The smart interval betting strategy (sold version)

Author: High frequency quantization, Date: 2023-06-11 19:13:20Tags:

The strategy is presented:

The Smart Spending Strategy is an investment strategy based on AI technology, which has advantages mainly in the following areas:

Automated decision-making: Smart betting strategies can automatically analyze market data, generate trading signals, and execute trades automatically through AI technology, enabling fully automated trading decisions.

Accurate predictive capabilities: Intelligent betting strategies can use AI technology to deeply learn and analyze market data to improve predictive capabilities and more accurately predict market trends and trading signals.

Efficient risk control: Smart betting strategies can monitor and control market risk in real time through AI technology, thus achieving efficient risk control and fund management.

Adaptability: Smart betting strategies can adapt to market conditions and investor risk preferences to better adapt to different market environments and investor needs.

Efficient execution: Smart arbitrage strategies can be used to achieve efficient transaction execution through AI technology, thereby improving transaction efficiency and execution capability.

It is important to note that there are also certain risks associated with smart betting strategies, which need to be adjusted and optimized according to the actual situation, while also requiring a certain knowledge and mastery of AI technology.

A leveraged buyout strategy is a common investment strategy where the basic idea is to increase the investment at a loss in the hope of making up for the previous loss in future profits. The advantages of this strategy are mainly reflected in the following aspects:

High flexibility: The strategy can be adapted to the market situation, flexibly adjusting the amount of investment and the number of investments according to the actual situation to achieve the best effect.

Strong risk control: The investment strategy can control the risk by gradually increasing the investment, which can be reduced by increasing the investment to compensate for the previous loss when the market loses.

Profitability potential: The investment strategy can yield higher returns when the market is good, because when the market is good, higher returns can be obtained by increasing the investment.

Wide applicability: The strategy is applicable to a wide range of markets, including stocks, futures, foreign exchange, etc. and can be adjusted according to the characteristics of different markets to achieve optimal results.

It is important to note that there is also a certain risk in the strategy of spread betting, which can lead to an increase in the amount of investment if the market is not good, and ultimately lead to a loss. Therefore, when using a spread betting strategy, it is necessary to adjust and control the risk according to the market situation in order to achieve the best effect.

ATR (Average True Range) is a commonly used technical indicator used to measure market volatility. In quantitative trading, the inclusion of an ATR adjustment interval can bring the following benefits:

More adaptable to market fluctuations: market volatility is constantly changing, and adding an ATR adjustment interval allows you to adjust the trading interval according to changes in market volatility, which makes it more adaptable to market fluctuations.

Risk control: The addition of ATR adjustment intervals controls the frequency of trading and thus controls the risk. When the market is more volatile, the trading intervals can be shortened to respond more quickly to market changes; when the market is less volatile, the trading intervals can be extended to avoid the risk of frequent trading.

Increased earnings: Adding an ATR adjustment interval can increase the number of trades when the market is more volatile, thus increasing earnings. When the market is less volatile, the number of trades is reduced, avoiding the costs of frequent trading.

It is important to note that the intervals for addressing the ATR adjustment need to be adjusted according to the actual situation, and it is not possible to blindly pursue high-frequency trading or low-frequency trading. At the same time, the ATR indicator also has a certain lag, which requires a comprehensive analysis in combination with other indicators and market conditions.

The main advantages and benefits of this strategy are:

Using the ATR indicator to calculate volatility: This strategy uses the ATR indicator to calculate the true wavelength, which can more accurately reflect market volatility and thus control trading frequency and risk more precisely.

Using WMA indicators to calculate moving averages: This strategy uses WMA indicators to calculate moving averages to more accurately reflect market trends and thus more accurately judge trading signals.

Strict stop-loss and stop-gap mechanisms: This strategy sets up a strict stop-loss and stop-gap mechanism to effectively control risk and loss while protecting gains.

Flexible parameter setting: The parameter setting of this strategy is more flexible and can be adjusted according to the actual situation, thus better adapting to different market conditions.

Wide applicability: The strategy is applicable to a wide range of markets, including stocks, futures, foreign exchange, etc., and can be adjusted according to the characteristics of different markets to achieve optimal results.

It is important to note that this strategy is for reference only and needs to be adjusted and optimized according to the actual situation when applied. At the same time, quantitative trading involves knowledge and skills in multiple aspects, and a certain amount of programming and trading experience is required to better apply the strategy.

Repeat recording

The retest record is too long, interested can upload the retest themselves

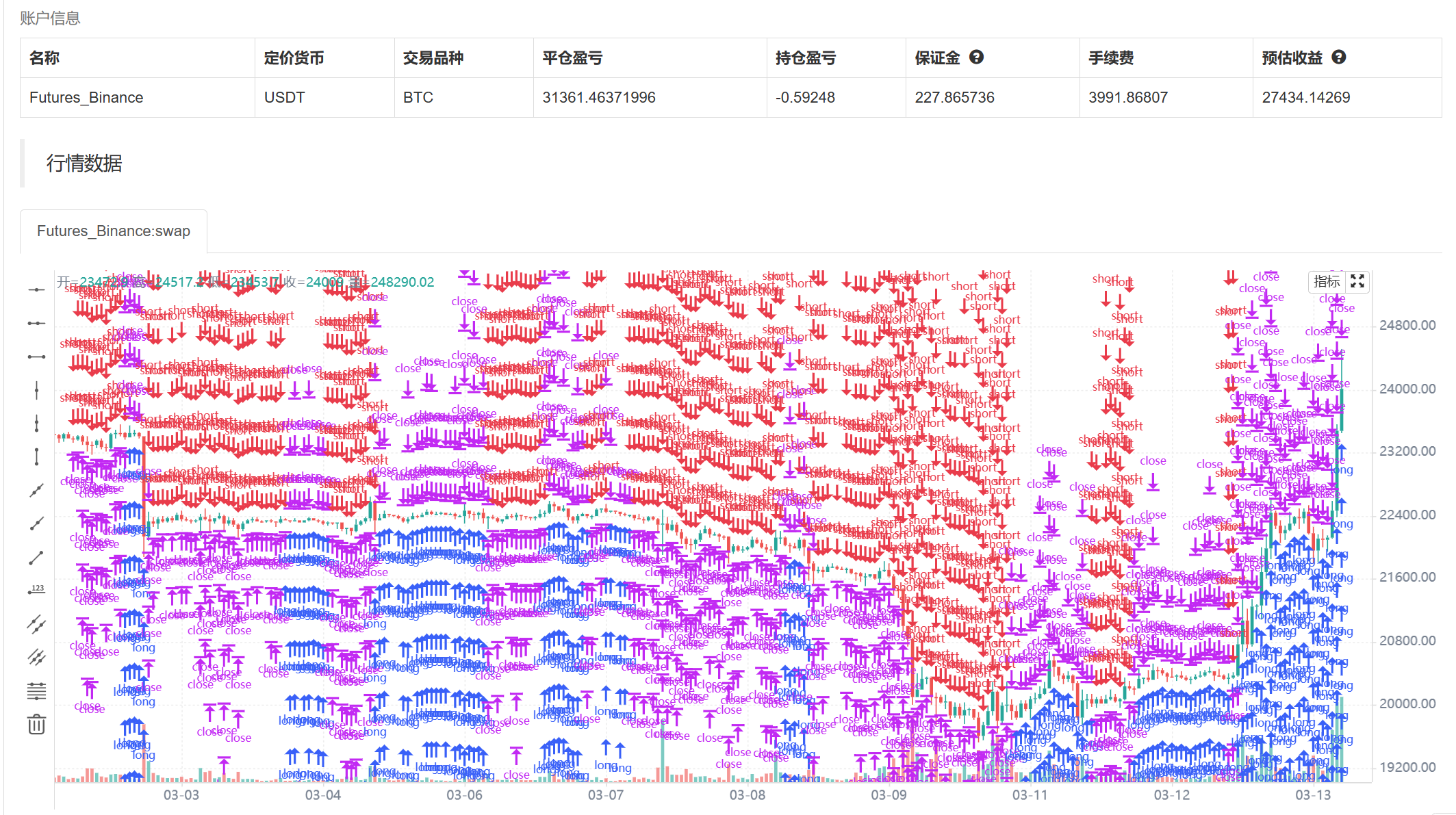

Displayed on the screen There is a funding curve. There are assets on display Showing hold orders

2023.05.15 User feedback gains are not able to cover the processing fee, checking finds that the processing fee varies for each user. To solve this problem, refer to the processing fee parameter

/*backtest

start: 2023-04-01 00:00:00

end: 2023-05-01 00:00:00

period: 5m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT","balance":10000}]

args: [["TransactionVal",300,411371]]

*/

/*

0.具体请看该教程https://www.fmz.com/bbs-topic/4145

1.添加交易所

2.部署托管者

3.创建与修改参数

4.创建和管理实盘

5.技术支持 VX:18826683356 okex实盘交易免费

5.1 币安实盘交易权限费用如下

6.TRC(20)主网 收USDT地址: TFZn8YGYRVuE5CPLsSieaKgPbwJrG3E8e7

7 通过币安支付 手机号18826683356 (免手续费)建议使用该方式支付

8.币安需要支付 100USDT/3月

币安需要支付 500USDT/永久

9.不对策略利润作任何保证,可以参考回测参数设置运行

10.非开通权限,时间宝贵,请勿联系

*/

/*

参数解析

设置杠杆:设置该合约使用资金的倍数,杠杆越大开仓需要的保证金越小

止损值:亏损额达账号总资金的一定百分比,清仓强平

初始开单价值USDT:首单开仓的价值,如果设置为300,当前交易产品为BTC_USDT,报价为30000,那么开仓量为300/30000=0.01个

加倍数值:如果已经有持仓订单,会加仓拉平持仓成本,设置为1,那么加仓量与持仓量一致。该参数需要设置为正整数

ATR周期波幅天数:指标ATR的参数

长期均线:指标MA的参数

短期均线:指标MA的参数

均线反转平仓:打勾,长期均线>短期均线 会全平所有多单;长期均线<短期均线 会全平所有空单

最大开单次数:符合条件可以加仓补单的次数,结束一轮循环会重新计数

ATR系数:用来修改ATR值,调整波动间隔

*/

//2023.05.15 用户反馈获利无法覆盖手续费,检查发现每个用户的手续费有差异化。为解决该问题,引用手续费率参数

//双向持仓

function main() {

Log("策略保密,复制可以直接加载币安期货交易所回测与OKEX期货交易所免费实盘");

Log("策略保密,复制可以直接加载币安期货交易所实盘,需要支付费用开通权限");

$.main1()

}

- MA CROSSOVER

- EMA-Cross-JC Intraday with Trailing SL

- Quantify the Unlimited Grid Trading Strategy

- Cousins quantified Shannon grid trading strategy

- Following robots V1.0 ((requires the same exchange, multiple users can follow orders, set the multiple of the order)

- Brin's belt tactics stop him and Martin Gelder double

- JavaScript version of page search K-line history data template (learning)

- OKX example of partial transaction wrapping

- Binance partial transaction wrapping example

- Random counting is a Martingale strategy.

- The Martingale test

- MartinGale Strategy1

- TradingView Signal Execution Policy 2 (Teaching) (Copy)

- Grid management tools

- New announcement on the Chat GPT processing exchange

- The price momentum is linear - 3 times the 330,000-year gain