Weighted Standard Deviation Trading Strategy

Author: ChaoZhang, Date: 2023-11-24 13:54:58Tags:

Overview

This strategy uses the weighted standard deviation indicator combined with moving average to implement trend trading on cryptocurrencies. It calculates a price channel of weighted standard deviation based on closing prices and volumes over a certain period. When the price breaks through the upper or lower channel, long or short positions are taken. Stop loss and take profit conditions are also set to limit losses per trade.

Strategy Logic

The code defines two custom functions to calculate weighted standard deviation from time series and arrays. The key steps are:

- Calculate the weighted average price based on closing price and volume

- Calculate the squared error of each candle vs the average price

- Calculate variance based on sample size, weights and adjusted mean

- Take square root to derive standard deviation

This gives us a channel centered on the weighted average price, with upper and lower bounds at one standard deviation away. When price breaks through the channel bottom from below, go long. When it breaks through the top from above, go short.

Advantage Analysis

The biggest edge of this strategy is the combination of moving average and volatility analysis. The MA judges the market trend direction while the SD range defines a sensible band - both verify each other for higher reliability. Also, the volume weighting helps filter false breaks for higher success probability on actual breaks.

The stop loss and take profit points further help trade with the trend and avoid excessive losses on reversals. This is a subtlety that many novice traders fail to implement.

Risk Analysis

The main risk is from violent market swings. This can cause the SD channel to swing wildly too, making judgements difficult. Also, choosing too short periods risks getting misled by noise and errors.

The remedy is to smooth the parameters and period settings appropriately. Consider combining other indicators like RSI to improve breakout confirmation.

Optimization Directions

- Optimize period parameters - test 5min, 15min, 30mins etc for best combo

- Optimize stop loss/take profit ratios for maximum return

- Add filters eg volume to avoid false breaks

- Add candlestick filters on close price, wick etc to improve accuracy

Conclusion

This strategy successfully employs the weighted standard deviation indicator together with MA to track cryptocurrency trends. Reasonable stop loss/take profit setups also help trade market rhythm and avoid excessive reversal losses. Further optimizations via parameter tuning and multi-indicator confirmation can improve reliability for a solid algo trading strategy.

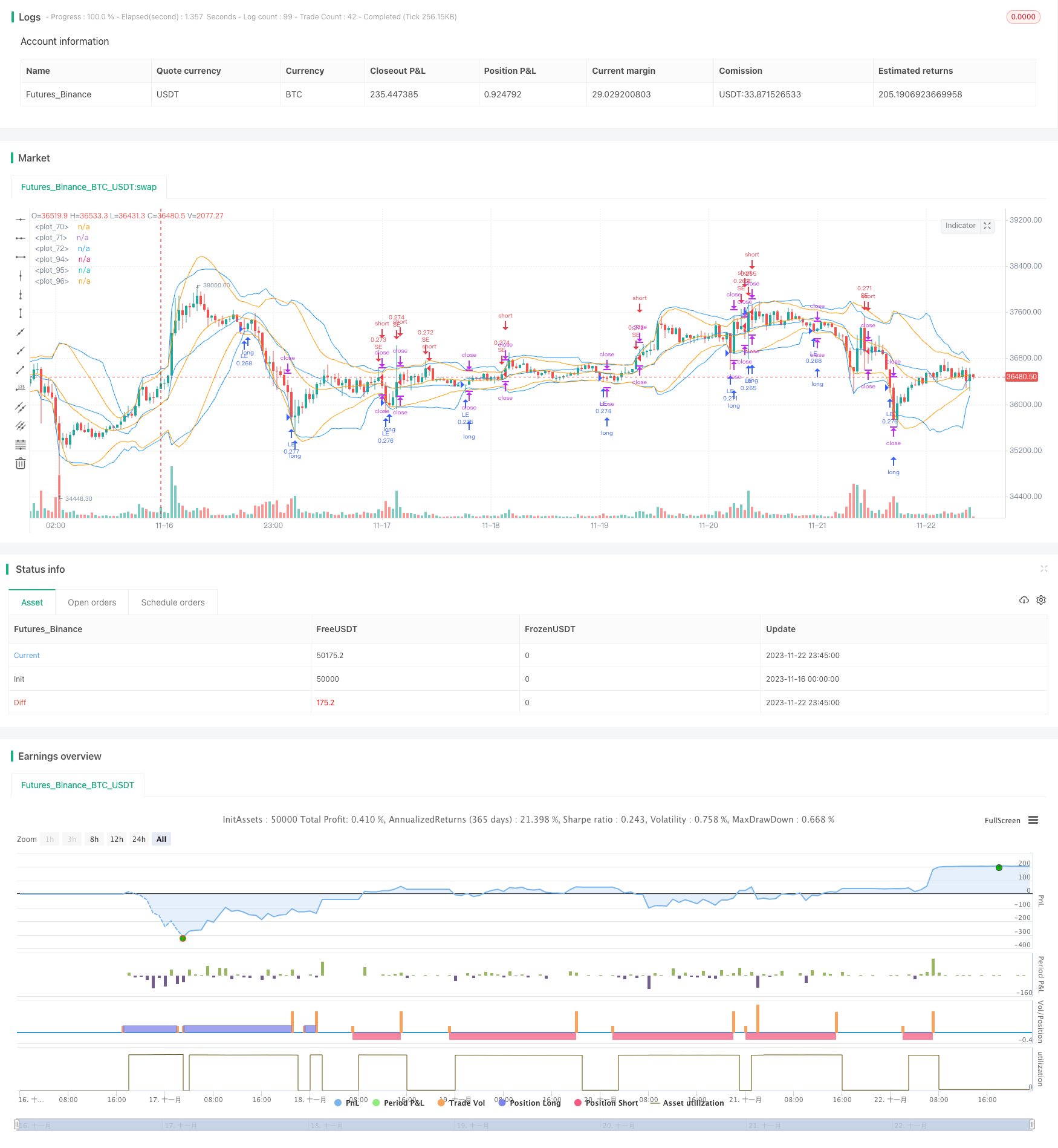

/*backtest

start: 2023-11-16 00:00:00

end: 2023-11-23 00:00:00

period: 45m

basePeriod: 5m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © rumpypumpydumpy © cache_that_pass

//@version=4

strategy("[cache_that_pass] 1m 15m Function - Weighted Standard Deviation", overlay=true, pyramiding=0, default_qty_type=strategy.percent_of_equity, default_qty_value=20, initial_capital=10000, commission_type=strategy.commission.percent, commission_value=0.075)

f_weighted_sd_from_series(_src, _weight, _n) => //{

// @function: Calculates weighted mean, variance, standard deviation, MSE and RMSE from time series variables

// @parameters:

// _src: time series variable of sample values

// _weight: time series of corresponding weight values.

// _n : number of samples

_xw = _src * _weight

_sum_weight = sum(_weight, _n)

_mean = sum(_xw, _n) / _sum_weight

float _sqerror_sum = 0

int _nonzero_n = 0

for _i = 0 to _n - 1

_sqerror_sum := _sqerror_sum + pow(_mean - _src[_i], 2) * _weight[_i]

_nonzero_n := _weight[_i] != 0 ? _nonzero_n + 1 : _nonzero_n

_variance = _sqerror_sum / ((_nonzero_n - 1) * _sum_weight / _nonzero_n)

_dev = sqrt(_variance)

_mse = _sqerror_sum / _sum_weight

_rmse = sqrt(_mse)

[_mean, _variance, _dev, _mse, _rmse]

//}

// -----------------------------------------------------------------------------

f_weighted_sd_from_arrays(_a_src, _a_weight, _n) => //{

// @function: Calculates weighted mean, variance, standard deviation, MSE and RMSE from arrays

// Expects index 0 of the arrays to be the most recent sample and weight values!

// @parameters:

// _a_src: array of sample values

// _a_weight: array of corresponding weight values.

// _n : number of samples

float _mean = na, float _variance = na, float _dev = na, float _mse = na

float _rmse = na, float _sqerror_sum = na, float _sum_weight = na

float[] _a_xw = array.new_float(_n)

int _nonzero_n = 0

if array.size(_a_src) >= _n

_sum_weight := 0

_sqerror_sum := 0

for _i = 0 to _n - 1

array.set(_a_xw, _i, array.get(_a_src, _i) * array.get(_a_weight, _i))

_sum_weight := _sum_weight + array.get(_a_weight, _i)

_nonzero_n := array.get(_a_weight, _i) != 0 ? _nonzero_n + 1 : _nonzero_n

_mean := array.sum(_a_xw) / _sum_weight

for _j = 0 to _n - 1

_sqerror_sum := _sqerror_sum + pow(_mean - array.get(_a_src, _j), 2) * array.get(_a_weight, _j)

_variance := _sqerror_sum / ((_nonzero_n - 1) * _sum_weight / _nonzero_n)

_dev := sqrt(_variance)

_mse := _sqerror_sum / _sum_weight

_rmse := sqrt(_mse)

[_mean, _variance, _dev, _mse, _rmse]

//}

// -----------------------------------------------------------------------------

// Example usage :

// -----------------------------------------------------------------------------

len = input(20)

// -----------------------------------------------------------------------------

// From series :

// -----------------------------------------------------------------------------

[m, v, d, mse, rmse] = f_weighted_sd_from_series(close, volume, len)

plot(m, color = color.blue)

plot(m + d * 2, color = color.blue)

plot(m - d * 2, color = color.blue)

// -----------------------------------------------------------------------------

// -----------------------------------------------------------------------------

// From arrays :

// -----------------------------------------------------------------------------

var float[] a_src = array.new_float()

var float[] a_weight = array.new_float()

if barstate.isfirst

for i = 1 to len

array.unshift(a_weight, i)

array.unshift(a_src, close)

if array.size(a_src) > len

array.pop(a_src)

[a_m, a_v, a_d, a_mse, a_rmse] = f_weighted_sd_from_arrays(a_src, a_weight, len)

plot(a_m, color = color.orange)

plot(a_m + a_d * 2, color = color.orange)

plot(a_m - a_d * 2, color = color.orange)

// -----------------------------------------------------------------------------

series_text = "Mean : " + tostring(m) + "\nVariance : " + tostring(v) + "\nSD : " + tostring(d) + "\nMSE : " + tostring(mse) + "\nRMSE : " + tostring(rmse)

array_text = "Mean : " + tostring(a_m) + "\nVariance : " + tostring(a_v) + "\nSD : " + tostring(a_d) + "\nMSE : " + tostring(a_mse) + "\nRMSE : " + tostring(a_rmse)

debug_text = "Volume weighted from time series : \n" + series_text + "\n\nLinearly weighted from arrays : \n" + array_text

//debug = label.new(x = bar_index, y = close, text = debug_text, style = label.style_label_left)

//.delete(debug[1])

//test strategy

if low <= (m - d * 2)

strategy.entry("LE", strategy.long)

if high >= (m + d * 2)

strategy.entry("SE", strategy.short)

// User Options to Change Inputs (%)

stopPer = input(3.11, title='Stop Loss %', type=input.float) / 100

takePer = input(7.50, title='Take Profit %', type=input.float) / 100

// Determine where you've entered and in what direction

longStop = strategy.position_avg_price * (1 - stopPer)

shortStop = strategy.position_avg_price * (1 + stopPer)

shortTake = strategy.position_avg_price * (1 - takePer)

longTake = strategy.position_avg_price * (1 + takePer)

if strategy.position_size > 0

strategy.exit(id="Close Long", stop=longStop, limit=longTake)

// strategy.close("LE", when = (longStop) or (longTake), qty_percent = 100)

if strategy.position_size < 0

strategy.exit(id="Close Short", stop=shortStop, limit=shortTake)

// strategy.close("SE", when = (shortStop) or (shortTake), qty_percent = 100)

- Traffic Light Trading Strategy Based on EMA

- Dual Moving Average Matching Strategy Based on Bollinger Bands

- Inverse Las Vegas Algorithmic Trading Strategy

- Solid Moving Average System Strategy

- Advanced Bollinger Band Moving Average Grid Trend Tracking Strategy

- Ichimoku Kinko Hyo indicator Balancing Trend Strategy

- Volume Price Indicator Balanced Trading Strategy

- Twisted SMA Adaptive Crossover Long Line Strategy

- Dual Moving Average Arbitrage Strategy

- Quantitative Investment Strategy Based on Monthly Buy Date

- Triple Moving Average Quantitative Trading Strategy

- EMA Crossover Strategy

- Short-Term, Medium-Term and Long-Term EMA Crossover Trading Strategy

- Trend Following Strategy Based on Time Series Decomposition and Volume Weighted Bollinger Bands

- Detrended Price Oscillator Quantitative Trading Strategy

- Multi-indicator Trend Following Strategy

- CCI Dual Timeframe Trend Following Strategy

- T3-CCI Trend Tracking Strategy

- Cross Timeframe SuperTrend Breakout Strategy

- Momentum Reversal Moving Average Combination Strategy