Interest Arbitrage of Binance Perpetual Funding Rate (Current Bull Market Annualized 100%)

Author: FMZ~Lydia, Created: 2022-11-09 10:09:10, Updated: 2024-12-05 22:06:54

Perpetual Contracts and Funding Rate

The earliest digital currency contracts were delivery contracts only. Later, BitMEX introduced the perpetual contract innovatively, which is very popular. At present, almost all the mainstream exchanges support the perpetual contract.

The later the delivery date of the delivery contract is, the greater the price fluctuation is, the greater the deviation between the contract price and the spot price will be. But on the delivery date, the settlement will be forced according to the spot price, so the price will always return. Unlike the regular delivery of the delivery contract, the perpetual contract can be held all the time. A mechanism is needed to ensure that the contract price is consistent with the spot price, which is the funding rate mechanism. If the price is bullish for a period of time, many people will go long, which will result in the perpetual price higher than the spot. At this time, the funding rate is generally positive, that is, the long position side will pay fees to the short position side according to the position. The larger the market deviation is, the higher the rate will be, making the price difference tend to fall. The going long trading perpetual contract is equivalent to borrowing money and leverage, and the capital has a cost of use, so most of the time it is a positive rate of one ten-thousandth. The funding rate is charged for every 8 hours, so the perpetual price is often very close to the spot price.

Analysis of Arbitrage Returns

The funding rate is positive for most of the time. If you go short the perpetual contract, go long the spot and hold it for a long time, theoretically, you can get a positive funding rate return in the long run regardless of the increase or decrease of the currency price. We will analyze the feasibility in details.

Digital currency provides a history of funding rates: https://www.binance.com/cn/futures/funding-history/1 , a few examples here:

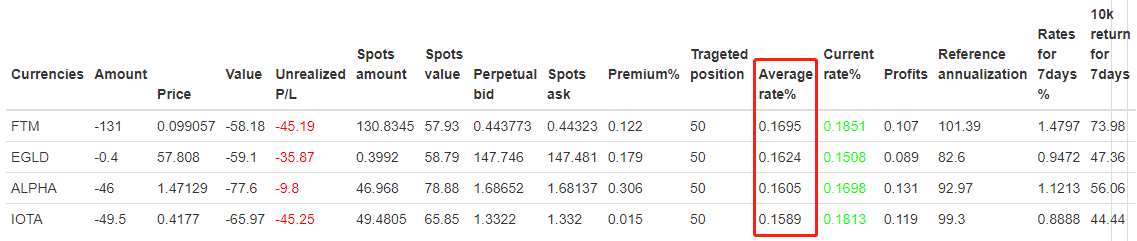

The average rates for the near-term (March 2021) currencies are:

It can be seen that the average rate of multiple currencies is more than 0.15% (due to the recent bull market, the rate is high, but it is difficult to continue). According to the latest return, the daily return will be 0.15% * 3=0.45%, without counting the annualized compound interest, it will be 164%. Considering the cash hedging, double leverage of futures, plus the loss of opening positions, premium, closing positions and other adverse factors, the annualization rate should be 100%. Rollback is almost negligible. In the non-bull market, the annual rate is about 20%.

Risk Analysis and Avoidance

Negative rates

The rate can be as low as -0.75%, and if it occurs once, the loss is equivalent to the return of 75 times of the one ten-thousandth rate. Although the currency of the average rate has been screened, it is inevitable that there are still unexpected market. The solution is not only to avoid new currencies and demon currencies, but most importantly to diversify your hedges. If you hedge more than 30 currencies at a time, the loss of one currency will account for a small portion only. In addition, you need to close your position in advance when you encounter this situation, but because of the fees and closing positions costs, you can’t close your position when you encounter negative rates, generally speaking, you can close your position to avoid loss when the rate is -0.2% or less. Generally, when the rate is negative, the perpetual price is lower than the spot price, and the negative premium makes it possible to make profits after deducting the handling fees.

Premium changes

Generally speaking, positive rates represent a premium for perpetuity on spot, if the premium is high, it may earn a certain premium and return, of course the strategy has been a long-term position, so it will not to lose this part of profit. Attention should be paid not to open a position against a high negative premium. Of course, in the long run, the issue of premium change can be ignored.

Risk of contract margin closeout

Because of decentralized hedging, this part of the risk is much smaller. Take the perpetual double leverage as an example, unless the overall price increase by 50%, there will be the possibility of margin closeout. And because of the spot hedging, there will be no loss at this time. As long as the position is closed for fund transfer, or the margin can be increased at any time. The higher the sustainable leverage, the higher the capital utilization rate, and the greater the risk of contract margin closeout will be.

Long term bear market

Bull market rates are mostly positive, and the average rate in many currencies can exceed two ten-thousandth, occasionally, there is a very high rate. If the market turns into a long-term bear market, the average rate will decrease, and the probability of large negative rates will increase, which will reduce returns.

Specific Ideas for the Strategy

- The currency can be filtered automatically or specified manually. You can refer to the historical funding rate. Tradings can only be executed when the threshold value is exceeded.

- Obtain the current rate, if it exceeds the threshold setted, we can start to place an order of both futures and spots for hedging to fix a certain value.

- If the price of a single currency increases too much, the strategy can close the position automatically to avoid excessive perpetual risk.

- If the rate of a currency is too low, it is necessary to close the position to avoid the charged rate.

- The strategy does not require the speed of opening positions. The opening and closing positions are entrusted by iceberg orders to reduce the impact.

Summary

The overall risk of the rate arbitrage strategy is low, the capital capacity is large, so it’s relatively stable, and the profit is not much. Therefore, it’s suitable for low-risk arbitrageurs. If there is idle funds in the exchange, you can consider running this strategy.

- Quantitative Practice of DEX Exchanges (2) -- Hyperliquid User Guide

- DEX exchange quantitative practices ((2) -- Hyperliquid user guide

- Quantitative Practice of DEX Exchanges (1) -- dYdX v4 User Guide

- Introduction to Lead-Lag Arbitrage in Cryptocurrency (3)

- DEX exchange quantitative practice ((1) -- dYdX v4 user guide

- Introduction to the Lead-Lag suite in digital currency (3)

- Introduction to Lead-Lag Arbitrage in Cryptocurrency (2)

- Introduction to the Lead-Lag suite in the digital currency (2)

- Discussion on External Signal Reception of FMZ Platform: A Complete Solution for Receiving Signals with Built-in Http Service in Strategy

- Discussing FMZ platform external signal reception: a complete set of strategies for the reception of signals from built-in HTTP services

- Introduction to Lead-Lag Arbitrage in Cryptocurrency (1)

- Modeling and Analysis of Bitcoin Volatility Based on ARMA-EGARCH Model

- [Binance Championship] Binance Delivery Contract Strategy 3 - Butterfly Hedging

- The Use of Servers in Quantitative Trading

- Solution to Get the http Request Message Sent by the Docker

- A brief explanation of why it is not feasible to achieve asset movement on OKEX through a contract hedging strategy

- Detailed Explanation of Futures Backhand Doubling Algorithm Strategy Notes

- Earn 80 Times in 5 Days, the Power of High-frequency Strategy

- Research and Example on the Maker Spots and Futures Hedging Strategy Design

- Building a Quantitative Database of FMZ with SQLite

- How to Assign Different Version Data to a Rented Strategy via Strategy Rental Code Metadata

- Digital Currency Futures Double-EMA Turning Point Strategy (Tutorial)

- Subscribe New Shares Strategy for Digital Currency Spot (Tutorial)

- Realize an idea with 60 Lines of Code -- Contract Bottom Fishing Strategy

- Digital Currency Spot Multi-variety Double-EMA Strategy (Tutorial)

- Design of Order Synchronization Management System Based on FMZ Quant (2)

- Digital currency futures multi-species ATR strategy (tutorial)

- Write a semi-automatic trading tool by using the Pine language

- Explore High-frequency Strategy Design from the Magic Change of LeeksReaper

- LeeksReaper Strategy Analysis (2)

- The "Magic Double EMA Strategy" from the YouTube Veterans