Momentum Strategy Based on LazyBear's Squeeze

Author: ChaoZhang, Date: 2023-12-21 14:22:49Tags:

Overview

The main idea of this strategy is based on LazyBear’s Squeeze Momentum indicator to analyze the timing of buying and selling. It analyzes the inflection points in the momentum trend, locating the peaks and troughs as sell and buy signals respectively. As it is a long strategy, it also takes into consideration the 50 period Exponential Moving Average to identify upward trends. If the closing price of the candle is above the 50EMA, and the slope of the 50EMA is trending upwards, then the buy signal is executed.

Strategy Principle

This strategy incorporates Bollinger Bands and Keltner Channels to identify trends and squeeze zones. Specifically, it calculates a 20-period Bollinger Bands and 20-period Keltner Channels. When Bollinger Bands fall entirely within the Keltner Channels, it is viewed as a squeeze signal. The squeeze zone is identified when the Bollinger Bands lower band goes above the Keltner Channels lower band and the Bollinger Bands upper band goes below the Keltner Channels upper band. Conversely, when the Bollinger Bands lower band falls below the Keltner Channels lower band and the Bollinger Bands upper band rises above the Keltner Channels upper band, it is a non-squeeze zone.

In addition, the strategy utilizes linear regression to analyze the change in momentum slope. It calculates the linear regression value of price over the last 20 periods minus the typical price. When the slope of the linear regression value is positive, it is viewed as an upward trend. When the slope is negative, it is a downward trend. Within the squeeze zone, if there is a reversal in the momentum slope, it signals a buy or sell. Specifically, when within the squeeze zone, a momentum flip from positive to negative issues a sell signal. And when within the squeeze zone, a momentum flip from negative to positive issues a buy signal.

To filter out false signals, the strategy also judges if the closing price is above the 50-day Exponential Moving Average and if the 50-day Exponential Moving Average is in an upward slope. Only when both conditions are met will the buy signal be executed.

Advantage Analysis

This is a very clever strategy, utilizing two different types of indicators to make a multi-dimensional judgment of the market, which can effectively avoid false signals. Specifically, its advantages are:

-

Comprehensive application of Bollinger Bands, Keltner Channels and momentum indicators for multi-dimensional analysis and improved accuracy.

-

Squeeze zones can effectively identify peaks and troughs of momentum reversals and precisely capture turns.

-

Trend filtering based on closing price and 50-day EMA avoids repetitive opening of positions during consolidations.

-

Signals only emitting during squeeze zones reduces false signals and improves profitability rate.

-

Large parameter optimization space allows targeted optimizations via adjusting periods etc.

-

Long and short combined, considers large cycle trends and integrates medium-term indicators, long direction is clear.

Risk Analysis

Although this strategy has Nonfarmed multiple technical indicators, there are still some risks:

-

Missing buy/sell opportunities when Bollinger Bands and Keltner Channels diverge.

-

Large losses may occur during violent market rises or falls.

-

In high volatility markets, squeeze situations may not be obvious, resulting in fewer signals.

-

Prone to adjustment losses during bull-bear transitions.

To avoid these risks, we can take the following measures:

-

Optimize parameters to synchronize Bollinger Bands and Keltner Channels as much as possible.

-

Set stop loss to control single loss.

-

Use this strategy as part of a portfolio strategy, combined with other strategies.

-

Reduce positions appropriately during high volatility markets.

Optimization Directions

There is still large room for optimizing this strategy, mainly in the following directions:

-

Optimize periods of Bollinger Bands and Keltner Channels to synchronize them as much as possible.

-

Test different multiplier factors to find optimal parameter combinations.

-

Try introducing other indicators for confirmation, such as RSI etc.

-

Based on Wen Hua Five Color Lines models, selectively utilize this strategy depending on market stages.

-

Adopt machine learning etc to dynamically optimize parameters.

-

Backtest on different coins to find the most suitable trading products.

-

Explore efficacy of this strategy on longer timeframes (daily, weekly etc).

Conclusion

The LazyBear Squeeze Momentum Strategy comprehensively employs various technical indicators, accurately identifying momentum reversals for trading during squeeze zones, avoiding repetitive opening of positions during non-trending markets. It has systematically defined quantifiable buy and sell rules, performing excellently in backtests. Through optimizing parameter settings, introducing new judgment indicators etc, this strategy has large room for improvements and is worth in-depth research and application by quant traders.

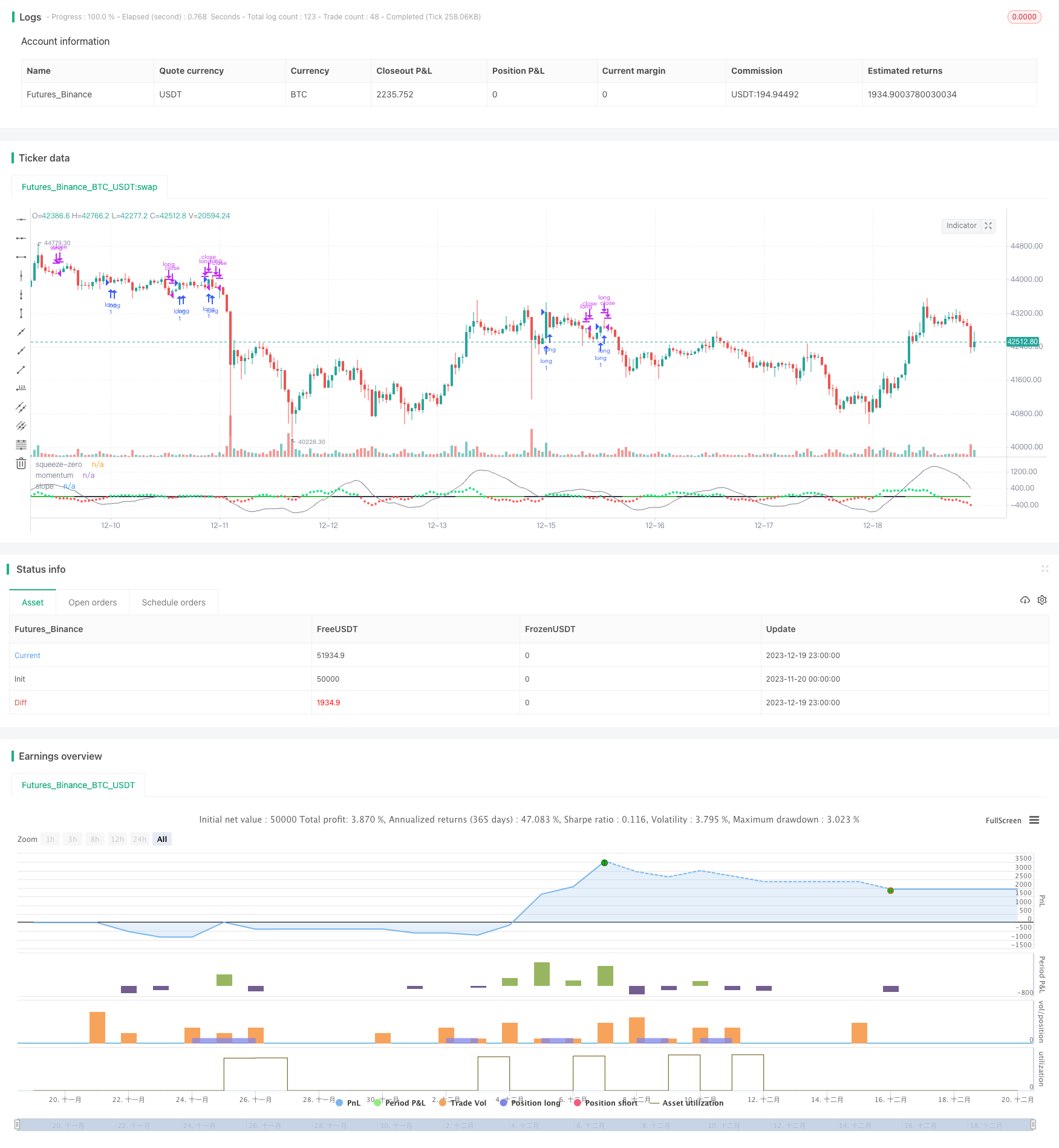

/*backtest

start: 2023-11-20 00:00:00

end: 2023-12-20 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

//

// @author LazyBear

// List of all my indicators: https://www.tradingview.com/v/4IneGo8h/

//

initialBalance = 8000

strategy("Crypto momentum strategy", overlay=false)

length = input(20, title="BB Length")

mult = input(2.0, title="BB MultFactor")

lengthKC = input(20, title="KC Length")

multKC = input(1.5, title="KC MultFactor")

useTrueRange = input(true, title="Use TrueRange (KC)", type=input.bool)

// Calculate BB

source = close

basis = sma(source, length)

ema = ema(source, 50)

dev = multKC * stdev(source, length)

upperBB = basis + dev

lowerBB = basis - dev

// Calculate KC

ma = sma(source, lengthKC)

range = useTrueRange ? tr : high - low

rangema = sma(range, lengthKC)

upperKC = ma + rangema * multKC

lowerKC = ma - rangema * multKC

sqzOn = lowerBB > lowerKC and upperBB < upperKC

sqzOff = lowerBB < lowerKC and upperBB > upperKC

noSqz = sqzOn == false and sqzOff == false

val = linreg(source - avg(avg(highest(high, lengthKC), lowest(low, lengthKC)), sma(close, lengthKC)), lengthKC, 0)

slope = (val - val[2])

emaSlope = (ema - ema[1])

bcolor = iff(slope > 0, color.lime, color.red)

scolor = noSqz ? color.green : sqzOn ? color.black : color.green

squeeze = (noSqz ? 0 : sqzOn ? 1 : 0)

plot(val, color=color.gray, style=plot.style_line, linewidth=1, title="momentum")

plot(slope, color=bcolor, style=plot.style_circles, linewidth=2, title="slope")

plot(0, color=scolor, style=plot.style_line, linewidth=2, title="squeeze-zero")

co = crossover(slope / abs(slope), 0)

cu = crossunder(slope / abs(slope), 0)

if co and source > ema and emaSlope > 0

strategy.entry("long", strategy.long, comment="long")

if cu

strategy.close("long")

- Super Trend Triple Strategy

- Dynamic Trailing Stop Loss Strategy

- Moving Average Crossover Strategy with Stop-Loss and Take-Profit

- Mean Reversion Reverse Strategy Based on Moving Average

- Bollinger Bands Based High Frequency Trading Strategy

- A Quantitative Ichimoku Cloud Trading Strategy

- Momentum Strategy Based on Double Bottom Breakout Model

- Stochastic Vortex Strategy

- The Multi-Period Trading Strategy Based on Volatility Index and Stochastic Oscillator

- Extended Adaptive CCI Bottom Fishing Trading Strategy for Commodities

- Floor-Crossing Sawtooth Profit Stop Strategy Based on Moving Average

- Dynamic Weighted Moving Average Trading Strategy

- Last Candle Strategy

- Quantitative Strategy of Negative Volume Index Reversal

- Triple Supertrend Breakout Strategy

- MACD of Relative Strength Strategy

- Triple Dragon System

- Top Trading Only Based on Weekly EMA8 Strategy

- EMA Pullback Strategy

- Dual Moving Average Trend Tracking Strategy