SMA Crossover Trading Strategy

Author: ChaoZhang, Date: 2023-12-25 16:03:48Tags:

Overview

This strategy is designed based on the golden cross and dead cross principles of Simple Moving Average (SMA). The strategy uses two SMAs, namely fast SMA and slow SMA. When the fast SMA crosses above the slow SMA from below, a buy signal is generated. When the fast SMA crosses below the slow SMA from above, a sell signal is generated.

Strategy Logic

The strategy mainly relies on two SMA indicator lines. The fast SMA has a shorter period and can capture price changes faster. The slow SMA has a longer period and can filter out some noise. When the fast SMA crosses above the slow SMA from below, it indicates that the short-term rising speed is faster and generates a buy signal. When the fast SMA crosses below the slow SMA from above, it indicates that the short-term falling speed is faster and generates a sell signal.

By setting different SMA period parameters, the strategy parameters can be adjusted to some extent to adapt to different market environments. At the same time, the strategy also allows setting the backtesting time range for testing the strategy parameters on historical data.

Advantage Analysis

- Uses the well-known SMA indicator with simple logic

- Customizable SMA period parameters with strong adaptability

- Backtesting time range can be set for parameter optimization

- Using crossover to generate signals has a certain filtering effect and can reduce wrong trades

Risk Analysis

- SMA itself has lagging effect and may miss short-term opportunities

- Unable to determine the momentum of the trend, the effectiveness of signal generation may be unstable

- Improper SMA period parameter settings will increase false signals

To address the above risks, the following measures can be taken:

- Appropriately shorten the SMA cycle to improve sensitivity

- Incorporate other indicators to determine trend momentum

- Find the optimal parameter combination using parameter optimization tools

Optimization Directions

- Add stop loss strategy to control single loss

- Add position management mechanism

- Combine with other technical indicators

- Add machine learning algorithms to achieve dynamic parameter optimization

Summary

This is a typical trend following strategy. By applying the simple principle of double moving average crossover, it can obtain good tracking results when the parameters are set appropriately. However, SMA itself has a certain lagging effect and cannot determine the momentum of the trend. Therefore, in actual application, other auxiliary tools need to be introduced to form an indicator combination, and supplemented with automated parameter optimization and risk control means, in order to make the strategy steadily profitable.

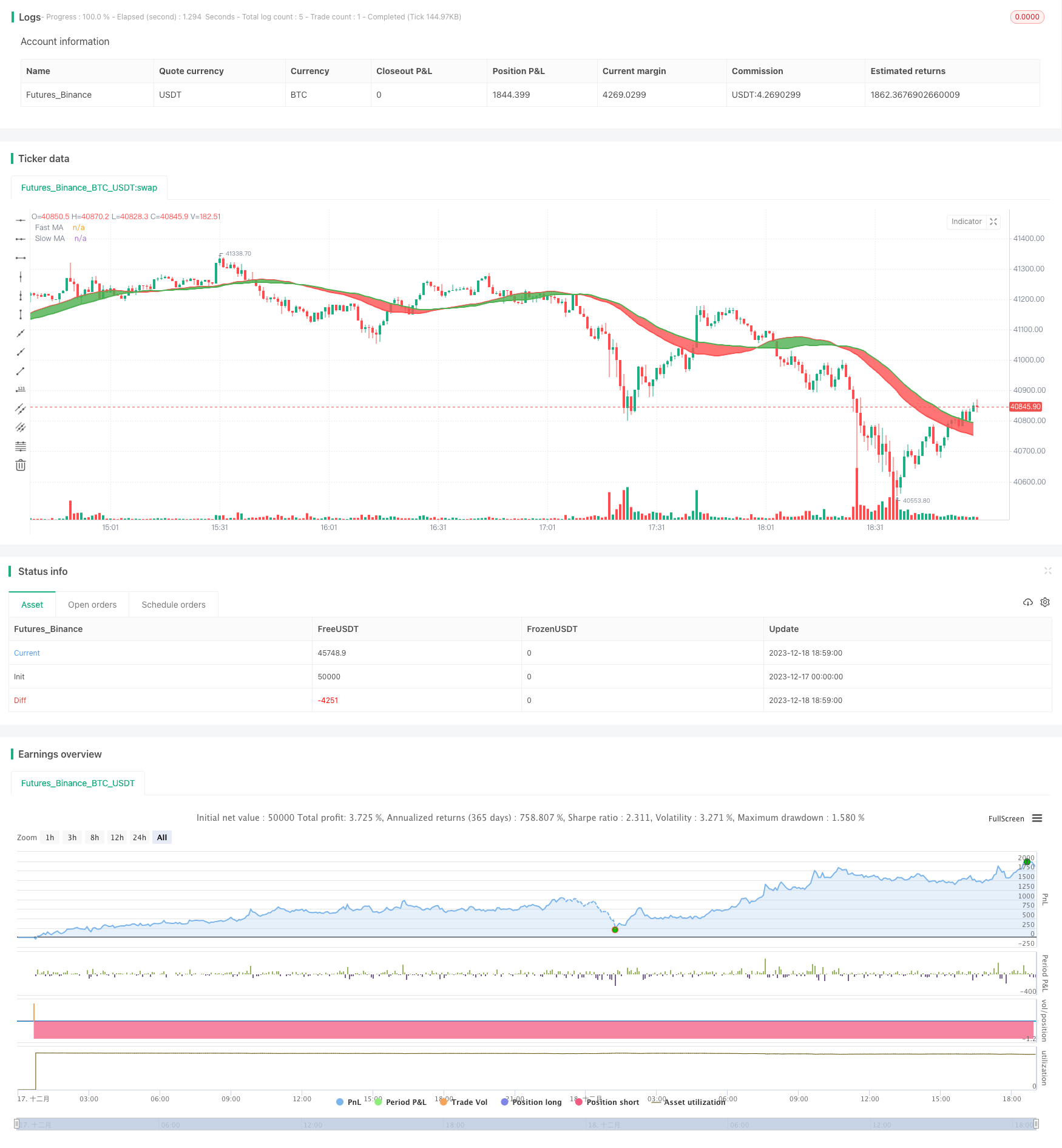

/*backtest

start: 2023-12-17 00:00:00

end: 2023-12-18 19:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

//strategy(title="MA Cross Entry & Exit w/Date Range", overlay=true, initial_capital=10000, currency='USD')

strategy(title="SMA Cross Entry & Exit Strategy", overlay=true)

// Credit goes to this developer for the "Date Range Code"

// https://www.tradingview.com/script/62hUcP6O-How-To-Set-Backtest-Date-Range/

// === GENERAL INPUTS ===

// short ma

maFastSource = input(defval = open, title = "Fast MA Source")

maFastLength = input(defval = 36, title = "Fast MA Period", minval = 1)

// long ma

maSlowSource = input(defval = open , title = "Slow MA Source")

maSlowLength = input(defval = 46, title = "Slow MA Period", minval = 1)

// === SERIES SETUP ===

// a couple of ma's..

maFast = sma(maFastSource, maFastLength)

maSlow = sma(maSlowSource, maSlowLength)

// === PLOTTING ===

fast = plot(maFast, title = "Fast MA", color = red, linewidth = 2, style = line, transp = 30)

slow = plot(maSlow, title = "Slow MA", color = green, linewidth = 2, style = line, transp = 30)

// === INPUT BACKTEST RANGE ===

FromMonth = input(defval = 9, title = "From Month", minval = 1, maxval = 12)

FromDay = input(defval = 1, title = "From Day", minval = 1, maxval = 31)

FromYear = input(defval = 2018, title = "From Year", minval = 2017)

ToMonth = input(defval = 1, title = "To Month", minval = 1, maxval = 12)

ToDay = input(defval = 1, title = "To Day", minval = 1, maxval = 31)

ToYear = input(defval = 9999, title = "To Year", minval = 2017)

// === FUNCTION EXAMPLE ===

start = timestamp(FromYear, FromMonth, FromDay, 00, 00) // backtest start window

finish = timestamp(ToYear, ToMonth, ToDay, 23, 59) // backtest finish window

window() => time >= start and time <= finish ? true : false // create function "within window of time"

// === LOGIC ===

//enterLong = crossover(maFast, maSlow)

//exitLong = crossover(maSlow, maFast)

enterLong = crossover(maSlow, maFast)

exitLong = crossover(maFast, maSlow)

// Entry //

strategy.entry(id="Long Entry", long=true, when=window() and enterLong)

strategy.entry(id="Short Entry", long=false, when=window() and exitLong)

// === FILL ====

fill(fast, slow, color = maFast > maSlow ? green : red)

- Simple Buy Low Sell High Strategy

- N Bar Close Below Open Short Strategy

- Statistical Volatility Backtest Strategy Based on Extreme Value Method

- Relative Strength Index Stop Loss Strategy

- Dual Channel Donchian Breakout Strategy

- A Multi-Period Trading Strategy Based on Moving Averages

- Pivot Reversal Upgraded Long Only - A Dual Momentum Strategy

- Turtle Trading Strategy

- Dual Moving Average Tracking Strategy

- Dual Moving Average Momentum Squeeze Strategy

- Based on Weighted Moving Average Strategy

- Dual Moving Average Crossover Strategy

- Trend Reversal Trading Strategy Based on EMA Crossover

- RSI Based Bullish Trend Following Strategy

- Multi Timeframe Oscillation Channel Trend Tracking Strategy

- Low Lag Triple Moving Average Fast Trading Strategy

- Trend Following Strategy Based on Multi Timeframe TEMA Crossover

- Dynamic Balancing Strategy with 50% Funds and 50% Positions

- Single-Side Entry Strategy Based on Moving Average

- Adaptive Multi Timeframe Fibonacci Retracement Trading Strategy