Lion Fissure Balance Strategy

Author: ChaoZhang, Date: 2023-11-02 16:55:00Tags:

Overview

The Lion Fissure Balance strategy is a simple short-term trading strategy based on moving average crossovers. It mainly uses two moving averages - when the fast MA crosses above the slow MA from below, go long; when the fast MA crosses below the slow MA from above, close the position. The strategy name comes from the popular trading jargon “Lion Fissure”, implying capturing minor price actions and profiting from the narrow gap between MAs.

Strategy Logic

The strategy uses two moving averages: a fast MA (smallMAPeriod) and a slow MA (bigMAPeriod). The two MAs form a price channel, with the fast MA as the channel base and the slow MA as the channel ceiling. When price breaks above the channel base upwards, go long; when price breaks the channel ceiling downwards, close position.

Specifically, the strategy first calculates the fast MA (smallMA) and slow MA (bigMA). It then calculates the buy line (buyMA), which is (100 - percentBelowToBuy)% of the slow MA. When the fast MA crosses above the buy line upwards, go long; when reaching 1% profit or holding 7 bars without profit, close position.

In summary, the strategy aims to capture the “Lion Fissure” between MAs for short-term profits. It also sets profit taking and stop loss conditions to control per trade risk.

Advantage Analysis

The strategy has the following advantages:

-

Simple concept easy to understand and implement. Dual MA crossovers are the most basic technical indicator strategy.

-

Easy backtesting. The strategy directly uses TradingView built-in backtester without extra implementation.

-

Powerful visualization. TradingView can directly show trade signals and statistical data on charts.

-

Controllable risk. The strategy sets profit taking and stop loss conditions to effectively control per trade loss.

-

Flexible customization. Users can adjust MA parameters and other indicators to suit different products and trading styles.

Risk Analysis

The strategy also has the following risks:

-

Potentially excessive signals. Dual MA strategies tend to generate false signals during consolidations.

-

Single indicator reliance. Using only MA crosses ignores other factors, potentially resulting in poor signal quality.

-

Difficult parameter optimization. Finding the optimal MA combination requires extensive computation.

-

Backtest bias. Simple dual MA strategies often perform better in backtests than live trading.

-

Difficult stop loss. Fixed stop loss levels may fail to adapt to changing market conditions.

Optimization Directions

The strategy can be improved from the following aspects:

-

Add other filters like volume and volatility to avoid ineffective signals during consolidations.

-

Incorporate trend bias to avoid counter-trend trading. Longer-period MAs can be added to determine trend direction.

-

Use machine learning to find optimal parameters, like sequential parameter optimization or genetic algorithms.

-

Enhance stop loss strategies, like trailing stop loss and adaptive stop loss for better flexibility.

-

Optimize entry timing using other indicators to identify higher probability entry points.

-

Conduct quantitative research and backtesting to improve stability of optimized parameter sets.

-

Develop automated trading systems to systematically optimize and evaluate parameter combinations.

Conclusion

The Lion Fissure Balance strategy is an excellent starter strategy for beginners to learn. It applies the simple dual MA crossover logic and sets profit taking and stop loss rules to capture short-term price swings. The strategy is easy to understand and implement, and shows good backtest results. However, it suffers from optimization difficulty and questionable live performance. We can improve the strategy by incorporating other indicators, optimizing parameters, and developing automated trading systems. Overall, the Lion Fissure Balance strategy provides a great learning platform for quantitative trading beginners.

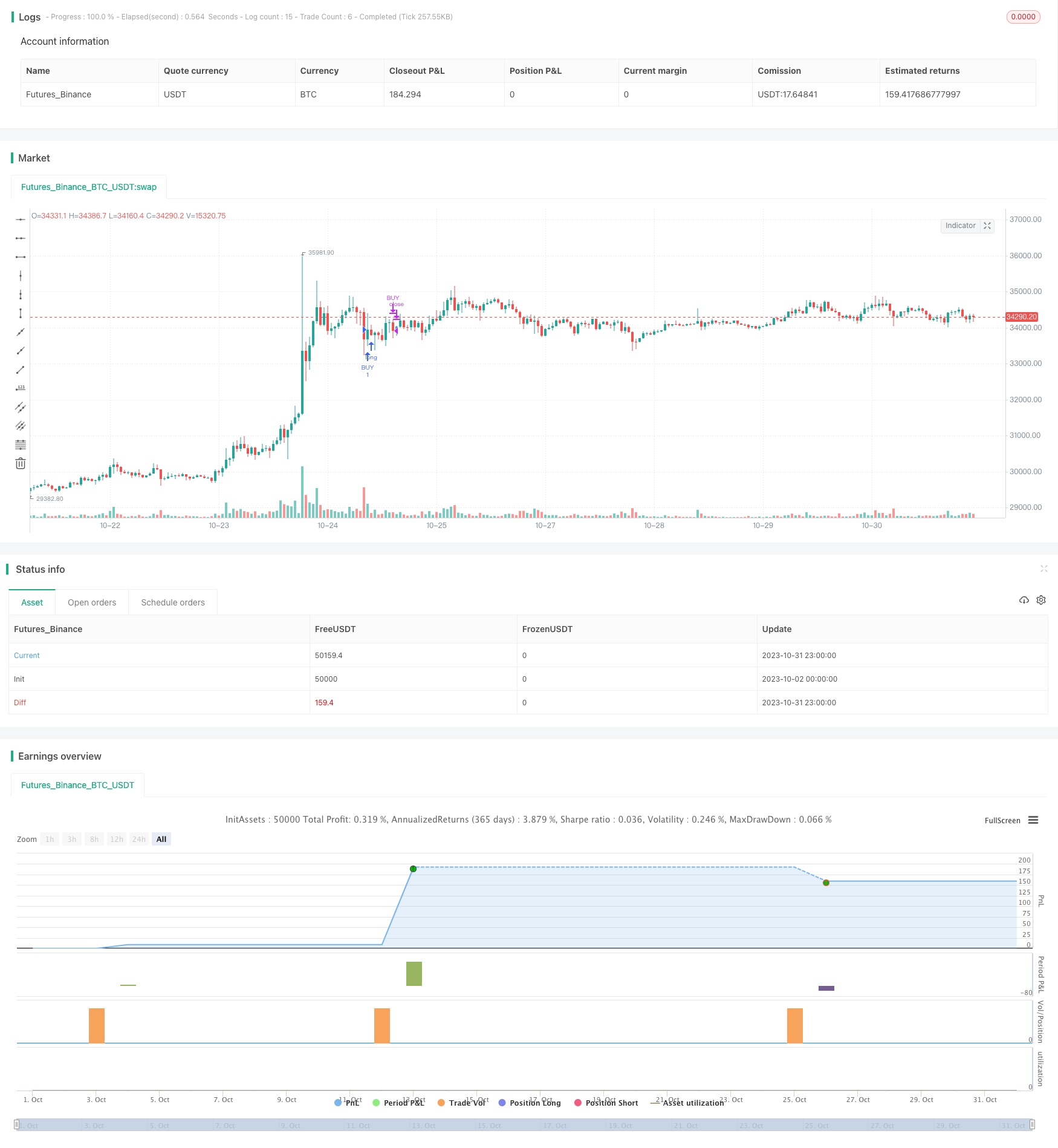

/*backtest

start: 2023-10-02 00:00:00

end: 2023-11-01 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © TraderHalai

// This script was born out of my quest to be able to display strategy back test statistics on charts to allow for easier backtesting on devices that do not natively support backtest engine (such as mobile phones, when I am backtesting from away from my computer). There are already a few good ones on TradingView, but most / many are too complicated for my needs.

//

//Found an excellent display backtest engine by 'The Art of Trading'. This script is a snippet of his hard work, with some very minor tweaks and changes. Much respect to the original author.

//

//Full credit to the original author of this script. It can be found here: https://www.tradingview.com/script/t776tkZv-Hammers-Stars-Strategy/?offer_id=10&aff_id=15271

//

// This script can be copied and airlifted onto existing strategy scripts of your own, and integrates out of the box without implementation of additional functions. I've also added Max Runup, Average Win and Average Loss per trade to the orignal script.

//

//Will look to add in more performance metrics in future, as I further develop this script.

//

//Feel free to use this display panel in your scripts and strategies.

//Thanks and enjoy! :)

//@version=5

// strategy("Strategy BackTest Display Statistics - TraderHalai", overlay=true, default_qty_value= 5, default_qty_type = strategy.percent_of_equity, initial_capital=10000, commission_type=strategy.commission.percent, commission_value=0.1)

//DEMO basic strategy - Use your own strategy here - Jaws Mean Reversion from my profile used here

source = input(title = "Source", defval = close)

smallMAPeriod = input(title = "Small Moving Average", defval = 2)

bigMAPeriod = input(title = "Big Moving Average", defval = 8)

percentBelowToBuy = input(title = "Percent below to buy %", defval = 1)

smallMA = ta.sma(source, smallMAPeriod)

bigMA = ta.sma(source, bigMAPeriod)

buyMA = ((100 - percentBelowToBuy) / 100) * ta.sma(source, bigMAPeriod)[0]

buy = ta.crossunder(smallMA, buyMA)

if(buy)

strategy.entry("BUY", strategy.long)

if(strategy.openprofit >= strategy.position_avg_price * 0.01) // 1% profit target

strategy.close("BUY")

if(ta.barssince(buy) >= 7) //Timed Exit, if you fail to make 1 percent in 7 candles.

strategy.close("BUY")

///////////////////////////// --- BEGIN TESTER CODE --- ////////////////////////

// COPY below into your strategy to enable display

////////////////////////////////////////////////////////////////////////////////

// strategy.initial_capital = 50000

// // Declare performance tracking variables

// drawTester = input.bool(true, "Draw Tester")

// var balance = strategy.initial_capital

// var drawdown = 0.0

// var maxDrawdown = 0.0

// var maxBalance = 0.0

// var totalWins = 0

// var totalLoss = 0

// // Prepare stats table

// var table testTable = table.new(position.top_right, 5, 2, border_width=1)

// f_fillCell(_table, _column, _row, _title, _value, _bgcolor, _txtcolor) =>

// _cellText = _title + "\n" + _value

// table.cell(_table, _column, _row, _cellText, bgcolor=_bgcolor, text_color=_txtcolor)

// // Custom function to truncate (cut) excess decimal places

// truncate(_number, _decimalPlaces) =>

// _factor = math.pow(10, _decimalPlaces)

// int(_number * _factor) / _factor

// // Draw stats table

// var bgcolor = color.new(color.black,0)

// if drawTester

// if barstate.islastconfirmedhistory

// // Update table

// dollarReturn = strategy.netprofit

// f_fillCell(testTable, 0, 0, "Total Trades:", str.tostring(strategy.closedtrades), bgcolor, color.white)

// f_fillCell(testTable, 0, 1, "Win Rate:", str.tostring(truncate((strategy.wintrades/strategy.closedtrades)*100,2)) + "%", bgcolor, color.white)

// f_fillCell(testTable, 1, 0, "Starting:", "$" + str.tostring(strategy.initial_capital), bgcolor, color.white)

// f_fillCell(testTable, 1, 1, "Ending:", "$" + str.tostring(truncate(strategy.initial_capital + strategy.netprofit,2)), bgcolor, color.white)

// f_fillCell(testTable, 2, 0, "Avg Win:", "$"+ str.tostring(truncate(strategy.grossprofit / strategy.wintrades, 2)), bgcolor, color.white)

// f_fillCell(testTable, 2, 1, "Avg Loss:", "$"+ str.tostring(truncate(strategy.grossloss / strategy.losstrades, 2)), bgcolor, color.white)

// f_fillCell(testTable, 3, 0, "Profit Factor:", str.tostring(truncate(strategy.grossprofit / strategy.grossloss,2)), strategy.grossprofit > strategy.grossloss ? color.green : color.red, color.white)

// f_fillCell(testTable, 3, 1, "Max Runup:", str.tostring(truncate(strategy.max_runup, 2 )), bgcolor, color.white)

// f_fillCell(testTable, 4, 0, "Return:", (dollarReturn > 0 ? "+" : "") + str.tostring(truncate((dollarReturn / strategy.initial_capital)*100,2)) + "%", dollarReturn > 0 ? color.green : color.red, color.white)

// f_fillCell(testTable, 4, 1, "Max DD:", str.tostring(truncate((strategy.max_drawdown / strategy.equity) * 100 ,2)) + "%", color.red, color.white)

// // --- END TESTER CODE --- ///////////////

- EMA 13 48 Trend Following Strategy

- Williams Accumulation/Distribution (Williams AD) Strategy

- Relative Momentum Index Strategy

- Double Box Trend Following System

- Martingale Strategy with Expanded Moving Average Range for Stock Trading

- Bull and Bear Balance Strategy

- Oma and Apollo Dual Rail Trading Strategy

- Dual Moving Average Crossover Strategy

- Dual Signal Trend Tracking Strategy

- Trend Following SMA Strategy

- Adaptive ATR Moving Average Trading Strategy

- Bi-directional Reversal Strategy

- Combo Strategy of 123 Reversal and Fractal Chaos Oscillator

- Breakout Trading Strategy

- Momentum Indicator Long Short Strategy

- Dual Channel Tracking Reversal Strategy

- Coordinate Sliding Stop Loss Strategy

- Precise Trend Breakout Trading Strategy

- Bull Market Buy Dips Strategy

- DAKELAX-XRPUSDT Bollinger Band Mean Reversion Strategy