2.1 Introduction to the quantitative trading tool

Author: Goodness, Created: 2019-06-25 12:00:49, Updated: 2025-01-16 21:38:20

Introduction to the quantitative trading tool

Summary

In the previous chapter, we learned about the concepts of quantitative trading, have a basic understanding of quantitative trading. So what tools are available on the market that can do quantitative trading? How can we choose according to our own needs?

Open source software and commercial software

Most quantitative trading tools can be broadly divided into two categories: open source software and commercial software. The so-called open source software can be understood as the source code of the software is open, you can directly download the source code; commercial software generally refers to closed source software maintained and operated by commercial companies, users usually need to pay to use it.

Open source quantitative software

First of all, open source software has great flexibility and is completely free. Users can basically use this software to implement any function. Whether it is a low-frequency trading strategy, an arbitrage strategy or an option strategy, it can be realized through a customized module. The user controls the source code of the software, and can understand every corner of the software, so it is more reliable and safe.

Although open source software has many advantages, it is not very user-friendly to beginners in quantitative trading. You need to systematically learn a standard programming language such as Python, Java or C++. From entry to give up, the difficulty can be imagined, sometimes the bug can be transferred to your doubts about life. And unlike commercial software, there is a dedicated technical customer service to answer questions instantly. At this time, not only does it have no sense of accomplishment, but it also dispels the motivation for your continued learning.

Therefore, from a learning perspective, it is recommended to start a quantitative trading beginner step by step, starting with the simplest commercial software, although it is paid, but if the strategy is profitable, the software cost is only a fraction of the profit, and further, the commercial software was maintained by a mature team, and its maturity is definitely much stronger than open source software.

Commercial quantitative trading software

There are dozens of commercial software that can do quantitative trading worldwide, such as: Interactive Broker with professional and comprehensive products, capable of handling massive concurrent data; APAMA for high-frequency trading, C++-supported interface; and MultiCharts for individual traders. Users can choose according to their actual situation.

Although the above is commercial software, it is also a standard programming language or scripting language. It is not as good as directly using free and secure open source software. beginners here are recommended using the FMZ Quant directly as a stepping stone to quantitative trading learning.

Knowing the FMZ Quant trading tools

The FMZ Quant trading tool is very user-friendly to beginners, and even if you are zero-based, you can experience the quantitative charm based on the tools inside. The tool is designed for high-frequency trading and has stringent requirements for performance and safety. Support high frequency strategy, arbitrage strategy, trend strategy. And it integrates the complete process of strategy development, testing, optimization, simulation, and real trading. In addition, it supports both simple and easy-to-use M languages, as well as advanced quantitative trading languages such as Python and C++ with the costs only 0.125 yuan / hour, reducing the cost of software in your learning and exploration phase, and can simulate simulation trading for free.

Take the first step in quantitative trading : using quantitative tools

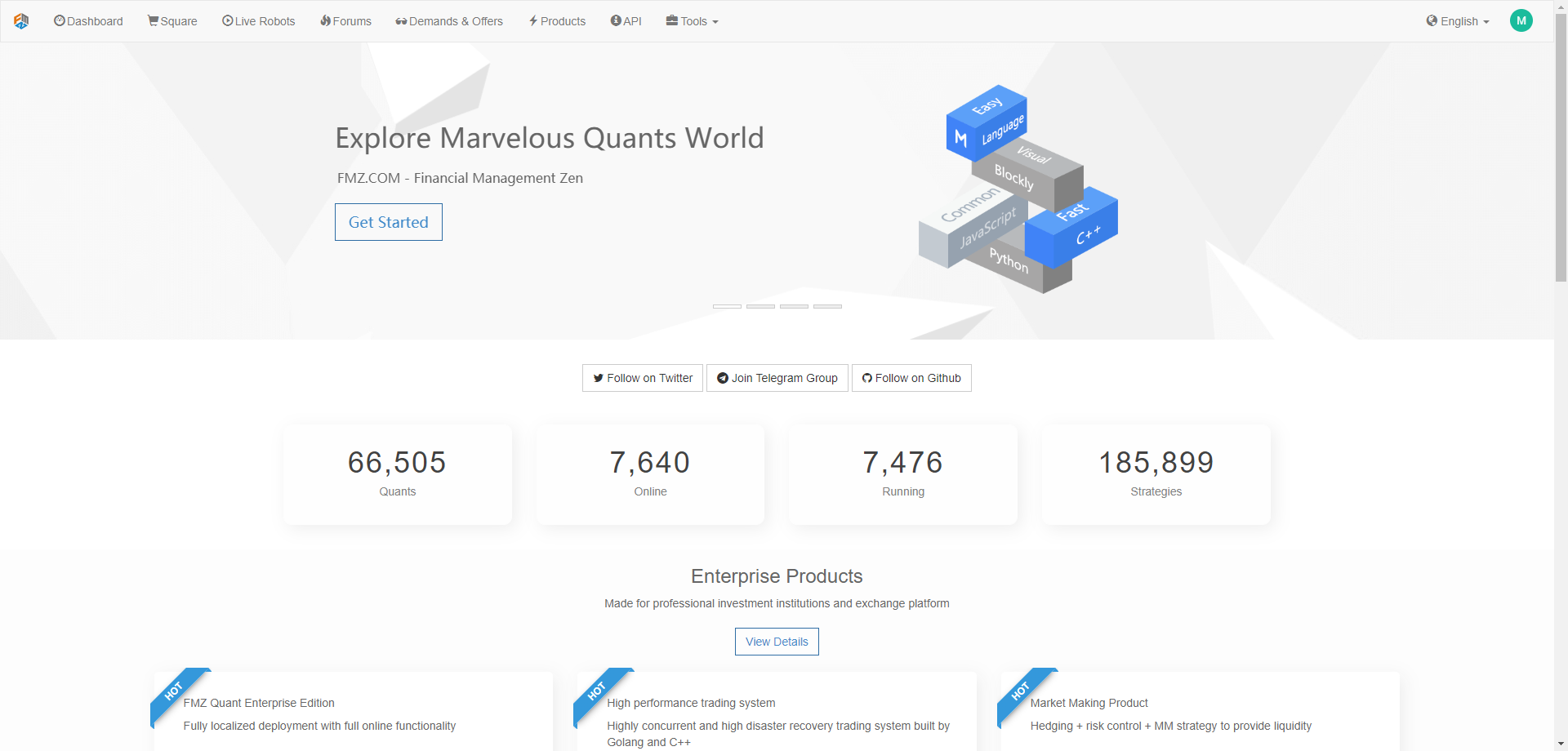

Quantitative tools are very simple to use and you only need to go to the website to design your own quantitative strategy. You can log in to the official website of the FMZ Quant platform, click on the “dashboard” to use it (as shown below).

The FMZ Quant platform programming will have a centralized function area. (as shown in the figure below). you can write the trading strategy and performing backtesting; Create the unique “docker” system and a specific trading robot. As for the specific usage of the function, we will introduce it in detail in the follow-up article. Currently we only do the preliminary.

1.Your main control page 2.Manage all your bots (start,stop,delete,open,etc) 3.Manage all your strategies’ code 4.Deploy and manage your docker 5.Add new exchanges 6.Manual trading on the exchanges you added 7.Pay your bill 8.Ask any question here 9.FMZ’s simulated exchange 10.Debug tool where you can run a block of code without start a bot. 11.All kinds of message 12.Strategy square where open-source and charging strategies are listed 13.Live Robots where all live-running bots are listed. 14.Forums where you can post a post to discuss any question related. 15.Ask for someone to write code for you or provide this service for others. 16.Products for exchanges and agencies. 17.API documentation. 18.Some usefull tools, check fo yourself. 19.Your account information.

people who first reaches quantitative trading don’t have to be discouraged if they don’t understand programming. In order to reduce the user’s usage threshold, the FMZ Quant community has produced a number of video tutorials to help beginners for a quick start. At the same time, thousands of official and third-party free and open trading strategies are aggregated in the Strategy square to facilitate copying and learning.

Before jump in the real market, the simulation trading is also an indispensable stage. The simulation tool is in line with the real exchange, and it is completely free, which is highly consistent. Greatly improve the efficiency of strategy verification.

To sum up

No matter whether it is open source software or commercial software, there is no good or bad at all, and there is no perfect quantitative trading tool. Each tool has its own focus, and the most important one is to choose the tool that suits you according to your own needs. Commercial software needs to pay, it is better in terms of services, etc. It may be more suitable for beginners who have just entered the Quants industry. If you have been in the industry for a long time, have accumulated a lot of experience, or need to implement more complex trading strategies, open source software is a better choice.

Next section notice

How to use the tool? when we bought a new phone, the first time we need to do a simple boot settings, the quantification tool also needs to do the basic configuration, in the next section we will take you to configure the FMZ Quant trading tools. Including: adding exchanges, adding dockers, creating trading strategies, creating robots, and more. After completing the basic configuration, we can formally write our first quantitative trading strategy.

After-school exercises

What are the two major categories of quantitative trading tools? What are the commonly used quantitative trading programming languages?

- Quantitative Practice of DEX Exchanges (2) -- Hyperliquid User Guide

- DEX exchange quantitative practices ((2) -- Hyperliquid user guide

- Quantitative Practice of DEX Exchanges (1) -- dYdX v4 User Guide

- Introduction to Lead-Lag Arbitrage in Cryptocurrency (3)

- DEX exchange quantitative practice ((1) -- dYdX v4 user guide

- Introduction to the Lead-Lag suite in digital currency (3)

- Introduction to Lead-Lag Arbitrage in Cryptocurrency (2)

- Introduction to the Lead-Lag suite in the digital currency (2)

- Discussion on External Signal Reception of FMZ Platform: A Complete Solution for Receiving Signals with Built-in Http Service in Strategy

- Discussing FMZ platform external signal reception: a complete set of strategies for the reception of signals from built-in HTTP services

- Introduction to Lead-Lag Arbitrage in Cryptocurrency (1)

- 4.2 How to implement strategic trading in JavaScript language

- 4.1 JavaScript language quick start

- 3.5 Visual Programming language implementation of trading strategies

- 3.4 Visual programming quick start

- 3.3 How to implement strategies in M language

- 3.2 Getting started with the M language

- 3.1 Quantitative trading programming language evaluation

- 2.4 How to write a trading strategy on FMZ Quant platform

- 2.3 Common API explanations

- 2.2 How to configure the FMZ Quant trading system

- 1.4 What are the elements of a complete strategy?

- 1.3 What are needed for quantitative trading?

- 1.2 Why choose quantitative trading

- 1.1 What is quantitative trading?

- FMZ Quant Quantitative Trading Quick Start

- The exchange's vulnerabilities are being analyzed

- Can we quantify a transaction without typing a code?

- Simplified version of Multi-platform Hedging Stabilization Arbitrage strategy (Study purpose only)

- Late sharing Bitcoin high-frequency robot that earned 5% daily in 2014