Fibonacci Retracement Reversal Strategy

Author: ChaoZhang, Date: 2023-12-07 15:15:26Tags:

Overview

The Fibonacci Retracement Reversal strategy is a quantitative trading strategy based on Fibonacci retracement levels and the Relative Strength Index (RSI) indicator. This strategy combines the Fibonacci channel theory and overbought/oversold indicator to make reversal trades against the major trend in order to profit in the short-term cycles.

Strategy Logic

The strategy first calculates two important price zones based on the 0.618 Fibonacci levels - the 0.618 times high point and 0.618 times low point. When prices approach these areas, we believe a reversal may occur.

In addition, the strategy also uses the RSI indicator to determine overbought/oversold conditions. RSI below 30 indicates oversold status while RSI above 70 suggests overbought condition. These also imply potential price reversals.

Combining the two conditions, the buy signal is triggered when: close breaks above the 0.618 times low point AND RSI is below 30; the sell signal triggers when: close breaks below the 0.618 times high point AND RSI goes over 70.

Upon buy signal, the strategy will long at market price. Upon sell signal, it will short at market price. Also, take profit and stop loss levels are set so that the position will be closed when price moves favorably by certain percentage (take profit) or moves adversely by certain percentage (stop loss).

Pros

The strategy combines both trend and reversal scenarios, taking into account major trend while profiting from short-term retracement. The main advantages are:

- Fibonacci levels have inherent support/resistance attributes, serving as effective price zone indicator.

- RSI overbought/oversold status suggests potential turning points.

- Long/short signals are clear, catching reversal chances.

- Take profit/stop loss controls risk.

Risks

There are some risks to be awared of:

- Losses may occur if no major trend reversal happens despite short-term bounces. Larger timeframe analysis can help avoid this.

- Stop loss may be triggered before reversal happens. Wider stop loss zone could help.

- Reversals may sustain for long time, requiring sufficient capital support.

Optimization

The strategy can be further optimized by:

-

Collect more historical data to test and tune key parameters like Fibonacci zone range and RSI overbought/oversold lines for better fit to real market.

-

Incorporate more indicators to generate stronger signals, like candlestick patterns, volume changes etc.

-

Adjust parameters or rules according to different trading instruments’ characteristics.

-

Add dynamic stop loss mechanism to trail price real-time.

Conclusion

The Fibonacci Retracement Reversal strategy balances trend and reversal scenarios to profit in short-term while controlling risks. Further optimizations may lead to greater returns.

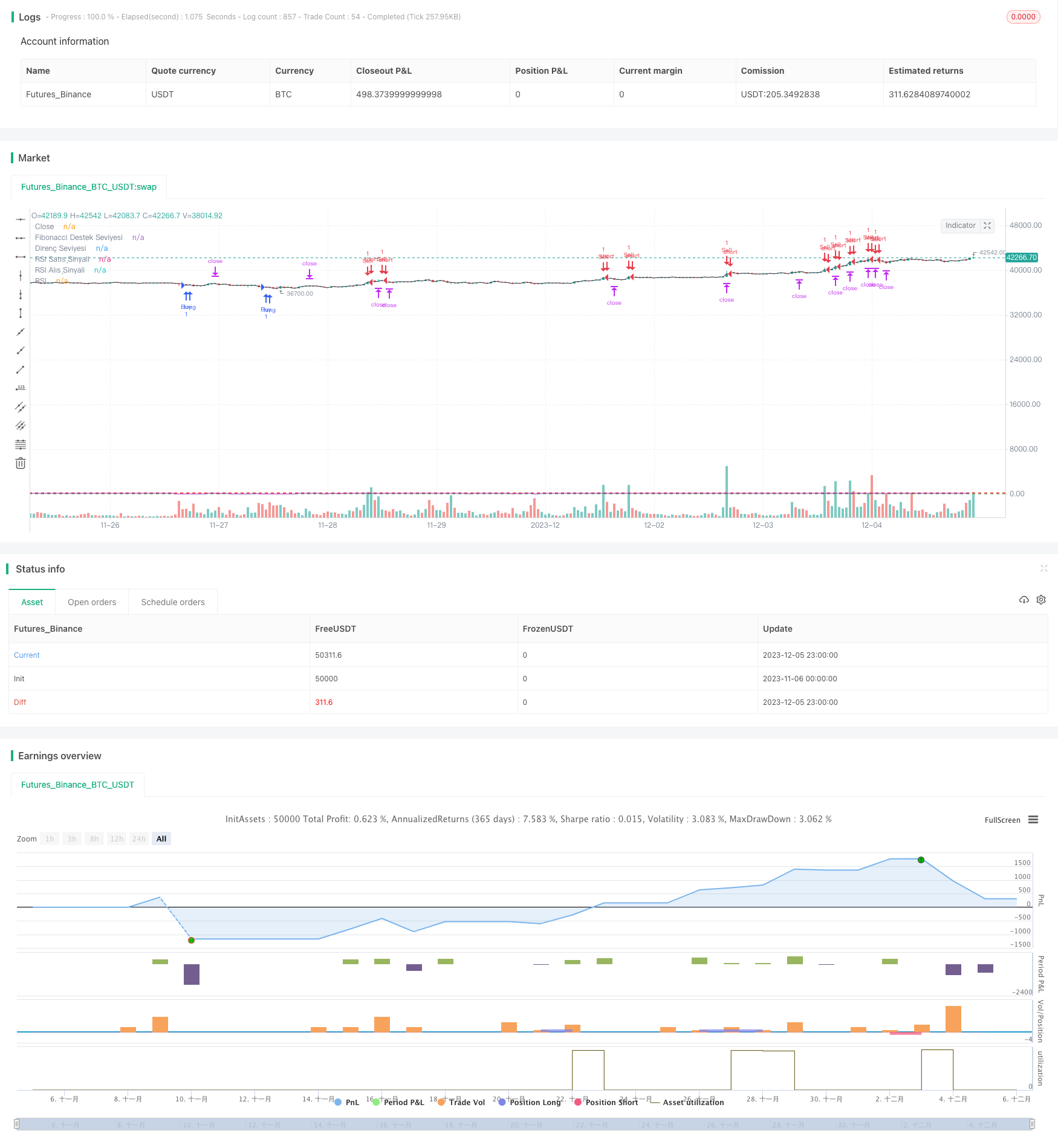

/*backtest

start: 2023-11-06 00:00:00

end: 2023-12-06 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("FBS Trade", overlay=true)

// Fibonacci seviyeleri

fibonacciLevels = input(0.618, title="Fibonacci Düzeltme Seviyesi")

// RSI ayarları

rsiLength = input(14, title="RSI Periyodu")

overboughtLevel = input(70, title="RSI Satış Sinyali Seviyesi")

oversoldLevel = input(30, title="RSI Alış Sinyali Seviyesi")

// Take Profit ve Stop Loss yüzdesi

takeProfitPercent = input(1, title="Take Profit Yüzdesi") / 100

stopLossPercent = input(1, title="Stop Loss Yüzdesi") / 100

// Fibonacci seviyelerini hesapla

highFibo = high * (1 + fibonacciLevels)

lowFibo = low * (1 - fibonacciLevels)

// RSI hesaplama

rsiValue = ta.rsi(close, rsiLength)

// Alış ve satış koşulları

buyCondition = close > lowFibo and rsiValue < 30

sellCondition = close < highFibo and rsiValue > overboughtLevel

// Take Profit ve Stop Loss seviyeleri

takeProfitLong = strategy.position_avg_price * (1 + takeProfitPercent)

stopLossLong = strategy.position_avg_price * (1 - stopLossPercent)

takeProfitShort = strategy.position_avg_price * (1 - takeProfitPercent)

stopLossShort = strategy.position_avg_price * (1 + stopLossPercent)

// Alış ve satış işlemleri

if (buyCondition)

strategy.entry("Buy", strategy.long)

if (sellCondition)

strategy.entry("Sell", strategy.short)

// Take Profit ve Stop Loss seviyeleri

if (strategy.position_size > 0)

strategy.exit("Take Profit/Close Buy", from_entry="Buy", limit=takeProfitLong, stop=stopLossLong)

if (strategy.position_size < 0)

strategy.exit("Take Profit/Close Sell", from_entry="Sell", limit=takeProfitShort, stop=stopLossShort)

// Sadece mumları ve buy/sell işlemlerini göster

plot(close, color=color.black, title="Close")

// Destek ve direnç bölgeleri

supportLevel = input(27, title="Fibonacci Destek Seviyesi")

resistanceLevel = input(200, title="Direnç Seviyesi")

hline(supportLevel, "Fibonacci Destek Seviyesi", color=color.green)

hline(resistanceLevel, "Direnç Seviyesi", color=color.red)

// Trend çizgileri

var line trendLine = na

if (ta.crossover(close, highFibo))

trendLine := line.new(bar_index[1], highFibo[1], bar_index, highFibo, color=color.green, width=2)

if (ta.crossunder(close, lowFibo))

trendLine := line.new(bar_index[1], lowFibo[1], bar_index, lowFibo, color=color.red, width=2)

// RSI ve Fibo'yu grafiğe çizme

hline(overboughtLevel, "RSI Satış Sinyali", color=color.red, linestyle=hline.style_dashed)

hline(oversoldLevel, "RSI Alış Sinyali", color=color.green, linestyle=hline.style_dashed)

plot(rsiValue, color=color.purple, title="RSI")

// 15 dakikalıkta 3 mumda bir alarm

is15MinBar = ta.change(time('15'), 1)

if (is15MinBar % 3 == 0)

alert("15 dakikalıkta 3 mum geçti.")

- StochRSI Based Quantitative Trading Strategy

- Dual EMA Engulfing Breakout Strategy

- Alligator RSI Trading Strategy

- RSI and Stochastic RSI Combination Strategy

- Double Rail Breakthrough Moving Average Crossover Strategy

- Short-term Trading Strategy Based on SMA and EMA

- Dynamic Momentum Strategy

- John's Bitcoin Intraday Trading Strategy Based on Multiple Indicators

- Slow Moving Average Strategy

- Z-Score Price Breakout Strategy

- Dual-factor Quant Trading Strategy

- Dual EMA Golden Cross Trading Strategy

- BTC Trading Strategy Based on Moving Average Crossover

- MACD Indicator Bottom Reversal Early Warning Strategy

- Mala's Adaptive Moving Average Strategy

- Golden Ratio Mean Reversion Trend Trading Strategy

- Trend Trading Strategy Based on Multiple Moving Averages

- Dual Indicator Filtered Buy Signal Strategy

- Dual Moving Average Crossover Trading Strategy

- Dual EMA Crossover Strategy