Corn Moving Average Balance Trading Strategy

Author: ChaoZhang, Date: 2023-11-13 17:59:42Tags:

Overview

The Corn Moving Average Balance Trading Strategy utilizes the golden and dead crossovers of moving averages with different periods for long and short balance trading. It also incorporates various visual effects like candle colors, background colors and shape markers to assist in observing trend changes. This strategy is suitable for intermediate to advanced traders who are familiar with moving average theories.

Strategy Logic

The strategy first defines two user-adjustable parameters: the active moving average period len1 and the baseline moving average period len2. The active moving average has a shorter period to capture short-term trend changes, while the baseline moving average has a longer period to filter out market noises. Users can freely choose between 5 different types of moving averages: EMA, SMA, WMA, DEMA and VWMA. The code uses if logic to calculate different types of moving averages based on user’s selection.

When the short-term moving average crosses over the long-term one, a golden cross is generated for opening long positions. When a dead cross happens, the strategy opens short positions. The long and short balance trading increases profit opportunities. In addition, the candle colors also display the current trend direction.

The shape markers visually show the positions of golden and dead crosses. The background color assists in determining the trend direction. This strategy has both the “long and short balance” and “long only” trading modes available.

Advantages

- More reliable trading signals with multiple indicators combined

- Increased profit potential with long and short balance trading

- Customizable moving average types and periods adaptable to different market environments

- Intuitive trend spotting with various visual effects

- Clear code structure easy to understand and customize

Risks and Solutions

-

Misleading signals from moving averages

- Use moving average combos of different periods to reduce misleading signals

- Add other exit conditions like stop loss

-

Certain periods may fit the strategy better

- Test different period parameters to find the optimal ones

- Make the period parameter dynamic and adjustable in the code

-

Increased loss risk with long and short trading

- Adjust position sizing properly

- Select long only trading mode

Optimization Directions

- Add stop loss to control single trade loss

- Build conditions for re-entering the market

- Optimize position sizing strategies

- Explore new trading signals like volatility indicators

- Dynamically optimize the period parameters

- Optimize the weights between different moving average types

Summary

The Corn Moving Average Balance Trading Strategy integrates the strengths of moving average indicators and enables long and short balance trading. It has rich visual effects for trend spotting and customizable parameters for adaptability. But misleading signals and position sizing need to be watched out for. This strategy provides intermediate to advanced traders a customizable framework for reference.

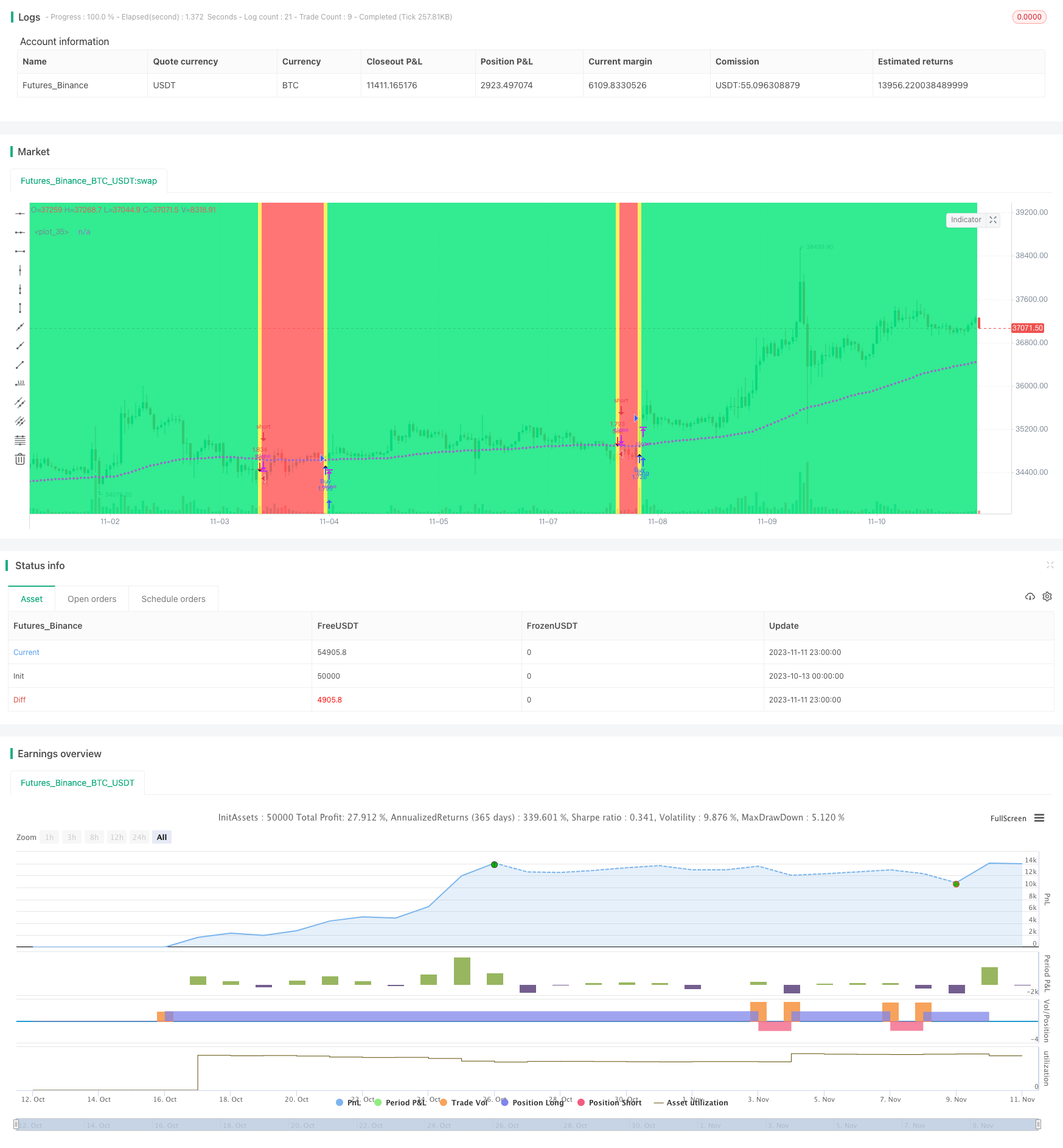

/*backtest

start: 2023-10-13 00:00:00

end: 2023-11-12 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

strategy("MASelect Crossover Strat", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=100)

av1 = input(title="Active MA", defval="EMA", options=["EMA", "SMA", "WMA", "DEMA", "VWMA"])

av2 = input(title="Base MA", defval="EMA", options=["EMA", "SMA", "WMA", "DEMA", "VWMA"])

len1 = input(20, "Active Length")

len2 = input(100, "Base Length")

src = input(close, "Source")

strat = input(defval="Long+Short", options=["Long+Short", "Long Only"])

ema1 = ema(src, len1)

ema2 = ema(src, len2)

sma1 = sma(src, len1)

sma2 = sma(src, len2)

wma1 = wma(src, len1)

wma2 = wma(src, len2)

e1 = ema(src, len1)

e2 = ema(e1, len1)

dema1 = 2 * e1 - e2

e3 = ema(src, len2)

e4 = ema(e3, len2)

dema2 = 2 * e3 - e4

vwma1 = vwma(src, len1)

vwma2 = vwma(src, len2)

ma1 = av1 == "EMA"?ema1:av1=="SMA"?sma1:av1=="WMA"?wma1:av1=="DEMA"?dema1:av1=="VWMA"?vwma1:na

ma2 = av2 == "EMA"?ema2:av2=="SMA"?sma2:av2=="WMA"?wma2:av2=="DEMA"?dema2:av2=="VWMA"?vwma2:na

co = crossover(ma1, ma2)

cu = crossunder(ma1, ma2)

barcolor(co?lime:cu?yellow:na)

col = ma1 >= ma2?lime:red

bgcolor(co or cu?yellow:col)

plotshape(co, style=shape.triangleup, location=location.belowbar)

plotshape(cu, style=shape.triangledown)

plot(ma1, color=col, linewidth=3), plot(ma2, style=circles, linewidth=1)

strategy.entry("Buy", strategy.long, when=co)

if strat=="Long+Short"

strategy.entry("Sell", strategy.short, when=cu)

else

strategy.close("Buy", when=cu)

- Multi Timeframe Trend Tracking Strategy

- Dual-track Oscillator Pattern Strategy

- Momentum Squeeze Strategy

- MCL-YG Bollinger Band Breakout Pair Trading Strategy

- Dual-confirmation Reversal Trading Strategy

- Trend Reversal Tracking Stop Loss Strategy

- Weekend Trading Strategy

- ANN-based Quantitative Trading Strategy

- Momentum Breakout Strategy

- Dual MACD Quantitative Trading Strategy

- Dual Reversal Entry Strategy

- Momentum Market Sentiment Indicator Strategy

- Momentum Squeeze Breakout Trend Tracking Strategy

- Inverse MACD Momentum Entangled with DMI Breakout Short-Term Scalping Strategy

- EMA Percentage Channel with Bollinger Band Range Trading Strategy

- Dual EMA Crossover Strategy

- Gradual Stop Loss Movement Strategy

- Momentum Breakout Strategy with Volatility Stop

- Extreme Distribution Swing Strategy

- Multi-indicator Crossover Strong Trend Tracking Strategy