SMA and RSI Long Only Strategy

Author: ChaoZhang, Date: 2023-12-18 10:28:10Tags:

Overview

This strategy is adapted from the articles by Enrico Malverti. It mainly uses Simple Moving Average (SMA) and Relative Strength Index (RSI) to identify long entry and exit signals. The strategy only goes long but not short.

Strategy Logic

The entry signal is triggered when closing price crosses over the longer period SMA line.

Exit signals include:

- Close long when RSI crosses below 70 or goes above 75;

- Stop loss when closing price crosses below the shorter period SMA line;

- Take profit when closing price crosses below the shorter period SMA line.

The stop loss SMA line and take profit SMA line are also plotted.

Advantage Analysis

The advantages of this strategy:

- Uses simple and easy-to-understand indicator combination;

- Only goes long to avoid short selling risk;

- Has clear entry, stop loss and take profit rules, controllable risk;

- Easy to optimize by adjusting SMA periods etc.

Risk Analysis

There are some risks:

- Psychological bias of losing confidence after losses;

- SMA line shift may cause risks;

- RSI divergence signals may be unreliable.

Solutions:

- Build fixed trading mechanism following rules;

- Optimize SMA periods;

- Add other filters for RSI signals.

Optimization Directions

The strategy can be further optimized:

- Test different parameters for SMA;

- Add other indicators as filters;

- Add trend identification to distinguish trend and consolidation;

- Parameter adaption and optimization.

Conclusion

The overall idea is simple and clear. With basic indicators and controllability, it suits medium-long term trading. But parameter tuning and indicator filtering require lots of tests and optimization to make the strategy more solid and reliable. Simple ideas need huge efforts on optimization and combination to form real usable trading systems.

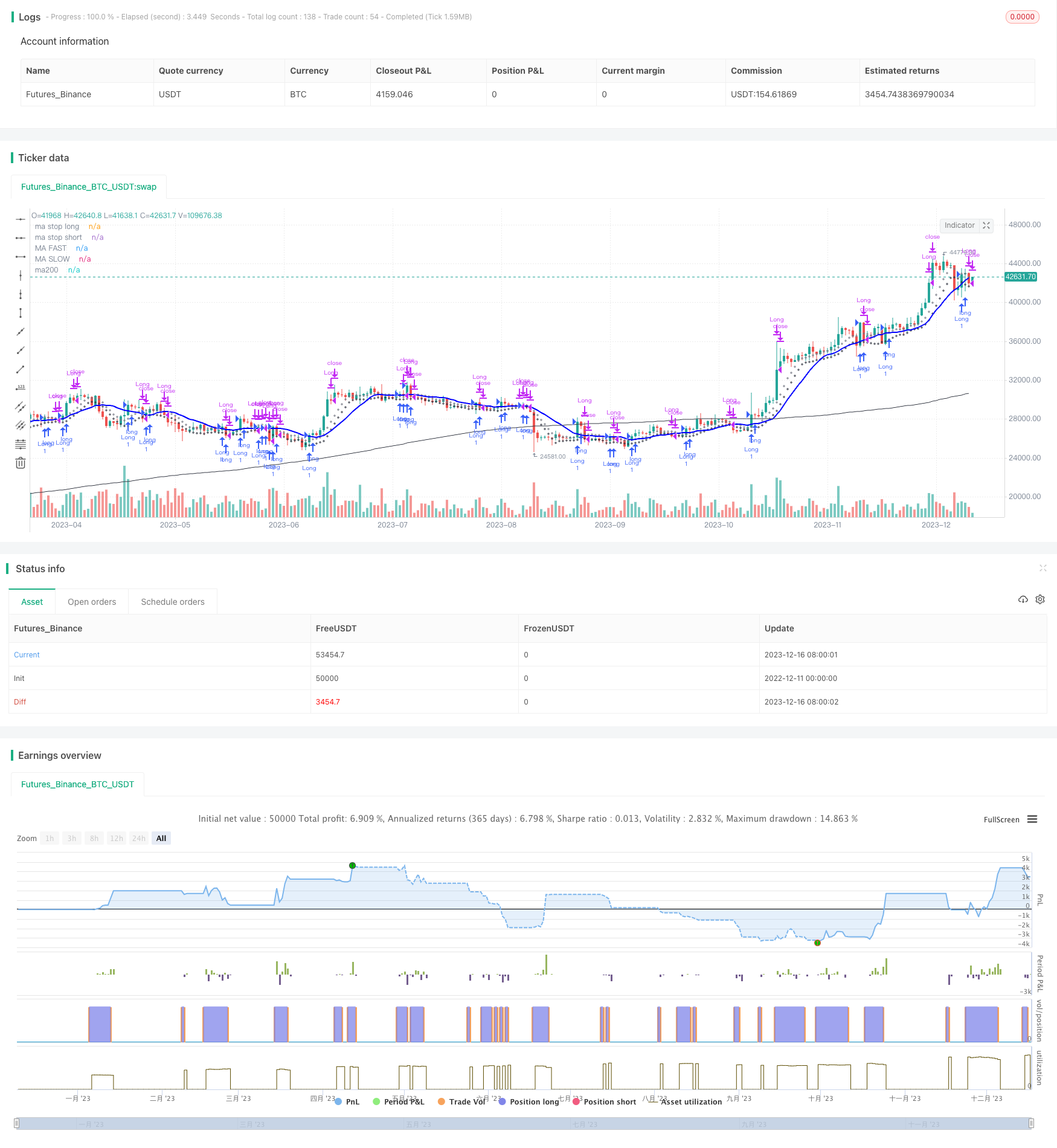

/*backtest

start: 2022-12-11 00:00:00

end: 2023-12-17 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version= 4

// form the original idea of Enrico Malverti www.enricomalverti.com , trading system 2015

// https://sauciusfinance.altervista.org

strategy(title="MAs & RSI strategy long only", overlay = true, max_bars_back=500)

///********FROM EMAS TO SIMPLE MA *****

// NON AGGIUNTO SCHAFF INDICATOR, che serve per discriminare quali titoli scegliere dallo screener (segnale già aperto o il primo o, a parità,

//quello più alto) ==> Tolte le bande di Bollinger (che filtrano "poco")

// INPUTS

emapf = input(14, title ="Ma periodo veloce", minval=1, step = 1)

emapl = input(14, title ="Ma periodo lungo", minval=1, step = 1)

emaps = input(7, title ="Ma periodi stop", minval=1, step = 1)

rsi_period = input(14, title="RSI period", minval = 1, step = 1)

// CALCULATIONS

maf = sma(close, emapf)

mal = sma(close, emapl)

// rsi

myrsi = rsi(close, rsi_period)

//ema stop long ed ema stop short

//Ema7 messo da "massimo" a "chiusura" come target per posizioni short. Il limite è, in questo caso, sempre ema20 (più restringente - asimmetria)

// in questo t.s., lo short viene soltanto indicato come "rappresentazione grafica", non agito

mass = sma(close, emaps)

masl = sma(low, emaps)

ma200=sma(close,200)

/// Entry

strategy.entry("Long", true, when = crossover(close,mal))

rsi1 = crossunder(myrsi,70)

rsi2 = myrsi > 75

// previously, 80

st_loss_long = crossunder(close,masl)// **chiusura sotto EMA7**

target_long= crossunder(close,maf) //* Chiusura sotto EMA14*

// exits. *RSI**Long: Target if over bandamax, loss if under bandamin. Viceversa, for short

strategy.close("Long", when = rsi1, comment="crossunder RSI")

strategy.close("Long", when = rsi2, comment ="RSI MAX")

strategy.close("Long", when = st_loss_long, comment = "Stop loss")

strategy.close("Long", when = target_long, comment = "target_long" )

plot(masl, title="ma stop long", color=#363A45, linewidth= 1, style=plot.style_cross)

plot(maf, title="MA FAST", color=#FF0000, linewidth= 1)

plot(mal, title="MA SLOW", color=#0000FF, linewidth= 2)

plot(mass, title="ma stop short", color=#787B86,linewidth= 1, style=plot.style_cross)

plot(ma200, title="ma200", color=color.black, linewidth= 1)

- Galileo Galilei's Moving Average Crossover Strategy

- AC Backtest Strategy of Williams Indicator

- Low Volatility Directional Buy with Profit Taking and Stop Loss

- Fixed Percentage Stop Loss and Take Profit Strategy Based on Moving Averages

- Quantitative Trading Strategy Based on Double EMA and Price Volatility Index

- Momentum Breakout Bi-directional Tracking Strategy

- Super Trend LSMA Long Strategy

- Three Bar and Four Bar Breakout Reversion Strategy

- Adaptive SMI Ergodic Trading Strategy Based on Adaptive Exponential Moving Average Lines

- SMA and PSAR Strategy for Spot Trading

- Dual Moving Average Reversal Breakout Strategy

- Trend Following Strategy Based on Ichimoku Cloud

- High Frequency Trading Strategy Based on Bollinger Bands and StochRSI Indicators

- Dual Reversion Balance Strategy

- HYE Mean Reversion SMA Strategy

- Dual Moving Average Reversal Strategy

- Dual Direction Price Breakthrough Moving Average Timing Trading Strategy

- Bollinger Breakout Stock Strategy

- Seven Candlestick Oscillation Breakthrough Strategy

- Golden Dead Cross Trend Tracking Strategy