Overview

This strategy combines the Bollinger Bands and Relative Strength Index (RSI) technical indicators. It generates buy and sell signals when the RSI indicator crosses over the oversold or overbought levels and the price touches or breaks through the Bollinger Bands.

Strategy Logic

Calculate the 20-period SMA as the basis line. The upper band is the basis + 2 standard deviations and the lower band is the basis - 2 standard deviations to construct the Bollinger Bands.

Calculate the 14-period RSI. RSI above 70 is overbought zone and below 30 is oversold zone.

When RSI breaks below 30 and price is lower than the lower band, a buy signal is generated. When RSI breaks above 70 and price is higher than the upper band, a sell signal is generated.

Advantage Analysis

Bollinger Bands uses standard deviation to judge price volatility and future trends with strong capability.

RSI judges overbought and oversold levels. Combined with Bollinger Bands, it can effectively discover reversal opportunities.

RSI is easy to form breakout signals. Combined with Bollinger Bands, the trading signals are more accurate and reliable.

Risk Analysis

Bollinger Bands are not 100% accurate and prices may break through the upper or lower band and keep running.

RSI may also form false breakout signals which are inconsistent with Bollinger Bands.

Proper parameter tuning is important. Improper settings may lead to too frequent or rare trading signals.

Optimization

Test different parameter periods to find the optimal parameter combination.

Incorporate other indicators like KD, MACD to improve signal reliability.

Optimize stop loss and take profit based on backtest results to control risks.

Summary

This strategy integrates Bollinger Bands’ trend analysis and RSI’s overbought-oversold judgment to generate trading signals. Overall, the strategy logic is clear and easy to implement with certain practical value. But it also has some risks. Parameters tuning and indicators integration are needed to continuously optimize it to adapt to different market environments.

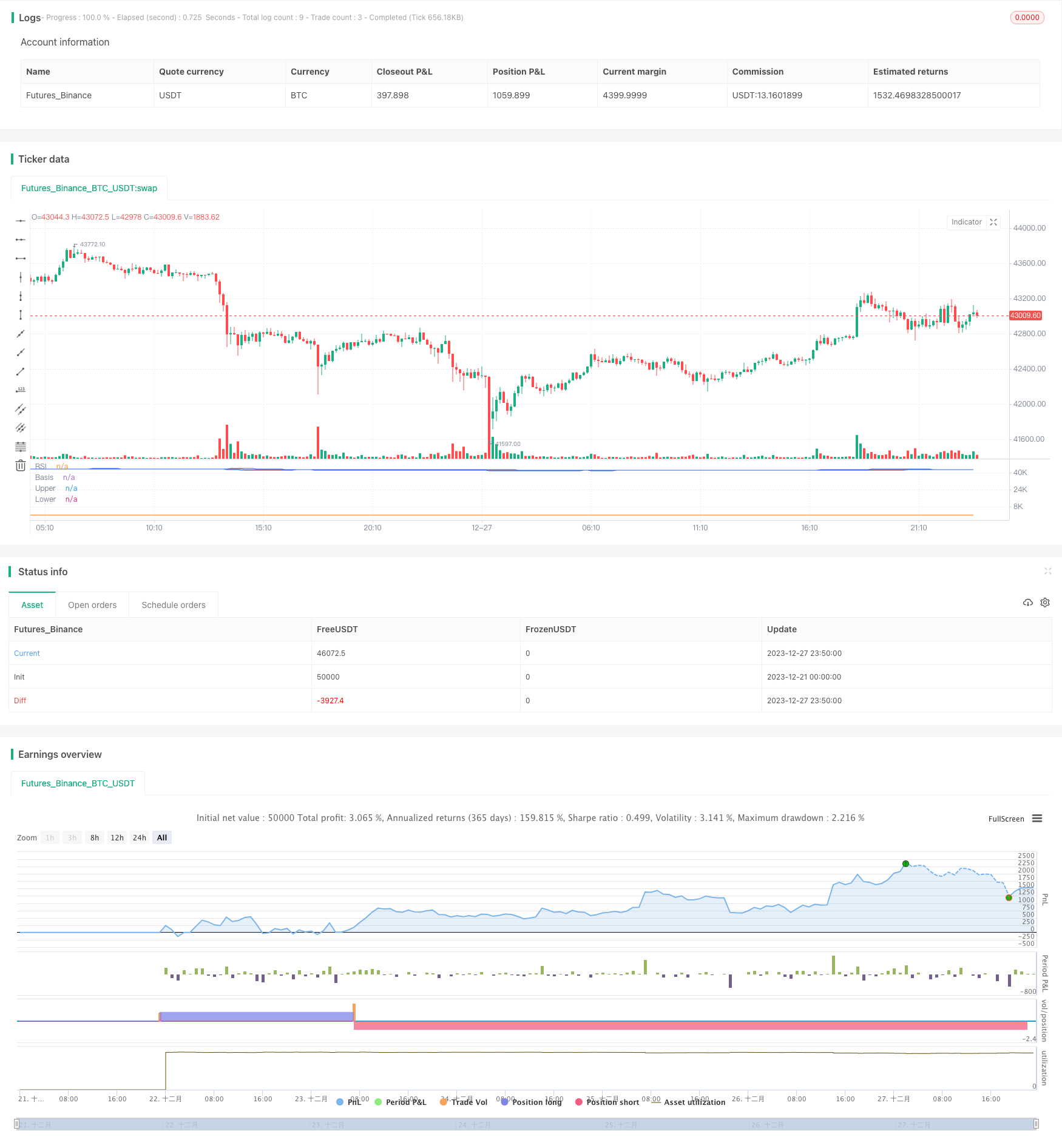

/*backtest

start: 2023-12-21 00:00:00

end: 2023-12-28 00:00:00

period: 10m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Bollinger Bands and RSI Strategy", overlay=false)

// Define the parameters

length = input.int(20, "Length", minval=1)

src = input(close, "Source")

mult = input.float(2.0, "StdDev", minval=0.001, maxval=50)

rsiLength = input.int(14, "RSI Length", minval=1)

rsiOverbought = input.int(70, "RSI Overbought Level", minval=1, maxval=100)

rsiOversold = input.int(30, "RSI Oversold Level", minval=1, maxval=100)

// Calculate the Bollinger Bands

basis = ta.sma(src, length)

dev = mult * ta.stdev(src, length)

upper = basis + dev

lower = basis - dev

// Plot the Bollinger Bands

plot(basis, "Basis", color=#FF6D00)

p1 = plot(upper, "Upper", color=#2962FF)

p2 = plot(lower, "Lower", color=#2962FF)

fill(p1, p2, color=color.rgb(33, 150, 243, 90), title="Background")

// Calculate the RSI

rsi = ta.rsi(src, rsiLength)

// Plot the RSI

plot(rsi, "RSI", color=#FF6D00)

// Define the entry and exit conditions

longCondition = ta.crossover(rsi, rsiOversold) and src < lower // Use ta.crossover here

if (longCondition)

strategy.entry("Long", strategy.long)

shortCondition = ta.crossunder(rsi, rsiOverbought) and src > upper // Use ta.crossunder here

if (shortCondition)

strategy.entry("Short", strategy.short)

// Plot the buy and sell signals

plotshape(longCondition, title="Buy", location=location.belowbar, color=color.green, style=shape.triangleup, size=size.small)

plotshape(shortCondition, title="Sell", location=location.abovebar, color=color.red, style=shape.triangledown, size=size.small)