Dynamic Balancing Strategy with 50% Funds and 50% Positions

Author: ChaoZhang, Date: 2023-12-25 14:12:30Tags:

Strategy Overview

This strategy dynamically balances between 50% funds and 50% positions to control risk. By continuously adjusting the ratio between funds and positions, it manages risk for investors who cannot monitor the market in real-time.

Strategy Logic

-

Initialize capital at 1 million, divided equally into 50% funds and 50% positions.

-

During the trading period, if remaining funds exceed unrealized profit/loss by 1.05 times at each open, use 2.5% of remaining funds to add positions.

-

If unrealized profit/loss exceeds remaining funds by 1.05 times, sell partial positions to restore balance.

-

Close all positions at end of trading period.

Advantages

-

Effective risk control by dynamically balancing funds and positions, avoiding huge losses in extreme market conditions.

-

Simple to operate for busy investors, only need to adjust fund/position ratios.

-

Customizable parameters to meet varying risk appetites.

Risks

-

Unable to capitalize on short-term fluctuations, profit potential limited.

-

Long one-sided run may result in insufficient position size.

-

Improper parameter tuning leads to excess position flipping or low capital utilization.

Enhancement Opportunities

-

Introduce more parameters for finer fund/position control.

-

Incorporate stop loss/profit taking for larger positions.

-

Test different trading period parameters to improve adaptability.

Conclusion

This strategy achieves risk control by dynamically balancing between funds and positions. Simple to implement compared to other strategies. Can be further improved by introducing more adjustable parameters and combining with other strategy concepts.

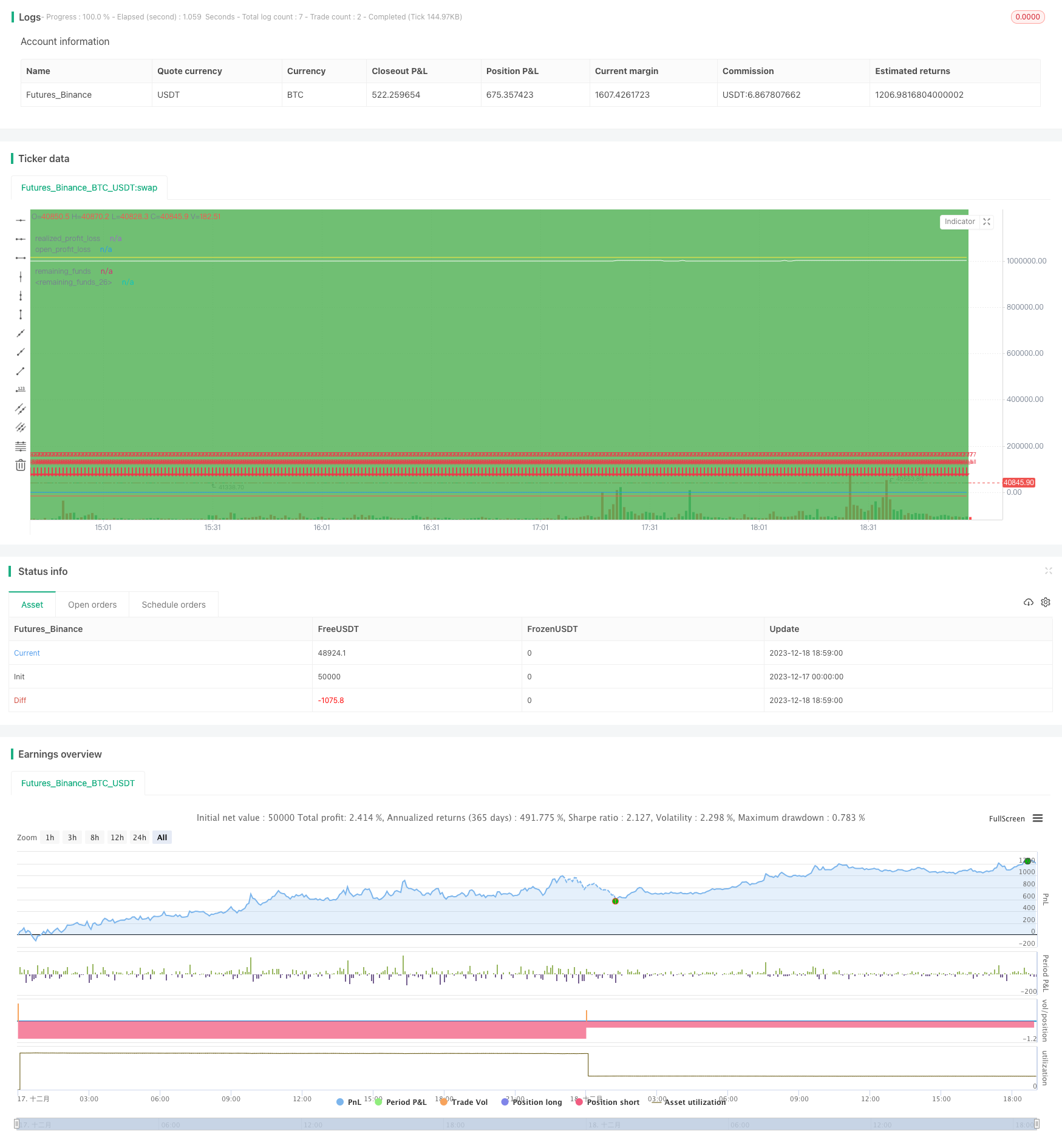

/*backtest

start: 2023-12-17 00:00:00

end: 2023-12-18 19:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("00631L Trading Simulation", shorttitle="Sim", overlay=true, initial_capital = 1000000)

// 设置本金

capital = 1000000

// 设置购买和出售日期范围

start_date = timestamp(2020, 11, 4)

next_date = timestamp(2020, 11, 5)

sell_date = timestamp(2023, 10, 24)

end_date = timestamp(2023, 10, 25) // 结束日期改为2023年10月25日

// 判断是否在交易期间

in_trade_period = true

// 实现的盈亏

realized_profit_loss = strategy.netprofit

plot(realized_profit_loss, title="realized_profit_loss", color=color.blue)

// 未实现的盈亏

open_profit_loss = strategy.position_size * open

plot(open_profit_loss, title="open_profit_loss", color=color.red)

// 剩余资金

remaining_funds = capital + realized_profit_loss - (strategy.position_size * strategy.position_avg_price)

plot(remaining_funds, title="remaining_funds", color=color.yellow)

// 總權益

total_price = remaining_funds + open_profit_loss

plot(total_price, title="remaining_funds", color=color.white)

// 购买逻辑:在交易期间的每个交易日买入 daily_investment 金额的产品

first_buy = time >= start_date and time <= next_date

buy_condition = in_trade_period and dayofmonth != dayofmonth[1]

// 出售邏輯 : 在交易期间的截止日出售所有商品。

sell_all = time >= sell_date

// 在交易期間的第一日買入50%本金

if first_buy

strategy.order("First", strategy.long, qty = capital/2/open)

// 在每个K线的开盘时进行买入

// 加碼邏輯 : 剩余资金 > 未实现的盈亏 * 1.05

add_logic = remaining_funds > open_profit_loss * 1.05

if buy_condition

strategy.order("Buy", strategy.long, when = add_logic, qty = remaining_funds * 0.025 / open)

//

// 減碼邏輯 : 剩余资金 > 未实现的盈亏 * 1.05

sub_logic = open_profit_loss > remaining_funds * 1.05

if buy_condition

strategy.order("Sell", strategy.short, when = sub_logic, qty = open_profit_loss * 0.025/open)

//

strategy.order("Sell_all", strategy.short, when = sell_all, qty = strategy.position_size)

// 绘制交易期间的矩形区域

bgcolor(in_trade_period ? color.green : na, transp=90)

- Dual Moving Average Tracking Strategy

- Dual Moving Average Momentum Squeeze Strategy

- SMA Crossover Trading Strategy

- Based on Weighted Moving Average Strategy

- Dual Moving Average Crossover Strategy

- Trend Reversal Trading Strategy Based on EMA Crossover

- RSI Based Bullish Trend Following Strategy

- Multi Timeframe Oscillation Channel Trend Tracking Strategy

- Low Lag Triple Moving Average Fast Trading Strategy

- Trend Following Strategy Based on Multi Timeframe TEMA Crossover

- Single-Side Entry Strategy Based on Moving Average

- Adaptive Multi Timeframe Fibonacci Retracement Trading Strategy

- Oscillating Long-Short RSI Crypto Switching Strategy

- Trend Trading Strategy Based on Triple Hull Moving Averages and Ichimoku Kinko Hyo

- Dynamic Moving Averages and Keltner Channel Trading Strategy

- Trend Following Strategy Based on RSI and Weighted Moving Average

- Dual Moving Average Reversal Strategy

- Double Bollinger Bands Breakout Strategy

- Keltner Channel Tracking Strategy

- Price Volume Trend Strategy