The triangular system is called the Exodus system.

Author: [Translated from Chinese], Date: 2021-07-26 14:09:40Tags:

The system is a bidirectional contract strategy, where the conditions are to do more or do nothing, the lower unit is the number of contracts, the lower unit is several BTC when using the yuan, the lower unit is the yuan when using the tokens. This is the latest update. This policy is set to run at the hour level, but the hour level has too few openings, so the minute level is updated. However, the minute level needs to be modified manually.

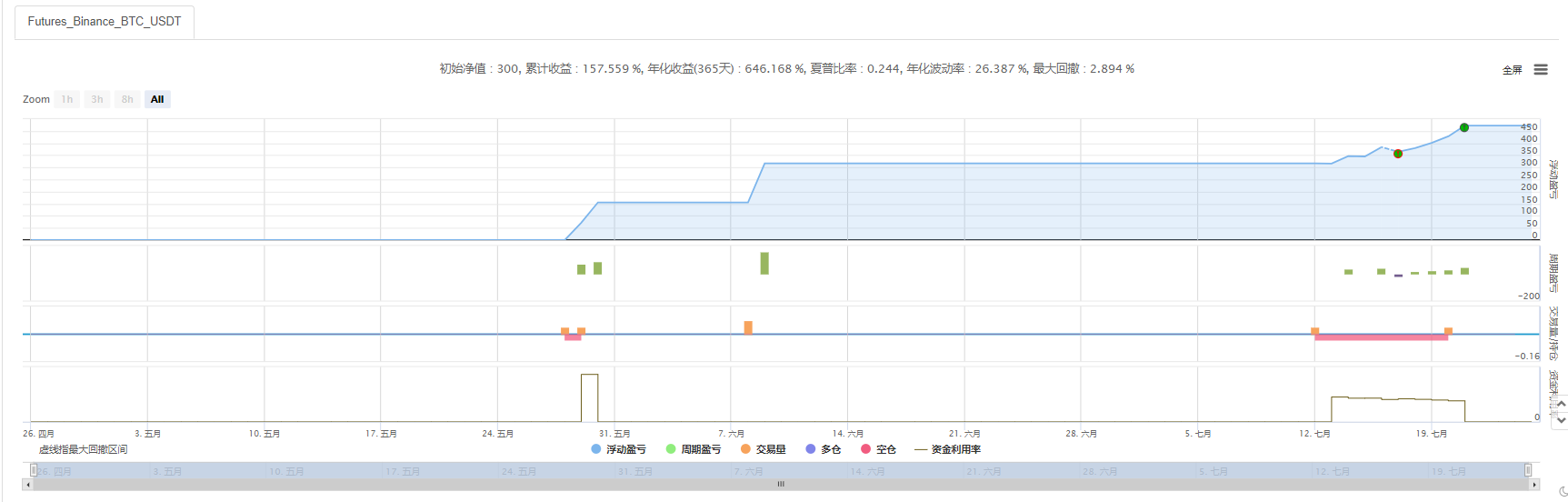

The following retest results are hourly.

**** 4-27 to 7-25**

Capital 300, down to 0.04 BTC **** 1-1 to 7-25 ****

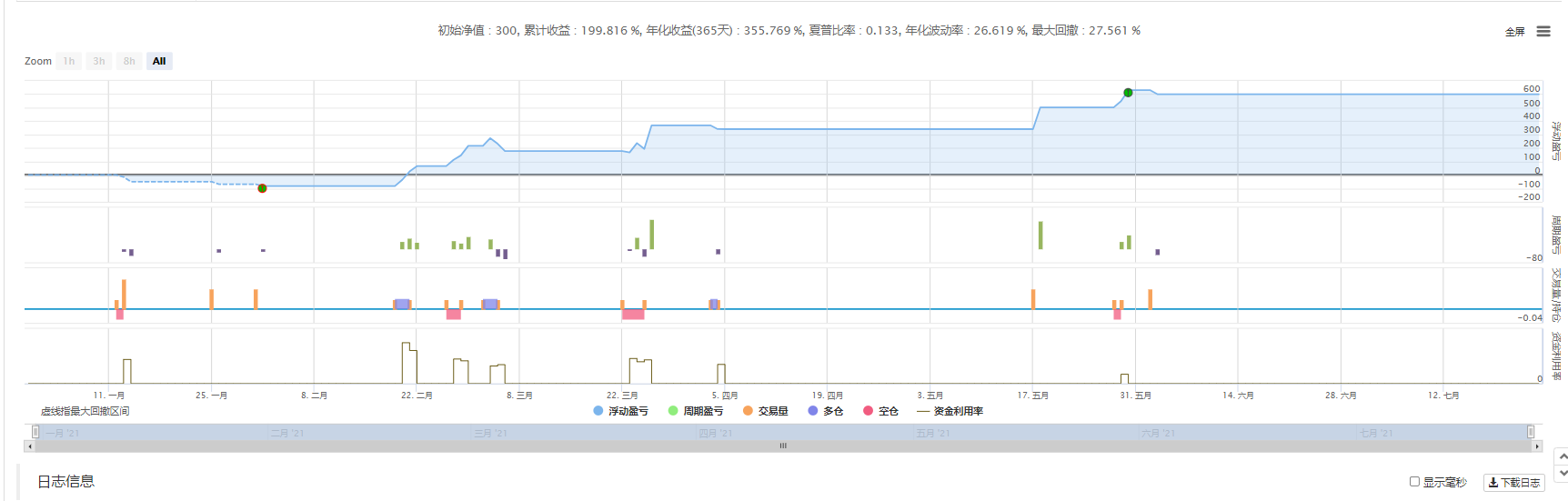

Capital 300, down 0.03btc, down 0.04 is insufficient

If you want to use your own hard drive, please retest and decide your next order.

**** 1-1 to 7-25 ****

Capital 300, down 0.03btc, down 0.04 is insufficient

If you want to use your own hard drive, please retest and decide your next order.

If you have money, support the author.

/*backtest

start: 2021-04-27 00:00:00

end: 2021-07-25 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT","balance":300}]

args: [["afterEmaCrossTime",4],["buyVolume",0.04],["winLossRate",5]]

*/

function GetCrossStatus(a, lastA, b, lastB) {

let lastStatus = lastA < lastB;

let curStatus = a < b;

let crosssStaus = 0; //0表示没有交叉,1表示金叉,2表示死叉

//判断金叉还是死叉,同时判断此刻大于0轴或者小于0轴,因为在此系统中要求金叉时macd>0才有意义,死叉时macd<0才有意义

if (curStatus != lastStatus) //状态不同时表示金叉或者死叉了

{

if (a > b) {

crosssStaus = 1; //金叉

}

if (a < b)

crosssStaus = 2; //死叉

}

return crosssStaus;

}

var lastOpenTime;

function GetCurRecord(records) {

return records[records.length - 1];

}

function GetCurTime(records) {

return GetCurRecord(records).Time;

}

function GetCurPrice(records) {

return GetCurRecord(records).Close;

}

function Open(direction) {

let pos = exchange.GetPosition()[0];

if (pos != null) {

return;

}

let amount = buyVolume;

if (direction == 1) { //做多

Log("做多", amount);

exchange.SetDirection("buy");

exchange.Buy(-1, amount);

}

if (direction == 2) { //做空

Log("做空", amount);

exchange.SetDirection("sell");

exchange.Sell(-1, amount);

}

}

function Close(ticker,fastLine,midLine) {

let pos = exchange.GetPosition()[0];

if (pos == null) {

return;

}

if (pos.Type == PD_LONG) {

if (ticker.Last < pos.Price*(1- stopLossRate/100) || ticker.Last > pos.Price*(1+(stopLossRate*winLossRate)/100)) {

Log("平多,开仓价为:",pos.Price,"本次盈利:",pos.Profit);

exchange.SetDirection("closebuy");

exchange.Sell(-1, pos.Amount);

}

}

if (pos.Type == PD_SHORT) {

if (ticker.Last > pos.Price*(1+ stopLossRate/100) || ticker.Last < pos.Price*(1-(stopLossRate*winLossRate)/100) ) {

Log("平空,开仓价为:",pos.Price,"本次盈利:",pos.Profit);

exchange.SetDirection("closesell");

exchange.Buy(-1, pos.Amount);

}

}

}

var lastEmaCrossTime = 0;

var lastMacdCrossTime = 0;

function NearMacdCross(time) {

//Log("MACD",time,lastMacdCrossTime,time - lastMacdCrossTime);

return time - lastMacdCrossTime <= afterEmaCrossTime * 1000 * 3600;

}

function NearEmaCross(time) {

//Log("EMA",time,lastMacdCrossTime,time - lastMacdCrossTime);

return time - lastEmaCrossTime <= afterEmaCrossTime * 1000 * 3600;

}

var emaMeet = 0; //0表示不满足,1满足做多条件,2满足做空条件

var macdMeet = 0; //判断macd是否满足条件,0表示不满足,1表示做多条件满足,2表示做空条件满足

function main() {

exchange.SetContractType("swap");

while (1) {

let r = exchange.GetRecords(PERIOD_M1*period);

//************均线EMA****************

let emaChart8 = TA.EMA(r, EMA1);

let emaChart34 = TA.EMA(r, EMA2);

let emaChart89 = TA.EMA(r, EMA3);

let ema8 = emaChart8;

let curEma8 = ema8[emaChart8.length - 1];

let lastEma8 = ema8[emaChart8.length - 2];

let ema34 = emaChart34;

let curEma34 = ema34[emaChart34.length - 1];

let lastEma34 = ema34[emaChart34.length - 2];

let ema89 = emaChart89;

let curEma89 = ema89[emaChart89.length - 1];

let lastEma89 = ema89[emaChart89.length - 2];

//判断8均线和34均线的死叉和金叉,当金叉时如果当前实体在ema89均线以上做多,当死叉时如果实体在ema89以下时做空

let ticker = exchange.GetTicker();

let low = ticker.Low;

let high = ticker.High;

let close = ticker.Close;

Close(ticker,curEma8,curEma34);

let crossStatus1 = GetCrossStatus(curEma8, lastEma8, curEma34, lastEma34);

if (crossStatus1 != emaMeet) { //状态变化时更新状态

if (crossStatus1 == 1) {

emaMeet = 1;

Log("ema金叉,时间:", GetCurTime(r),talib.LINEARREG_SLOPE(ema8));

lastEmaCrossTime = r[r.length - 1].Time;

}

if (crossStatus1 == 2) {

emaMeet = 2;

//Log("ema死叉,时间:", GetCurTime(r));

lastEmaCrossTime = r[r.length - 1].Time;

//Log("Ema 2");

}

}

//***************Macd*************

let macdChart = TA.MACD(r, MACD1, MACD2, MACD3);

let macd = macdChart[2]; //动能柱

let curMacd = macd[r.length - 1]; //当前动能柱

let lastMacd = macd[r.length - 2]; //上一根动能柱,直接根据动能柱的正反来判断macd的金叉和死叉

//auto lastMacd = macd[r.size() - 2]; //上一根动能柱

//判断金叉还是死叉

let dif = macdChart[0];

let curDif = dif[r.length - 1];

let lastDif = dif[r.length - 2];

//判断金叉还是死叉,同时判断此刻大于0轴或者小于0轴,因为在此系统中要求金叉时macd>0才有意义,死叉时macd<0才有意义

//Macd形成金叉或者死叉的瞬间

if (curMacd < 0 != lastMacd < 0) {

if (curMacd > 0) {

macdMeet = 1;

//Log("macd金叉", lastMacd, curMacd);

lastMacdCrossTime = GetCurTime(r);

}

if (curMacd < 0) {

macdMeet = 2;

//Log("macd死叉", lastMacd, curMacd);

lastMacdCrossTime = GetCurTime(r);

}

}

let Account = exchange.GetAccount();

let curBalance = exchange.GetAccount().Balance; //余额

let curStock = exchange.GetAccount().Stocks; //币量

//均线系统

var curTime = GetCurTime(r);

if (NearEmaCross(curTime) && NearMacdCross(curTime)) {

if (emaMeet == 1 && macdMeet == 1 && curDif >= 0) {

Open(1);

}

if (emaMeet == 2 && macdMeet == 2 && curDif < 0) {

Open(2);

}

}

var myDate = new Date();

var myDataM = myDate.getMinutes();

var myDateS = myDate.getSeconds() * 1000;

var myDateMs = myDate.getMilliseconds(); //获取到毫秒以减少误差

Sleep(Math.abs(period - myDataM % period) * 60000 - myDateS - myDateMs);

}

}

- Binance gets a one-time list of all contract holdings and formats them as inventors.

- Multi-variety futures hedging (manual version)

- Tests - on the long-term effects of Martin

- OKEX V5 WS interface account holding push example

- Keltner channel breakthrough stop loss plus profit 10% i.e. long hold strategy - v2.3-dev - multi-cycle

- Testing - about the currency that might be spiked using kdj and volume filtering

- One-sided grid of the grid deformation strategy (note)

- Crawling for new permanent upper and lower coins

- Push notifications for my language position change

- Hedging strategies for different currencies Ver1.1

- TradingView is downloadable for bots 1.1.

- WR breaks through to Martin

- ahr999 fixed betting strategy

- Inventor APP chart testing policy

- Hedging strategies for different currencies (Teaching)

- Dry goods - down-supply precision and price precision - applicable to all exchanges

- Martin's strategy for digital currency futures

- The original version by Martin Variation

- Two-way contract mesh trading v1.0.2

- grid

MAIKEOI'm so happy for you.

This world is my only one.At least you have to retest for a year, this year's bull market recommends not retesting, bear market retesting, after all bull market is easy to make money.

Oo100011Can you change the k-line cycle? It's like a clock.

wajingongHow can I contact you?

This world is my only one.It's all trends, just different in size and direction.

[Translated from Chinese]Who uses trendy strategies in bear markets?

[Translated from Chinese]Updated to add the ability to change k-line cycles

[Translated from Chinese]This strategy is best run on a one-hour cycle, and changing most of the yields will reduce the amount of time it takes to get the best results.

[Translated from Chinese]WeChat 17863938515 This is a free app.