Momentum Market Sentiment Indicator Strategy

Author: ChaoZhang, Date: 2023-11-13 17:51:20Tags:

Overview

This strategy reveals market sentiment by comparing price changes to volume, and presents it in a MACD format to generate trading signals.

Strategy Logic

The strategy mainly uses the following methods to reveal market sentiment:

-

Price change per volume of each bar. This directly shows the strength of buying and selling forces.

-

Apply exponential moving averages to price change and volume separately, then divide the EMA of price change by the EMA of volume. This filters out some noise and results in a smoother “market sentiment” curve.

-

Apply fast and slow EMAs on “market sentiment” to get MACD-like lines. The MACD line shows momentum direction and strength, the signal line is its moving average, and the histogram shows their difference, representing momentum change.

The histogram crossing above 0 signals increasing bullish sentiment, while crossing below 0 signals increasing bearish sentiment. Divergences on the histogram can also be observed.

Advantage Analysis

The strategy has the following advantages:

-

Uses volume information to judge market sentiment, more convincing.

-

MACD form is intuitive and easy to use.

-

Customizable parameters for different products and timeframes.

-

Can detect divergences on histogram to find potential trend reversals.

-

Clear code structure, easy to understand and optimize.

Risk Analysis

The strategy also has the following risks:

-

Volume reflects sentiment but does not guarantee correct signals. Need to combine with price action.

-

Improper MACD parameter setting may cause missed or false signals. Parameters need to be optimized for specific products and timeframes.

-

Divergences may be false signals, unable to confirm trend reversals, so need to be interpreted carefully.

-

Risk of late entry and being trapped. Can wait for trailing stop loss or validate with trends and related products.

Optimization Directions

The strategy can be optimized in the following aspects:

-

Test combinations of parameters on different products and timeframes to find optimal parameters.

-

Add stop loss to reduce loss risk.

-

Combine with related product price trends to validate signals.

-

Use machine learning to dynamically optimize parameters.

-

Add filters to reduce false signals, e.g. higher timeframe trends, volatility, etc.

Conclusion

The strategy judges market sentiment by comparing price change and volume, and generates signals in a MACD format. Considering volume in addition to just price can more accurately determine the strength of buyers and sellers. The parameters can be optimized for different products and timeframes, with further optimization potential. Overall, the strategy has a novel idea, easy to use, effectively captures market momentum, and is worth further development.

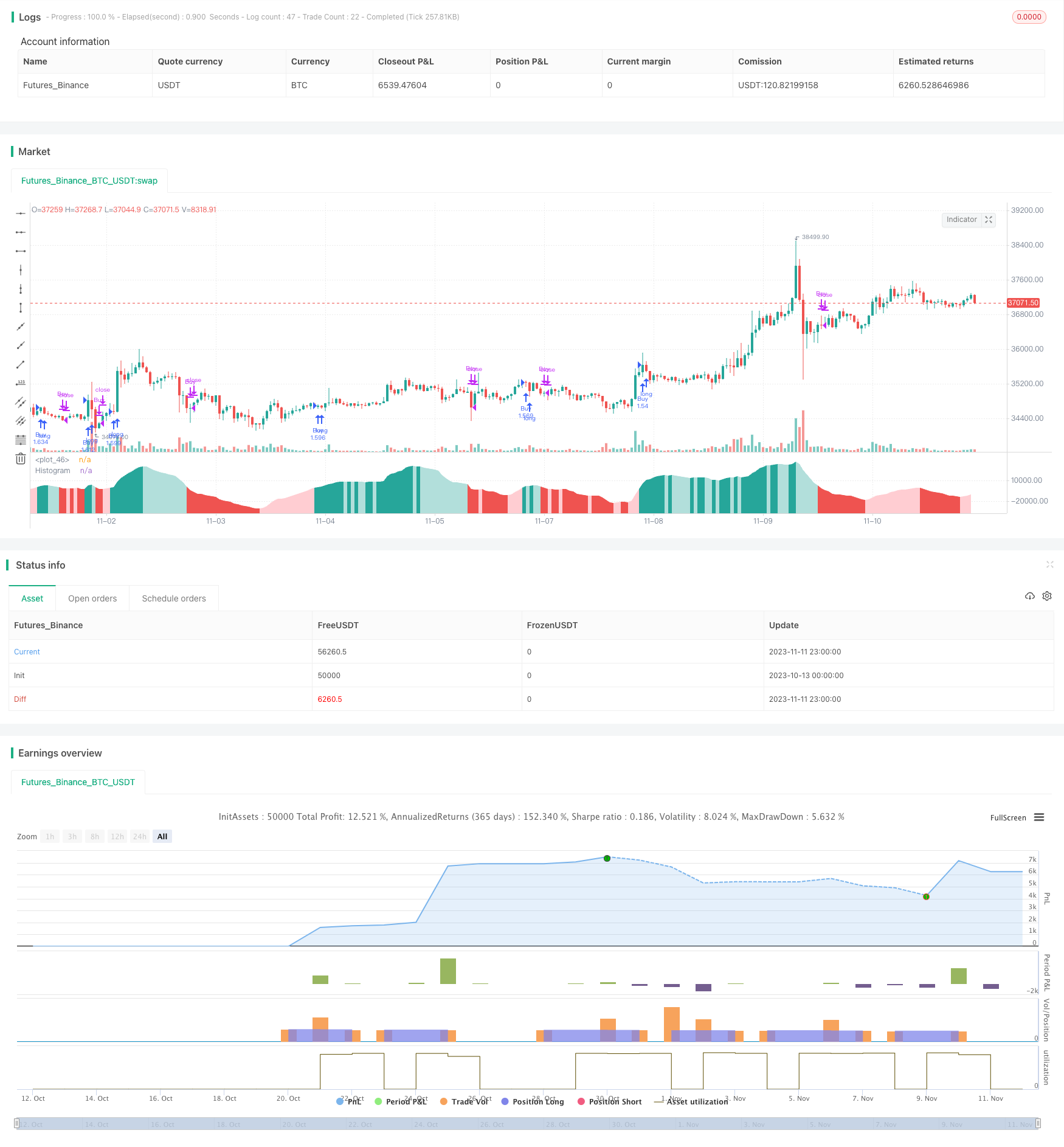

/*backtest

start: 2023-10-13 00:00:00

end: 2023-11-12 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © dannylimardi

//@version=4

strategy("Sentiment Oscillator", "Sentiment", overlay=false, initial_capital=100, default_qty_type=strategy.percent_of_equity, default_qty_value=100, commission_type=strategy.commission.percent, commission_value=0.08)

//Inputs

msLen = input(49, type=input.integer, title="Market Sentiment Lookback Length")

emaLen1 = input(40, type=input.integer, title="Fast EMA Length")

emaLen2 = input(204, type=input.integer, title="Slow EMA Length")

signalLen = input(20, type=input.integer, title="Signal Length")

showMs = input(false, type=input.bool, title="Show Market Sentiment?")

showHist = input(true, type=input.bool, title="Show Momentum?")

showMacd = input(false, type=input.bool, title="Show MACD Line?")

showSignal = input(false, type=input.bool, title="Show Signal Line?")

showCpv = input(false, type=input.bool, title="(Show Change/Volume for Each Bar?)")

showEma1 = input(false, type=input.bool, title="(Show Fast EMA?)")

showEma2 = input(false, type=input.bool, title="(Show Slow EMA?)")

//Calculations

priceChange = close - close[1]

changePerVolume = (priceChange/volume) * 10000000 // (The 1000000 doesn't have any significance, it's just to avoid color-change errors when the values are too emall.)

priceChangeEma = ema(priceChange, msLen)

volumeEma = ema(volume, msLen)

marketSentiment = priceChangeEma/volumeEma * 100000000

msEma1 = ema(marketSentiment, emaLen1)

msEma2 = ema(marketSentiment, emaLen2)

macd = msEma1-msEma2

signal = ema(macd, signalLen)

hist = macd-signal

//Plot colors

col_grow_above = #26A69A

col_grow_below = #FFCDD2

col_fall_above = #B2DFDB

col_fall_below = #EF5350

col_macd = #0094ff

col_signal = #ff6a00

//Drawings

plot(showHist ? hist : na, title="Histogram", style=plot.style_area, color=(hist>=0 ? (hist[1] < hist ? col_grow_above : col_fall_above) : (hist[1] < hist ? col_grow_below : col_fall_below)), transp=0 )

plot(showMacd ? macd : na, title="MACD", color=col_macd, transp=0)

plot(showSignal ? signal : na, title="Signal", color=col_signal, transp=0)

plot(showCpv ? changePerVolume : na, color=changePerVolume > changePerVolume[1] ? color.teal : color.red)

plot(0, color=color.white, transp=80)

plot(showEma1 ? msEma1 : na, color=color.aqua)

plot(showEma2 ? msEma2 : na, color=color.yellow)

plot(showMs ? marketSentiment : na, color=color.lime)

//Strategy

strategy.entry("Buy", strategy.long, when=crossover(hist, 0))

strategy.close("Buy", when=crossunder(hist, 0))

- Momentum Squeeze Strategy

- MCL-YG Bollinger Band Breakout Pair Trading Strategy

- Dual-confirmation Reversal Trading Strategy

- Trend Reversal Tracking Stop Loss Strategy

- Weekend Trading Strategy

- ANN-based Quantitative Trading Strategy

- Momentum Breakout Strategy

- Dual MACD Quantitative Trading Strategy

- Corn Moving Average Balance Trading Strategy

- Dual Reversal Entry Strategy

- Momentum Squeeze Breakout Trend Tracking Strategy

- Inverse MACD Momentum Entangled with DMI Breakout Short-Term Scalping Strategy

- EMA Percentage Channel with Bollinger Band Range Trading Strategy

- Dual EMA Crossover Strategy

- Gradual Stop Loss Movement Strategy

- Momentum Breakout Strategy with Volatility Stop

- Extreme Distribution Swing Strategy

- Multi-indicator Crossover Strong Trend Tracking Strategy

- Momentum Breakout Trading Strategy Based on Price Breakout and Mean Reversion

- Momentum Price Trend Tracking Strategy