Overview

This is an ETF algorithmic trading strategy based on Average True Range (ATR) and price breakout. It uses ATR to calculate stop loss and take profit levels, and open long or short positions when price breaks through the highest or lowest price of a certain period.

Strategy Logic

The strategy is mainly based on the following principles:

Use the highest and lowest prices of a certain period (e.g. 20 candles) to determine price trend and direction. Go long when price breaks through the highest price of the period, and go short when price breaks through the lowest price.

Use ATR to dynamically calculate stop loss level. The stop loss is placed at a distance of ATR value of an ATR period multiplied by a coefficient (e.g. 2) from the entry price.

Use ATR to determine take profit level. The take profit is placed at a distance of ATR value of an ATR period multiplied by a coefficient (e.g. 1) from the entry price.

Use ATR trailer multiplier to trail stop loss. Close positions with stop loss when price breaks through trailer stop loss level towards unfavourable direction.

The strategy is simple and reliable, as it considers both price trend direction for timely catching price movements, and sets stop loss and take profit for profit taking and risk control.

Advantage Analysis

The advantages of this strategy include:

The strategy logic is simple and clear, easy to understand and implement.

Using ATR to calculate adaptive stop loss and take profit levels helps flexible position sizing and risk control.

Breakout strategies are good at catching price trends, leading to good returns.

Trailer stop loss can close positions timely, avoiding excessive loss.

It is suitable for products with obvious trends, like ETFs and stocks.

Risk Analysis

The risks of the strategy include:

More false signals and reverse openings may occur during price consolidation.

Improper parameter tuning may lead to missing price trends or too many unnecessary trades.

Extreme parameter values may result in over-aggressive or over-conservative stop loss and take profit, influencing strategy profitability.

Underlying risks of ETFs like policy and premium risks can also impact strategy performance.

Corresponding solutions: 1. Optimize parameters to decrease unnecessary trades. 2. Add more factors and filters to confirm trading signals. 3. Adjust parameters adaptively for different markets. 4. Diversify investment and control position size of a single ETF.

Optimization Directions

The strategy can be further optimized from the following aspects:

Add indicators like moving average to filter out false signals.

Develop adaptive parameter optimization module to auto tune parameters for different periods and products.

Adopt machine learning models to predict next candle’s highest and lowest prices for determining breakout signals.

Consider trading volume overflow to avoid false breakout.

Optimize initial position sizing and allocation percentages adaptively for different products and market regimes.

Conclusion

The strategy has clear and simple logic. The core mechanisms of breakout and adaptive ATR stop loss/take profit can effectively control risks and lock in profits. Further enhancing Profit factors and risk control capabilities through parameter optimization and integrating more filters can make it a profitable and optimizable quantitative strategy.

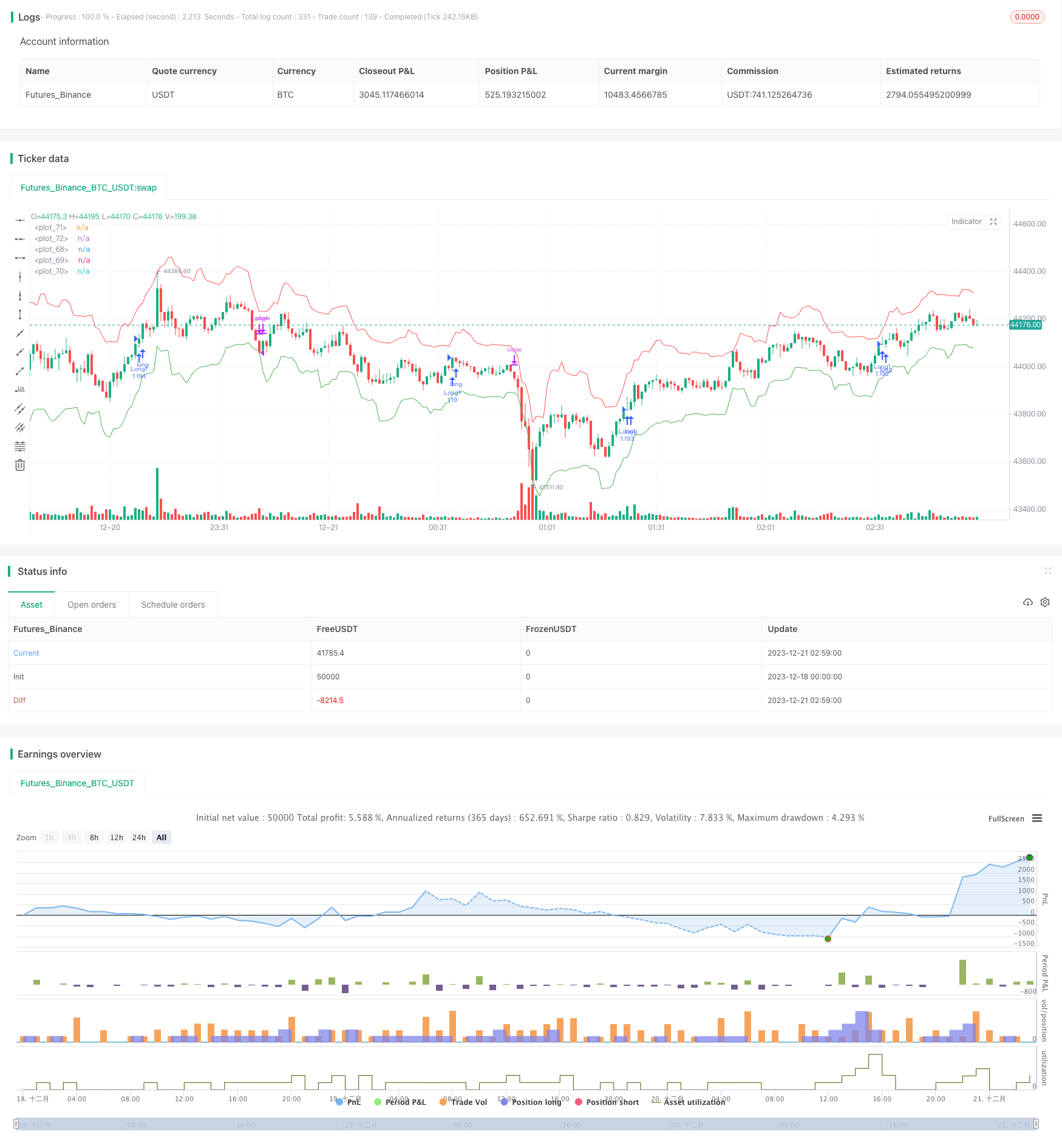

/*backtest

start: 2023-12-18 00:00:00

end: 2023-12-21 03:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © FX_minds

//@version=4

strategy("ETF tradedr", overlay=true, pyramiding=100, default_qty_type=strategy.percent_of_equity, default_qty_value=100)

//------------------------------ get user input

lookback = input(title="HH LL lookback", type=input.integer, defval=20)

ATR_periode = input(title="ATR period", type=input.integer, defval=14)

ATR_SL_multiplier = input(title="ATR SL multiplier", type=input.float, defval=2)

ATR_TP_multiplier = input(title="ATR TP multiplier", type=input.float, defval=1)

trailing_SL_ATR_multiplier = input(title="ATR trailing SL multiplier", type=input.float, defval=3.5)

lookback_trailing_SL = input(title="trailing SL lookback", type=input.integer, defval=4)

max_sequel_trades = input(title="max sequel trades", type=input.float, defval=1)

trade_long = input(title= "trade long ?", type=input.bool, defval=true)

trade_short = input(title= "trade short ?", type=input.bool, defval=false)

//------------------------------ determine entry conditions

long_condition = barstate.isconfirmed and crossover(high, highest(high, lookback)[1])

short_condition = barstate.isconfirmed and crossunder(low, lowest(low, lookback)[1])

//------------------------------ count open long trades

count_open_longs = 0

count_open_longs := nz(count_open_longs[1])

if (long_condition)

count_open_longs := count_open_longs +1

//label.new(bar_index, low, tostring(count_open_longs, "#"), xloc.bar_index, yloc.belowbar, color.green, label.style_none, color.green, size.large)

if (short_condition)

count_open_longs := 0

//------------------------------ count open short trades

count_open_shorts = 0

count_open_shorts := nz(count_open_shorts[1])

if (short_condition)

count_open_shorts := count_open_shorts +1

//label.new(bar_index, low, tostring(count_open_shorts, "#"), xloc.bar_index, yloc.belowbar, color.red, label.style_none, color.red, size.large)

if (long_condition)

count_open_shorts := 0

//------------------------------ calculate entryprice

entryprice_long = long_condition ? close : na

entryprice_short = short_condition ? close : na

//------------------------------ calculate SL & TP

SL_distance = atr(ATR_periode) * ATR_SL_multiplier

TP_distance = atr(ATR_periode) * ATR_TP_multiplier

trailing_SL_distance = atr(ATR_periode) * trailing_SL_ATR_multiplier

SL_long = entryprice_long - SL_distance

SL_short = entryprice_short + SL_distance

trailing_SL_short = lowest(close, lookback_trailing_SL) + trailing_SL_distance

trailing_SL_long = highest(close, lookback_trailing_SL) - trailing_SL_distance

trailing_SL_short_signal = crossover(high, trailing_SL_short[1])

trailing_SL_long_signal = crossunder(low, trailing_SL_long[1])

//------------------------------ plot entry price & SL

plot(entryprice_long, style=plot.style_linebr, color=color.white)

plot(SL_long, style=plot.style_linebr, color=color.red)

plot(SL_short, style=plot.style_linebr, color=color.green)

plot(trailing_SL_short, style=plot.style_linebr, color=color.red)

plot(trailing_SL_long, style=plot.style_linebr, color=color.green)

//------------------------------ submit entry orders

if (long_condition) and (count_open_longs <= max_sequel_trades) and (trade_long == true)

strategy.entry("Long" + tostring(count_open_longs, "#"), strategy.long)

strategy.exit("SL Long"+ tostring(count_open_longs, "#"),

from_entry="Long" + tostring(count_open_longs, "#"), stop=SL_long)

if (short_condition) and (count_open_shorts <= max_sequel_trades) and (trade_short == true)

strategy.entry("Short" + tostring(count_open_shorts, "#"), strategy.short)

strategy.exit("SL Short" + tostring(count_open_shorts, "#"),

from_entry="Short" + tostring(count_open_shorts, "#"), stop=SL_short)

//------------------------------ submit exit conditions

if (trailing_SL_long_signal)

strategy.close("Long" + tostring(count_open_longs, "#"))

strategy.close("Long" + tostring(count_open_longs-1, "#"))

strategy.close("Long" + tostring(count_open_longs-2, "#"))

strategy.close("Long" + tostring(count_open_longs-4, "#"))

strategy.close("Long" + tostring(count_open_longs-5, "#"))

strategy.close("Long" + tostring(count_open_longs-6, "#"))

strategy.close("Long" + tostring(count_open_longs-7, "#"))

strategy.close("Long" + tostring(count_open_longs-8, "#"))

strategy.close("Long" + tostring(count_open_longs-9, "#"))

if (trailing_SL_short_signal)

strategy.close("Short" + tostring(count_open_shorts, "#"))

strategy.close("Short" + tostring(count_open_shorts-1, "#"))

strategy.close("Short" + tostring(count_open_shorts-2, "#"))

strategy.close("Short" + tostring(count_open_shorts-3, "#"))

strategy.close("Short" + tostring(count_open_shorts-4, "#"))

strategy.close("Short" + tostring(count_open_shorts-5, "#"))

strategy.close("Short" + tostring(count_open_shorts-6, "#"))

strategy.close("Short" + tostring(count_open_shorts-7, "#"))

strategy.close("Short" + tostring(count_open_shorts-8, "#"))

strategy.close("Short" + tostring(count_open_shorts-9, "#"))