In addition to the above, there are also a number of other factors that can affect the price of a contract.

Author: LiteFly, Date: 2022-02-28 15:38:41Tags:

Strategy briefing

Dark hedging is a bidirectional trend strategy with tracking, low-risk gains, double-sided hedging in shocks (with the possibility of wear and tear), trend-following trades (unique replenishment positions, market-first strategic profit ideas), and a big fall bull will earn more. The address of the site:https://www.fmz.com/robot/438328

Explosive shelter instructions

The probability of a boom is small. Because it is a trend line, there may only be a surge in the shake zone (the larger the surge in the shake zone, the more it is necessary to break out of the zone to stop the boom), the larger the market (whether it is a boom or a crash) the more it is.

Parameters

The number of first positions after leverage (U): default 16,16; the number of positions in the order corresponding to the currency, refers to the 1st coin 16u, the 2nd coin and all subsequent coins are also 16u. If the parameter is changed to: 16,18,20-> refers to the 1st coin 16u, the 2nd coin 18u, the 3rd coin and all subsequent coins 20u. 2. reverse replenishment multiplier: default 1.8; refers to the number of replenishments when there is a market reversal, such as the current downward pull of a stronger multi-headed pull higher than the price of the last multiple single open position, the number of empty orders is 1, then the multiple single replenishment 1.8; between 1.5 and 2.5 suggested, the greater the more radical. 3. Expected liquidation ((%): Default 2, current ((total theoretical gains + total floating losses) when the liquidation reaches 2% of the total capital of the last time, all coins reopened the bottom of the liquidation. Every time you click on the All-clear all-clear all-storage stop button, the new expected liquidation value will be recalculated. 4. 100U is automatically transferred when the available assets are greater than *U. Default 0 is not transferred, even if the setting is greater than the current total amount of funds, 100u is automatically transferred to the cash account when the available funds are greater than this value.

Other parameters are omitted, and non-exceptional circumstances do not need to be changed.Generally run the default parametersIt is suggested that one coin is run for every 80-100 U, and the amount of funds can be changed to the maximum collateral parameter.

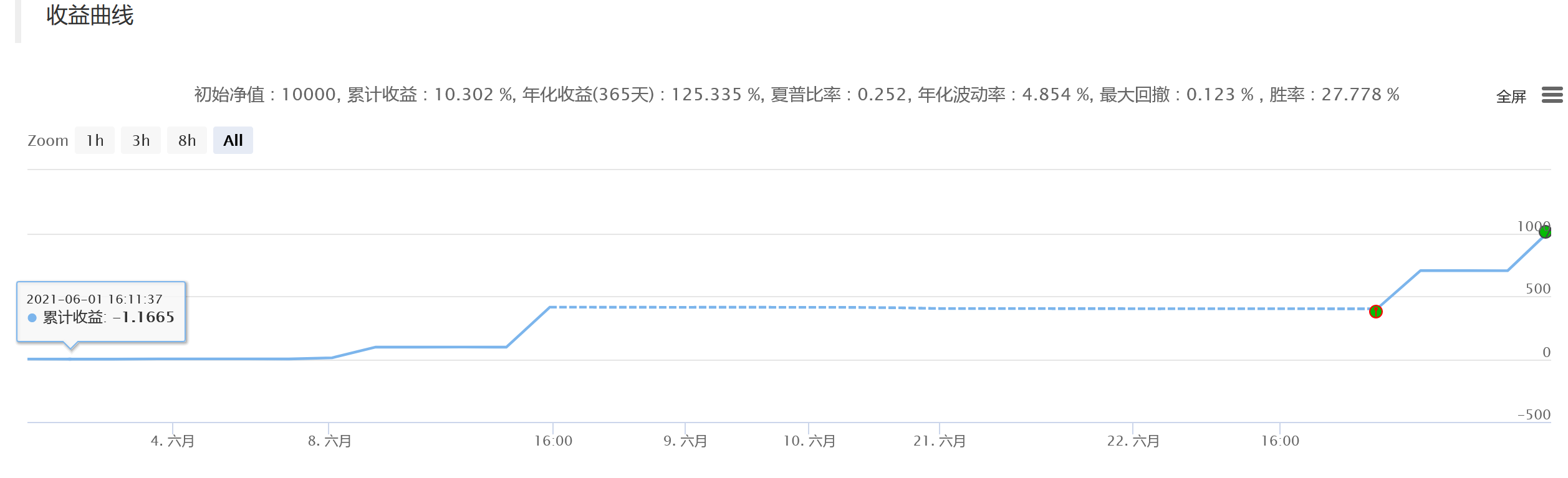

Strategic retesting

The bottom K line of the retest is to try to use 1 minute as much as possible, otherwise the gain-output is very large, 5 minutes may be a loss, 1 minute is a profit, of course 1 minute is not the most accurate, only to provide a reference.

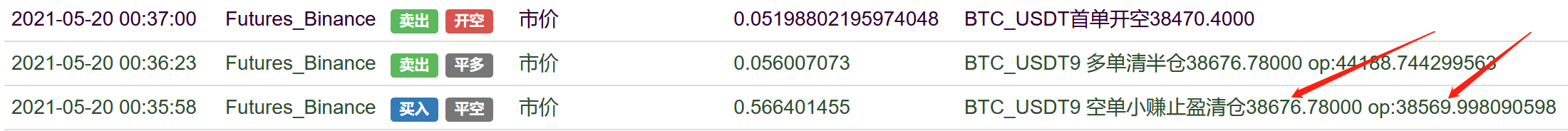

In addition, several reviews have shown that Min Min can sell profitably, but in the end it turned out to be a loss (the average list price is 38569.9, at 38676.7):

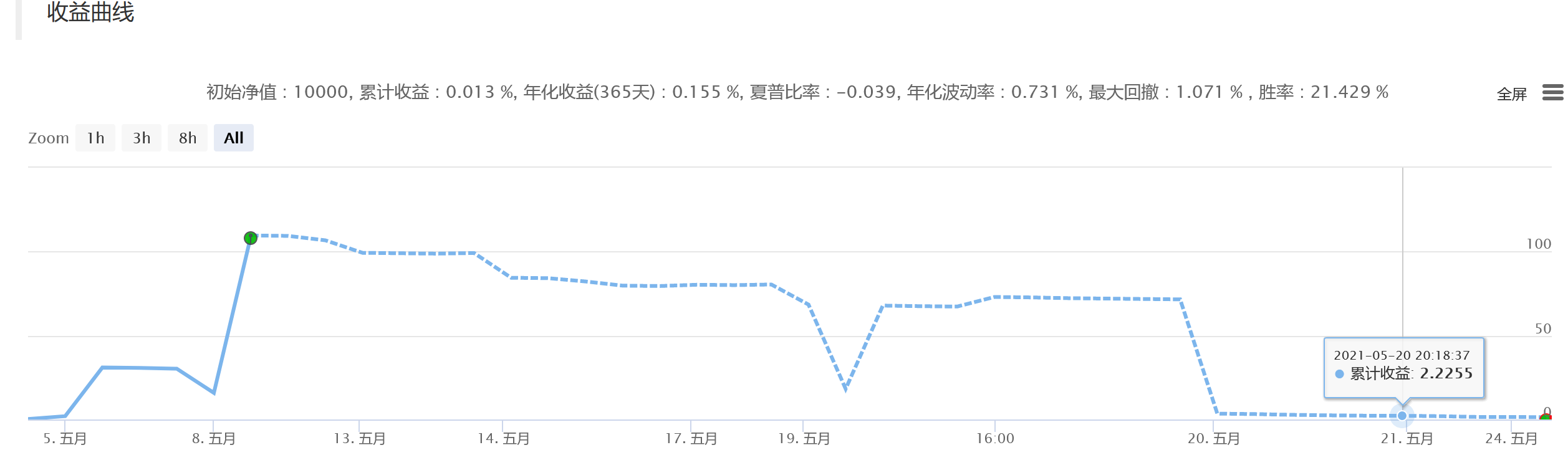

Reference to review1.BTC(2021.5.1-6.1)

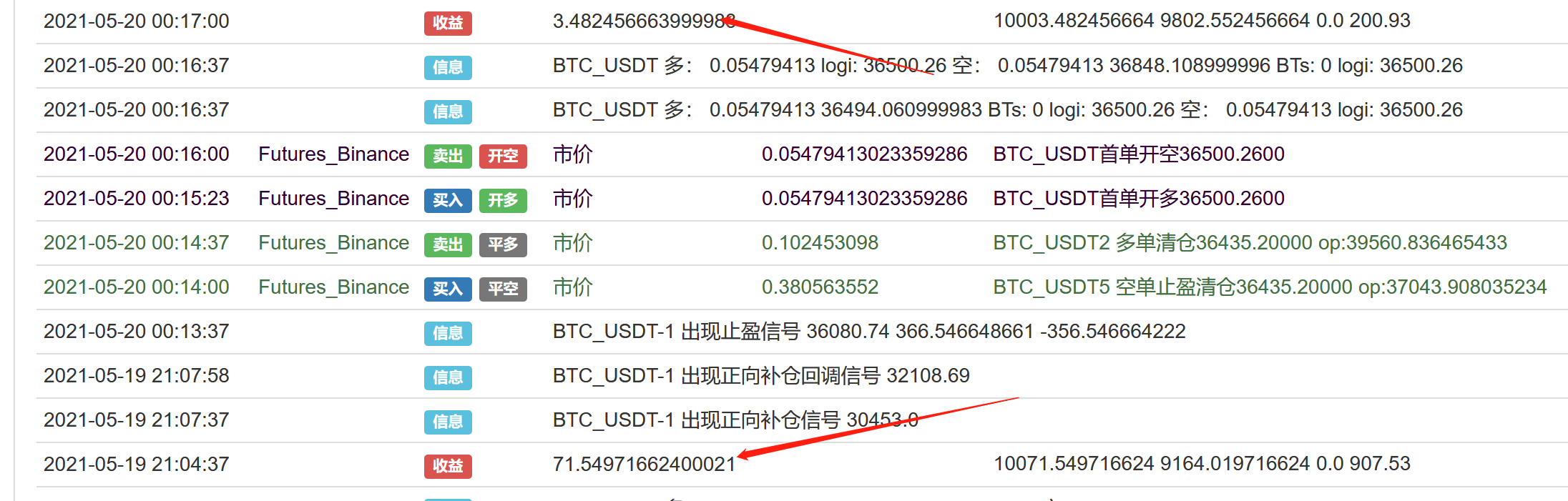

Combined retest logs

Combined retest logs The results of the review are not accurate, because the emergence of a bullish single stop bullish liquidation market is certainly a lot of empty total floating profit and loss is profitable, but the result is a loss. Since then, from 5.20-6.1 are in turmoil, there is no big market strategy and will not stop bullish, so the strategy is more suitable for running active currency.

The results of the review are not accurate, because the emergence of a bullish single stop bullish liquidation market is certainly a lot of empty total floating profit and loss is profitable, but the result is a loss. Since then, from 5.20-6.1 are in turmoil, there is no big market strategy and will not stop bullish, so the strategy is more suitable for running active currency.

2.BTC(2021.8.1-9.28)

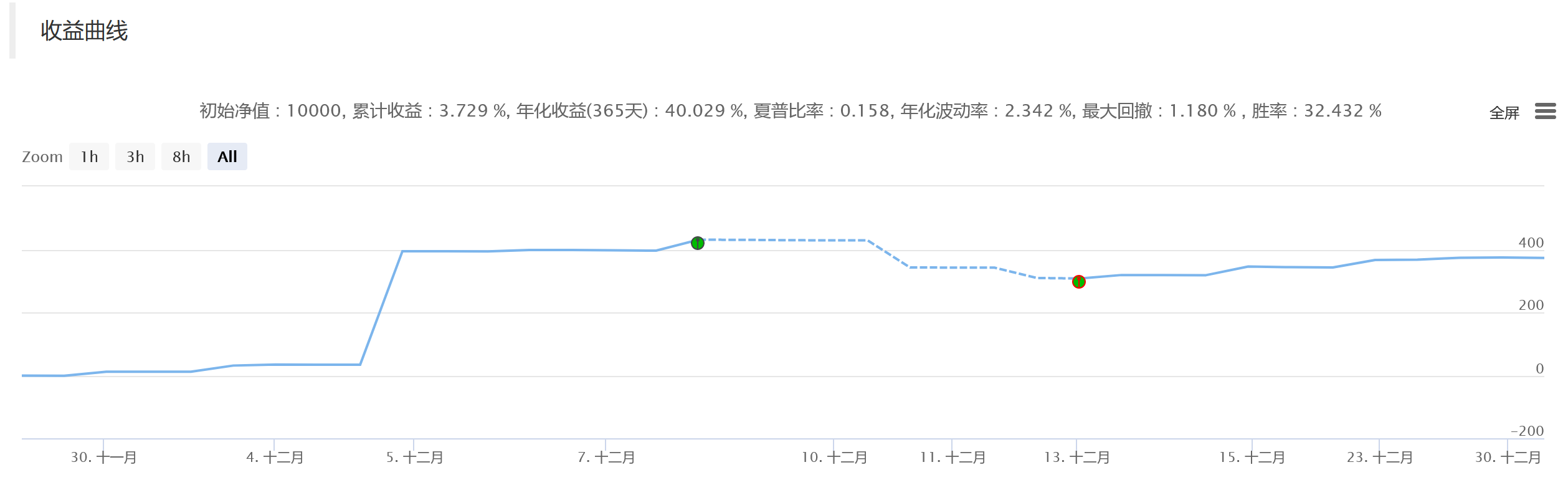

3.BTC(2021.11.29-12.31)

3.BTC(2021.11.29-12.31)

4.LTC ((2021.5.1-6.1) 5.19 decreased

5.LTC(2021.6.1-7.1)

5.LTC(2021.6.1-7.1)

6.LTC ((2021.7.1-10.1) 9.7 decreased

6.LTC ((2021.7.1-10.1) 9.7 decreased

7.ETC ((2021.7.1-10.1) 9.7 decreased

Major updates from the past

2022-04-10 New wear feature (new starter is enabled by default) to prevent large positions from being oversized. 2022-06-18 Optimizing strategic clearance and reverse replenishment functions. 2022-12-12 New grid mode, which will judge the current trend before opening a new position, and the one that judges the shocks will enter the grid mode until it jumps out of the shock zone and returns to the swing mode. 2023-02-07 Optimized small capture mode. 2023-03-24 Added clog queue management, adding queues for situations where orders are not received, making theoretical earnings statistics more accurate.

Real-world experience and skills

1. Re-assessment gains look small, but this is only the single coin gains of the main currency, the real market is running multiple coins, and there is an error, the real market runs active coins, the more active the gains can be higher. 2. If the market is good, a single wave of big markets may double, so there is usually no profit to wait for a certain currency to explode, other currency shocks wear and tear does not matter. 3. There may be a situation of being clutched: a very high pull (more than 10%), causing multiple positions to be held several times (more than 3 times), and then falling back abruptly (without triggering a median stop); first falling abruptly and then jumping abruptly. 2 The horn mouth gradually vibrates, there is no clear unilateral direction, the larger the horn mouth will be clutched the longer, the greater the buoyancy (more than 10% of the horn mouth needs to be detached to unlock). 4. After the vibration zone is coated, the longer the coating may be as the vibration expands. The solution after the coin is put into a set (no human intervention is required): run more coins, with most of the profit to compensate for the loss of the set in the range, currently has added the expected clearing function, after reaching the profit target, all the set will be re-run, and the set will also be cleared.

Benefits

Divide earnings by direct and theoretical earnings, direct earnings = current capital - initial capital, theoretical earnings = profit after each sale of the transaction. 1. Unknown funds affect direct earnings, such as the addition of undetected funds, such as newly added holdings of currencies. 2. The lack of access to order information or its inaccuracy may affect theoretical gains. Therefore, direct gains are the most intuitive gains, as long as there are no other capital operations, direct gains are the most accurate, but the actual process cannot limit the flow of funds of the client, so theoretical gains are used as the final settlement reference.

Strategic costs

The fee is charged mainly by dividend ((5-18%)), the first run fee is 800 yuan ((commission account gift 50U), subsequent rent is no longer charged, and there is no limit on the number of concurrent distributions. Fees: (theoretical gains + floating gains and losses) * Under 18%, the higher the fund, the lower the fee ratio This is the first time I've seen this video.dist.faayun.com

If you're interested in this strategy, please +V:gaobuying (add fmz), telegraph group search:

- Position management configuring ideas

- Grid hanging plus Martin multiplier increases

- This is a simple marketing strategy.

- Martinel printed the earnings chart

- The Fibonacci sequence strategy

- Multi-graph drawing line class library

- Simplified version of the Martingale contract multiplier

- Digital currency futures switching full-stock by full-stock plugin

- Drawing line robot doubled in a year, retracted by 1%, perfect curve

- (Bianan) Multi-product trends and reversals Martin shares his strategy

- Bn Obtained Minimum Variable Units of Accuracy

- Brin Martin test version V1.4

- Strategy across time cycles

- Synchronous server is a synchronous order management system.

- Order synchronization management system class library (single server)

- Trends by Martin Gridver 1.0.0 The strategy is for learning purposes only.

- ATR-RSI combined strategy

- Dry goods - currency system - currency factor

The grassRequires a physical address