Dual Moving Average Momentum Squeeze Strategy

Author: ChaoZhang, Date: 2023-12-25 17:01:28Tags:

Overview

This strategy combines three different technical indicators and generates trading signals using a dual moving average system, with additional filters based on the color and body of candlesticks, to construct a relatively stable and effective short-term trading strategy.

Strategy Logic

The strategy uses Bollinger Bands and KC channels in combination to identify compression and expansion phases in the market. Specifically, when Bollinger Bands are within the KC channel, it is considered compression; when Bollinger Bands break through the KC channel, it is considered expansion. Compression represents intensified volatility and possible trend reversal, and linear regression is used as the primary trading signal indicator at this time.

If the linear regression histogram is positive (representing an upward trend) and the bar is a red candlestick (representing a close lower), at the same time the candlestick body is larger than 1/3 of the average body of the past 30 candlesticks, such a combination signal goes long. Conversely, if the linear regression histogram is negative, the bar is a green candlestick, and the body is also large, it goes short.

The strategy also provides a visualization of the compression and expansion background to assist in judging the market stage.

Advantage Analysis

- Using multiple indicators for combination can effectively filter false signals

- Compression represents potential reversal points and improves strategy performance

- Body filter avoids being misled by small waves of false breakouts

- Easy to obtain better results through parameter optimization

Risk Analysis

- Linear regression can easily issue wrong signals, which may lead to losses

- The effect of Bollinger Bands and KC channels to judge compression is not ideal

- Filtering criteria are too harsh, possibly missing better entry points

- Drawdowns may be larger, need to withstand a certain degree of tolerance

Risks can be reduced by adjusting indicator parameters, optimizing filtering criteria, etc.

Optimization Directions

The strategy can be optimized in the following aspects:

- Try different parameter combinations and lengths to find the optimal parameters

- Increase or decrease filtering conditions to find the optimal filtering level

- Use machine learning methods to automatically find optimal parameters

- Test effects in specific varieties and adjust parameters according to different varieties

- Add stop loss strategy to control single loss

Conclusion

This strategy combines multiple indicators, while identifying compression opportunities, it increases filtering conditions to form a relatively robust efficient short-term strategy. Through parameter and filtering condition optimization, better results can be obtained. In addition, the strategy framework is flexible and easy to adjust for use in different varieties, worth further testing and optimization.

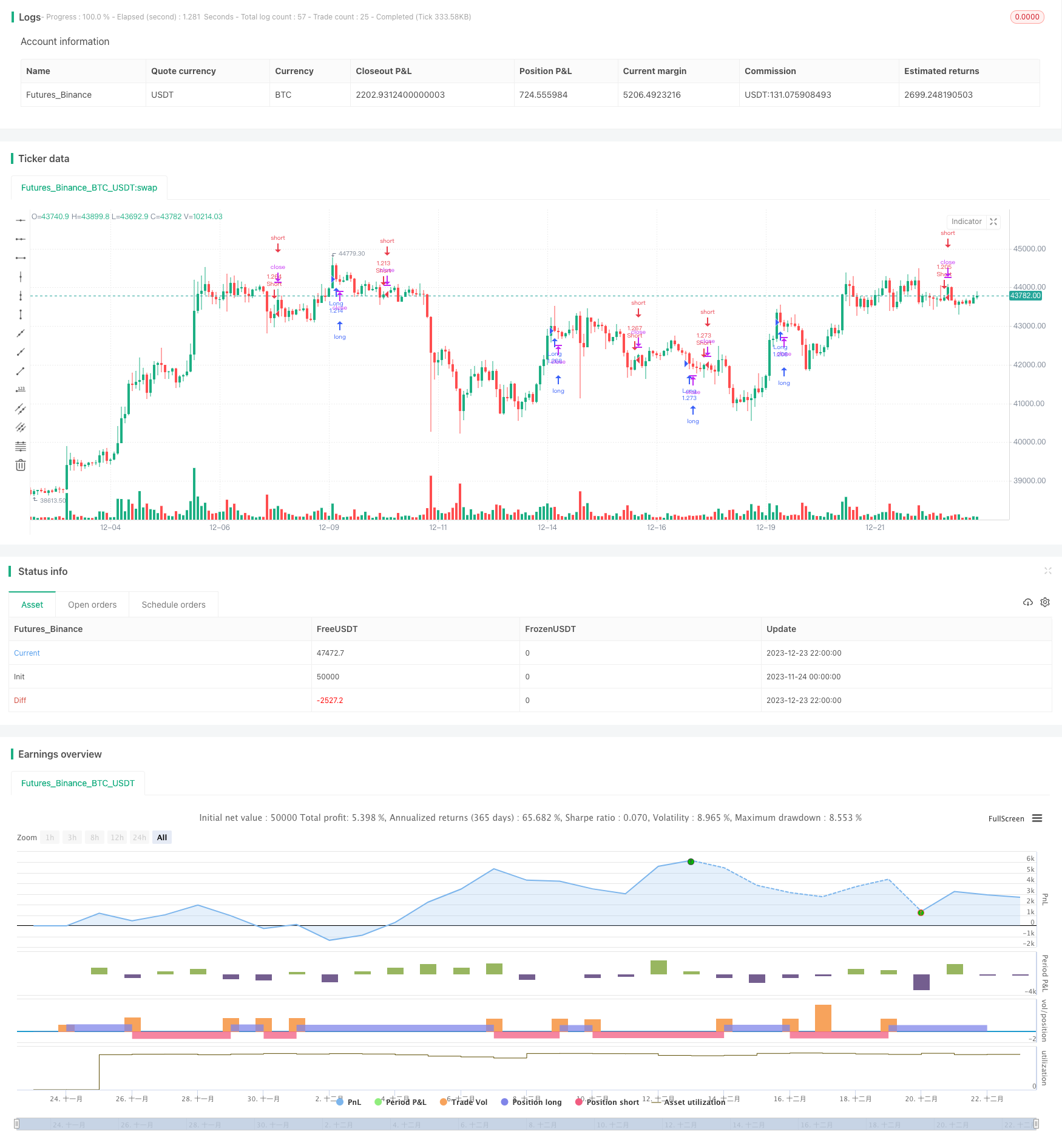

/*backtest

start: 2023-11-24 00:00:00

end: 2023-12-24 00:00:00

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//Noro

//2017

//@version=2

strategy(shorttitle = "Squeeze str 1.0", title="Noro's Squeeze Momentum Strategy v1.0", overlay = false, default_qty_type = strategy.percent_of_equity, default_qty_value = 100, pyramiding = 0)

//Settings

needlong = input(true, defval = true, title = "Long")

needshort = input(true, defval = true, title = "Short")

length = input(20, title="BB Length")

mult = input(2.0,title="BB MultFactor")

lengthKC=input(20, title="KC Length")

multKC = input(1.5, title="KC MultFactor")

useTrueRange = true

usecolor = input(true, defval = true, title = "Use color of candle")

usebody = input(true, defval = true, title = "Use EMA Body")

needbg = input(false, defval = false, title = "Show trend background")

fromyear = input(1900, defval = 1900, minval = 1900, maxval = 2100, title = "From Year")

toyear = input(2100, defval = 2100, minval = 1900, maxval = 2100, title = "To Year")

frommonth = input(01, defval = 01, minval = 01, maxval = 12, title = "From Month")

tomonth = input(12, defval = 12, minval = 01, maxval = 12, title = "To Month")

fromday = input(01, defval = 01, minval = 01, maxval = 31, title = "From day")

today = input(31, defval = 31, minval = 01, maxval = 31, title = "To day")

// Calculate BB

source = close

basis = sma(source, length)

dev = multKC * stdev(source, length)

upperBB = basis + dev

lowerBB = basis - dev

// Calculate KC

ma = sma(source, lengthKC)

range = useTrueRange ? tr : (high - low)

rangema = sma(range, lengthKC)

upperKC = ma + rangema * multKC

lowerKC = ma - rangema * multKC

sqzOn = (lowerBB > lowerKC) and (upperBB < upperKC)

sqzOff = (lowerBB < lowerKC) and (upperBB > upperKC)

noSqz = (sqzOn == false) and (sqzOff == false)

val = linreg(source - avg(avg(highest(high, lengthKC), lowest(low, lengthKC)),sma(close,lengthKC)), lengthKC,0)

bcolor = iff( val > 0, iff( val > nz(val[1]), lime, green), iff( val < nz(val[1]), red, maroon))

scolor = noSqz ? blue : sqzOn ? black : gray

trend = val > 0 ? 1 : val < 0 ? -1 : 0

//Background

col = needbg == false ? na : trend == 1 ? lime : red

bgcolor(col, transp = 80)

//EMA Body

body = abs(close - open)

emabody = ema(body, 30) / 3

//Signals

bar = close > open ? 1 : close < open ? -1 : 0

up = trend == 1 and (bar == -1 or usecolor == false) and (body > emabody or usebody == false)

dn = trend == -1 and (bar == 1 or usecolor == false) and (body > emabody or usebody == false)

if up

strategy.entry("Long", strategy.long)

if dn

strategy.entry("Short", strategy.short)

- Trend Tracking Breakout Strategy

- Simple Buy Low Sell High Strategy

- N Bar Close Below Open Short Strategy

- Statistical Volatility Backtest Strategy Based on Extreme Value Method

- Relative Strength Index Stop Loss Strategy

- Dual Channel Donchian Breakout Strategy

- A Multi-Period Trading Strategy Based on Moving Averages

- Pivot Reversal Upgraded Long Only - A Dual Momentum Strategy

- Turtle Trading Strategy

- Dual Moving Average Tracking Strategy

- SMA Crossover Trading Strategy

- Based on Weighted Moving Average Strategy

- Dual Moving Average Crossover Strategy

- Trend Reversal Trading Strategy Based on EMA Crossover

- RSI Based Bullish Trend Following Strategy

- Multi Timeframe Oscillation Channel Trend Tracking Strategy

- Low Lag Triple Moving Average Fast Trading Strategy

- Trend Following Strategy Based on Multi Timeframe TEMA Crossover

- Dynamic Balancing Strategy with 50% Funds and 50% Positions

- Single-Side Entry Strategy Based on Moving Average