Crossing Moving Average Trend Tracking Strategy

Author: ChaoZhang, Date: 2024-01-03 17:01:38Tags:

Overview

This strategy judges the price trend by calculating the cross of double moving averages, and issues buy and sell signals with certain parameter restrictions. It mainly consists of three parts: first, judge the price trend by calculating the cross of fast and slow moving averages; second, set certain parameter restrictions to avoid wrong trades; third, use stop profit and stop loss to control risks.

Strategy Principle

The core of this strategy lies in the calculation of fast and slow moving averages. The fast moving average has a period of half of the total moving average period, which is more sensitive to price changes; the slow moving average has a period of total moving average period, which reflects price changes more smoothly. When the fast moving average goes above the slow one, it is believed that the price rises up; when below, it falls down.

In addition, the strategy sets certain parameters to avoid wrong trades. For example, the decision threshold is to ensure that signals are issued only when the difference between the two moving averages exceeds a certain level; the confidence parameter is used to filter out small price fluctuations.

Finally, stop profit and stop loss are employed to control risks. If openprofit is less than stop loss point or larger than stop profit point, positions will be closed. This effectively limits the loss of a single trade.

Advantage Analysis

The biggest advantage of this strategy is to combine the judgment of price trend and volatility characteristics through moving average indicators. Cross of double moving averages is a classic effective technical approach to determine price trends. With parameter optimization, it can accurately capture trends. The confidence parameter can effectively filter out choppy markets and avoid frequent wrong trades.

In addition, parameters like decision threshold, stop profit and stop loss can also greatly reduce trading risks by avoiding chasing highs and selling lows.

Risk Analysis

The main risk of this strategy is the possibility of wrong signals from the double moving averages. Both fast and slow MAs are weighted moving averages which react slowly to sudden events, thus missing short-term price reversals. At this time, the confidence parameter can provide double confirmation.

In addition, improper settings of stop profit and stop loss points will also increase risks. Overly high profit target and low stop loss point may lead to losses beyond expectations. Reasonable parameters need to be set according to the characteristics of different trading products and volatility.

Optimization Directions

The strategy can be optimized in the following aspects:

-

Optimize the moving average periods, set adaptive moving averages to better model price fluctuations of different cycles;

-

Set dynamic tracking mechanisms for stop profit and stop loss, calculate volatility in real time based on market conditions, so that the stop points can change dynamically;

-

Increase machine learning models to judge price trend directions, utilize more historical data to determine current price movements, and reduce wrong signals.

Conclusion

In general, this is a classic simple and effective trend trading strategy. It uses double moving average cross to determine trends, sets parameters to control risks, and has high configurability for multi-product trading. If more intelligent judgment means like machine learning can be introduced, the overall effect could be even better for further research.

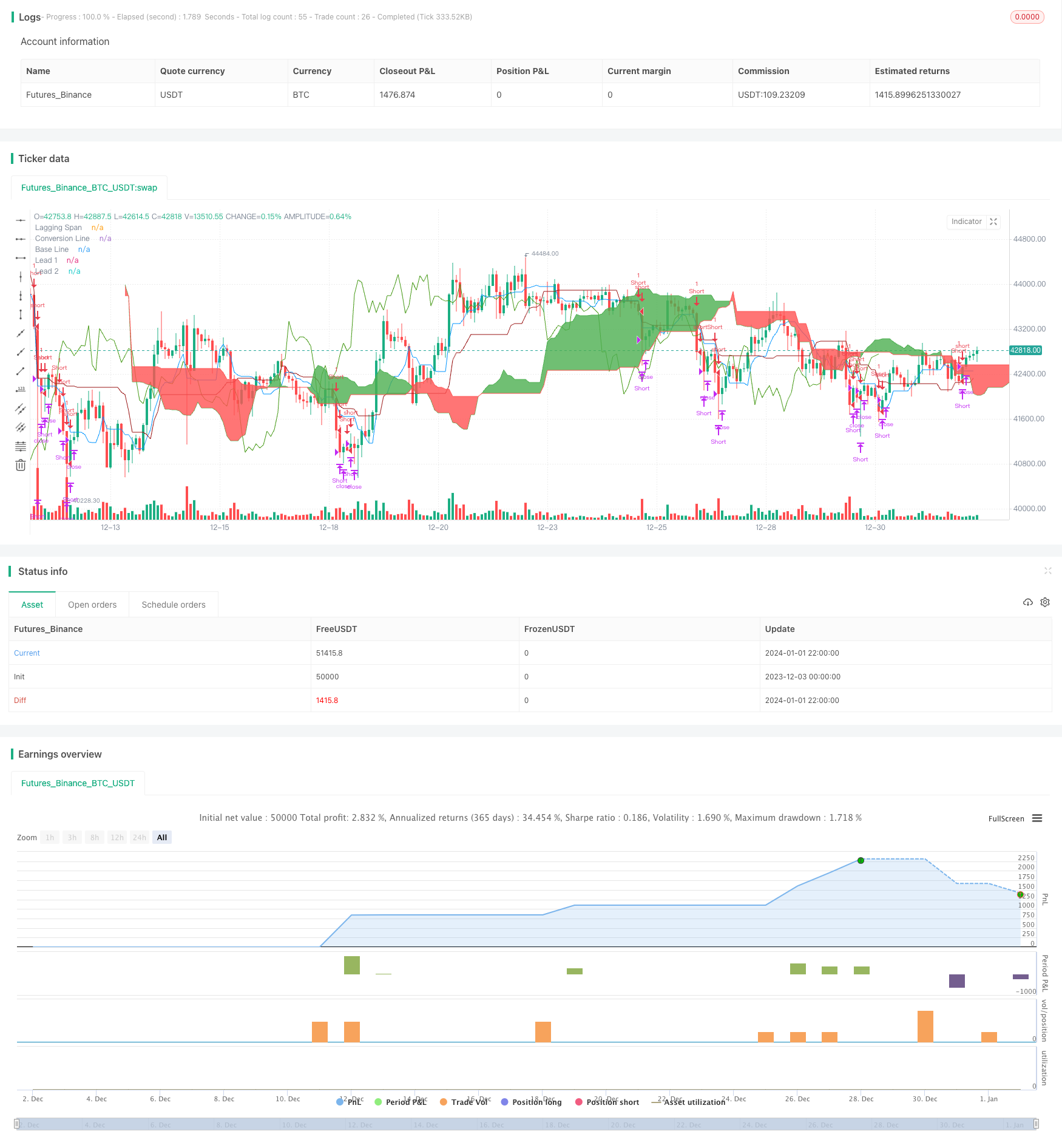

/*backtest

start: 2023-12-03 00:00:00

end: 2024-01-02 00:00:00

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

// Any timeFrame ok but good on 15 minute & 60 minute , Ichimoku + Daily-Candle_cross(DT) + HULL-MA_cross + MacD combination 420 special blend

strategy("Trade Signal", shorttitle="Trade Alert", overlay=true )

keh=input(title="Double HullMA",defval=14, minval=1)

dt = input(defval=0.0010, title="Decision Threshold (0.001)", type=float, step=0.0001)

SL = input(defval=-10.00, title="Stop Loss in $", type=float, step=1)

TP = input(defval=100.00, title="Target Point in $", type=float, step=1)

ot=1

n2ma=2*wma(close,round(keh/2))

nma=wma(close,keh)

diff=n2ma-nma

sqn=round(sqrt(keh))

n2ma1=2*wma(close[1],round(keh/2))

nma1=wma(close[1],keh)

diff1=n2ma1-nma1

sqn1=round(sqrt(keh))

n1=wma(diff,sqn)

n2=wma(diff1,sqn)

b=n1>n2?lime:red

c=n1>n2?green:red

d=n1>n2?red:green

confidence=(request.security(syminfo.tickerid, '5', close[1])-request.security(syminfo.tickerid, '60', close[1]))/request.security(syminfo.tickerid, '60', close[1])

conversionPeriods = input(9, minval=1, title="Conversion Line Periods")

basePeriods = input(26, minval=1, title="Base Line Periods")

laggingSpan2Periods = input(52, minval=1, title="Lagging Span 2 Periods")

displacement = input(26, minval=1, title="Displacement")

donchian(len) => avg(lowest(len), highest(len))

conversionLine = donchian(conversionPeriods)

baseLine = donchian(basePeriods)

leadLine1 = avg(conversionLine, baseLine)

leadLine2 = donchian(laggingSpan2Periods)

LS=close, offset = -displacement

MACD_Length = input(9)

MACD_fastLength = input(12)

MACD_slowLength = input(26)

MACD = ema(close, MACD_fastLength) - ema(close, MACD_slowLength)

aMACD = ema(MACD, MACD_Length)

closelong = n1<n2 and close<n2 and confidence<dt or strategy.openprofit<SL or strategy.openprofit>TP

if (closelong)

strategy.close("Long")

closeshort = n1>n2 and close>n2 and confidence>dt or strategy.openprofit<SL or strategy.openprofit>TP

if (closeshort)

strategy.close("Short")

longCondition = n1>n2 and strategy.opentrades<ot and confidence>dt and close>n2 and leadLine1>leadLine2 and open<LS and MACD>aMACD

if (longCondition)

strategy.entry("Long",strategy.long)

shortCondition = n1<n2 and strategy.opentrades<ot and confidence<dt and close<n2 and leadLine1<leadLine2 and open>LS and MACD<aMACD

if (shortCondition)

strategy.entry("Short",strategy.short)

//alerts

alertcondition(closelong, title='Close Buy Position', message='Close Buy Position')

alertcondition(closeshort, title='Close Short Position', message='Close Short Position')

alertcondition(longCondition, title='Buy Signal', message='Buy Signal Alert')

alertcondition(shortCondition, title='Sell Signal', message='Sell Signal Alert')

//a1=plot(n1,color=c)

//a2=plot(n2,color=c)plot(cross(n1, n2) ? n1 : na, style = circles, color=b, linewidth = 4)

//plot(cross(n1, n2) ? n1 : na, style = line, color=d, linewidth = 4)

plot(conversionLine, color=#0496ff, title="Conversion Line")

plot(baseLine, color=#991515, title="Base Line")

plot(close, offset = -displacement, color=#459915, title="Lagging Span")

p1=plot (leadLine1, offset = displacement, color=green, title="Lead 1")

p2=plot (leadLine2, offset = displacement, color=red, title="Lead 2")

fill(p1, p2, color = leadLine1 > leadLine2 ? green : red)

// remove the "//" from before the plot script if want to see the indicators on chart

- Quant Trend Following Strategy

- Hull Filter Moving Average Strategy

- Bear Power Strategy

- Dual Moving Average Crossover Strategy

- Dual Reversion CMO Quantum Strategy

- RSI and SMA Crossover Strategy

- Bollinger Band Breakout Strategy

- Price Momentum Tracking Strategy

- Grid Trading Strategy Based on Moving Average System

- Momentum Reversal Strategy

- Fibonacci Golden Ratio and Relative Strength RSI Strategy

- Reversal and Center of Gravity Integrated Trading Strategy Based on Multi-strategy

- Dual and Triple Exponential Moving Average Crossover Strategy

- Bollinger Bands Breakout Swing Trading Strategy

- Trend Tracking Reversal Strategy

- AlexInc's Bar v1.2 Breakout Accumulation Strategy Based on Meaningful Bar Filtering

- Stock Quant Trading Strategy Combining Exponential Moving Average with Trailing Stop Loss and Percentage Stop Loss

- Moving Average Crossover System

- Close Buying Next Open Profit Taking Strategy

- Moving Stop Loss Tracking Strategy