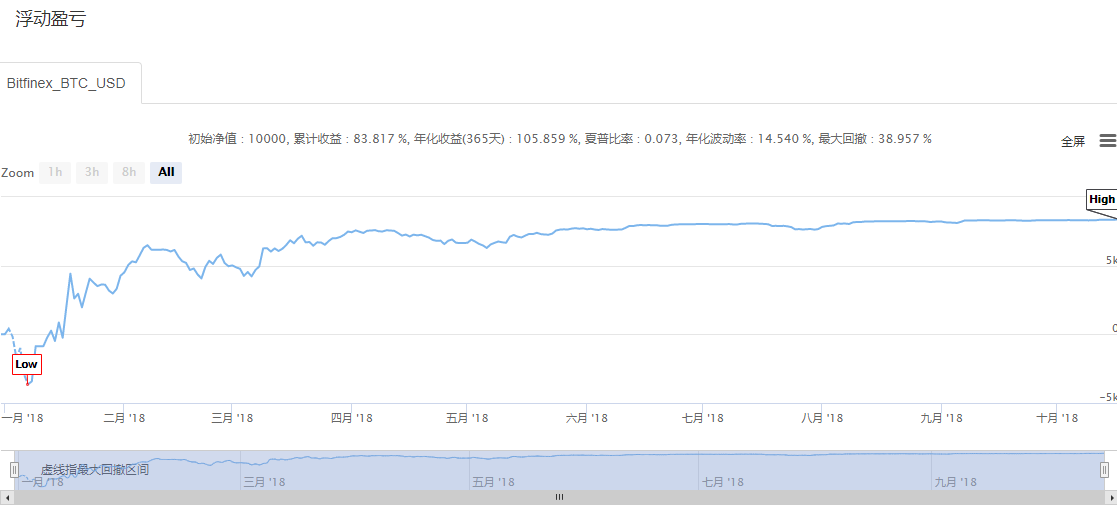

A complete dynamic balancing strategy for digital currency

Strategic logic

Conditions of purchase: If the market value of the current holding minus the current available balance is less than minus 5% of the current available balance, the position is bought.

Conditions of sale: If the current market value of the holding minus the current available balance is greater than 5% of the current available balance, the equity is sold.

Prerequisites

The current market

Current assets

The total market value of the currency

The wealth gap

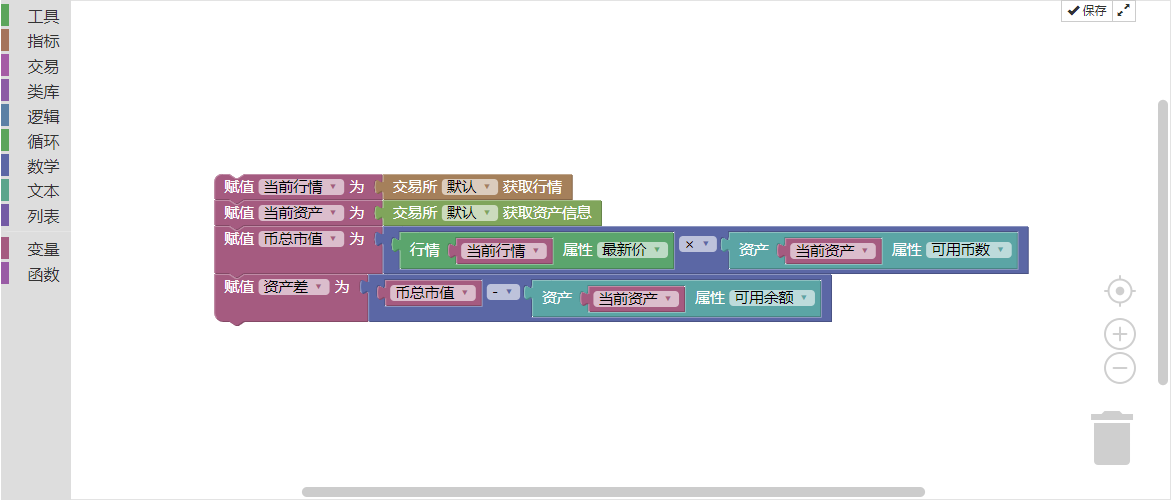

Step 1 of the visualization writing strategy

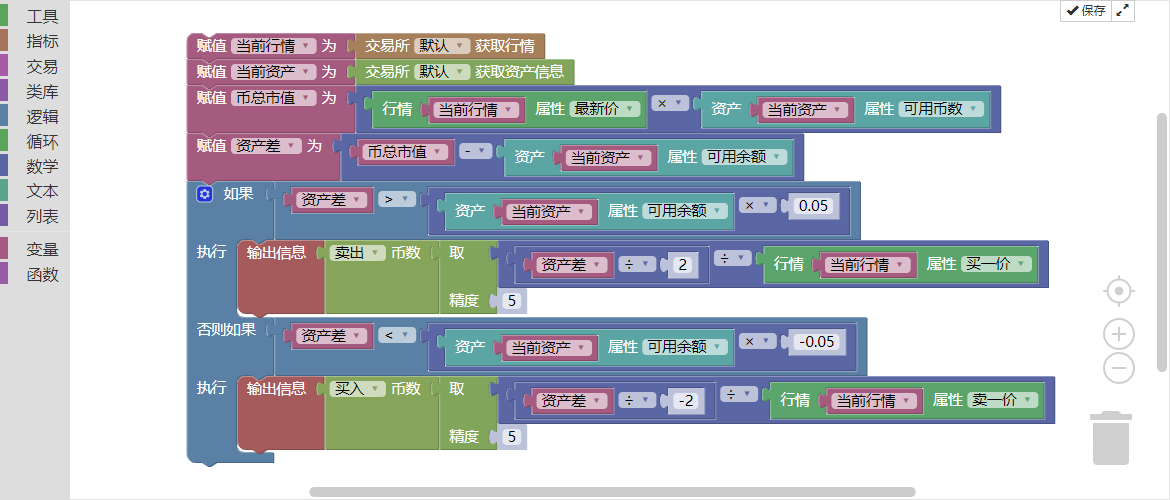

We calculate the four prerequisites of the trading strategy and assign values to the respective variables. To visualize the programming, the code block looks like this:

It is important to note that the total market value of the currency is the total market value of the current number of coins held, which is calculated by multiplying the current total number of coins held by the current latest price. The asset gap is the total market value of the currency minus the current available balance.

Step 2 of the visualization writing strategy

Once the prerequisite attribution is complete, the transaction logic is written. This is not as complicated as imagined. It is simply to express the above strategic logic in the form of blocks of code. That is, if the asset is less than 5% of the negative available balance, it is bought, and if the asset is greater than 5% of the available balance, it is sold.

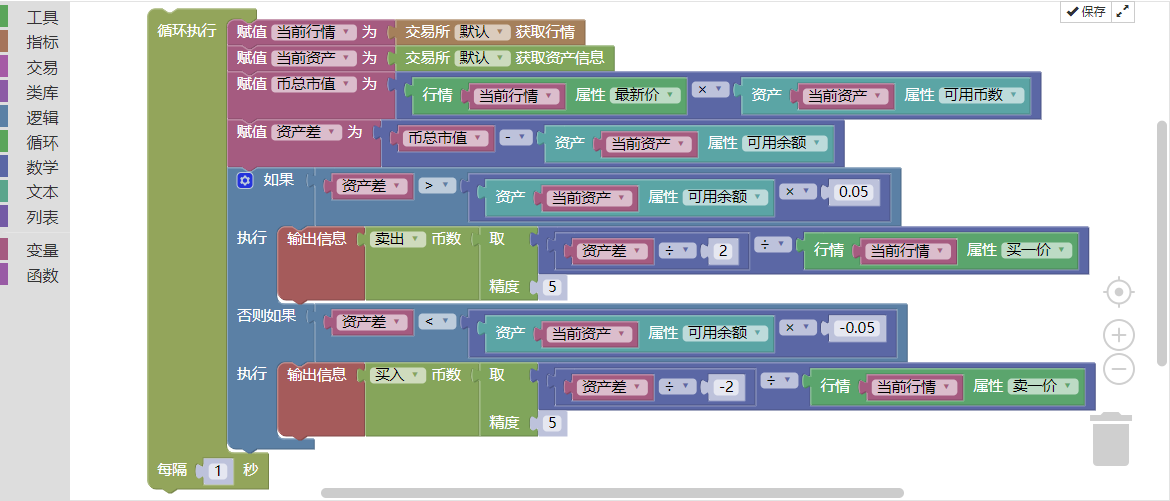

The whole strategy seems to have been written, but it should be noted that the program is executed from top to bottom and stops after execution. But our trading strategy is not to execute the transaction conditions once, but to execute them repeatedly in a loop. That is, the program needs to continuously check whether the policy conditions have been met, and if it is to execute a buy or sell, it must continue to check.

Visualization strategies are essentially the same as strategies written in other programming languages, and also support multiple cycles, accurate historical data testing, and of course support for both domestic and foreign commodity futures and digital currency trading.

To this end, a complete trading strategy has yet to be completed. In order to take care of the handlers, this strategy has been shared on Strategy Square and can be directly copied.

The following is a link to the policy:

https://www.fmz.com/strategy/121404

NO.6

The 10,000-hour law is always there, but it's impossible for a zero-based trader to take 10,000 hours to get back on track. So you have to have a ladder, and for a zero-based trader, the inventor's quantized visualization programming is a quick entry ladder.

With visualization programming, you don't need to remember syntax and method names, just simply browse the function module to find what you want. This is where the inventors of quantization came from, to help more beginners of quantification lower the entry threshold, increase the interest in quantification, and everyone can become a quantification trader!

However, visualising programming as a quantitative entry point is not a problem, but it has its limitations, such as not being able to develop too complex, too detailed trading strategies.

Finally, I wish all my friends who want to do quantitative trading, whether they are from scratch or not, to be able to achieve their learning goals through action. Thanks for reading!

- Quantitative Practice of DEX Exchanges (2) -- Hyperliquid User Guide

- DEX exchange quantitative practices ((2) -- Hyperliquid user guide

- Quantitative Practice of DEX Exchanges (1) -- dYdX v4 User Guide

- Introduction to Lead-Lag Arbitrage in Cryptocurrency (3)

- DEX exchange quantitative practice ((1) -- dYdX v4 user guide

- Introduction to the Lead-Lag suite in digital currency (3)

- Introduction to Lead-Lag Arbitrage in Cryptocurrency (2)

- Introduction to the Lead-Lag suite in the digital currency (2)

- Discussion on External Signal Reception of FMZ Platform: A Complete Solution for Receiving Signals with Built-in Http Service in Strategy

- Discussing FMZ platform external signal reception: a complete set of strategies for the reception of signals from built-in HTTP services

- Introduction to Lead-Lag Arbitrage in Cryptocurrency (1)

- 2.4 How to write a trading strategy on FMZ Quant platform

- 2.3 Common API explanations

- 2.2 How to configure the FMZ Quant trading system

- 2.1 Introduction to the quantitative trading tool

- 1.4 What are the elements of a complete strategy?

- 1.3 What are needed for quantitative trading?

- 1.2 Why choose quantitative trading

- 1.1 What is quantitative trading?

- FMZ Quant Quantitative Trading Quick Start

- The exchange's vulnerabilities are being analyzed

- Simplified version of Multi-platform Hedging Stabilization Arbitrage strategy (Study purpose only)

- Late sharing Bitcoin high-frequency robot that earned 5% daily in 2014

The Mad Sands 77( ̄_ ̄) That's great.

The bride too.Cows on rockets

The bride too.I don't understand the phrase, brother. It's called "bullshit".