Teach you to transform a Python single-species strategy into a multi-species strategy

Author: FMZ~Lydia, Created: 2022-12-20 17:26:27, Updated: 2025-01-11 18:20:56

Teach you to transform a Python single-currency strategy into a multi-currency strategy

I. Teach you to transform a Python single-currency strategy into a multi-currency strategy

In the last article, a very simple Python strategy was implemented: “Strategy for buying the winners of Python version”, this strategy can operate an account to conduct program trading on a certain trading pair. The principle is very simple, that is, chasing after increasing and killing after decreasing. Sometimes we want to use the same trading logic to operate different trading pairs. You can create multiple robots and set different trading pairs to conduct transactions in various currencies. If the strategy is not very complex, in view of the strong flexibility of the FMZ Quant Trading Platform, it is easy to transform a strategy into a multi-species strategy, so that you can run multiple trading pairs by creating only one robot.

Strategy source code after transformation:

'''backtest

start: 2019-02-20 00:00:00

end: 2020-01-10 00:00:00

period: 1m

exchanges: [{"eid":"OKEX","currency":"BTC_USDT"},{"eid":"OKEX","currency":"ETH_USDT","stocks":30},{"eid":"OKEX","currency":"LTC_USDT","stocks":100}]

'''

import time

import json

params = {

"arrBasePrice": [-1, -1, -1], # -1

"arrRatio": [0.05, 0.05, 0.05], # 0.05

"arrAcc": [], # _C(exchange.GetAccount)

"arrLastCancelAll": [0, 0, 0], # 0

"arrMinStocks": [0.01, 0.01, 0.01], # 0.01

"arrPricePrecision": [2, 2, 2], # 2

"arrAmountPrecision": [3, 2, 2], # 2

"arrTick":[]

}

def CancelAll(e):

while True :

orders = _C(e.GetOrders)

for i in range(len(orders)) :

e.CancelOrder(orders[i]["Id"], orders[i])

if len(orders) == 0 :

break

Sleep(1000)

def process(e, index):

global params

ticker = _C(e.GetTicker)

params["arrTick"][index] = ticker

if params["arrBasePrice"][index] == -1 :

params["arrBasePrice"][index] = ticker.Last

if ticker.Last - params["arrBasePrice"][index] > 0 and (ticker.Last - params["arrBasePrice"][index]) / params["arrBasePrice"][index] > params["arrRatio"][index]:

params["arrAcc"][index] = _C(e.GetAccount)

if params["arrAcc"][index].Balance * params["arrRatio"][index] / ticker.Last > params["arrMinStocks"][index]:

e.Buy(ticker.Last, params["arrAcc"][index].Balance * params["arrRatio"][index] / ticker.Last)

params["arrBasePrice"][index] = ticker.Last

if ticker.Last - params["arrBasePrice"][index] < 0 and (params["arrBasePrice"][index] - ticker.Last) / params["arrBasePrice"][index] > params["arrRatio"][index]:

params["arrAcc"][index] = _C(e.GetAccount)

if params["arrAcc"][index].Stocks * params["arrRatio"][index] > params["arrMinStocks"][index]:

e.Sell(ticker.Last, params["arrAcc"][index].Stocks * params["arrRatio"][index])

params["arrBasePrice"][index] = ticker.Last

ts = time.time()

if ts - params["arrLastCancelAll"][index] > 60 * 5 :

CancelAll(e)

params["arrLastCancelAll"][index] = ts

def main():

global params

for i in range(len(exchanges)) :

params["arrAcc"].append(_C(exchanges[i].GetAccount))

params["arrTick"].append(_C(exchanges[i].GetTicker))

exchanges[i].SetPrecision(params["arrPricePrecision"][i], params["arrAmountPrecision"][i])

for key in params :

if len(params[key]) < len(exchanges):

raise "params error!"

while True:

tblAcc = {

"type" : "table",

"title": "account",

"cols": ["Account information"],

"rows": []

}

tblTick = {

"type" : "table",

"title": "ticker",

"cols": ["Market information"],

"rows": []

}

for i in range(len(exchanges)):

process(exchanges[i], i)

for i in range(len(exchanges)):

tblAcc["rows"].append([json.dumps(params["arrAcc"][i])])

tblTick["rows"].append([json.dumps(params["arrTick"][i])])

LogStatus(_D(), "\n`" + json.dumps([tblAcc, tblTick]) + "`")

Sleep(500)

II. Find a difference

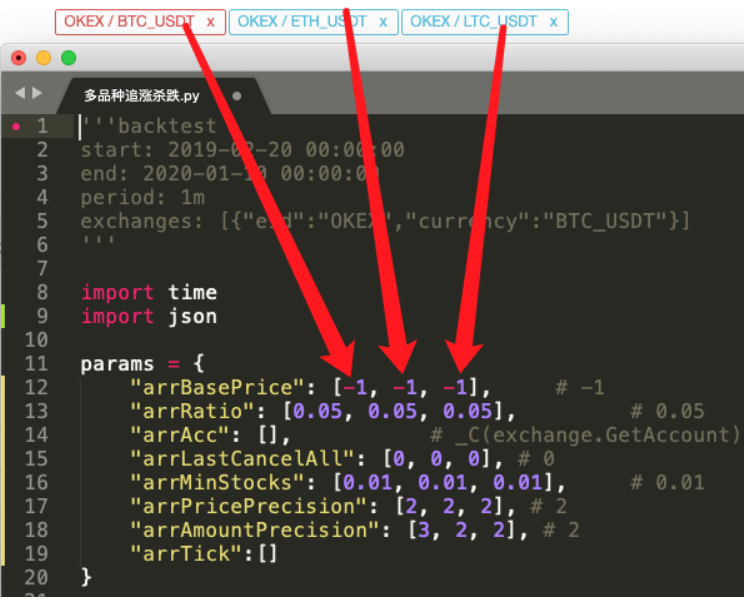

By comparing the code, do you find that it is very different from the code in the previous article? In fact, the trading logic is exactly the same, without any change. We only modify the strategy to multiple-species one, we cannot use the previous form of “single variable as strategy parameter”. A more reasonable solution is to make the parameter into an array, and the index of each position in the array corresponds to the added trading pair.

Then encapsulate the code of trading logic into a function process. On the main strategy loop, call this function iteratively according to the added trading pairs, and let each trading pair execute the trading logic code once.

- Iterative (traversal) call:

for i in range(len(exchanges)):

process(exchanges[i], i)

- Strategy parameters:

params = {

"arrBasePrice": [-1, -1, -1], # -1

"arrRatio": [0.05, 0.05, 0.05], # 0.05

"arrAcc": [], # _C(exchange.GetAccount)

"arrLastCancelAll": [0, 0, 0], # 0

"arrMinStocks": [0.01, 0.01, 0.01], # 0.01

"arrPricePrecision": [2, 2, 2], # 2

"arrAmountPrecision": [3, 2, 2], # 2

"arrTick":[]

}

This design allows each trading pair to have its own parameters, because each trading pair may have a large price difference, and the parameters may also be different, sometimes requiring differential settings.

CancelAll function You can compare the change of this function. This function only modifies a little code, and then think about the intention of such modification.

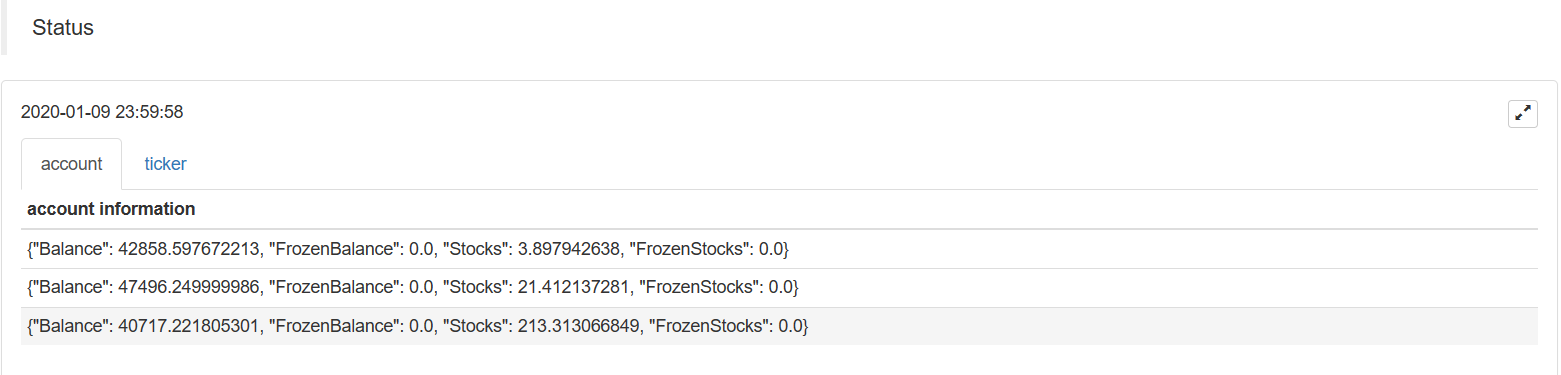

Status bar chart data A chart is added to display the market data and account asset data in the status bar, so that the corresponding assets and market of each exchange object can be displayed in real time. Is it easy to change a Python strategy into a multi-species strategy after mastering the above design ideas?

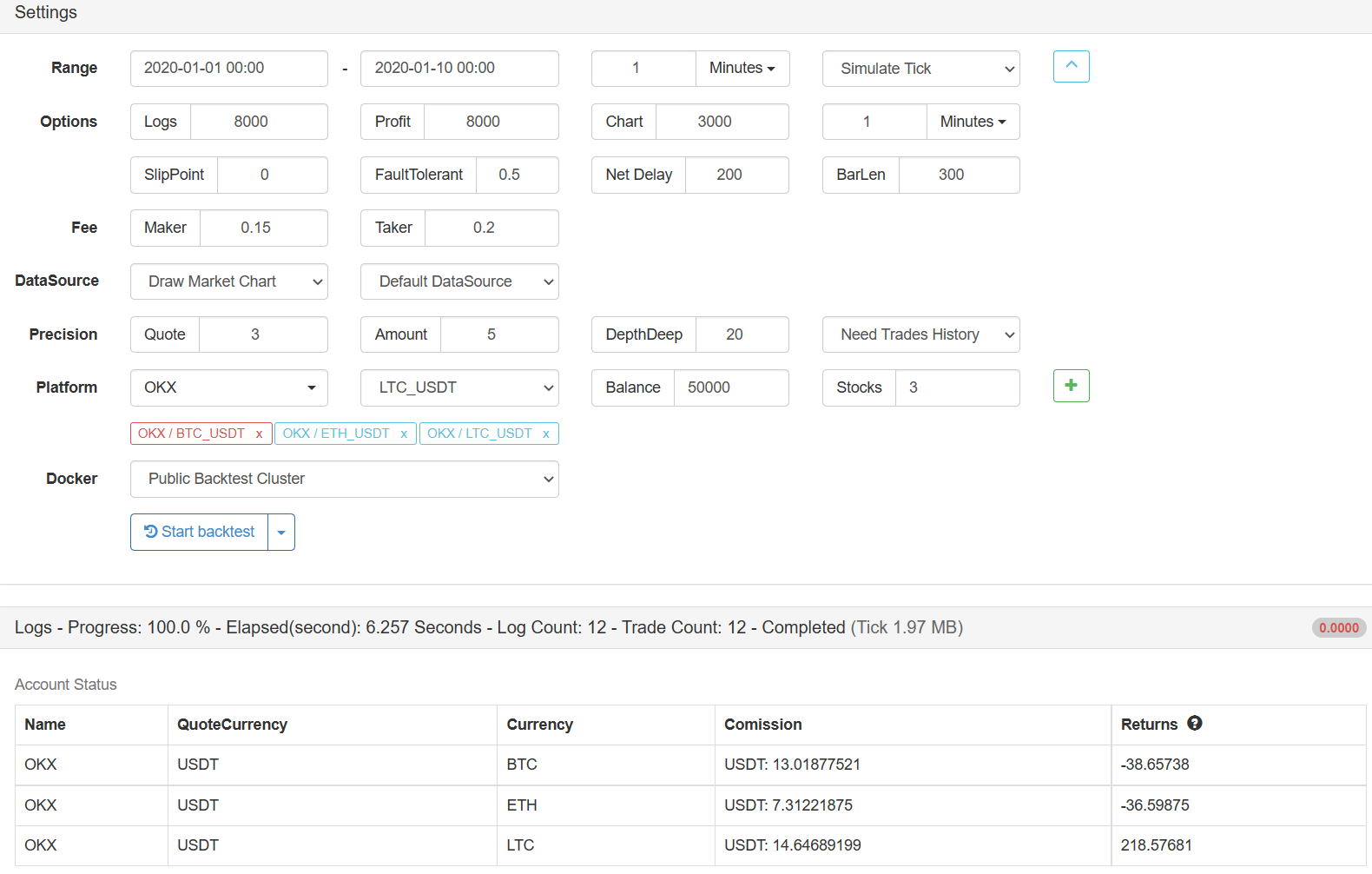

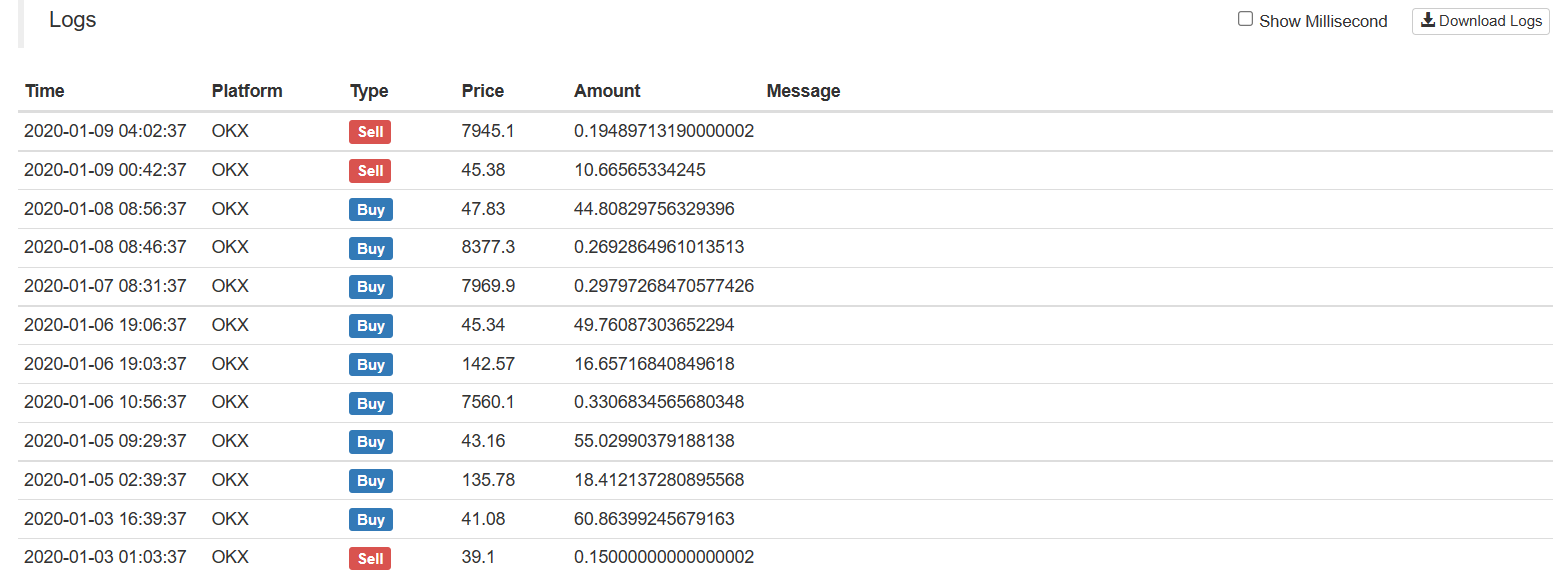

III. Backtest

The strategy is for learning and backtesting purposes only, and you can optimizenand upgrade it if you are interested. Strategy address

- Quantitative Practice of DEX Exchanges (2) -- Hyperliquid User Guide

- DEX exchange quantitative practices ((2) -- Hyperliquid user guide

- Quantitative Practice of DEX Exchanges (1) -- dYdX v4 User Guide

- Introduction to Lead-Lag Arbitrage in Cryptocurrency (3)

- DEX exchange quantitative practice ((1) -- dYdX v4 user guide

- Introduction to the Lead-Lag suite in digital currency (3)

- Introduction to Lead-Lag Arbitrage in Cryptocurrency (2)

- Introduction to the Lead-Lag suite in the digital currency (2)

- Discussion on External Signal Reception of FMZ Platform: A Complete Solution for Receiving Signals with Built-in Http Service in Strategy

- Discussing FMZ platform external signal reception: a complete set of strategies for the reception of signals from built-in HTTP services

- Introduction to Lead-Lag Arbitrage in Cryptocurrency (1)

- Teach you to write strategies -- transplant a MyLanguage strategy

- Teach you to add multi-chart support to the strategy

- Teach you to write a K-line synthesis function in the Python version

- Analysis of Donchian Channel Strategy in the Research Environment

- When FMZ encounters ChatGPT, remember an attempt to use AI to assist in learning quantitative transactions

- Off the shelf quantitative trading tool for digital currency options

- Simple grid strategy in Python version

- Linear pending order flow strategy developed based on data playback function

- Strategy for buying the winners of Python version

- FMZ Journey -- with Transition Strategy

- Implement a quantitative trading robot timed start or stop gadget by using Python

- Oak teaches you to use JS to interface with FMZ extended API

- Call Dingding interface to realize robot push message

- Balanced Pending Order Strategy (Teaching Strategy)

- Thoughts on asset movement through contract hedging strategy

- Many years later, you will find this article is the most valuable one in your investment career - find out where the returns and risks come from

- Recent FMZ official charging strategy introduction

- Preliminary Exploration of Python Crawler Application on FMZ Platform -- Crawling the Content of Binance Announcement

- Implementation of Dual Thrust trading algorithm by using Mylanguage on FMZ Quant platform

- Introduction FAQ to Quantitative Trading of Digital Currency