Momentum Tracking Trading Strategy

Author: ChaoZhang, Date: 2023-12-20 16:06:26Tags:

Strategy Overview

The Momentum Tracking Trading Strategy is an automated trading strategy that mainly tracks market momentum trends and uses multiple technical indicators as auxiliary judgments. This strategy parses K-line information to determine the direction and strength of the current market’s main funds, and then issues trading signals based on indicators such as volume price and moving average to achieve trend tracking.

Overall, this strategy is suitable for medium and long term trend trading, and can effectively capture market trends and reduce trading frequency to pursue higher single profits. At the same time, after optimizing the strategy parameters, it can also be used for short-term trading.

Strategy Principle

Main Power Judgement

The core of the momentum tracking strategy is to judge the direction of the market’s main funds. The strategy calculates the ATR indicator to monitor the volatility of the market in real time. When volatility increases, it means the main funds are accumulating or distributing, and the strategy will temporarily exit the market to avoid the period when the main funds are operating.

When volatility weakens, it means the main force accumulation or allocation is complete, and the strategy will re-enter the market to determine the specific direction of the main force. The judgment method is to calculate the market’s support and pressure positions to see if there are signs of breakthroughs. If there is a clear breakthrough, it will prove that the main funds have chosen that direction.

Auxiliary Judgement

After determining the direction of the main funds, the strategy will also introduce multiple auxiliary technical indicators for verification again to avoid misjudgments. Specifically, MACD, KDJ and other indicators will be calculated to determine whether they are consistent with the direction of the main funds.

Only when the direction of the main funds and auxiliary indicators issue signals in the same direction will the strategy open positions. This effectively controls the trading frequency and only enters at high probability.

Stop Loss Exit

After opening positions, the momentum tracking strategy will track price changes in real time, and use the expansion of ATR values as a stop loss signal. This means that the market has entered the main operating stage again and must exit to cash immediately to avoid being trapped.

In addition, if the price movement exceeds a certain range and then pullbacks, stop loss will also occur. This is a normal technical retracement and needs to be stopped out immediately for risk control.

Advantages of the Strategy

High Systematicness

The biggest advantage of momentum tracking strategies is their high degree of systematization and standardization. Its trading logic is clear, and each entry and exit has clear principles and rules instead of arbitrary trading.

This makes the replicability of this strategy very strong. Users can apply it for long-term use after configuration without manual intervention.

Mature Risk Control

The strategy has built-in multi-level risk control mechanisms, such as main power judgments, auxiliary verification, stop loss line setting, etc., which can effectively control non-systematic risks.

Specifically, the strategy only opens positions in high probability situations and sets scientific stop loss points to maximize avoidance of losses. This ensures stable capital growth.

Relatively Sustainable Returns

Compared to short-term strategies, the holding period of momentum tracking strategies is longer, and each profit is higher. This makes the overall strategy returns more stable and sustainable.

In addition, the strategy tracks medium and long-term trends, which can fully capture the volatility of trends. This is especially noticeable in major trending markets.

Risk Warnings

Difficult Parameter Optimization

The momentum tracking strategy involves multiple parameters, such as ATR parameters, penetration parameters, stop loss parameters, etc. There is a certain correlation between these parameters, requiring repeated testing to find the optimal parameter combination.

Improper parameter configuration can easily lead to excessive trading frequency or insufficient risk control. This requires the user to have certain experience in strategy optimization.

Breakout Trap

When the strategy determines the main power and indicator signals, it relies on the breakthrough of prices to confirm. But there may be false breakouts in penetration operations, which will increase the probability of being trapped.

If a key breakthrough fails, it may lead to greater losses. This is an inherent weakness of the strategy.

Optimization Directions

Introduce Machine Learning

Machine learning algorithms can be used to automatically detect correlations between parameters and find optimal parameter combinations. This is much more efficient than manual testing.

Specifically, the EnvironmentError algorithm can be used to continuously iterate parameters based on reinforcement learning to maximize strategy returns.

Increase Filters

More auxiliary filters can be introduced on the basis of existing indicators, such as trading volume indicators, capital flow indicators, etc., to verify breakthrough signals three or four times to improve reliability.

But too many filters can also lead to missing opportunities. Filter intensity needs to be balanced. In addition, the filters themselves should also avoid correlation.

Strategy Fusion

Combine the momentum tracking strategy with other strategies to take advantage of the strengths of different strategies to achieve orthogonality and improve overall stability.

For example, incorporating short-term reversal strategies and opening reverse trades after breakthroughs can lock in more profits.

Summary

In general, the Momentum Tracking Trading Strategy is a systemized trend tracking strategy worth recommending. It has clear trading logic, sufficient risk control, and can bring users stable and efficient investment returns.

But the strategy itself also has some inherent weaknesses. It requires users to have the ability to optimize parameters and integrate strategies in order to maximize the effectiveness of this strategy. Overall, the momentum tracking strategy is a quantitative product suitable for quantitative enthusiasts with some foundation.

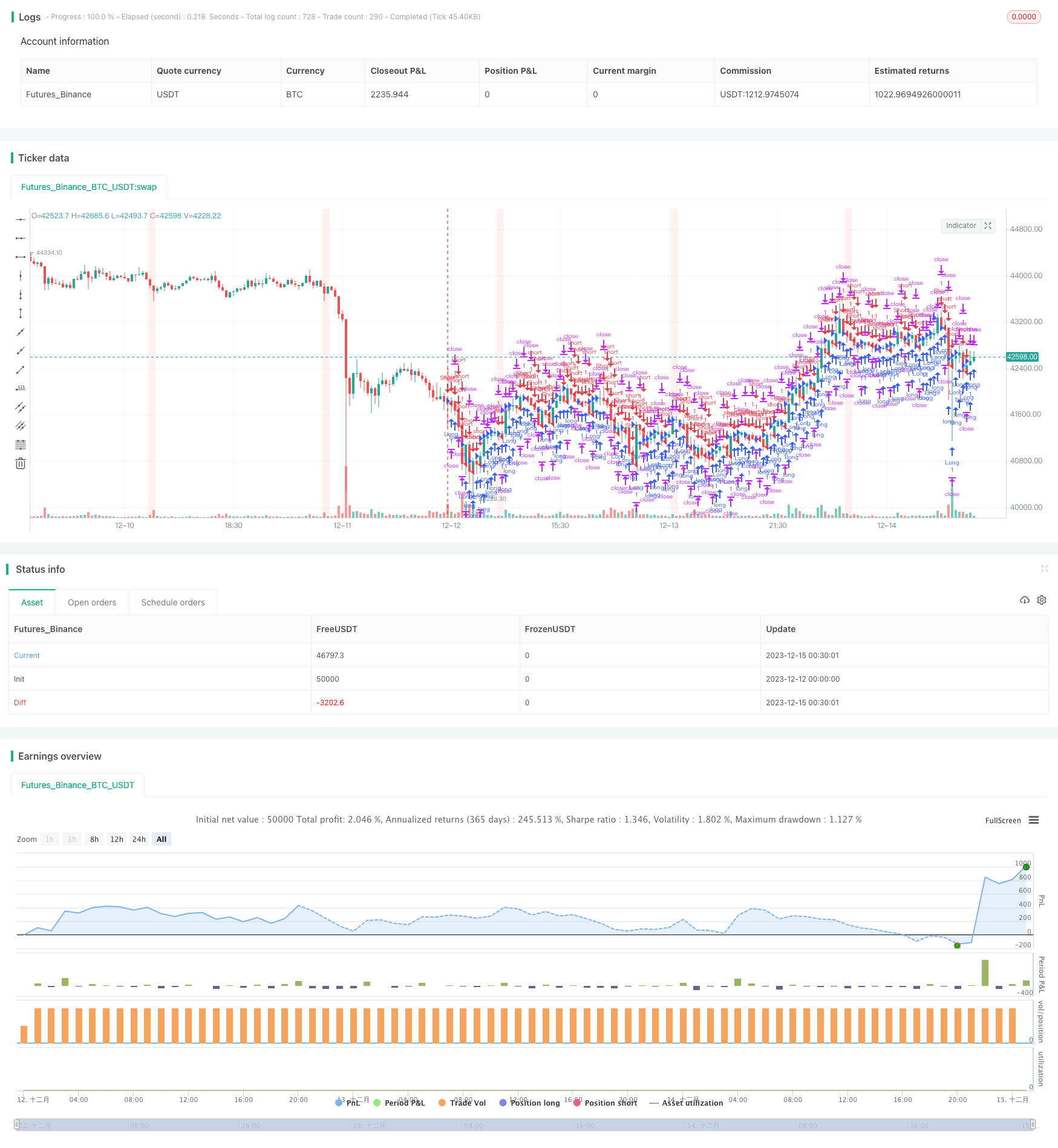

/*backtest

start: 2023-12-12 00:00:00

end: 2023-12-15 01:00:00

period: 30m

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//Created by frasmac2k Strategy credit to Alex Morris

//@version=5

strategy("Mechanical", shorttitle="MECH", overlay=true)

// Get the current date and time

currentYear = year

currentMonth = month

currentDay = dayofmonth

// Create a timestamp for the present date and time

currentTimestamp = timestamp(currentYear, currentMonth, currentDay)

// Define time interval for backtesting

dStart = input(timestamp('2023-07-01'), title='Set Start date', tooltip='Select a start date to run the script from')

// Define direction of strategy

direction = input.string('Forward',title='Direction', tooltip='Forward will go LONG on a Green anchor candle. Inverse will go short on a Green anchor candle and vice versa for Red candle', options=['Forward', 'Inverse'])

// Define the anchor hour as user input with a range of 0 to 23

anchorHour = input.int(11, title="Anchor Hour", tooltip='Set the hour to trade', minval=0, maxval=23)

// Define the take profit and stop loss in pips

takeProfitPips = input.int(10, title='Define TP Pips', tooltip='How many pips do you want to set TP. Choose a sensible value related to the instrument', minval=5)

stopLossPips = input.int(10,'Define SL Pips', tooltip='How many pips do you want to set SL. Choose a sensible value related to the instrument', minval=5)

// Define Tick size

tick10p = input.int(100, title='tick size', tooltip='Choose how many ticks equal 10 pips. This can vary by broker so measure 10 pips on the chart and select how many ticks that equates to. Forex is typically 100. Some instruments such as indices can be 1000', options=[100,1000])

// Declare TP/SL variables

var float takeProfit = na

var float stopLoss = na

// Calculate take profit and stop loss levels in ticks

if tick10p == 100

takeProfit := takeProfitPips * 10

stopLoss := stopLossPips * 10

if tick10p == 1000

takeProfit := takeProfitPips * 100

stopLoss := stopLossPips * 100

// Declare offset time

var int offset = na

if currentTimestamp > timestamp('2023-10-29')

offset := 4

else

offset := 5

//adjust for exchange time

anchorHour := anchorHour - offset

// Define the anchor hour as user input with a range of 0 to 23

tradeHour = anchorHour

// Define logical check for strategy date range

isStratTime = true

// Calculate the time condition for placing the order at the user-defined hour (start of the next hour)

isTradeTime = true

// Logic condition for forwards or inverse

isForward = direction == 'Forward'

isInverse = direction == 'Inverse'

// Declare entry condition variables

var bool longCondition = na

var bool shortCondition = na

// Declare and initialize variables for anchorCandle open and close prices

var float anchorOpen = na

var float anchorClose = na

var float tradeOpen = na

var float tradeClose = na

// Set logic by direction

if isForward

// Strategy logic

if isTradeTime and isStratTime

//Obtain candle open/close

anchorOpen := open

anchorClose := close

// Define entry conditions

longCondition := anchorClose > anchorOpen

shortCondition := anchorClose < anchorOpen

// Entry logic

if longCondition

strategy.entry("Long", strategy.long)

strategy.exit("Exit Long", from_entry="Long", profit=takeProfit, loss=stopLoss, comment_profit='TP', comment_loss='SL')

if shortCondition

strategy.entry("Short", strategy.short)

strategy.exit("Exit Short", from_entry="Short", profit=takeProfit, loss=stopLoss, comment_profit='TP', comment_loss='SL')

if isInverse

// Strategy logic

if isTradeTime and isStratTime

//Obtain candle open/close

anchorOpen := open

anchorClose := close

// Define entry conditions

shortCondition := anchorClose > anchorOpen

longCondition := anchorClose < anchorOpen

// Entry logic

if longCondition

strategy.entry("Long", strategy.long)

strategy.exit("Exit Long", from_entry="Long", profit=takeProfit, loss=stopLoss, comment_profit='TP', comment_loss='SL')

if shortCondition

strategy.entry("Short", strategy.short)

strategy.exit("Exit Short", from_entry="Short", profit=takeProfit, loss=stopLoss, comment_profit='TP', comment_loss='SL')

// Define the time range for the background shade

startHour = anchorHour

startMinute = 0

endHour = anchorHour

endMinute = 0

// Check if the current time is within the specified range

isInTimeRange = (hour == startHour and minute >= startMinute) or (hour == endHour and minute <= endMinute) or (hour > startHour and hour < endHour)

// Define the background color for the shade

backgroundColor = color.new(color.red, 90)

// Apply the background shade

bgcolor(isInTimeRange ? backgroundColor : na)

- Liquidity Driven Trend Strategy - A Quant Trading Strategy Based on Flow Trend Indication

- EMA Crossover Strategy with Trailing Stop Loss

- SMA RSI & Sudden Buy Sell Strategy

- Dual-factor Quantitative Reversal Tracking Strategy

- Ehlers Instantaneous Trendline Strategy

- Dual EMA Golden Cross Breakthrough Strategy

- Bull and Bear Power Moving Average Trading Strategy

- Quantitative Strategy: Bollinger Bands RSI CCI Crossover Strategy

- The VWAP breakout tracking strategy

- Momentum Reversal Trading Strategy

- Multiple Weighted Moving Averages Trend Strategy

- Trading Strategy Based on Bollinger Bands and MACD

- Macd Blue Red Leverage Strategy

- Momentum Capture Channel Strategy

- Hedging Oscillation Reversal Strategy

- Quantitative Trading Strategy Based on Bollinger Bands and RSI

- The Relative Volume Indicator Strategy

- The Octagon Cloud Tracing Strategy

- Probability-Enhanced RSI Strategy

- Triple EMA Trend Following Strategy