EintSimple Pullback Strategy

Author: ChaoZhang, Date: 2024-01-15 14:04:54Tags:

Moving Average Crossover EintSimple Pullback Strategy

Overview

The EintSimple Pullback Strategy is a mean reversion strategy based on dual moving average crossover. It first uses a long-term and a short-term moving average line. When the short-term moving average line breaks through the long-term moving average line from the bottom, a buy signal is generated. To filter false breakouts, this strategy also requires the close price to be higher than the long-term moving average line.

After entering the market, if the price falls back below the short-term moving average line again, it will trigger an exit signal. In addition, this strategy also sets a stop loss exit. If the retracement from the highest point reaches the set stop loss percentage, it will also exit positions.

Strategy Logic

The strategy mainly relies on the golden cross of dual moving averages to determine entry timing. Specifically, the following conditions must be met at the same time before opening a position to go long:

- The close price is greater than the long-term moving average ma1

- The close price is lower than the short-term moving average ma2

- There is currently no position

After meeting the above conditions, this strategy will take a full long position.

The exit signal judgment is based on two conditions. One is that the price falls back below the short-term moving average again. The other is that the retracement from the highest point reaches the set stop loss percentage. The specific exit conditions are as follows:

- The close price is greater than the short-term moving average ma2

- The retracement from the highest point reaches the set stop loss percentage

When either exit condition is met, this strategy will close all long positions.

Advantages

-

Using dual moving average crossover combined with solid close prices to judge can effectively filter false breakouts.

-

Adopting pullback entry can enter after the price forms short-term inflection points.

-

With stop loss setting, it can limit the maximum drawdown.

Risks

-

Dual moving average crossover strategies tend to produce frequent trading signals and may chase peaks and kill bottoms.

-

Improper parameter settings of moving averages may result in overly smooth or overly sensitive curves.

-

Overly loose stop loss settings will lead to enlarged losses.

Optimization

-

Test different length combinations of long-term and short-term moving averages to find the optimal parameters.

-

Compare the effects of using close price and typical price to determine moving average crossovers.

-

Test adding filters like volume or volatility indicators.

-

Backtest optimize the stop loss percentage to find the best setting.

Conclusion

The EintSimple Pullback Strategy is a simple and practical dual moving average pullback strategy. It effectively utilizes the directional functionality of moving averages while combining solid close prices to filter out false signals. Although this strategy is prone to frequent trading and chasing peaks and killing bottoms, it can be further improved through parameter optimization and adding filters. Overall, this is a great strategy for quantitative trading beginners to practice on and optimize.

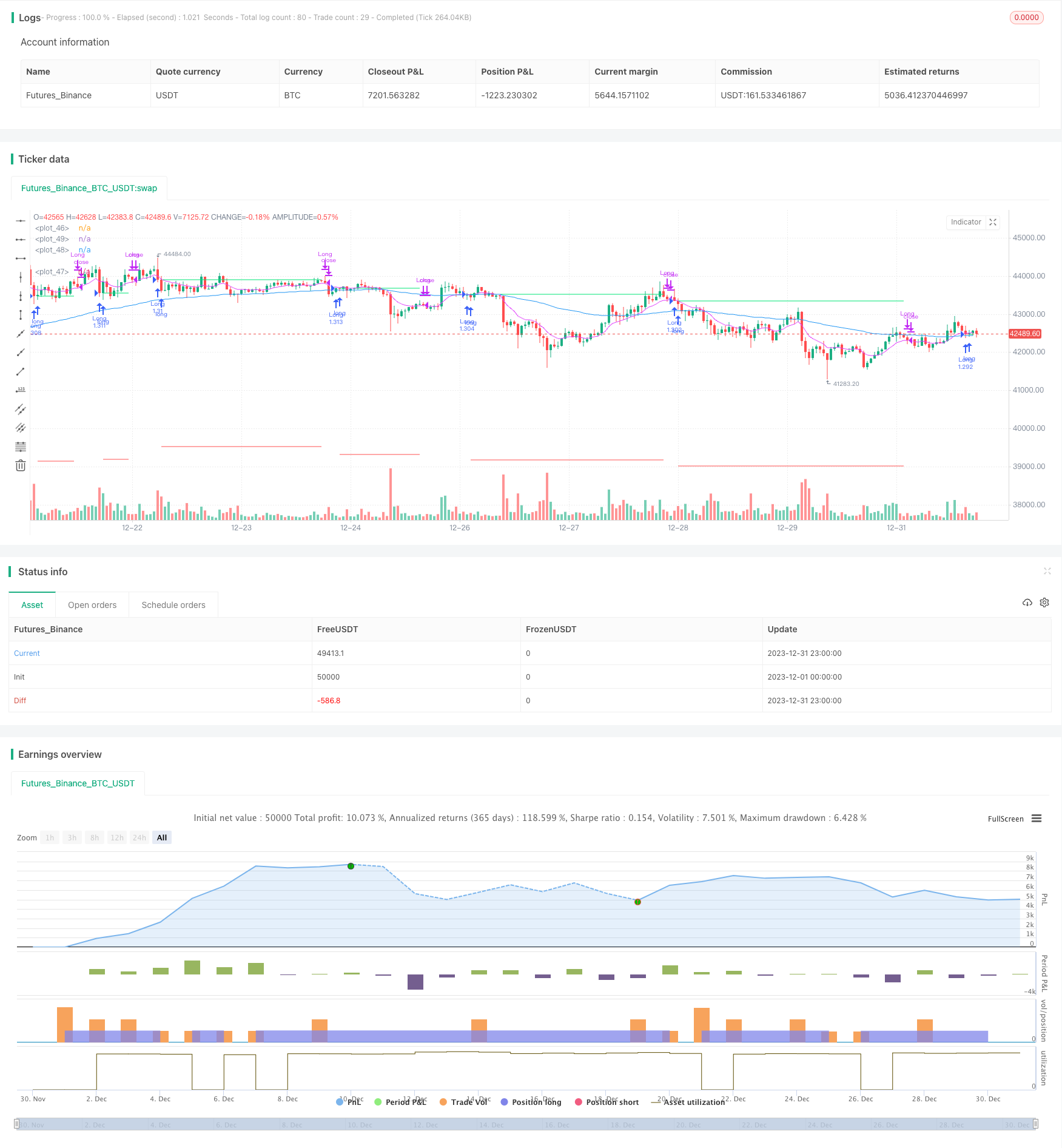

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © ZenAndTheArtOfTrading / www.PineScriptMastery.com

// @version=5

strategy("Simple Pullback Strategy",

overlay=true,

initial_capital=50000,

default_qty_type=strategy.percent_of_equity,

default_qty_value=100)// 100% of balance invested on each trade

// Get user input

i_ma1 = input.int(title="MA 1 Length", defval=75, step=1, group="Strategy Parameters", tooltip="Long-term EMA")

i_ma2 = input.int(title="MA 2 Length", defval=9, step=1, group="Strategy Parameters", tooltip="Short-term EMA")

i_stopPercent = input.float(title="Stop Loss Percent", defval=0.10, step=0.1, group="Strategy Parameters", tooltip="Failsafe Stop Loss Percent Decline")

i_lowerClose = input.bool(title="Exit On Lower Close", defval=true, group="Strategy Parameters", tooltip="Wait for a lower-close before exiting above MA2")

i_startTime = input(title="Start Filter", defval=timestamp("01 Jan 1995 13:30 +0000"), group="Time Filter", tooltip="Start date & time to begin searching for setups")

i_endTime = input(title="End Filter", defval=timestamp("1 Jan 2099 19:30 +0000"), group="Time Filter", tooltip="End date & time to stop searching for setups")

// Get indicator values

ma1 = ta.ema(close, i_ma1)

ma2 = ta.ema(close, i_ma2)

// Check filter(s)

f_dateFilter = true

// Check buy/sell conditions

var float buyPrice = 0

buyCondition = close > ma1 and close < ma2 and strategy.position_size == 0 and f_dateFilter

sellCondition = close > ma2 and strategy.position_size > 0 and (not i_lowerClose or close < low[1])

stopDistance = strategy.position_size > 0 ? ((buyPrice - close) / close) : na

stopPrice = strategy.position_size > 0 ? buyPrice - (buyPrice * i_stopPercent) : na

stopCondition = strategy.position_size > 0 and stopDistance > i_stopPercent

// Enter positions

if buyCondition

strategy.entry(id="Long", direction=strategy.long)

if buyCondition[1]

buyPrice := open

// Exit positions

if sellCondition or stopCondition

strategy.close(id="Long", comment="Exit" + (stopCondition ? "SL=true" : ""))

buyPrice := na

// Draw pretty colors

plot(buyPrice, color=color.lime, style=plot.style_linebr)

plot(stopPrice, color=color.red, style=plot.style_linebr, offset=-1)

plot(ma1, color=color.blue)

plot(ma2, color=color.fuchsia)

- IBS and Weekly High Based SP500 Futures Trading Strategy

- FraMA and MA Crossover Trading Strategy Based on FRAMA Indicator

- Trend Following Strategy Based on SSL Baseline

- Bollinger Bands Trend Following Strategy

- Momentum Trend Following Trading Strategy

- Open Close Cross Moving Average Trend Following Strategy

- Adaptive Trend Following Strategy

- Multi Timeframe RSI Strategy

- Bollinger Bands and K-line Combined Strategy

- Aroon Oscillator Based Stock Trading Strategy

- Polarized Fractal Efficiency (PFE) Trading Strategy

- Eleven Moving Averages Crossover Strategy

- Dual Moving Average Reversal Trading Strategy

- RSI of MACD Reversal Strategy

- Lunar Phase Based Bitcoin Trading Strategy

- Volatility Filtered Market Timing Strategy

- Trend Following Channel Breakout Strategy with Moving Average and Trailing Stop

- Quantitative Trading Dual Indicator Strategy

- Bidirectional Moving Average Reversion Trading Strategy

- RSI Bullish and Bearish Divergence Trading Strategy