Fast RSI Strategy Analysis

Author: ChaoZhang, Date: 2023-12-04 14:40:02Tags:

Strategy Name

Extreme Dual-Directional RSI Trend Strategy

Overview

This strategy utilizes the RSI indicator to determine price trends quickly. It has both long and short capabilities to capture faster short-term price levels.

Strategy Principle

The strategy uses an improved RSI indicator to judge the overbought and oversold status of prices, combined with candle body filtering to reduce noise. It goes long or short when the RSI is in the overbought or oversold zone and the candle body size is greater than 1/3 of the average body size. It closes positions when the candle reverses direction and the RSI pulls back to safer levels after the trading signals trigger.

Advantage Analysis

The strategy responds swiftly and can capture faster short-term trends. Meanwhile, the body filtering helps reduce noise and avoid being misled by false breakouts. It suits high volatility products well and can achieve higher returns.

Risk Analysis

The strategy is quite sensitive to price changes, easily misguided by false signals in the market. Also, stop losses may trigger frequently in the high volatility market. We can loosen the stop loss range and optimize RSI parameters to lower the false signal probability.

Optimization Directions

We can test different periodic parameters of the indicators to optimize the strategy and find the best parameter combination. Also, incorporating other indicators like the Turtle Trading rules may aid further in filtering signals. Training better RSI thresholds via machine learning methods could also be a worthwhile attempt.

Summary

Overall, this is an efficient and responsive short-term strategy. With some parameter and model optimization, it has the potential to further enhance stability and profitability. It merits continued research and tracking by quant traders.

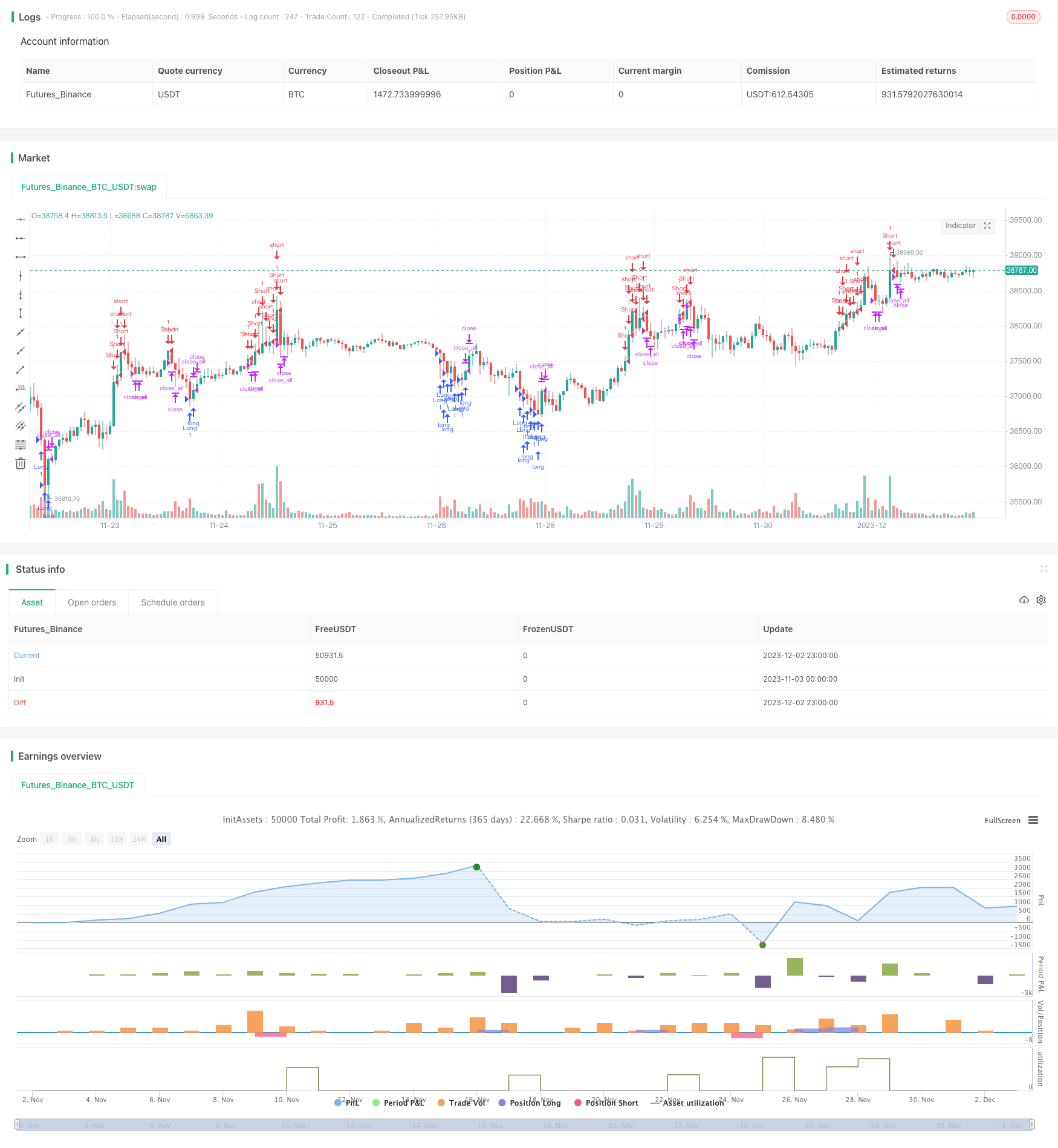

/*backtest

start: 2023-11-03 00:00:00

end: 2023-12-03 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

strategy(title = "Noro's Fast RSI Strategy v1.1", shorttitle = "Fast RSI str 1.1", overlay = true, default_qty_type = strategy.percent_of_equity, default_qty_value = 100, pyramiding = 5)

//Settings

needlong = input(true, defval = true, title = "Long")

needshort = input(true, defval = true, title = "Short")

rsiperiod = input(7, defval = 7, minval = 2, maxval = 50, title = "RSI Period")

limit = input(30, defval = 30, minval = 1, maxval = 100, title = "RSI limit")

rsisrc = input(close, defval = close, title = "RSI Source")

fromyear = input(2018, defval = 2018, minval = 1900, maxval = 2100, title = "From Year")

toyear = input(2100, defval = 2100, minval = 1900, maxval = 2100, title = "To Year")

frommonth = input(01, defval = 01, minval = 01, maxval = 12, title = "From Month")

tomonth = input(12, defval = 12, minval = 01, maxval = 12, title = "To Month")

fromday = input(01, defval = 01, minval = 01, maxval = 31, title = "From day")

today = input(31, defval = 31, minval = 01, maxval = 31, title = "To day")

//Fast RSI

fastup = rma(max(change(rsisrc), 0), rsiperiod)

fastdown = rma(-min(change(rsisrc), 0), rsiperiod)

fastrsi = fastdown == 0 ? 100 : fastup == 0 ? 0 : 100 - (100 / (1 + fastup / fastdown))

uplimit = 100 - limit

dnlimit = limit

//Body

body = abs(close - open)

emabody = ema(body, 30) / 3

//Signals

bar = close > open ? 1 : close < open ? -1 : 0

up = bar == -1 and fastrsi < dnlimit and body > emabody

dn = bar == 1 and fastrsi > uplimit and body > emabody

exit = ((strategy.position_size > 0 and fastrsi > dnlimit) or (strategy.position_size < 0 and fastrsi < uplimit)) and body > emabody

//Trading

if up

strategy.entry("Long", strategy.long, needlong == false ? 0 : na, when=(time > timestamp(fromyear, frommonth, fromday, 00, 00) and time < timestamp(toyear, tomonth, today, 00, 00)))

if dn

strategy.entry("Short", strategy.short, needshort == false ? 0 : na, when=(time > timestamp(fromyear, frommonth, fromday, 00, 00) and time < timestamp(toyear, tomonth, today, 00, 00)))

if time > timestamp(toyear, tomonth, today, 00, 00) or exit

strategy.close_all()

- Full Crypto Swing ALMA Cross MACD Quantitative Strategy

- Dual Moving Average Reversal Trading Strategy

- Adaptive Price Channel Strategy

- Turtle Breakout Strategy

- Mean Reversion Envelope Moving Average Strategy

- Momentum Breakout Moving Average Trading Strategy

- Dynamic Grid Trading Management Strategy

- Dynamic Moving Average Tracking Strategy

- Double Moving Average Oscillation Trading Strategy

- EMA bands + Leledc + Bollinger bands trend following strategy

- Adaptive Volatility Breakout Trading Strategy

- High Minus Exponential Moving Average Stock Strategy

- Donchian Channel Breakout Strategy

- Bitcoin - MA Crossover Strategy

- Fisher Transform Backtest Strategy

- 123 Reversal and STARC Bands Combo Strategy

- TFO and ATR Based Trend Tracking Stop Loss Strategy

- The Great Delight Multifactor Quantitative Strategy

- Follow Line Strategy

- Quadriple Exponential Moving Average Trading Strategy