Hull Filter Moving Average Strategy

Author: ChaoZhang, Date: 2024-01-04 15:16:34Tags:

Overview

This strategy uses short-term and long-term Hull moving averages to generate and filter trading signals. The short-term Hull moving average is used to generate signals, while the long-term Hull moving average is used for filtering signals. Trades are only taken when the short-term Hull moving average changes direction and the long-term Hull moving average is moving in the same overall direction.

The strategy also uses the ATR indicator to dynamically set stop loss and take profit levels when entering trades.

Strategy Logic

The short-term Hull moving average captures short-term price trends and turning points. When it changes direction, it signals a shift in the short-term price trend.

The long-term Hull moving average determines the overall price trend. For example, when it is rising, prices are in an overall upward trend.

Trades are only taken when the short-term Hull moving average turns direction, and its new direction aligns with the direction of the long-term Hull moving average. This filters out signals that go against the overall trend and may just be short-term market noise.

After entering positions, stop loss and take profit levels are set based on the ATR indicator value. The ATR reflects market volatility and risk levels. The stop loss is placed below price lows while take profit targets price highs, with ranges tied to the current ATR reading.

Advantage Analysis

Combining short-term signals and long-term filters effectively identifies mid-term trends and turning points, avoiding false signals from market noise.

Dynamic stop loss and take profit based on ATR sets reasonable ranges based on current volatility, balancing profit taking and loss prevention.

The Hull moving average has flexibility and accuracy advantages over standard moving averages, with better trend tracking.

Risk Analysis

The strategy relies on crosses between the Hull moving averages to generate signals. False crosses can result in bad trades, requiring analysis of overall market structure.

In ranging, choppy markets with price oscillating in a trading range, signal errors and unnecessary trades may pile up. This can be avoided by filtering signals with wider conditions during such markets.

Stop loss and take profit reliance on ATR means inaccurate volatility reads will result in bad placement. Other volatility measures can augment ATR to correct this.

Optimization

Additional short-term indicators like RSI can improve signal accuracy through convergence.

The filter logic between the Hull moving averages can be enhanced to have more strict entry requirements, avoiding false signals.

Parameter tuning research can uncover stability and profitability improvements from changes to moving average lengths, ATR periods, etc.

Summary

This strategy combines short-term signal generation, long-term signal filtering, and ATR-based stop loss/take profit in a robust mid-term trend following framework. It capably identifies mid-term inflection points while filtering out short-term noise. With parametric optimizations and added filters, it can achieve even better performance.

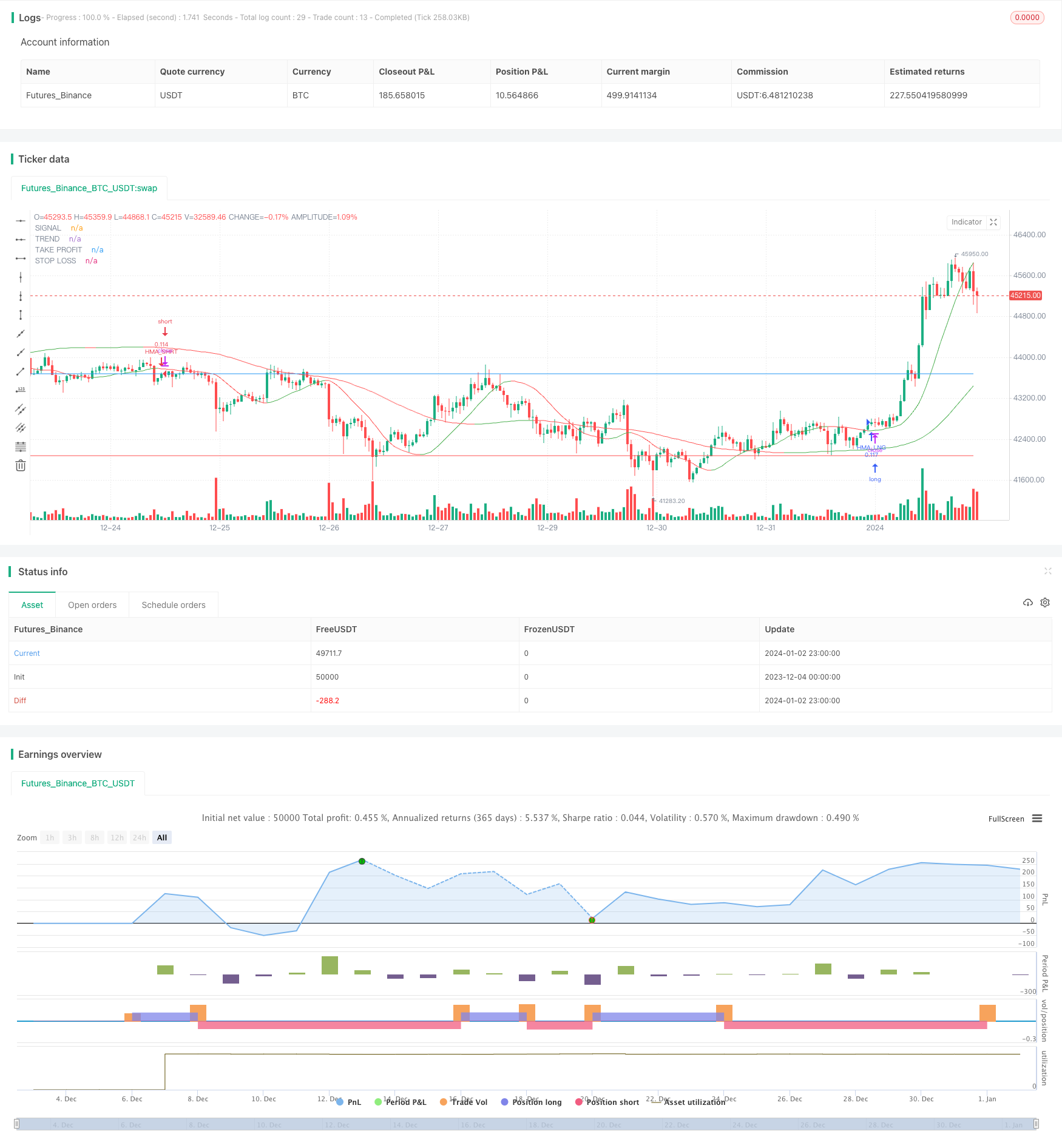

/*backtest

start: 2023-12-04 00:00:00

end: 2024-01-03 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("Hull Filtered Strategy", overlay=true, pyramiding=0, default_qty_type= strategy.percent_of_equity, default_qty_value = 10, calc_on_order_fills=false, slippage=0,commission_type=strategy.commission.percent,commission_value=0)

// Parameters for Hull Moving Averages

src = input(close, title="Source")

signal_period = input(50, title="Period of signal HMA")

filter_period = input(200, title="Period of filter HMA")

strat_dir_input = input(title="Strategy Direction", defval="all", options=["long", "short", "all"])

// Set allowed trading directions

strat_dir_value = strat_dir_input == "long" ? strategy.direction.long : strat_dir_input == "short" ? strategy.direction.short : strategy.direction.all

strategy.risk.allow_entry_in(strat_dir_value)

// stop loss and take profit

sl_factor = input(2,title="Stop Loss Factor")

tp_factor = input(3,title="Take Profit Factor")

atr_period = input(14, title="ATR Period (SL/TP)")

// Testing Start dates

testStartYear = input(2010, "Backtest Start Year")

testStartMonth = input(1, "Backtest Start Month")

testStartDay = input(1, "Backtest Start Day")

testPeriodStart = timestamp(testStartYear,testStartMonth,testStartDay,0,0)

//Stop date if you want to use a specific range of dates

testStopYear = input(2030, "Backtest Stop Year")

testStopMonth = input(12, "Backtest Stop Month")

testStopDay = input(31, "Backtest Stop Day")

testPeriodStop = timestamp(testStopYear,testStopMonth,testStopDay,0,0)

// -----------------------------------------------------------------------------

// Global variables

// -----------------------------------------------------------------------------

var float tp = na

var float sl = na

var float position = na

// -----------------------------------------------------------------------------

// Functions

// -----------------------------------------------------------------------------

testWindow() =>

time >= testPeriodStart and time <= testPeriodStop ? true : false

// -----------------------------------------------------------------------------

// The engine

// -----------------------------------------------------------------------------

hma_signal = hma(src, signal_period)

hma_filter = hma(src, filter_period)

// Used to determine exits and stop losses

atr_e = atr(atr_period)

// if hma_filter increases hma_trend is set to 1, if it decreases hma_trend is set to -1. If no trend is available, hma_trend is set to ß0

trend = hma_filter > hma_filter[1] ? 1 : hma_filter < hma_filter[1] ? -1 : 0

signal = hma_signal > hma_signal[1] ? 1 : hma_signal < hma_signal[1] ? -1 : 0

// -----------------------------------------------------------------------------

// signals

// -----------------------------------------------------------------------------

if signal[0] == 1 and signal[1] != 1 and trend == 1 and testWindow()

sl := close - sl_factor*atr_e

tp := close + tp_factor*atr_e

strategy.entry("HMA_LNG", strategy.long)

strategy.exit("LE", "HMA_LNG", profit=100*tp_factor*atr_e, loss=100*sl_factor*atr_e)

if signal[0] == -1 and signal[1] != -1 and trend == -1 and testWindow()

sl := close + sl_factor*atr_e

tp := close - tp_factor*atr_e

strategy.entry("HMA_SHRT", strategy.short)

strategy.exit("SE", "HMA_SHRT", profit=100*tp_factor*atr_e, loss=100*sl_factor*atr_e)

if strategy.position_size != 0

sl := sl[1]

tp := tp[1]

// -----------------------------------------------------------------------------

// PLOT

// -----------------------------------------------------------------------------

hma_s = plot(hma_signal, title="SIGNAL", color = signal == 1 ? color.green : color.red)

hma_l = plot(hma_filter, title="TREND", color = trend == 1 ? color.green : color.red)

plot(tp, title="TAKE PROFIT", color= strategy.position_size != 0 ? color.blue: na, linewidth=1)

plot(sl, title="STOP LOSS", color= strategy.position_size != 0 ? color.red: na, linewidth = 1)

- Adaptive Botvenko Indicator Long Short Strategy

- Bollinger Bands and VWAP based Quantitative Trading Strategy

- Momentum Bollinger Bands Breakout Strategy

- Dual Moving Average Crossover Reverse Trend Tracking Strategy

- Quant Lights Moving Average Trend Tracking Optimization Strategy

- Volume Energy Driven Strategy

- HMA Momentum Breakthrough Strategy

- ATR and Volatility Index Based Trend Tracking Strategy

- Momentum Trend Tracking Strategy

- Quant Trend Following Strategy

- Bear Power Strategy

- Dual Moving Average Crossover Strategy

- Dual Reversion CMO Quantum Strategy

- RSI and SMA Crossover Strategy

- Bollinger Band Breakout Strategy

- Price Momentum Tracking Strategy

- Grid Trading Strategy Based on Moving Average System

- Momentum Reversal Strategy

- Crossing Moving Average Trend Tracking Strategy

- Fibonacci Golden Ratio and Relative Strength RSI Strategy