Camarilla Pivot Points Breakthrough and Momentum Reversal Low Absorption Golden Cross Strategy

Author: ChaoZhang, Date: 2023-12-07 16:57:11Tags:

Overview

This strategy is based on the breakthrough signals of Camarilla pivot points, combined with the RSI reversal indicator as a low absorption opportunity, forming an advanced momentum reversal low absorption strategy. When the price breaks through the Camarilla pivot point, a trading signal is generated. The low RSI further confirms the dip opportunity. This belongs to an advanced momentum reversal strategy.

Strategy Principle

The core signal of the strategy comes from the Camarilla pivot points. Camarilla pivot points are calculated based on the price range of the previous day and divided into S1 to S5 pivot points and R1 to R5 pivot points. A buy signal is generated when the price breaks upward from the S1 pivot point, and a sell signal is generated when the price breaks downward from the R1 pivot point. In addition, the RSI indicator is used to determine whether it is in an oversold state to improve the success rate of entry.

Specifically, the strategy first calculates the Camarilla pivot points based on yesterday’s highest price, lowest price and closing price. Then it judges whether the closing price breaks through the pivot point to generate trading signals. At the same time, it determines whether the RSI indicator is in a low position. Below 30 is considered oversold. Only when the closing price breaks through the pivot point and the RSI is below 30 will a real trading signal be generated. The buy signal is the upward breakthrough of the S1 pivot point, and the sell signal is the downward breakthrough of the R1 pivot point.

For example, if yesterday’s price fluctuated between 10-11, today’s closing price breaks through 11.05 (S1 pivot point), and at the same time the RSI indicator shows 20, a buy signal is generated. If today’s closing price breaks through 10.95 (R1 pivot point), and RSI shows 20, a sell signal is generated. Therefore, this strategy combines the advantages of breakthrough signals and oversold signals.

Advantage Analysis

The biggest advantage of this strategy is to identify oversold and reversal opportunities. Camarilla pivot points itself will grasp important support and resistance points of prices. Combined with the RSI indicator to determine the timing of reversals, it can accurately locate the bottom and avoid chasing rises and falls. This belongs to a more advanced breakthrough strategy.

In addition, pivot points are calculated dynamically to keep up with price changes in a timely manner. Unlike traditional technical indicators that require parameter settings. The strategy inherits the advantages of pivot point analysis and is more flexible. In addition, reversal opportunities are quite clear and will not appear frequent false signals.

Risk Analysis

The biggest risk of this strategy is that prices may have false breakouts. Although the RSI indicator is used to confirm the oversold state, the price may still reverse after breaking through the pivot point. This will cause the stop loss to be hit.

Another risk is that the RSI indicator fails. Even if there is a plunge, if the RSI does not fall below 30, no trading signal is formed, and reversal opportunities will be missed. To address this risk, RSI parameter settings can be optimized accordingly.

Optimization Directions

The following aspects of the strategy can be optimized:

-

Optimize RSI parameters. Test different oversold lines, is 30 better or 20 more appropriate?

-

Add other indicators for combination. For example, the KDJ indicator can further confirm the reliability of the reversal signal.

-

Test different Camarilla pivot points. You can only use S1 and R1 to reduce the probability of false breakouts.

-

Optimize stop loss strategies. You can set stop loss based on ATR indicators or track breakthrough pivot points as stop loss.

-

Test different types of contracts. Applicable to different types of products such as stock index, foreign exchange, commodities. Parameters need to be adjusted.

Summary

This strategy belongs to an advanced momentum reversal breakthrough strategy. It judges breakthrough signals through Camarilla pivot points and determines oversold status through RSI indicators. The advantage of the strategy is to identify reversal opportunities. The biggest risk is the false breakthrough of prices. By optimizing parameters and risk management, the stability and profitability of the strategy can be further improved.

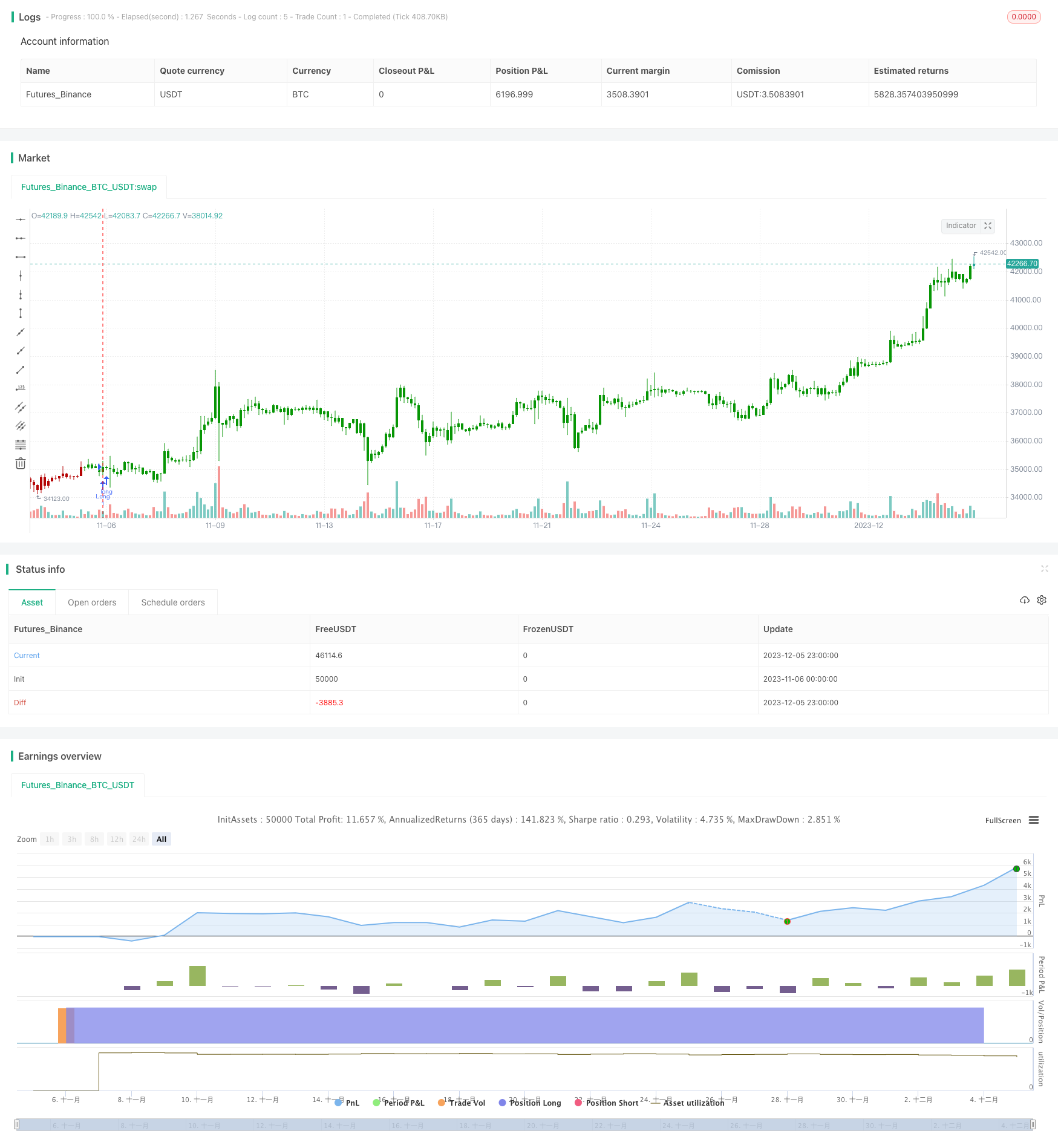

/*backtest

start: 2023-11-06 00:00:00

end: 2023-12-06 00:00:00

period: 3h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 07/05/2020

// Pivot point studies highlight prices considered to be a likely turning point

// when looking at values from a previous period, whether it be daily, weekly,

// quarterly or annual. Each pivot point study has its own characteristics on

// how these points are calculated.

//

// Red color = Sell

// Green color = Buy

//

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

strategy(title="Camarilla Pivot Points Backtest", shorttitle="CPP", overlay = true)

res = input(title="Resolution", type=input.resolution, defval="D")

SellFrom = input(title="Sell from ", defval="R1", options=["R1", "R2", "R3", "R4", "R5"])

BuyFrom = input(title="Buu from ", defval="S1", options=["S1", "S2", "S3", "S4", "S5"])

reverse = input(false, title="Trade reverse")

xHigh = security(syminfo.tickerid,res, high)

xLow = security(syminfo.tickerid,res, low)

xClose = security(syminfo.tickerid,res, close)

xXLC3 = (xHigh+xLow+xClose) / 3

xRange = xHigh-xLow

S1 = xClose - xRange * (1.1 / 12)

S2 = xClose - xRange * (1.1 / 6)

S3 = xClose - xRange * (1.1 / 4)

S4 = xClose - xRange * (1.1 / 2)

R1 = xClose + xRange * (1.1 / 12)

R2 = xClose + xRange * (1.1 / 6)

R3 = xClose + xRange * (1.1 / 4)

R4 = xClose + xRange * (1.1 / 2)

R5 = (xHigh/xLow) * xClose

S5 = xClose - (R5 - xClose)

pos = 0

S = iff(BuyFrom == "S1", S1,

iff(BuyFrom == "S2", S2,

iff(BuyFrom == "S3", S3,

iff(BuyFrom == "S4", S4,

iff(BuyFrom == "S5", S5, 0)))))

B = iff(SellFrom == "R1", R1,

iff(SellFrom == "R2", R2,

iff(SellFrom == "R3", R3,

iff(SellFrom == "R4", R4,

iff(SellFrom == "R5", R5, 0)))))

pos := iff(close > B, 1,

iff(close < S, -1, nz(pos[1], 0)))

possig = iff(reverse and pos == 1, -1,

iff(reverse and pos == -1 , 1, pos))

if (possig == 1)

strategy.entry("Long", strategy.long)

if (possig == -1)

strategy.entry("Short", strategy.short)

if (possig == 0)

strategy.close_all()

barcolor(possig == -1 ? #b50404: possig == 1 ? #079605 : #0536b3 )

- Dual Moving Average Price Reversal Breakout Strategy

- Moving Average Pullback Trading Strategy

- Moving Average Aggregation Williams Commercial Bid-Ask Pressure Indicator Strategy

- Dual Moving Average Reversal Tracking Strategy

- Moving Average Aggregation MACD Strategy

- EMAskeletonstrategy

- Quantitative Trading Strategy Based on Random Numbers

- MACD-based Dual Trading Strategy

- Parabolic SAR and CCI Strategy with EMA Exit for Gold Trading

- EMA Momentum Moving Average Crossover Strategy

- Donchian Channel With Trailing Stop Loss Strategy

- The Vortex Oscillator Trend Following Strategy

- Intraday Pivot Points Trading Strategy

- Comb Reverse EMA Volume Weighting Optimization Trading Strategies

- Fibonacci Zone DCA Strategy

- Bollinger Bands Reversal Trend Strategy

- StochRSI Based Quantitative Trading Strategy

- Dual EMA Engulfing Breakout Strategy

- Alligator RSI Trading Strategy

- RSI and Stochastic RSI Combination Strategy