Short-term Trend Tracking Strategy Based on Gann Me Analysis Indicator

Author: ChaoZhang, Date: 2024-01-03 16:10:08Tags:

Overview

This strategy constructs multiple EMA indicators with different cycles and calculates their difference to form the Gann Me indicator for judging price trends and generating trading signals. It is suitable for short-term trend tracking and can effectively capture price change trends.

Principles

The strategy first constructs 6 short-cycle EMA indicators and 6 long-cycle EMA indicators. The short-cycle EMA includes 3-day, 5-day, 8-day, 10-day, 12-day and 15-day lines. The long-cycle EMA includes 30-day, 35-day, 40-day, 45-day, 50-day and 60-day lines.

Then calculate the sum of short-cycle EMAs (g) and the sum of long-cycle EMAs (mae). The difference between long and short cycle EMAs (gmae = mae - g) forms the Gann Me difference indicator. This difference indicator can judge price trends.

When the difference crosses above the 0 axis, it means that the short-term moving average rises faster than the long-term one, which is a bullish signal to go long. When the difference crosses below the 0 axis, it means that the short-term moving average falls faster than the long-term one, which is a bearish signal to go short.

Advantages

- Using dual EMA lines strategy can effectively track short-term trends

- Building multiple EMAs avoids false breakthroughs and improves signal accuracy

- Difference indicator intuitively judges long and short term trends

- Simple parameter settings, easy for live trading

Risks

- Short-term operations have certain stop-loss risks

- Multi-EMA parameter settings need testing and optimization

- Only suitable for short-term operations, not suitable for long-term holds

Optimization

- Test and optimize EMA parameters to improve trading efficiency

- Increase stop loss strategy to control single loss

- Combine with other indicators to filter entry signals

- Optimize capital management, adjust position management

Summary

This strategy captures short-term price trend changes by constructing the Gann Me difference indicator. It belongs to a short-term tracking strategy. The advantages are sensitive reaction and suitability for high-frequency trading. The disadvantages are sensitivity to market variables and higher stop loss risks. Overall, the strategy performs well and is worth testing and applying in real trading.

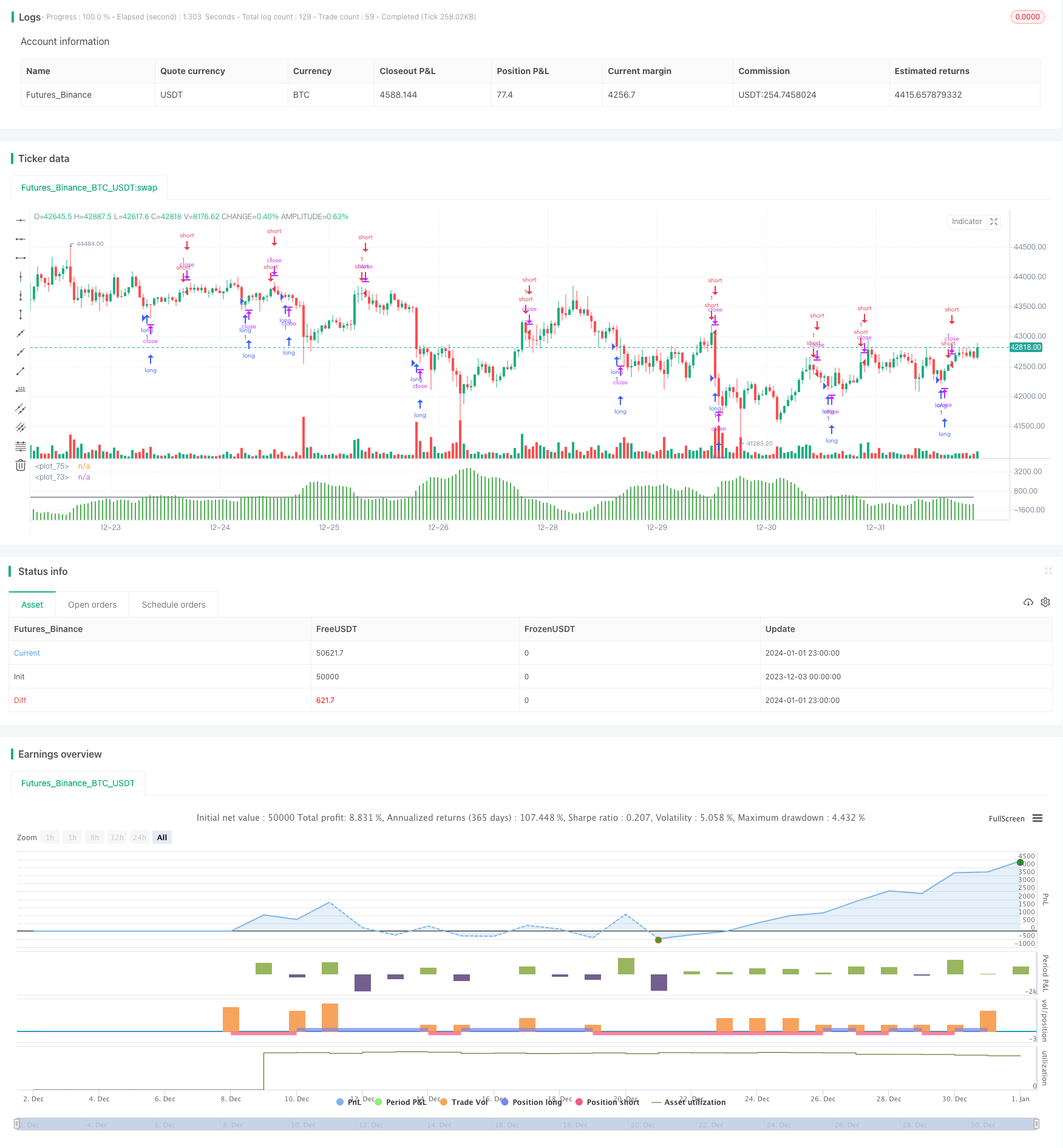

/*backtest

start: 2023-12-03 00:00:00

end: 2024-01-02 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

strategy(title="GMAE Original (By Kevin Manrrique)", overlay=false)

/// This indicator was built and scripted by Kevin Manrrique. Please leave this copyright to the script at all times, if rebuilt please add your name onto the script.

/// If you have any questions, please message me directly. Thank you.

/// Sincerely,

///

/// Kevin Manrrique

///ONE///

len = input(3, minval=1, title="Length")

src = input(close, title="Source")

out = ema(src, len)

//plot(out, title="EMA", color=blue)

len2 = input(5, minval=1, title="Length")

src2 = input(close, title="Source")

out2 = ema(src2, len2)

//plot(out2, title="EMA", color=blue)

len3 = input(8, minval=1, title="Length")

src3 = input(close, title="Source")

out3 = ema(src3, len3)

//plot(out3, title="EMA", color=blue)

len4 = input(10, minval=1, title="Length")

src4 = input(close, title="Source")

out4 = ema(src4, len4)

//plot(out4, title="EMA", color=blue)

len5 = input(12, minval=1, title="Length")

src5 = input(close, title="Source")

out5 = ema(src5, len5)

//plot(out5, title="EMA", color=blue)

len6 = input(15, minval=1, title="Length")

src6 = input(close, title="Source")

out6 = ema(src6, len6)

//plot(out6, title="EMA", color=blue)

///TWO///

len7 = input(30, minval=1, title="Length")

src7 = input(close, title="Source")

out7 = ema(src7, len7)

//plot(out7, title="EMA", color=red)

len8 = input(35, minval=1, title="Length")

src8 = input(close, title="Source")

out8 = ema(src8, len8)

//plot(out8, title="EMA", color=red)

len9 = input(40, minval=1, title="Length")

src9 = input(close, title="Source")

out9 = ema(src9, len9)

//plot(out9, title="EMA", color=red)

len10 = input(45, minval=1, title="Length")

src10 = input(close, title="Source")

out10 = ema(src10, len10)

//plot(out10, title="EMA", color=red)

len11 = input(50, minval=1, title="Length")

src11 = input(close, title="Source")

out11 = ema(src11, len11)

//plot(out11, title="EMA", color=red)

len12 = input(60, minval=1, title="Length")

src12 = input(close, title="Source")

out12 = ema(src12, len12)

//plot(out12, title="EMA", color=red)

g=out+out2+out3+out4+out5+out6

mae=out7+out8+out9+out10+out11+out12

gmae=mae-g

plot(gmae, style=columns, color=green)

baseline=0

plot(baseline, style=line, color=black)

longCondition = crossover(gmae, baseline)

if (longCondition)

strategy.entry("long", strategy.long)

shortCondition = crossunder(gmae, baseline)

if (shortCondition)

strategy.entry("short", strategy.short)

- Fibonacci Golden Ratio and Relative Strength RSI Strategy

- Reversal and Center of Gravity Integrated Trading Strategy Based on Multi-strategy

- Dual and Triple Exponential Moving Average Crossover Strategy

- Bollinger Bands Breakout Swing Trading Strategy

- Trend Tracking Reversal Strategy

- AlexInc's Bar v1.2 Breakout Accumulation Strategy Based on Meaningful Bar Filtering

- Stock Quant Trading Strategy Combining Exponential Moving Average with Trailing Stop Loss and Percentage Stop Loss

- Moving Average Crossover System

- Close Buying Next Open Profit Taking Strategy

- Moving Stop Loss Tracking Strategy

- The Gaussian Moving Average Trading Strategy

- Adaptive Kaufman Moving Average Trend Following Strategy

- Bandpass Filtering Trend Extraction Strategy

- Dual Reversal High-Low Strategy

- Heyping Moving Average Trend Strategy

- Long and Short Opening Strategy Based on Multi Timeframe Moving Average and MACD

- Momentum Indicator RSI Reversal Trading Strategy

- Double Bollinger Band Breakout Strategy

- Automatic Tracking Trend Strategy Based on T3 and ATR

- ATR Channel Breakout Trend-following Strategy