MACD Quantitative Trading Strategy

Author: ChaoZhang, Date: 2023-12-19 15:11:57Tags:

Overview

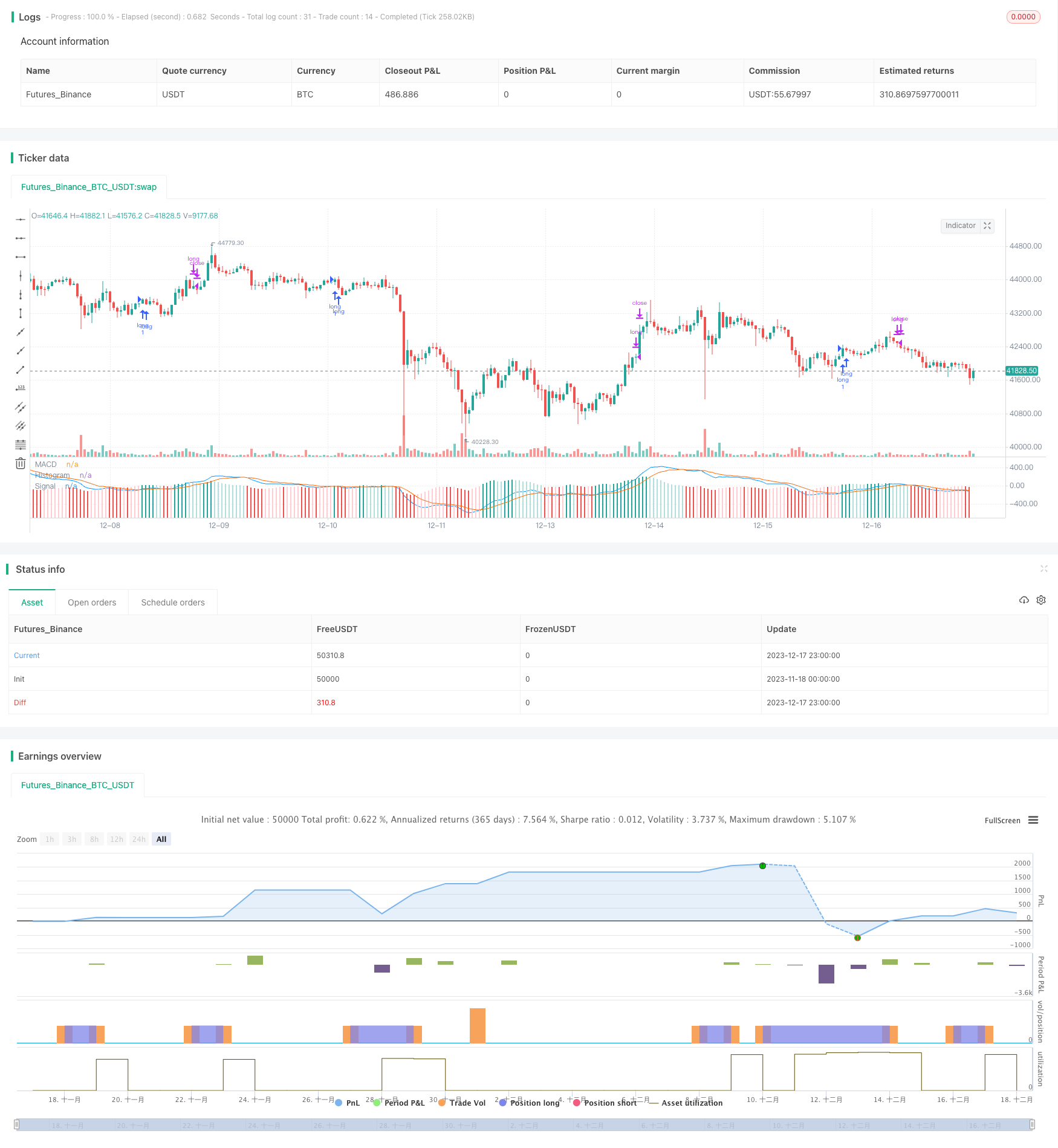

This strategy uses the MACD indicator to build long position trading signals when the MACD is below a certain level to take advantage of mean reversion opportunities.

Strategy Logic

A long signal is generated when the MACD line is below the SIGNAL line and the absolute value of MACD is below -0.00025. After taking a long position, if the MACD line crosses above the SIGNAL line again, the position will be closed.

This strategy utilizes the MACD indicator to detect oversold zones. According to the theory of moving averages, there is a probability of mean reversion in the short term, and a long signal is established based on this probability.

Advantages

- Utilizes the MACD indicator to judge oversold levels, which has a certain reliability.

- Simple trading signals and rules that are easy to implement.

- Long holding periods means less frequent trading, reducing transaction costs and slippage.

Risks

- Risk of failed mean reversion. It will lead to losses if no reversion happens.

- Invalid signals from poor MACD parameter selection.

This risk can be reduced through parameter optimization.

Enhancements

- Optimize MACD parameters to find best combinations.

- Test different holding periods to find optimal duration.

- Add stop loss mechanisms.

Summary

This strategy utilizes the probability of mean reversions from oversold levels identified by the MACD indicator to generate long signals, and profits through long holding periods. Optimizing MACD parameters and adding stop losses improves reliability. In summary, it uses relatively simple indicators and rules to construct an easy to understand and implement quantitative strategy.

//@version=3

strategy(title="MACD - EURUSD", shorttitle="MACD EURUSD")

// Getting inputs

fast_length = input(title="Fast Length", defval=12)

slow_length = input(title="Slow Length", defval=26)

src = input(title="Source", defval=close)

signal_length = input(title="Signal Smoothing", minval = 1, maxval = 50, defval =9)

sma_source = input(title="Simple MA(Oscillator)", type=bool, defval=false)

sma_signal = input(title="Simple MA(Signal Line)", type=bool, defval=false)

// Plot colors

col_grow_above = #26A69A

col_grow_below = #FFCDD2

col_fall_above = #B2DFDB

col_fall_below = #EF5350

col_macd = #0094ff

col_signal = #ff6a00

// Calculating

fast_ma = sma_source ? sma(src, fast_length) : ema(src, fast_length)

slow_ma = sma_source ? sma(src, slow_length) : ema(src, slow_length)

macd = fast_ma - slow_ma

signal = sma_signal ? sma(macd, signal_length) : ema(macd, signal_length)

hist = macd - signal

plot(hist, title="Histogram", style=columns, color=(hist>=0 ? (hist[1] < hist ? col_grow_above : col_fall_above) : (hist[1] < hist ? col_grow_below : col_fall_below) ), transp=0 )

plot(macd, title="MACD", color=col_macd, transp=0)

plot(signal, title="Signal", color=col_signal, transp=0)

longCond = crossover(macd, signal) and macd < -0.00025

exitLong = crossover(macd, hist)

strategy.entry("long", strategy.long, when=longCond==true)

strategy.close("long", when=exitLong==true)

- Dual-Track Fast Quantitative Reversal Trading Strategy

- Heikin Ashi and Kaufman Adaptive Moving Average Trading Strategy

- Momentum Breakout Trading Strategy

- Ichimoku Moving Average Crossover Strategy

- Momentum and Volume Trading Strategy

- Fractal Breakout Strategy

- Bill Williams Awesome Oscillator Trading Strategy

- Volatility Finite Volume Elements Strategy

- This BIST stocks 4-stage quantitative acquisition strategy

- Kifier's Hidden MFI/STOCH Divergence/Trend Breaker Trading Strategy

- Dual Moving Average Trend Tracking Strategy

- A Momentum Tracking Mean Reversion Strategy

- Directional Movement Index Dual-direction Trading Strategy

- Bollinger Band Breakout Trading Strategy

- Laguerre RSI Trading Strategy

- Dynamic Re-entry Buy-only Strategy

- The Solid as a Rock VIP Quant Strategy

- Golden Cross Optimized Moving Average Crossover Trading Strategy

- Crossing Moving Average Strategy

- The Wave Trend Trading Strategy Based on LazyBear