Bear bear-Alpha "Boll" V4.0 sp. nevertheless great counterattack version

Author: Savageindex, Date: 2023-08-02 22:41:58Tags:

# 🚀 Bear bear-Alpha “Boll”

Simple Strategy, Extraordinary Success 🏆

📱 Contact & Purchase

- VX: louiscoin

- TG: @opsave

💎 Pricing Plans

Non-negotiable pricing - Monthly License (30 days) / 150 USDT - Semi-annual License (183 days) / 600 USDT - Annual License (365 days) / 1000 USDT - 2+ bonus days for same-day purchase

🔗 Strategy Showcase

🎯 Bear Strategy - The Art of Balance

💡 Strategy Genesis

Remember the crypto winter of 2022? When traditional Martingale strategies led many traders to failure, a thought emerged: “What if we could reduce Martingale’s risks while preserving its advantages?”

This was the beginning of the Bear Strategy.

🎭 Core Strategy Philosophy

Imagine playing a game where you’re not blindly “all-in”, but rather:

Timing Is Everything

- Like a hunter waiting for prey, we wait for clear market signals

- Not entering on every Bollinger Band breakthrough

- Waiting for multiple signal confirmations to reduce false breakouts

Smart Position Scaling

- Beyond simple multiplication

- Like chess, evaluating the situation before making moves

- Multiple checks through volatility and trend strength

- Ensuring higher probability for each scale-in

Comprehensive Protection

- Like multi-layered armor

- Dynamic stop-loss to prevent significant losses

- Trailing take-profit to secure gains

- Volatility-adaptive parameter adjustment

🎪 Strategy Features

Think of it as a customizable LEGO set:

Flexible Mode Switching

Conservative? → Enable all risk controls Aggressive? → Disable certain limitations Balanced? → Fine-tune parametersIntelligent Protection

High Volatility? → Auto-adjust stop-loss Major Trend? → Dynamic trailing take-profit Market Anomaly? → Auto-stop tradingAdaptive Response

Sideways Market → Bollinger Band breakout mode Trending Market → Trend following mode Pullback Market → Grid scaling mode

⚠️ Risk Warning

Remember, this isn’t a “get-rich-quick” strategy, but a tool requiring careful calibration:

Market Risks

- Even the best strategy can’t fight a market crash

- Trending markets may require multiple scale-ins

- Maintain sufficient margin, recommended under 30%

Usage Guidelines

- Start with small capital

- Gradually familiarize with parameters

- Find your optimal settings

Important Notice

- No strategy guarantees perpetual profits

- Past performance doesn’t guarantee future results

- Choose parameters according to your risk tolerance

🎯 Suitable Scenarios

Best for: - Major coins like SOL, ETH - Markets with moderate volatility - Medium-sized accounts

Not suitable for: - Small-cap altcoins - Extreme market conditions - Very large or very small accounts

💎 Strategy Essence

Success isn’t about maximizing profits, but about: - Surviving during losses - Staying rational during profits - Continuous growth in the market

📚 Usage Guidelines

Beginner Phase

- Use conservative parameters

- Test with small capital

- Observe for at least one month

Growth Phase

- Gradually adjust parameters

- Record market responses

- Find your optimal combination

Advanced Phase

- Adapt to market conditions

- Build your trading system

- Develop comprehensive money management

🌟 Final Words

This strategy is like a Swiss Army knife - it provides various tools, but how to use them depends on you.

Remember: - Markets are ever-changing - Parameters need adjustment - Risk control is paramount - Patience is your best friend

⚠️ Final reminder: This isn’t a “guaranteed profit” strategy, but a tool that requires understanding, adjustment, and growth. Success lies in how you use it, not in blind reliance.

🎁 Purchase Benefits

- Strategy registration code

- Detailed parameter guide (included in manual)

- Basic technical support (functionality fixes and updates)

📞 Start Your Trading Journey

Contact us: - VX: louiscoin - TG: @opsave

Related Links: - FMZ Live Demo - Bybit Copy Trading - Parameter Settings Guide

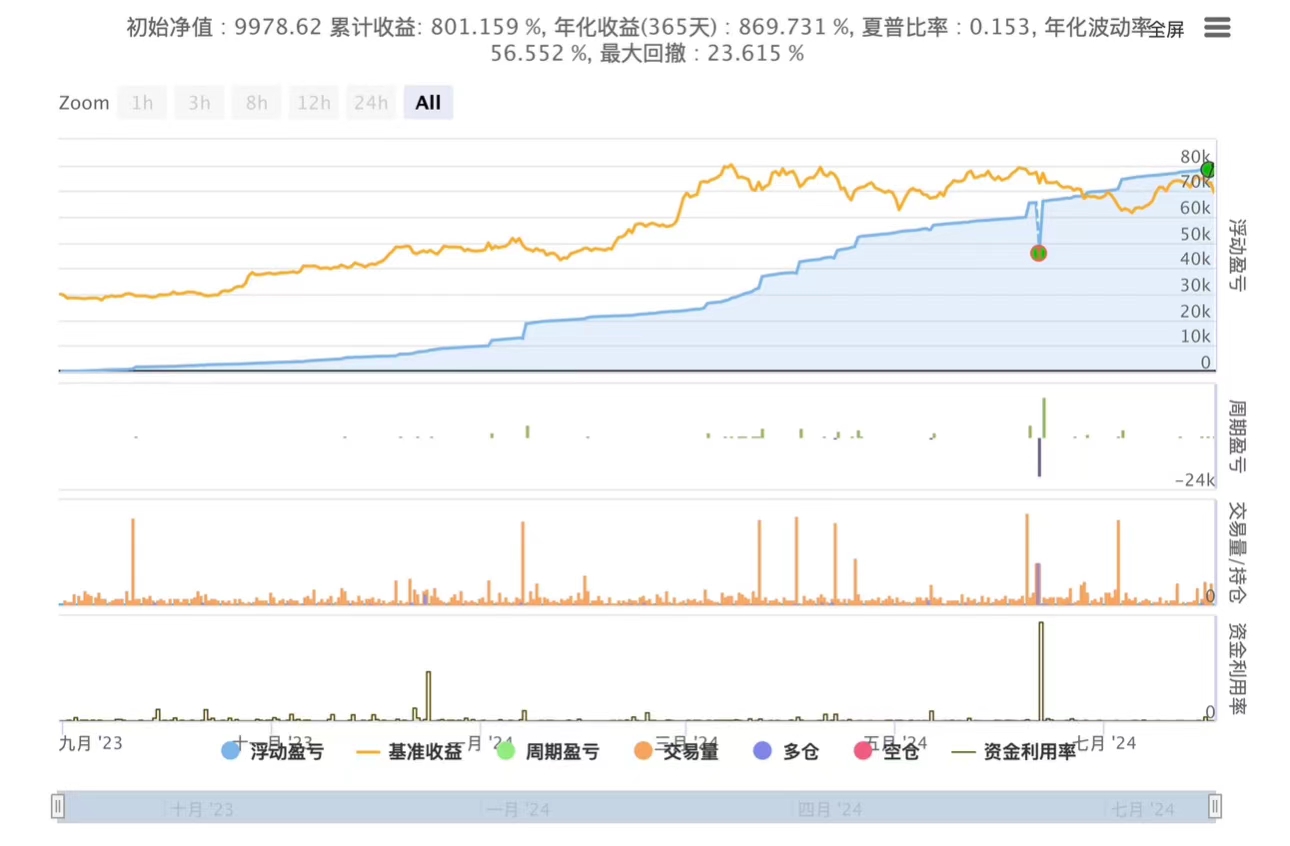

BTCUSDT Backtest Results

SOLUSDT Backtest Results

SOLUSDT Backtest Results

- Trade01 high and low orbital line + mean line

- Trade03- double evenline + fluctuation rate poorly filtered

- Trade02-Aaron indicator + MA strategy is also available.

- MA CROSSOVER

- EMA-Cross-JC Intraday with Trailing SL

- Quantify the Unlimited Grid Trading Strategy

- Cousins quantified Shannon grid trading strategy

- Following robots V1.0 ((requires the same exchange, multiple users can follow orders, set the multiple of the order)

- Brin's belt tactics stop him and Martin Gelder double

- JavaScript version of page search K-line history data template (learning)

- OKX example of partial transaction wrapping

- Binance partial transaction wrapping example

- The smart interval betting strategy (sold version)

- Random counting is a Martingale strategy.

- The Martingale test

- MartinGale Strategy1

- TradingView Signal Execution Policy 2 (Teaching) (Copy)

- Grid management tools

solor1988This strategy is Martin's double strategy.

Beans 888Is it that the mind can only make one coin?

SavageindexHey, Bear Bear-Alpha "Boll is not a traditional Martin strategy, but a flexible self-defining trading system! Key features: 1. Gakuura is optional, not mandatory Support for self-configured parameters 3. Can turn off the auto-storage function 4. Wind control is always first. For example: * Do you want to keep it? * Maximum number of replenishes = 0 * Just do the single store * Strictly stop loss It's your strategy, it's up to you to decide how to play! Not Martin, but a customized trading tool. The core advantages: fully controllable, flexible, versatile, built for the user!

SavageindexYou can choose your own coin.