Crossing Moving Average Strategy

Author: ChaoZhang, Date: 2023-12-19 13:34:30Tags:

Overview

The crossing moving average strategy is a quantitative trading strategy that generates trading signals by using exponential moving averages (EMAs) of different time periods. This strategy employs the crossovers of three EMAs - 5-period, 9-period, and 21-period - to determine market trends and generate buy and sell signals. It also incorporates longer-period 100-period and 200-period EMAs to gauge the major trend.

Principles

The core indicators of this strategy are the three EMAs of 5-period, 9-period and 21-period. Its trading logic is based on the following points:

-

A buy signal is generated when the 5-period EMA crosses above the 9-period EMA, and a sell signal when it crosses below.

-

The 21-period EMA can be used to validate the trading signals. Trading signals are more reliable when both 5 and 9 EMAs are above the 21 EMA for buy signals, and below it for sell signals.

-

The 100 and 200 EMAs serve to determine mid to long-term trends in the market. They can provide trend validation or warning for short-term trading signals.

Advantage Analysis

This strategy has the following advantages:

-

Simple to implement and operate. EMA calculation and crossover judgment is straightforward.

-

Sensitive to market changes. The fast 5 & 9 EMAs can quickly capture short-term trends.

-

Easy to set stop loss/take profit. EMAs themselves can serve as moving stop loss lines.

-

Extendable. Other EMAs or indicators can be easily introduced to enrich the system.

Risk Analysis

The main risks of this strategy include:

-

False signal risk. EMA crossovers are not 100% reliable and false breaks can occur. Other factors need careful review.

-

Trend reversal risk. Fast EMA crosses may just reflect short-term corrections, ignoring major trend reversals. Mid to long term EMAs should be checked.

-

Parameter tuning risk. Parameters can vary greatly across different products and market regimes, requiring thorough optimization and testing.

Optimization Directions

This strategy can be optimized in the following aspects:

-

Introduce other filters like KD, MACD etc to screen signals and reduce false signals.

-

Expand stop loss size to limit losses. Or adopt trailing stop to lock in profits.

-

Optimize parameters to find the optimal EMA period combinations. Machine learning can also be used to dynamically optimize the periods.

-

Automate the entire trading workflow by integrating quantitative frameworks.

Summary

The crossing moving average strategy has a clear logic and is easy to operate, capturing short-term trends effectively. But sole reliance on EMA crosses for decision making still has blind spots. Additional factors are required to reduce risks. This strategy has good potential for enhancements by introducing more technical indicators or techniques to improve its profitability and stability.

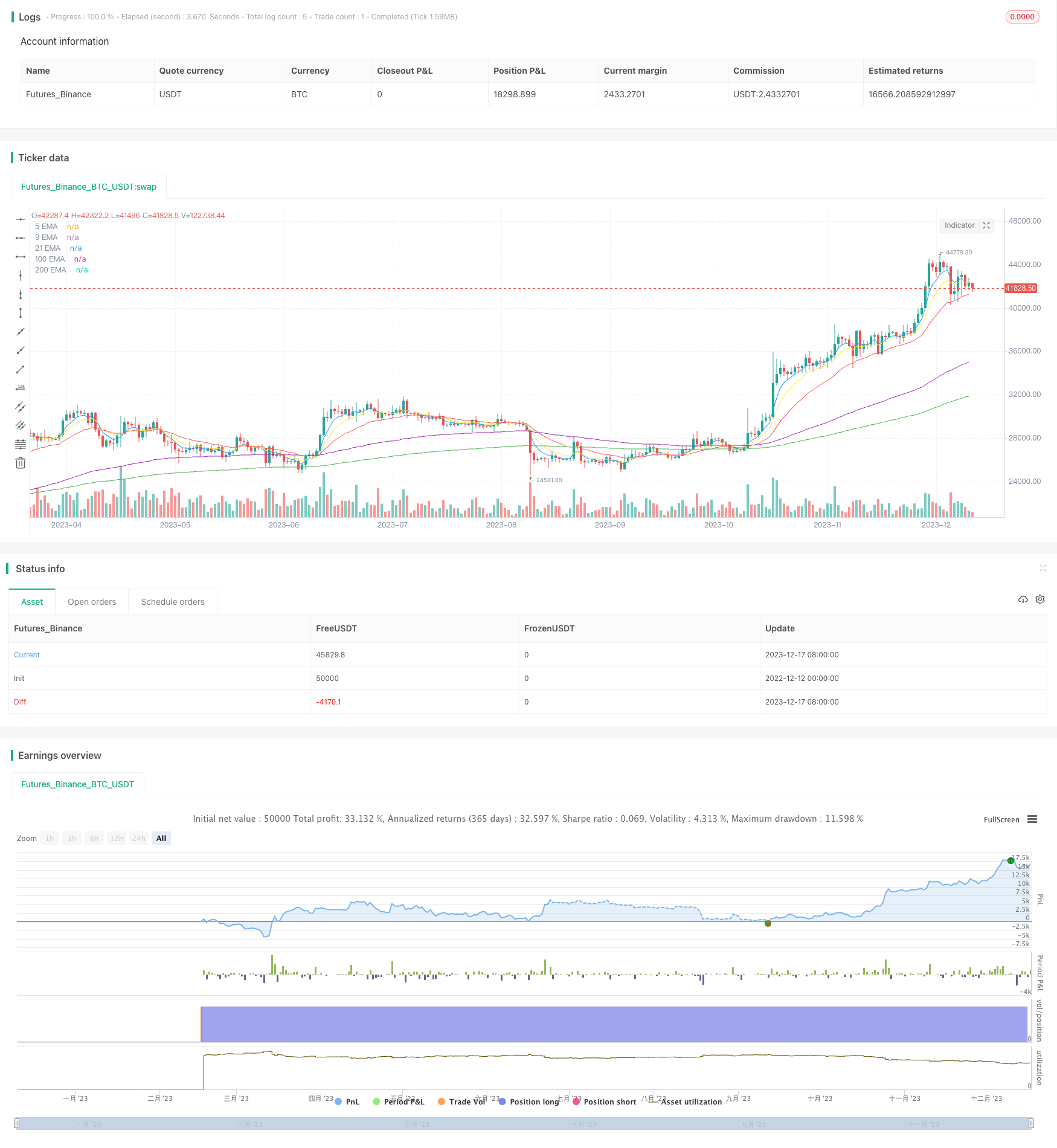

/*backtest

start: 2022-12-12 00:00:00

end: 2023-12-18 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © nagversion

//@version=5

strategy("5/9/21 EMA Strategy with 200 and 100 EMA", overlay=true)

// Calculate EMAs

ema5 = ta.ema(close, 5)

ema9 = ta.ema(close, 9)

ema21 = ta.ema(close, 21)

ema100 = ta.ema(close, 100)

ema200 = ta.ema(close, 200)

// Plot EMAs

plot(ema5, title="5 EMA", color=color.blue)

plot(ema9, title="9 EMA", color=color.yellow)

plot(ema21, title="21 EMA", color=color.red)

plot(ema100, title="100 EMA", color=color.purple)

plot(ema200, title="200 EMA", color=color.green)

// Strategy conditions

longCondition = ta.crossover(ema5, ema9) and ta.crossover(ema9, ema21)

shortCondition = ta.crossunder(ema5, ema9) and ta.crossunder(ema9, ema21)

if (longCondition)

strategy.entry("Long", strategy.long)

if (shortCondition)

strategy.entry("Short", strategy.short)

// Set strategy properties if required (like stop loss, take profit, etc.)

- Kifier's Hidden MFI/STOCH Divergence/Trend Breaker Trading Strategy

- MACD Quantitative Trading Strategy

- Dual Moving Average Trend Tracking Strategy

- A Momentum Tracking Mean Reversion Strategy

- Directional Movement Index Dual-direction Trading Strategy

- Bollinger Band Breakout Trading Strategy

- Laguerre RSI Trading Strategy

- Dynamic Re-entry Buy-only Strategy

- The Solid as a Rock VIP Quant Strategy

- Golden Cross Optimized Moving Average Crossover Trading Strategy

- The Wave Trend Trading Strategy Based on LazyBear

- Eight Day Extended Run Strategy

- Moving Average Pullback Strategy

- Dynamic MA Crossover Trend Following Strategy

- Stochastic Moving Average Strategy

- Momentum Oscillation Crossing Bollinger Bands with Moving Average Strategy

- RSI Bollinger Bands Short-term Trading Strategy

- Super Trend Tracking Stop Loss Strategy

- MACD Trend Following Intraday Strategy

- Dual Factor Mean Reversion Tracking Strategy