Overview

This strategy uses trend reversal indicators combined with trend tracking stop loss mechanisms to track trends in trending markets and reduce losses in range-bound markets.

Strategy Logic

The strategy uses Hull Moving Average as the main trend indicator. It goes long when price crosses above Hull MA and goes short when price crosses below Hull MA. Meanwhile, McGinley MA is used to confirm the trend.

When price reverses after opening position, validated by Hull MA crossover, the trend change logic will close the current position.

The strategy also utilizes a tracking stop loss mechanism based on ATR calculation. The stop loss price level adjust dynamically following price moves to realize trailing stop of profits.

Advantages

- Use Hull MA to detect trend reversal points sensitively

- Add McGinley MA for trend confirmation, filtering false breakouts

- Adopt dynamic trailing stop loss based on market volatility to control losses

- Respond timely to trend reversals when Hull MA is validated

- Easy to switch parameters for testing and optimization

Risks and Solutions

Stop loss may be triggered in ranging markets

- Expand stop loss buffer wisely

Tracking stop loss may lag behind fast market moves

- Use shorter smooth periods for stop loss to follow price faster

False breakouts may cause unnecessary losses

- Add more confirmations to avoid false signals

Inappropriate parameters may lead to poor performance

- Backtest on different market cycles to find optimal parameters

Optimization Directions

- Add more confirmations like candlestick patterns, Bollinger Bands, RSI etc. to improve signal quality

- Optimize parameters for different products and timeframes to find best parameter sets

- Try machine learning for adaptive parameter optimization

- Refine stop loss algorithms to reduce unnecessary stopping out

- Optimize position sizing and risk management

- Consider adding auto profit taking mechanisms

Conclusion

Overall this is a robust trend following strategy. Compared to fixed stop loss, the dynamic stop loss mechanism adjusts stop level based on market volatility, reducing the probability of being stopped out. The introduction of Hull MA and trend change logic also allows faster response to trend reversals. There are still risks like whipsaw and false breakout. Further optimizations on parameters, stop loss algorithms, position sizing etc. can improve strategy stability across different markets.

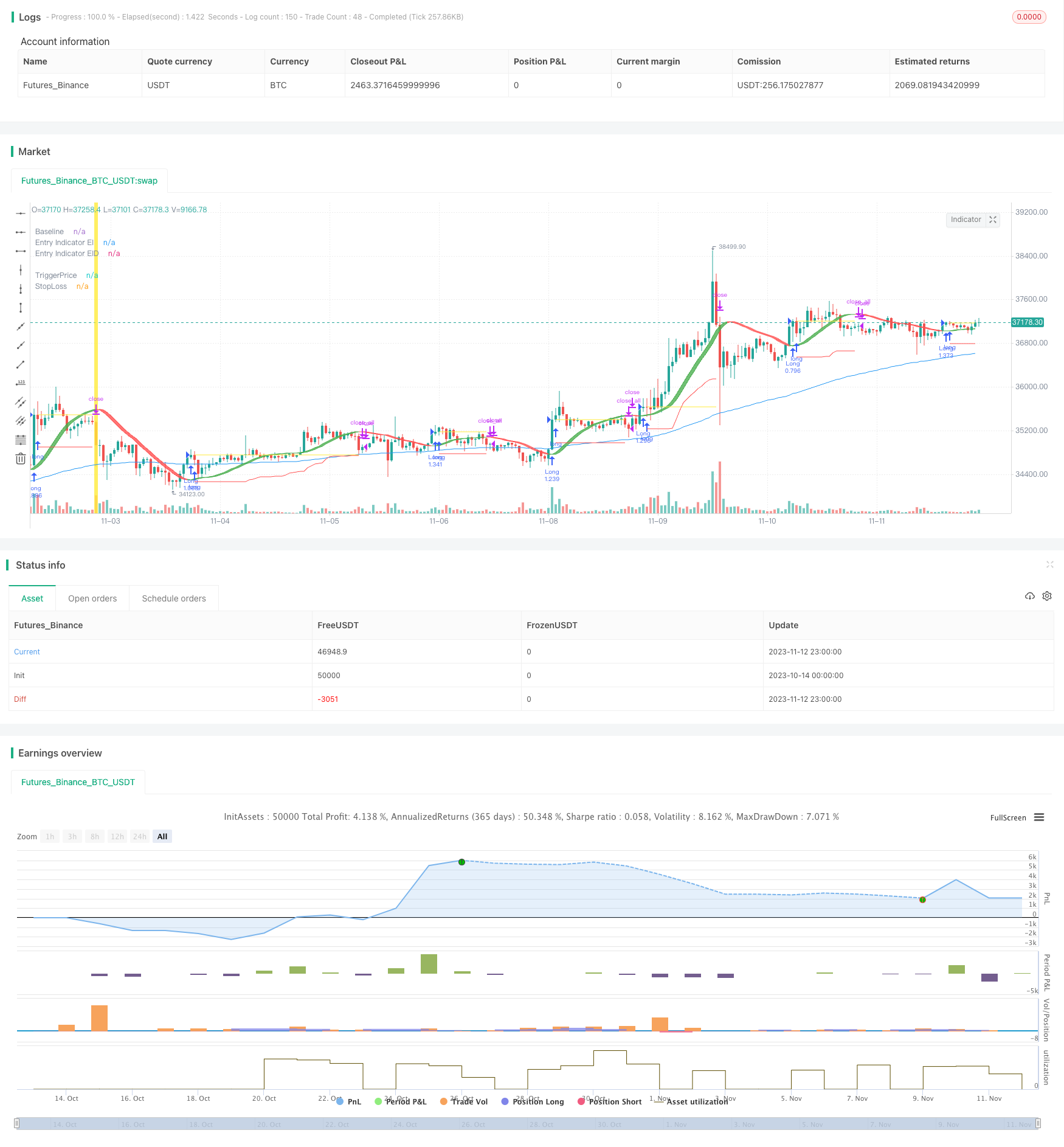

/*backtest

start: 2023-10-14 00:00:00

end: 2023-11-13 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// © Milleman

//@version=4

strategy("MilleMachine", overlay=true, default_qty_type = strategy.percent_of_equity, default_qty_value = 100, initial_capital=10000, commission_type=strategy.commission.percent, commission_value=0.06)

// Additional settings

Mode = input(title="Mode", defval="LongShort", options=["LongShort", "OnlyLong", "OnlyShort","Indicator Mode"])

UseTP = false //input(false, title="Use Take Profit?")

QuickSwitch = true //input(true, title="Quickswitch")

UseTC = true //input(true, title="Use Trendchange?")

// Risk management settings

//Spacer2 = input(false, title="======= Risk management settings =======")

Risk = input(1.0, title="% Risk",minval=0)/100

RRR = 2 //input(2,title="Risk Reward Ratio",step=0.1,minval=0,maxval=20)

SL_Mode = false // input(true, title="ON = Fixed SL / OFF = Dynamic SL (ATR)")

SL_Fix = 3 //input(3,title="StopLoss %",step=0.25, minval=0)/100

ATR = atr(14) //input(14,title="Periode ATR"))

Mul = input(2,title="ATR Multiplier",step=0.1)

xATR = ATR * Mul

SL = SL_Mode ? SL_Fix : (1 - close/(close+xATR))

// INDICATORS //////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////

Ind(type, src, len) =>

float result = 0

if type=="McGinley"

result := na(result[1]) ? ema(src, len) : result[1] + (src - result[1]) / (len * pow(src/result[1], 4))

if type=="HMA"

result := wma(2*wma(src, len/2)-wma(src, len), round(sqrt(len)))

if type=="EHMA"

result := ema(2*ema(src, len/2)-ema(src, len), round(sqrt(len)))

if type=="THMA"

lend = len/2

result := wma(wma(src, lend/3)*3-wma(src, lend/2)-wma(src,lend), lend)

if type=="SMA" // Simple

result := sma(src, len)

if type=="EMA" // Exponential

result := ema(src, len)

if type=="DEMA" // Double Exponential

e = ema(src, len)

result := 2 * e - ema(e, len)

if type=="TEMA" // Triple Exponential

e = ema(src, len)

result := 3 * (e - ema(e, len)) + ema(ema(e, len), len)

if type=="WMA" // Weighted

result := wma(src, len)

if type=="VWMA" // Volume Weighted

result := vwma(src, len)

if type=="SMMA" // Smoothed

w = wma(src, len)

result := (w[1] * (len - 1) + src) / len

if type == "RMA"

result := rma(src, len)

if type=="LSMA" // Least Squares

result := linreg(src, len, 0)

if type=="ALMA" // Arnaud Legoux

result := alma(src, len, 0.85, 6)

if type=="Kijun" //Kijun-sen

kijun = avg(lowest(len), highest(len))

result :=kijun

if type=="WWSA" // Welles Wilder Smoothed Moving Average

result := nz(result[1]) + (close -nz(result[1]))/len

result

// Baseline : Switch from Long to Short and vice versa

BL_Act = input(true, title="====== Activate Baseline - Switch L/S ======")

BL_type = input(title="Baseline Type", defval="McGinley", options=["McGinley","HMA","EHMA","THMA","SMA","EMA","DEMA","TEMA","WMA","VWMA","SMMA","RMA","LSMA","ALMA","Kijun","WWSA"])

BL_src = input(close, title="BL source")

BL_len = input(50, title="BL length", minval=1)

BL = Ind(BL_type,BL_src, BL_len)

// Confirmation indicator

C1_Act = input(false, title="===== Activate Confirmation indicator =====")

C1_type = input(title="C1 Entry indicator", defval="SMA", options=["McGinley","HMA","EHMA","THMA","SMA","EMA","DEMA","TEMA","WMA","VWMA","SMMA","RMA","LSMA","ALMA","Kijun","WWSA"])

C1_src = input(close, title="Source")

C1_len = input(5,title="Length", minval=1)

C1 = Ind(C1_type,C1_src,C1_len)

// Entry indicator : Hull Moving Average

Spacer5 = input(true, title="====== ENTRY indicator =======")

EI_type = input(title="EI Entry indicator", defval="HMA", options=["McGinley","HMA","EHMA","THMA","SMA","EMA","DEMA","TEMA","WMA","VWMA","SMMA","RMA","LSMA","ALMA","Kijun","WWSA"])

EI_src = input(close, title="Source")

EI_Len = input(46,title="Length", minval=1)

EI = Ind(EI_type,EI_src,EI_Len)

// Trail stop settings

TrailActivation = input(true, title="===== Activate Trailing Stop =====")

TS_type = input(title="TS Traling Stop Type", defval="EMA", options=["McGinley","HMA","EHMA","THMA","SMA","EMA","DEMA","TEMA","WMA","VWMA","SMMA","RMA","LSMA","ALMA","Kijun","WWSA"])

TrailSLScaling = 1 //input(100, title="SL Scaling", minval=0, step=5)/100

TrailingSourceLong = Ind(TS_type,low,input(5,"Smoothing Trail Long EMA", minval=1))

TrailingSourceShort = Ind(TS_type,high,input(2,"Smoothing Trail Short EMA", minval=1))

//VARIABLES MANAGEMENT

TriggerPrice = 0.0, TriggerPrice := TriggerPrice[1]

TriggerSL = 0.0, TriggerSL := TriggerSL[1]

SLPrice = 0.0, SLPrice := SLPrice[1], TPPrice = 0.0, TPPrice := TPPrice[1]

isLong = false, isLong := isLong[1], isShort = false, isShort := isShort[1]

//LOGIC

GoLong = crossover(EI,EI[1]) and (strategy.position_size == 0.0 and QuickSwitch) and (not BL_Act or BL/BL[1] > 1) and (not C1_Act or C1>C1[1]) and (Mode == "LongShort" or Mode == "OnlyLong")

GoShort = crossunder(EI,EI[1]) and (strategy.position_size == 0.0 and QuickSwitch) and (not BL_Act or BL/BL[1] < 1) and (not C1_Act or C1<C1[1]) and (Mode == "LongShort" or Mode == "OnlyShort")

ExitLong = isLong and crossunder(EI,EI[1]) and UseTC

ExitShort = isShort and crossover(EI,EI[1]) and UseTC

//FRAMEWORK

//Reset Long-Short memory

if isLong and strategy.position_size == 0.0

isLong := false

if isShort and strategy.position_size == 0.0

isShort := false

//Long

if GoLong

isLong := true, TriggerPrice := close, TriggerSL := SL

TPPrice := UseTP? TriggerPrice * (1 + (TriggerSL * RRR)) : na

SLPrice := TriggerPrice * (1-TriggerSL)

Entry_Contracts = strategy.equity * Risk / ((TriggerPrice-SLPrice)/TriggerPrice) / TriggerPrice

strategy.entry("Long", strategy.long, comment=tostring(round((TriggerSL/TriggerPrice)*1000)), qty=Entry_Contracts)

strategy.exit("TPSL","Long", limit=TPPrice, stop=SLPrice)

if isLong

NewValSL = TrailingSourceLong * (1 - (SL*TrailSLScaling))

if TrailActivation and NewValSL > SLPrice

SLPrice := NewValSL

strategy.exit("TPSL","Long", limit=TPPrice, stop=SLPrice)

if ExitLong

strategy.close_all(comment="TrendChange")

isLong := false

//Short

if GoShort

isShort := true, TriggerPrice := close, TriggerSL := SL

TPPrice := UseTP? TriggerPrice * (1 - (TriggerSL * RRR)) : na

SLPrice := TriggerPrice * (1 + TriggerSL)

Entry_Contracts = strategy.equity * Risk / ((SLPrice-TriggerPrice)/TriggerPrice) / TriggerPrice

strategy.entry("Short", strategy.short, comment=tostring(round((TriggerSL/TriggerPrice)*1000)), qty=Entry_Contracts)

strategy.exit("TPSL","Short", limit=TPPrice, stop=SLPrice)

if isShort

NewValSL = TrailingSourceShort * (1 + (SL*TrailSLScaling))

if TrailActivation and NewValSL < SLPrice

SLPrice := NewValSL

strategy.exit("TPSL","Short", limit=TPPrice, stop=SLPrice)

if ExitShort

strategy.close_all(comment="TrendChange")

isShort := false

//VISUALISATION

plot(BL_Act?BL:na, color=color.blue,title="Baseline")

plot(C1_Act?C1:na, color=color.yellow,title="confirmation Indicator")

EIColor = EI>EI[1] ? color.green : color.red

Fill_EI = plot(EI, color=EIColor, linewidth=1, transp=40, title="Entry Indicator EI")

Fill_EID = plot(EI[1], color=EIColor, linewidth=1, transp=40, title="Entry Indicator EID")

fill(Fill_EI,Fill_EID, title="EI_Fill", color=EIColor,transp=50)

plot(strategy.position_size != 0.0 and (isLong or isShort) ? TriggerPrice : na, title="TriggerPrice", color=color.yellow, style=plot.style_linebr)

plot(strategy.position_size != 0.0 and (isLong or isShort) ? TPPrice : na, title="TakeProfit", color=color.green, style=plot.style_linebr)

plot(strategy.position_size != 0.0 and (isLong or isShort) ? SLPrice : na, title="StopLoss", color=color.red, style=plot.style_linebr)

bgcolor(isLong[1] and cross(low,SLPrice) and low[1] > SLPrice and TriggerPrice>SLPrice ? color.yellow : na, transp=75, title="SL Long")

bgcolor(isShort[1] and cross(high,SLPrice) and high[1] < SLPrice and TriggerPrice<SLPrice ? color.yellow : na, transp=75, title="SL Short")