Price Change & Average Pricing Strategy Based on Quantitative Indicators

Author: ChaoZhang, Date: 2023-12-11 11:18:56Tags:

Overview

This strategy combines the price change rate and moving average technical indicators to locate the buy and sell points accurately. When the price drops sharply, a buy threshold is established. And when the price continues to fall, long positions are opened. When the price rises, a sell threshold is set up. And existing long positions are closed out when the price keeps rising and breaks through the sell threshold. At the same time, the strategy also adopts the pyramiding method to open multiple long positions at different price levels to lower the cost.

Principles

Long Entry Logic

- Calculate the Rate of Change (ROC) of the price, and set up the long entry threshold line.

- When the price breaks through the long entry threshold downwards, record this breakpoint and initiate the long entry limit line.

- The long entry limit line lasts for a certain duration defined by input parameters and expires afterwards.

- When the price continues to fall and crosses below the long entry limit line, the first long position is opened.

Long Close Logic

- Calculate the Rate of Change (ROC) of the price, and set up the long close threshold line.

- When the price breaks through the long close threshold upwards, record this breakpoint and initiate the long close limit line.

- The long close limit line lasts for a certain duration defined by input parameters and expires afterwards.

- When the price continues to rise and crosses above the long close limit line, all existing long positions are closed.

Risk Control

The strategy has built-in stop loss and take profit functions that can be customized to control risks dynamically.

Pyramiding

When opening each new trade position, the system calculates the subsequent long entry price according to the input percentage parameters, thus implementing averaging down through multiple long entries.

Advantages

- Adopt the rate of change (ROC) indicator to locate buy and sell signals accurately. ROC is very sensitive to price changes.

- Use limit lines for further confirmation of entry and exit signals to avoid false breaks.

- The pyramiding method tracks market value while keeping risks under control.

- Built-in stop loss and take profit strictly controls risks for each position.

Risks & Solutions

- Fierce market fluctuation may lead to too many open positions. We can set reasonable parameters for pyramiding to limit total open positions.

- Stop loss or take profit may get triggered frequently when the market is ranging. We can loosen the percentage levels or even disable SL & TP in sideways markets.

Optimizations

- Combine with other indicators like moving averages to filter entry signals. Only adopt ROC signals when prices actually break the MA lines.

- Improve the pyramiding logic, open subsequent positions only when prices continue to fall by a certain percentage instead of just lowering the entry price.

- Optimal parameter settings may differ significantly across trading instruments. Extensive backtest and demo trading is necessary.

- Build an adaptive stop loss mechanism with different percentage levels based on market volatility conditions.

Conclusion

The strategy effectively combines accurate entry signals with limit line filters, built-in risk management functions, and pyramiding for position sizing. With reasonable parameter tuning, it can acquire excess returns while keeping risks in check. Future improvements may focus more on signal filtering methods and risk control for broader market adaptability.

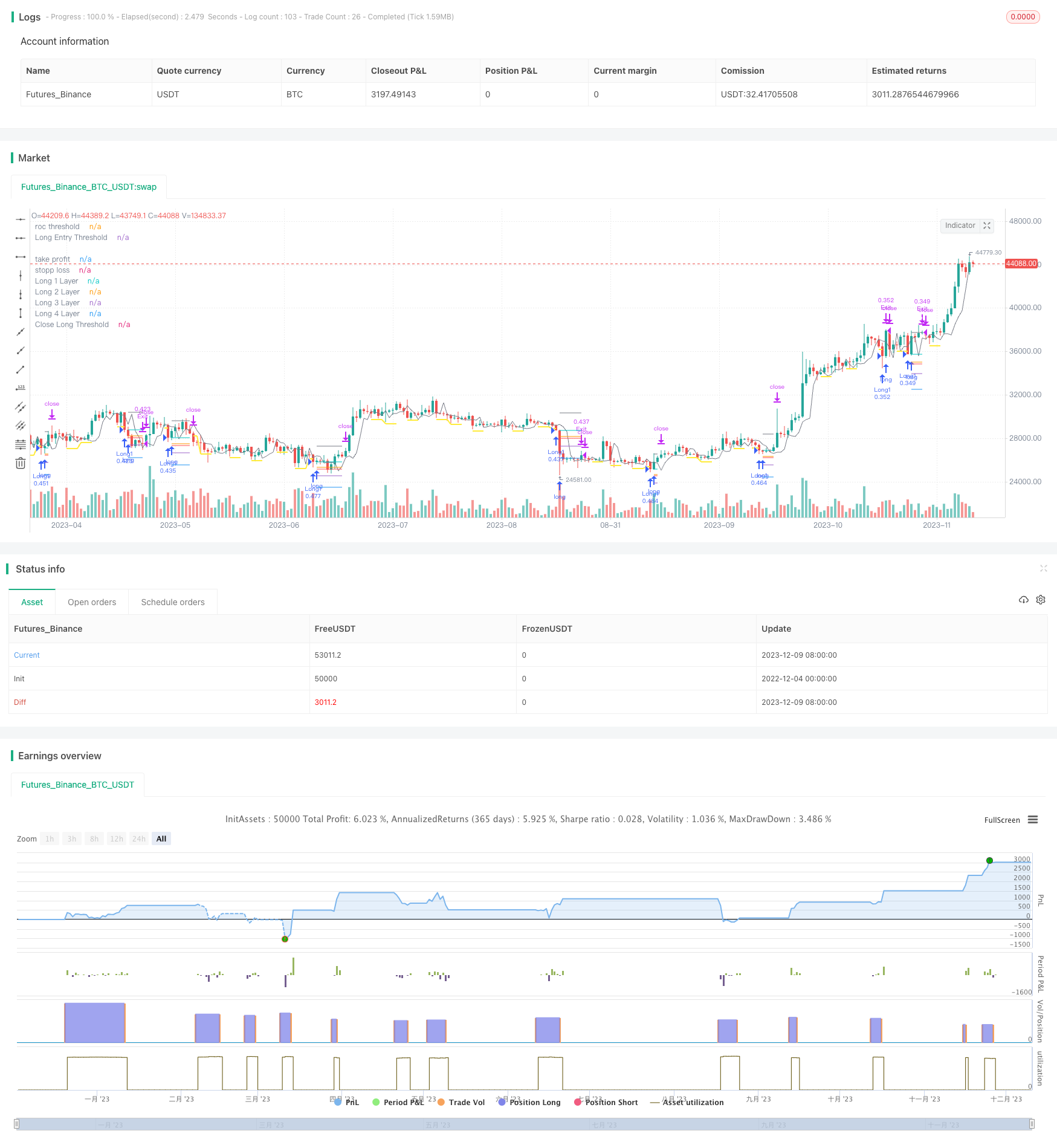

/*backtest

start: 2022-12-04 00:00:00

end: 2023-12-10 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// @version=4

// © A3Sh

// Rate of price change / Price averaging strategy //

// When the price drops to a specified percentage, a Long Entry Threshold is setup.

// The Long Entry Threshold is only active for a specified number of bars and will de-activate when not crossed.

// When the price drops further and crosses the Entry Threshold with a minimum of a specified percentage, a Long Position is entered.

// The same reverse logic used to close the Long Position.

// Stop loss and take profit are active by default. With proper tweaking of the settings it is possible to de-activate SL and TP.

// The strategy is inspired by the following strategies:

// Price Change Scalping Strategy developed by Prosum Solutions, https://www.tradingview.com/script/ue7Uc3sN-Price-Change-Scalping-Strategy-v1-0-0/

// Scalping Dips On Trend Strategy developed by Coinrule, https://www.tradingview.com/script/iHHO0PJA-Scalping-Dips-On-Trend-by-Coinrule/

strategy(title = "ROC_PA_Strategy_@A3Sh", overlay = true )

// Portfolio & Leverage Example

// credit: @RafaelZioni, https://www.tradingview.com/script/xGk5K4DE-BTC-15-min/

ge(value, precision) => round(value * (pow(10, precision))) / pow(10, precision)

port = input(25, group = "Risk", title = "Portfolio Percentage", type = input.float, step = 0.1, minval = 0.1, maxval = 200)

leverage = input(1, group = "Risk", title = "Leverage", minval = 1, maxval = 100)

mm = input(5, group = "Risk", title = "Broker Maintenance Margin Percentage", type = input.float, step = 0.1, minval = 0.1, maxval = 200)

c = ge((strategy.equity * leverage / open) * (port / 100), 4)

// Take Profit

tpa = input(true, type = input.bool, title = "Take Profit", group = "Risk", inline = "Take Profit")

tpp = input(5.6, type = input.float, title = "Percentage" , group = "Risk", step = 0.1, minval = 0.1, inline = "Take Profit")

tp = strategy.position_avg_price + (strategy.position_avg_price / 100 * tpp)

plot (tpa and strategy.position_size > 0 ? tp : na, color = color.gray, title = "take profit", style= plot.style_linebr, linewidth = 1)

// Stop Loss

sla = input(true, type = input.bool, title = "Stop Lossss ", group = "Risk", inline = "Stop Loss")

slp = input(2.5, type = input.float, title = "Percentage", group = "Risk", step = 0.1, minval = 0.1, inline = "Stop Loss")

sl = strategy.position_avg_price - (strategy.position_avg_price / 100 *slp)

plot (sla and strategy.position_size > 0 ? sl : na, color = color.red, title = "stopp loss", style= plot.style_linebr, linewidth = 1)

stopLoss = sla ? sl : na

// Long position entry layers. Percentage from the entry price of the the first long

ps2 = input(2, group = "Price Averaging Layers", title = "2nd Layer Long Entry %", step = 0.1)

ps3 = input(5, group = "Price Averaging Layers", title = "3rd Layer Long Entry %", step = 0.1)

ps4 = input(9, group = "Price Averaging Layers", title = "4th Layer Long Entry %", step = 0.1)

// ROC_Trigger Logic to open Long Position

rocLookBack = input(3, group = "ROC Logic to OPEN Long Entry", title="Rate of Change bar lookback")

rocThreshold = input(0.5, group = "ROC Logic to OPEN Long Entry", title="ROC Threshold % to Setup Long Entry", step = 0.1)

entryLimit = input(0.5, group = "ROC Logic to OPEN Long Entry", title="Price Drop Threshold % to OPEN Long Entry", step = 0.1)

entryTime = input(3, group = "ROC Logic to OPEN Long Entry", title="Duration of Long Entry Threshold Line in bars")

minLimit = input(0.8, group = "ROC Logic to OPEN Long Entry", title="Min % of Price Drop to OPEN Long Entry", step = 0.1)

//ROC calculation based to the price level of previous X bars

roc = close[rocLookBack] - (close / 100 * rocThreshold)

plot (roc, color = color.gray, title = "roc threshold", linewidth = 1 , transp = 20)

rocT1 = open > roc and close < roc ? 1 : 0 // When the price CROSSES the Entry Limit

rocT2 = (open < roc) and (close < roc) ? 1 : 0 // When the price is BELOW the Entry Limit

rocTrigger = rocT1 or rocT2

// Condition for Setting Up a Long Entry Thershold Line

rocCrossed = false

var SetUpLong = false

if rocTrigger and not SetUpLong

rocCrossed := true

SetUpLong := true

// Defining the Value of the Long Entry Thershold

condforValue = rocCrossed and (open - low) / (open / 100) > 0 or (open < roc and close < roc) ? low - (close / 100 * entryLimit) : roc - (close / 100 * entryLimit)

openValue = valuewhen (rocCrossed, condforValue, 0)

// Defining the length of the Long Entry Thershold in bars, specified with an input parameter

sincerocCrossed = barssince (rocCrossed)

plotLineOpen = (sincerocCrossed <= entryTime) ? openValue : na

endLineOpen = sincerocCrossed == entryTime ? 1 : 0

// Set the conditions back to false when the Entry Limit Threshold Line ends after specied number of bars

if endLineOpen and SetUpLong

rocCrossed := false

SetUpLong := false

// Set minimum percentage of price drop to open a Long Position.

minThres = (open - close) / (open / 100) > minLimit ? 1 : 0

// Open Long Trigger

openLong = crossunder (close, plotLineOpen) and strategy.position_size == 0 and minThres

plot (strategy.position_size == 0 ? plotLineOpen : na, title = "Long Entry Threshold", color= color.yellow, style= plot.style_linebr, linewidth = 2)

// Show vertical dashed line when long condition is triggered

// credit: @midtownsk8rguy, https://www.tradingview.com/script/EmTkvfCM-vline-Function-for-Pine-Script-v4-0/

vline(BarIndex, Color, LineStyle, LineWidth) =>

return = line.new(BarIndex, low - tr, BarIndex, high + tr, xloc.bar_index, extend.both, Color, LineStyle, LineWidth)

// if (openLong)

// vline(bar_index, color.blue, line.style_dashed, 1)

// ROC_Trigger Logic to close Long Position

rocLookBackL = input(3, group = "ROC Logic to CLOSE Long Entry", title = "Rate of Change bar lookback")

entryThresholdL = input(0.8, group = "ROC Logic to CLOSE Long Entry", title = "ROC Threshold % to Setup Close Threshold", step = 0.1) // Percentage from close price

entryLimit_CL = input(1.7, group = "ROC Logic to CLOSE Long Entry", title = "Price Rise Threshold % to CLOSE Long Entry", step = 0.1) // Percentage from roc threshold

entryTime_CL = input(3, group = "ROC Logic to CLOSE Long Entry", title = "Duration of Entry Limit in bars")

roc_CL = close[rocLookBackL] + (close/100 *entryThresholdL)

//plot(rocL, color=color.gray, linewidth=1, transp=20)

rocT1_CL = open < roc_CL and close > roc_CL ? 1 : 0

rocT2_CL = (open > roc_CL) and (close > roc_CL) ? 1 : 0

rocTrigger_CL = rocT1_CL or rocT2_CL

// Condition for Setting Up a Long CLOSE Thershold Line

rocCrossed_CL = false

var SetUpClose = false

if rocTrigger_CL and not SetUpClose

// The trigger for condA occurs and the last condition set was condB.

rocCrossed_CL := true

SetUpClose := true

// Defining the Value of the Long CLOSE Thershold

condforValue_CL= rocCrossed_CL and (high - open) / (open / 100) > 0 or (open > roc_CL and close > roc_CL) ? high + (close / 100 * entryLimit_CL) : roc_CL + (close / 100 * entryLimit_CL)

closeValue = valuewhen (rocCrossed_CL, condforValue_CL, 0)

// Defining the length of the Long CLOSE Thershold in bars, specified with an input parameter

sincerocCrossed_CL = barssince(rocCrossed_CL)

plotLineClose = (sincerocCrossed_CL <= entryTime_CL) ? closeValue : na

endLineClose = (sincerocCrossed_CL == entryTime_CL) ? 1 : 0

// Set the conditions back to false when the CLOSE Limit Threshold Line ends after specied number of bars

if endLineClose and SetUpClose

rocCrossed_CL := false

SetUpClose := false

plot(strategy.position_size > 0 ? plotLineClose : na, color = color.white, title = "Close Long Threshold", style = plot.style_linebr, linewidth = 2)

// ROC Close + Take Profit combined

closeCondition = close < tp ? plotLineClose : tpa ? tp : plotLineClose

// Store values to create and plot the different PA layers

long1 = valuewhen(openLong, close, 0)

long2 = valuewhen(openLong, close - (close / 100 * ps2), 0)

long3 = valuewhen(openLong, close - (close / 100 * ps3), 0)

long4 = valuewhen(openLong, close - (close / 100 * ps4), 0)

eps1 = 0.00

eps1 := na(eps1[1]) ? na : eps1[1]

eps2 = 0.00

eps2 := na(eps2[1]) ? na : eps2[1]

eps3 = 0.00

eps3 := na(eps3[1]) ? na : eps3[1]

eps4 = 0.00

eps4 := na(eps4[1]) ? na : eps4[1]

plot (strategy.position_size > 0 ? eps1 : na, title = "Long 1 Layer", style = plot.style_linebr)

plot (strategy.position_size > 0 ? eps2 : na, title = "Long 2 Layer", style = plot.style_linebr)

plot (strategy.position_size > 0 ? eps3 : na, title = "Long 3 Layer", style = plot.style_linebr)

plot (strategy.position_size > 0 ? eps4 : na, title = "Long 4 Layer", style = plot.style_linebr)

// Ener Long Positions

if (openLong and strategy.opentrades == 0)

eps1 := long1

eps2 := long2

eps3 := long3

eps4 := long4

strategy.entry("Long1", strategy.long, c, comment = "a=binance2 e=binance s=bnbusdt b=buy q=20% t=market")

if (strategy.opentrades == 1)

strategy.entry("Long2", strategy.long, c, limit = eps2, comment = "a=binance2 e=binance s=bnbusdt b=buy q=25% t=market")

if (strategy.opentrades == 2)

strategy.entry("Long3", strategy.long, c, limit = eps3, comment = "a=binance2 e=binance s=bnbusdt b=buy q=33.3% t=market")

if (strategy.opentrades == 3)

strategy.entry("Long4", strategy.long, c, limit = eps4, comment = "a=binance2 e=binance s=bnbusdt b=buy q=50% t=market")

// Setup Limit Close / Take Profit / Stop Loss order

strategy.exit("Exit", stop = stopLoss, limit = closeCondition, when =(rocTrigger_CL and strategy.position_size > 0), comment= "a=binance2 e=binance s=bnbusdt b=sell q=100% t=market")

// Make sure that all open limit orders are canceled after exiting all the positions

longClose = strategy.position_size[1] > 0 and strategy.position_size == 0 ? 1 : 0

if longClose

strategy.cancel_all()

- RSI Breakout Strategy

- Dynamic ATR Trailing Stop Loss Strategy

- Volatility Breakout Trading Strategy

- Momentum Reversal Trend Tracking Strategy

- Stochastic Oversold and Overbought Range RSI Strategy

- Trend Trader Bands Backtest Strategy Based on Trend Trader Moving Average

- MACD Stochastics Range Breakout Strategy

- Reversal Closing Price Breakout Strategy with Oscillating Stop Loss

- Golden Cross Moving Average Trading Strategy

- Dual Hull Moving Average Trading Strategy

- Bollinger Percentage Bands Trading Strategy

- Trailing Take Profit Trailing Stop Loss Strategy

- Y-Profit Maximizer Strategy

- Breakout Trend Following Strategy

- SuperTrend-based Trend Tracking Strategy

- Strategy Based on Exponential Moving Average and MACD Indicator

- Index Trading Strategy Based on Bollinger Bands

- Exponential Moving Average Bounce Strategy

- Price Volatility Breakout Strategy Based on Double Moving Averages

- SuperTrend and DEMA Based Trend Following Strategy