Oscillation Trading Strategy Between Moving Averages

Author: ChaoZhang, Date: 2023-12-11 14:38:48Tags:

Overview

This strategy combines the moving average indicator and Bollinger Bands to implement a strategy that oscillates between moving averages for two-way trading. Go long when the price breaks above the lower rail, go short when the price breaks below the upper rail, and profit from the oscillation between the moving averages.

Strategy Principle

- Calculate the fast moving average ma_short and slow moving average ma_long

- When ma_short crosses above ma_long, go long; when ma_short crosses below ma_long, go short

- Calculate the upper rail, lower rail and middle rail of Bollinger Bands

- When price breaks above lower rail, confirm long signal; when price breaks below upper rail, confirm short signal

- Open positions when the moving average indicator and Bollinger Bands give signals in the same direction, close positions when they give signals in opposite directions

Advantage Analysis

- The combination of dual indicators makes it relatively stable and can filter out some false signals

- Oscillating between moving averages and Bollinger Bands avoids chasing highs and selling lows

- Allowing two-way trading can take full advantage of price fluctuations for profit

Risk Analysis

- The parameter settings of Bollinger Bands will affect the trading frequency and profitability

- It is easy to generate large losses in strong trending markets

- The moving average system itself tends to generate more losing trades on exits

Risk Management:

- Optimize Bollinger Bands parameters to adjust to suitable trading frequency

- Set stop loss strategy to control single trade loss

- Use this strategy when the trend is not obvious

Optimization Directions

- Test different parameter combinations of moving average systems

- Evaluate whether to add volume indicators to filter signals

- Test whether to combine RSI and other indicators to determine overbought and oversold zones

The above optimizations can further improve profitability, reduce unnecessary trades, lower trading frequency and loss risks.

Summary

This strategy combines moving average systems and Bollinger Bands to implement oscillation trading between price moving averages. The combination of dual indicators can improve signal quality, and allowing two-way trading provides more opportunities. Further optimizing parameters and adding other auxiliary indicators can reduce unnecessary trades and improve profitability, which is worth live testing and optimization.

]

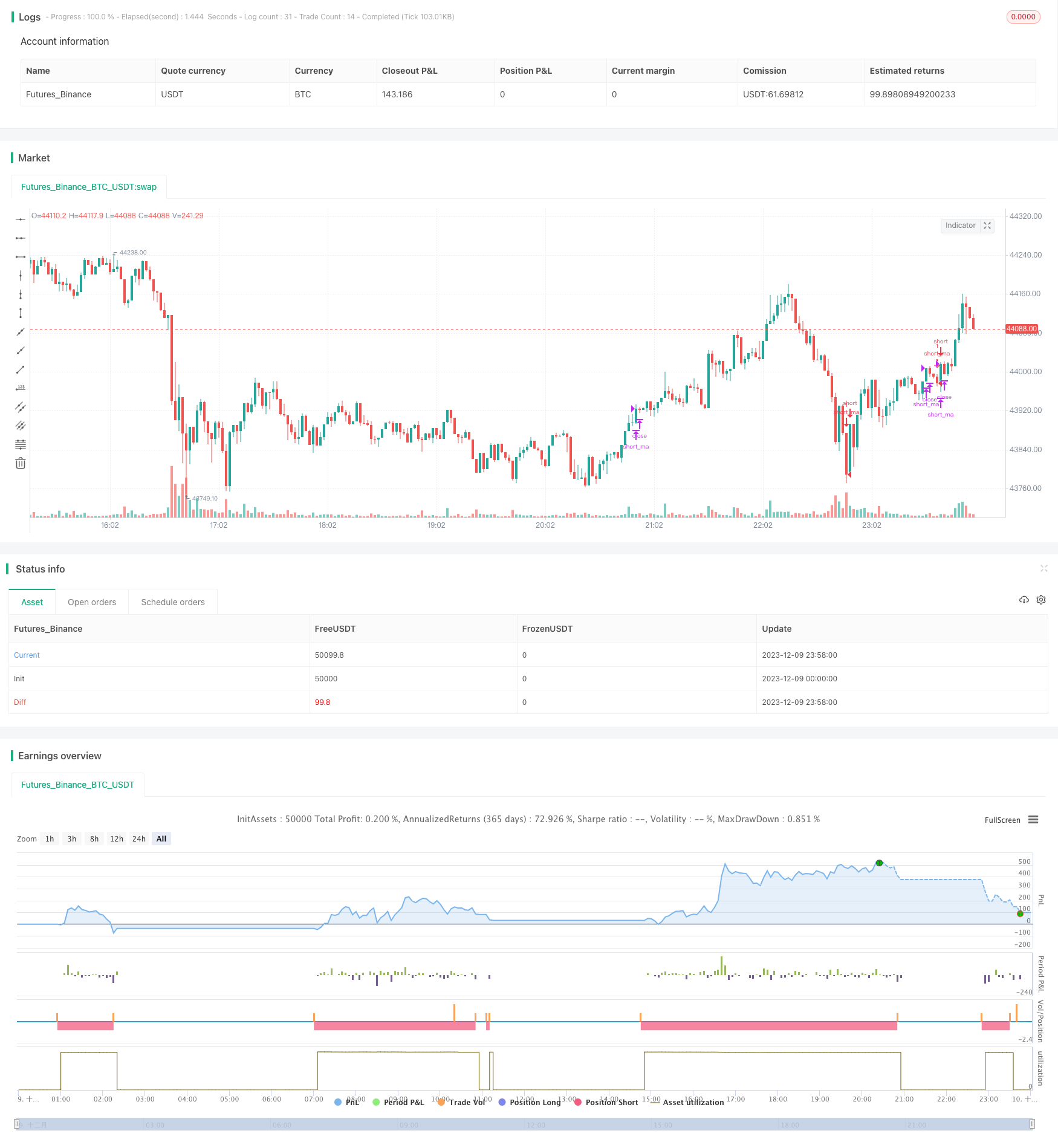

/*backtest

start: 2023-12-09 00:00:00

end: 2023-12-10 00:00:00

period: 2m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

strategy("MA-Zorrillo",overlay=true)

ma_short= sma(close,8)

ma_long= sma(close,89)

entry_ma = crossover (ma_short,ma_long)

exit_ma = crossunder (ma_short,ma_long)

BBlength = input(24, minval=1,title="Bollinger Period Length")

BBmult = 2 // input(2.0, minval=0.001, maxval=50,title="Bollinger Bands Standard Deviation")

BBbasis = sma(close, BBlength)

BBdev = BBmult * stdev(close, BBlength)

BBupper = BBbasis + BBdev

BBlower = BBbasis - BBdev

source = close

entry_bb = crossover(source, BBlower)

exit_bb = crossunder(source, BBupper)

vs_entry = false

vs_exit = false

for i = 0 to 63

if (entry_bb[i])

vs_entry := true

if (exit_bb[i])

vs_exit := true

entry = entry_ma and vs_entry

exit = exit_ma and vs_exit

strategy.entry(id="long_ma",long=true,when=entry)

strategy.close(id="long_ma", when=exit)

strategy.entry(id="short_ma",long=false,when=exit)

strategy.close(id="short_ma",when=entry)

- ATR Channel Mean Reversion Quantitative Trading Strategy

- Double Moving Average Crossover Strategy

- Inside Bar Range Breakout Strategy

- Dual Moving Average Bollinger Band Trend Tracking Strategy

- Moving Average Trend Following Trading Strategy

- Ichimoku Trend Following Strategy

- MACD Trend Following Strategy

- Octa-EMA and Ichimoku Cloud Quantitative Trading Strategy

- The Smooth Moving Average Ribbon Strategy

- 52 Week High Low Box Trading Strategy

- RSI Breakout Strategy

- Dynamic ATR Trailing Stop Loss Strategy

- Volatility Breakout Trading Strategy

- Momentum Reversal Trend Tracking Strategy

- Stochastic Oversold and Overbought Range RSI Strategy

- Trend Trader Bands Backtest Strategy Based on Trend Trader Moving Average

- MACD Stochastics Range Breakout Strategy

- Reversal Closing Price Breakout Strategy with Oscillating Stop Loss

- Golden Cross Moving Average Trading Strategy

- Dual Hull Moving Average Trading Strategy